原作者:Frank,PANews

In the field of blockchain, MEV (maximum extractable value) has always been a complex and non-negligible issue. It refers to the phenomenon that miners or validators extract additional profits from blocks by manipulating the order of transactions, inserting or deleting transactions. Common MEV methods include sandwich attacks, front-running, and liquidation arbitrage.

MEV behaves differently on different public chains, from common arbitrage transactions on Ethereum, to serious sandwich attacks on Solana, to the MEV potential gradually emerging in public chains such as Bitcoin, BSC, and TRON. This article will review the MEV phenomenon of major public chains, analyze their different implementation paths, and their potential impact on users and networks.

Ethereum: Sandwich attacks have declined, mainly arbitrage

As the public chain with the largest transaction volume, Ethereum has always been the public chain with the most concentrated MEV phenomenon. Especially during the period of active DeFi and NFT transactions. In 2023, the Ethereum Foundation suffered a sandwich attack from the MEV Bot when selling ETH, losing $9,101, and the MEVBot made a profit of about $4,060.

For ordinary users, MEV brings negative effects in most cases, especially when sandwich attacks and front-running transactions are rampant. But for miners or validators, MEV is an additional income that cannot be ignored, especially in the period when block rewards are declining. MEV income can supplement the income level of miners and validators, and has certain positive significance for maintaining the stability and decentralization of the entire blockchain network.

In the classification of MEV, except for sandwich attacks and front-running transactions that directly harm the interests of users, liquidation arbitrage and other behaviors are not harmful transactions in most cases for maintaining market liquidity. Therefore, how to reduce harmful behaviors such as sandwich attacks and retain MEV such as liquidation and arbitrage has become a difficult problem to maintain MEV balance.

In order to solve the fairness issues brought by MEV while balancing the benefits of validators, Flashbots launched the MEV-Boost and Flashbots Protect protocols. MEV-Boost is a relay system that allows validators to obtain optimized blocks from external block builders through relay nodes. These blocks maximize the benefits of transaction sorting through complex MEV extraction strategies. MEV-Boost introduces a transparent block construction process, avoiding traditional malicious MEV methods such as front-running and sandwich attacks.

Flashbots Protect is designed primarily for ordinary users to protect their transactions from MEV attacks such as front-running and sandwich attacks. Through Flashbots Protect, users can submit private transactions that are not publicly broadcast to Ethereums public mempool, but are sent directly to miners or validators that support Flashbots through private channels.

For a long time, the proportion of private orders transmitted through protocols such as MEV-Boost or Flashbots Protect on Ethereum has been around 30%, while the proportion of orders still transmitted through the public Mempool is still as high as 70%. This means that a large number of users do not like to use Flashbots Protect to initiate transactions. However, about 70% of transactions on Ethereum DEX are private orders initiated through Flashbots Protect. Currently, the proportion of MEV revenue on Ethereum is about 26%. This proportion shows that the main source of income for validators is still block rewards, and not just relying on MEV income.

Currently, the number of Ethereum validators registered for MEV-Boost has reached 1.47 million, accounting for more than 81%. Data from September 5 showed that the proportion of blocks generated through the MEV-Boost protocol in the past 14 days reached 89%. However, this does not mean that 89% of Ethereum orders are MEV orders transmitted through the privacy pool.

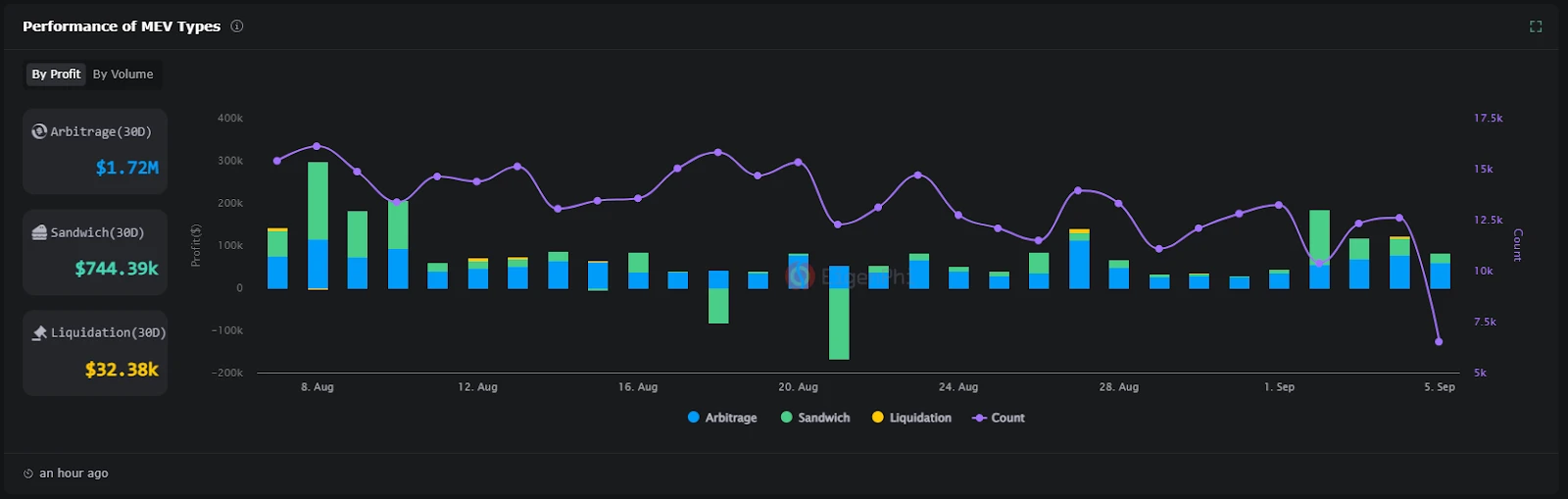

Currently, sandwich attacks seem to have been largely alleviated on Ethereum. According to Eigenphi data, the total revenue from sandwich attacks in the past 30 days was $740,000, and the arbitrage revenue in the same period was as high as $1.72 million.

Solana: MEV issues intensify, sandwich attacks threaten user transaction security

The MEV problem on Solana has become increasingly serious in this round of bull market. According to a survey by Blockworks Research, in April 2024, the MEV revenue on Solana has exceeded that of Ethereum. Before November 2023, the MEV revenue on Solana will be almost negligible.

Compared with Ethereum, the reason why Solanas MEV is discussed more by the community is that its sandwich attack has seriously affected the transactions of ordinary users. Previously, PANews had conducted in-depth research on this topic, in which a sandwich attack robot with an address starting with arsc grabbed $30 million in 2 months. In comparison, Uniswaps revenue in the past month was only $31 million. (Related reading: Grabbing $30 million in 2 months, Solanas largest sandwich attacker earns $570,000 a day and arouses public anger )

Regarding MEV on Solana, we have to mention Jito Labs. Jito-Solana developed by Jito Labs on Solana can be regarded as the Solana version of MEV-Boost. Although the implementation paths of the two are different, the overall idea is similar, both of which are to help validators maximize the benefits of MEV. Jito launched a block space auction mechanism that allows transaction initiators to pay a tip to the validator separately to ensure that the bundled transaction package is executed first. In addition, in March, Jito announced that it would temporarily shut down its running mempool to reduce sandwich attacks, because this memory pool can be used by sandwich attackers to monitor the content of transactions initiated by users, but MEV robots can still monitor transactions by running an RPC node.

Therefore, Jito鈥檚 closure of the mempool did not eliminate the sandwich attack on Solana, but the threshold became higher. The team that specializes in making profits through sandwich attacks has also become more cunning under the community鈥檚 crusade.

According to PANews, the previously notorious arsc robot did not stop, but continued to carry out sandwich attacks by changing its skin, and the scale of the attack is now larger than before, and it has almost monopolized the sandwich attacks on Solana. Sandwiched is a platform specially developed by the Ghost team to monitor Solana sandwich attacks. PANews carefully observed that the actual control addresses of the sandwich attack programs currently active on Solana are all arsc. To put it simply, arsc wrote the logic previously used for sandwich attacks into multiple smart contracts, and hundreds of addresses will be deployed on each contract to execute the contract for attack. In this way, if you only track the addresses, you cannot see the correlation. According to a rough observation, the average number of addresses under each smart contract is about hundreds to one thousand, so arsc may have tens of thousands of addresses used for sandwich attacks.

In the past year, the Tips income (MEV tips) obtained on Jito has exceeded 1.53 million SOL (worth approximately US$198 million), while Ethereum MEV income in the same period was approximately US$600 million.

BSC: Introducing a MEV solution similar to Flashbots, mainly for arbitrage

BSC and Ethereum have many similarities in MEV extraction mechanisms. BSC has also introduced a MEV solution similar to Flashbots. On BSC, bloXroutes MEV Relay is used. This solution uses private transaction bundles (Bundles) to protect user transactions from being targeted by MEV robots in the public mempool, thereby reducing user losses.

However, judging from the data, the overall profit of MEV on BSC is much higher than that of Ethereum. According to Eigenphi, the total MEV revenue of the BSC chain in the past 30 days is about 133 million US dollars, of which arbitrage revenue is about 130 million US dollars, and sandwich attack revenue is only 2.8 million US dollars. Among them, the data on August 22 showed that the arbitrage revenue on that day reached 30 million US dollars, which seems a bit abnormal. The total transaction volume of the entire BSC chain in August was only 20 billion US dollars. It is indeed questionable why the MEV revenue data can reach such a high value.

Ethereum L2: MEV has not yet reached scale, mainly based on liquidation income

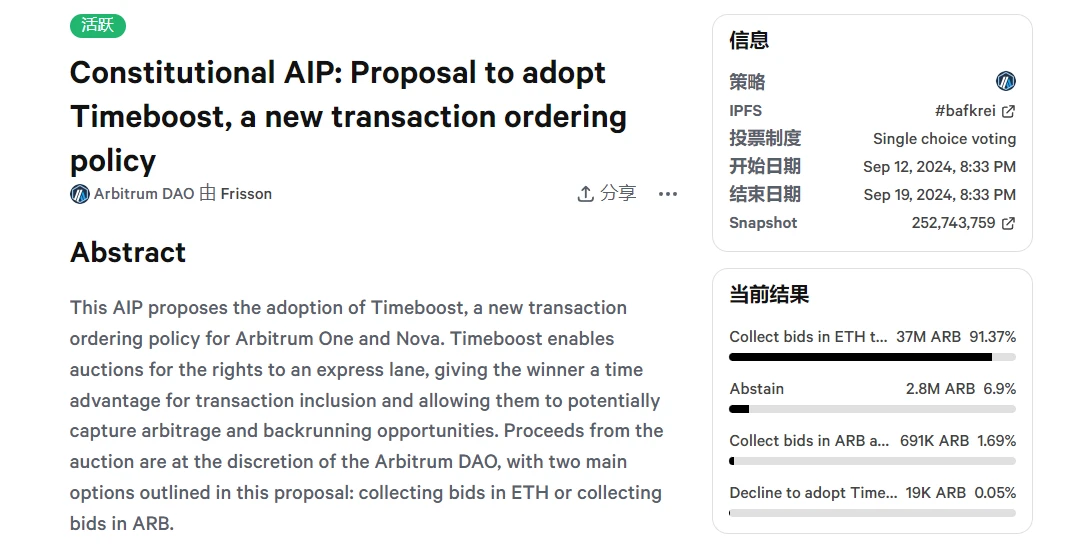

There are almost no data platforms on the specific situation of MEV on Ethereum Layer 2. According to the research paper by Arthur Bagourd and Luca Georges Francois, as of June 2023, the MEV revenue on Ethereum L2 (Polygon, Arbitrum, Optimism) is about 213 million US dollars. Among them, Polygon contributed the highest proportion, about 213 million US dollars, mainly due to a few large transactions that increased overall profits. Arbitrum MEV extracted a total profit of about 250,000 US dollars, and Optimisms data was about 250,000 US dollars. Overall, excluding extreme data, MEV on Ethereum L2 has not yet formed a large-scale stable income, which is mainly due to the large fluctuations in the transaction volume of Ethereum L2. In addition, the MEV revenue of Ethereum L2 mainly comes from liquidation gains rather than sandwich attacks. Recently, Arbitrum has adopted a transaction sorting mechanism called Timeboost, a relay system similar to MEV-Boost.

TRON: MEV opportunities are limited under the DPoS mechanism

As one of the public chains with the largest transaction volume, TRON has also seen a larger transaction volume recently due to the craze for MEME coins. However, many users have pointed out that there are a large number of robot attacks on TRON. Subsequently, TRON founder Justin Sun said that TRON does not have a MEV mechanism and that the robot attacks currently occurring are probabilistic attacks.

The consensus mechanism adopted by TRON is DPOS (Delegated Proof of Stake), under which there is usually no public mempool similar to traditional PoW and PoS. In the DPoS system, transactions are not first broadcast to public network nodes for miners or validators to select. Instead, transactions are submitted by users to Super Representatives (SRs) or trustee nodes, which have the power to generate blocks and confirm transactions. Unless these super representatives actively participate in MEV transactions, the probability of MEV occurring is generally low.

Bitcoin: MEV gradually emerges, mainly relying on inscriptions and miner behavior

Since Bitcoin is designed differently from Ethereum and uses a simple UTXO model, each transaction is mainly a transfer of Bitcoin between the sender and the receiver, so transaction ordering does not trigger complex arbitrage or liquidation opportunities like Ethereum. In addition, there are no complex smart contracts on the Bitcoin network, which means that miners cannot use arbitrage or liquidation to extract MEV like on Ethereum.

However, with the emergence of inscriptions, runes, Layer 2 and other Bitcoin ecosystems, the potential for MEV is also emerging on Bitcoin. Of course, for miners, more MEV opportunities will make up for the reduction in mining rewards. However, with the evolution of the Bitcoin protocol, MEV has also begun to become a challenge that needs to be addressed in the Bitcoin ecosystem. However, since the MEV behavior of the Bitcoin ecosystem has not yet formed a large-scale, standardized model, relevant data has not yet been seen.

Overall, MEV manifests itself in different forms on major public chains, from Ethereums mature arbitrage mechanism to the rampant sandwich attacks on Solana. Each ecosystem faces unique challenges and opportunities. As DeFi, NFT, and smart contract technologies continue to evolve, the MEV phenomenon will continue to develop, and different public chains will continue to explore solutions to balance MEV benefits and user experience. In the future, how to effectively manage MEV will become an important issue for public chains to maintain decentralization and network fairness.

This article is sourced from the internet: Inventory of the current status of MEV on various public chains: Arbitrage is the main focus on Ethereum, and sandwich attacks are still serious on Solana

Tari Labs, the organization responsible for developing the Tari next-generation blockchain protocol, launched Tari Universe on August 20, a groundbreaking mining application designed to make it easy for anyone to join the cryptocurrency revolution. Tari Universe uses the ASIC-resistant hashing algorithm RandomX and enables users to mine Tari using their existing Mac or PC. Say goodbye to the UX barriers of cryptocurrency – Tari Universes beautiful and simple interface makes mining easy for everyone. Users only need to download Tari Universe for free, install it, and click Start Mining to earn Tari tokens. In a global environment where inflation is out of control and many people are struggling, cryptocurrency mining provides a great opportunity for everyone. Soon™ the turtle, Tari’s official mascot, said: “Tari Universe is a beautifully simple crypto…