Bitcoin ended August with a drop of 8.6%, and as September began, the market began to discuss seasonal trends. Statistics show that BTC has fallen an average of 4.5% in the past six Septembers. If this trend continues, BTC may fall to $55,000, but strong support is expected around $54,000.

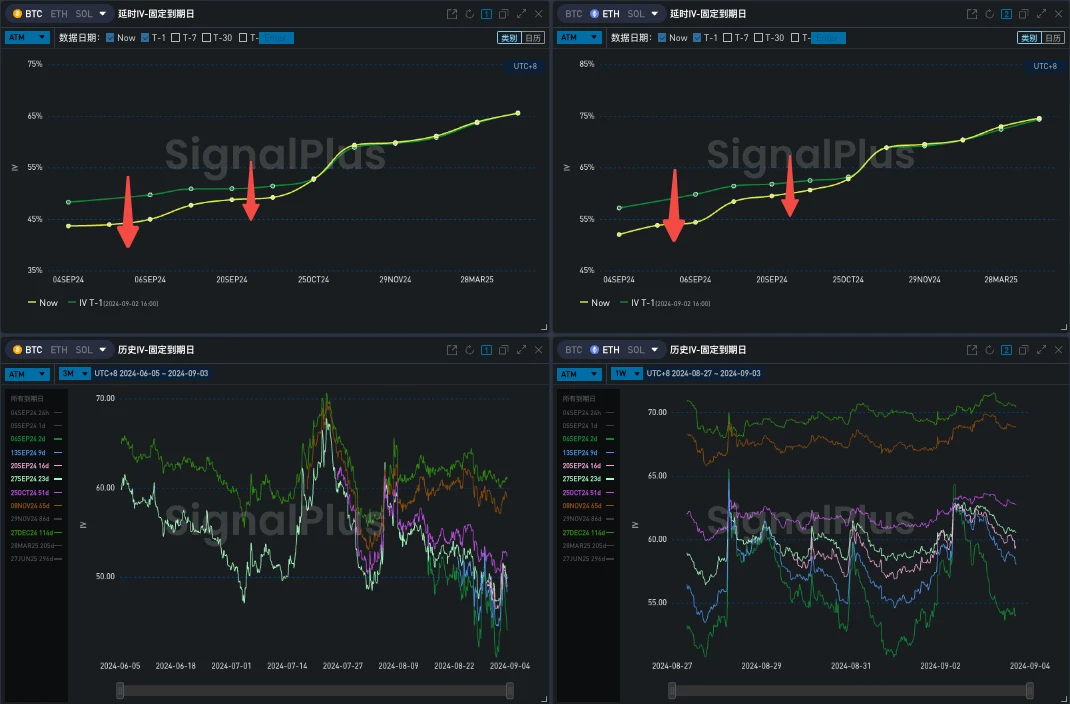

Judging from the local price changes, BTC fell to its lowest point in a week the day before yesterday and was supported around US$57,000. It rebounded to around US$59,000 during the day. The change in implied volatility was negatively correlated with the price. After the price rebounded today, the term structure steepened, and the front end gave up 2-3% of the vol increase, which was slightly lower than the median of the past three months, basically the same as Hourlys RV, and there are not many opportunities in VPR.

Source: Deribit (as of 2 MAY 16: 00 UTC+ 8)

Source: SignalPlus, term structure steepens

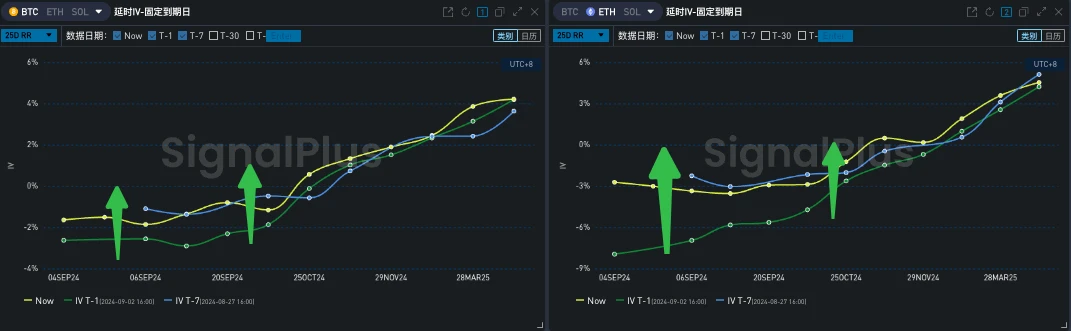

From the perspective of Vol Skew, the long-term bullish sentiment maintained a high level, and the positive correlation trend between the mid-to-front-end Risky and the price was significant. However, it was worth noting that the increase in BTC and ETH yesterday was quite different. From a macro perspective, the massive outflow of funds from BTC ETF, the selling pressure implied by the negative Coinbase premium index, and the dilemma of declining profits faced by miners cast a shadow on the market sentiment. From the perspective of Flow, ETHs short-term bullish demand helped push up the Risky premium. Although there are still long-term bullish buys on BTC, the selling on the front-end Top Side Wing caused by this round of price increases has undoubtedly suppressed the increase in its Skew.

Source: SignalPlus, Risky rebound

Data Source: Deribit, BTC ETH transaction distribution comparison

Source: SignalPlus, Block Trade

您可以使用 t.signalplus.com 上的 SignalPlus 交易风向标功能获取更多实时加密货币资讯,若想第一时间收到我们的更新,请关注我们的推特账号@SignalPlusCN,或加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram 群和 Discord 社区,与更多朋友交流互动。

SignalPlus 官方网站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240903): BTC Stress Resistant Month

相关:以 Rollup 为中心,以太坊协议升级的重要性正在逐渐降低

原文作者:Christine, Galaxy Research 原文翻译:Ismay, BlockBeats 编者注:随着以太坊逐渐转向以 Rollup 为中心的发展路线图,其协议变化的重要性正在逐渐减小。本文深入探讨了这种转变的原因及其对生态系统的潜在影响。通过分析以太坊协议开发人员不断变化的优先级,作者揭示了随着 Rollup 的成熟,协议级变化对用户的直接影响将会减少。文章还引用了以太坊基金会执行董事 Aya Miyaguchi 的观点,强调了减少协议和基金会角色的风险和必要性。同时,本文指出,未来金融的核心构建块正在协议之外构建,Rollup 和其他创新技术将逐渐……