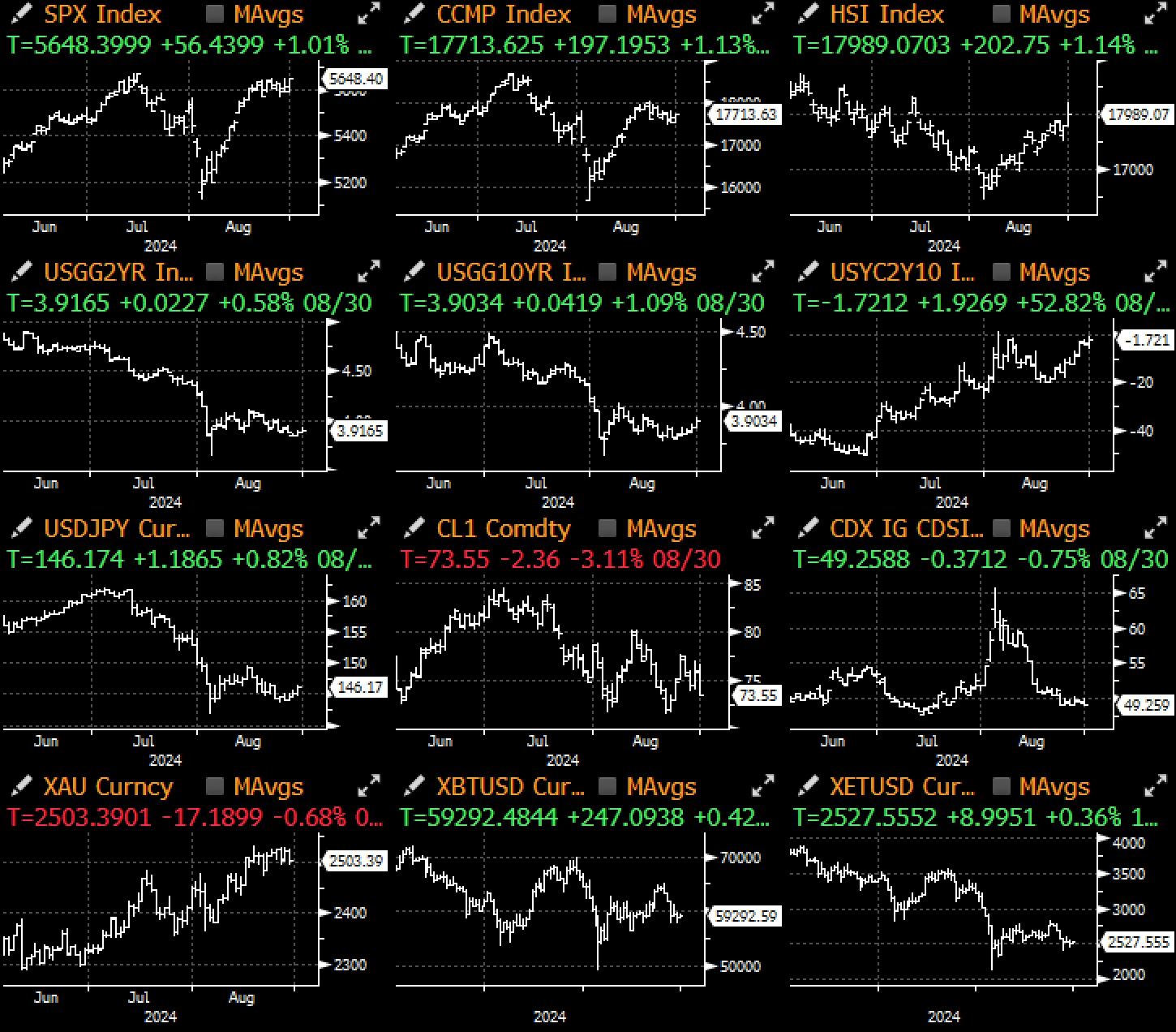

Last week was relatively quiet, with global equities largely back to their mid-term highs, and US Treasuries closing at the end of the month at the lower end of their August range. Data provided support, with second quarter GDP revised up to 3.0%, initial jobless claims remaining stable, and PCE data confirming that inflation is slowly moving toward the Feds long-term target.

Core PCE inflation increased by 0.16% month-on-month and 2.6% year-on-year. Personal spending data was quite healthy, increasing by 0.4% month-on-month. However, strong spending was largely driven by the continued decline in the US savings rate, which has now fallen to 2.9%, the lowest point since June 2022 and below the pre-pandemic average.

In fixed income, yields have been largely range bound over the past week, however the closely watched US Treasury yield curve (2/10s) is now just one step away from “inversion” after two years of negative territory, a strong signal that macro players are now fully on board with the Fed’s upcoming easing cycle. Long-dated bond prices are weighed down by supply indigestion, while September pricing indicates a ~33% chance of a 50bps rate cut due to falling inflation.

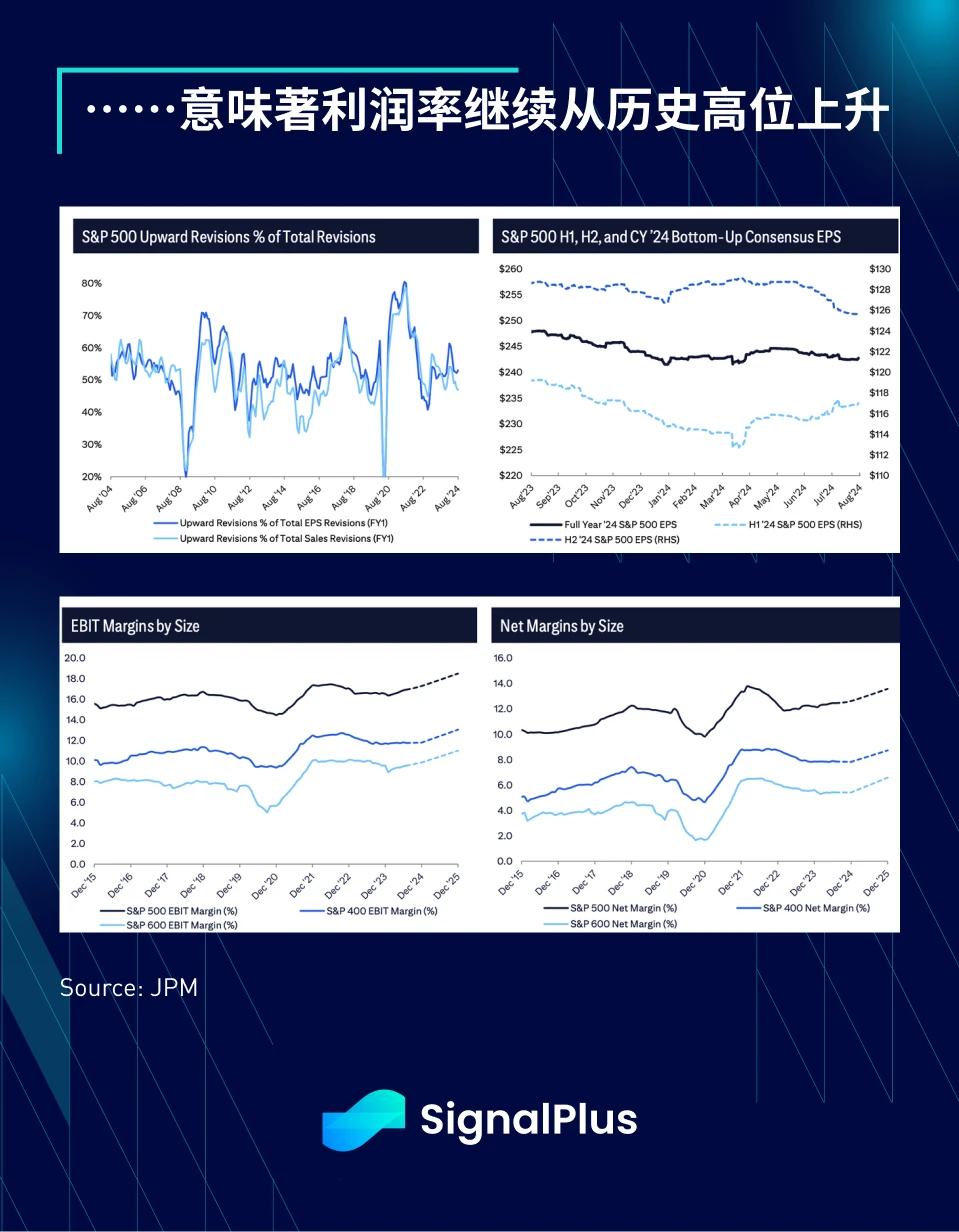

In the stock market, long-term investors and mutual fund investors have bought in massively after the market fell in early August, and investors still have confidence in the stock market, and SPX corporate earnings have continued to grow so far. In addition, the fundamentals remain very healthy, and despite various uncertainties in the economy, companies are still able to find ways to maintain profitability, and the already high EBIT and net profit margins continue to rise.

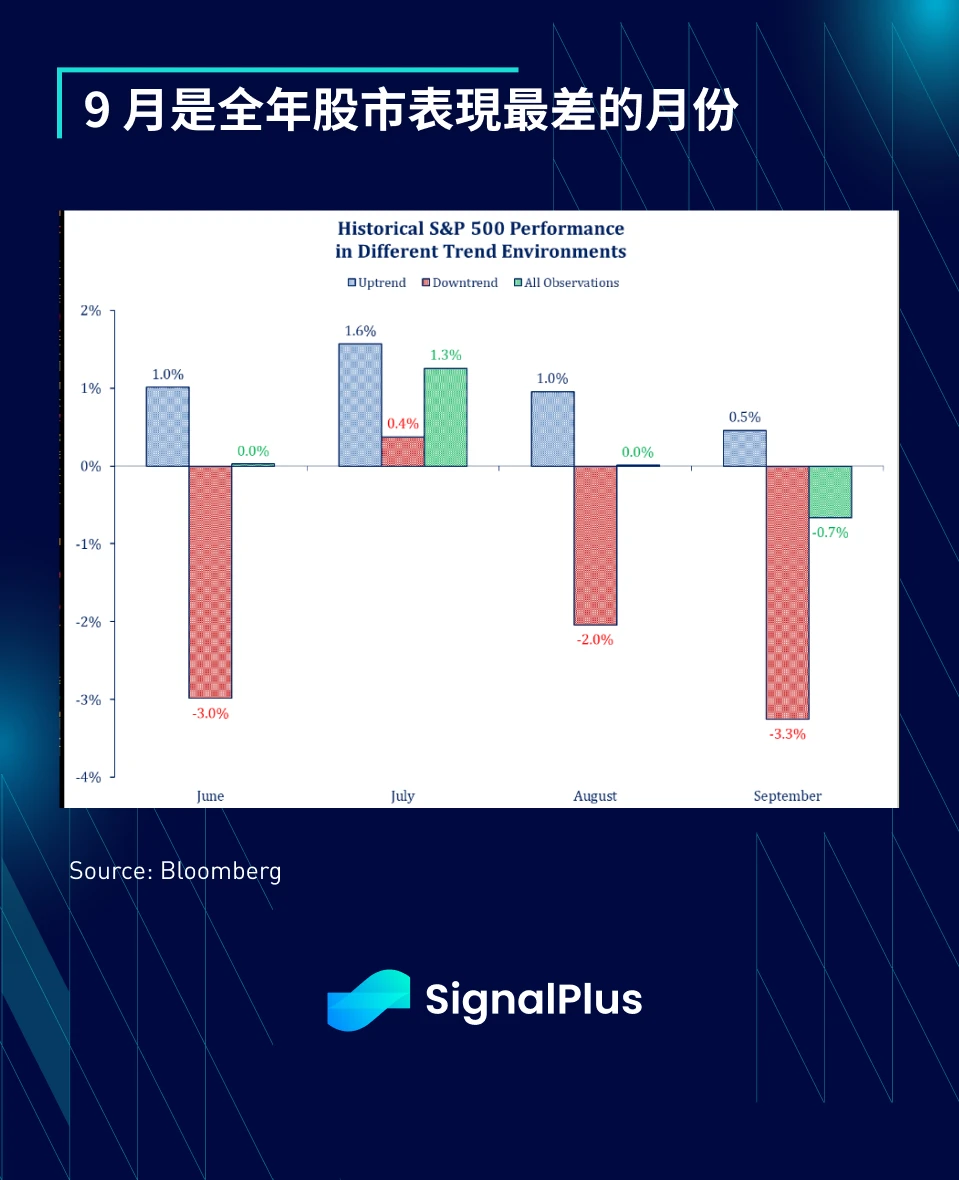

That being said, September is usually the worst month for US stocks from a seasonal perspective. Will this year be different? Will the potential catalyst come from weak non-farm payrolls in early September? Or will it be resistance to the aggressive tax increase plan by Harris/Walz? Or will there be an unexpected pick-up in inflation? This month is expected to be a very busy month starting with the release of the employment data on Friday.

Cryptocurrencies had a quiet but still disappointing week, with major currencies and altcoins all down around 10%. Add to that the arrest of TG founder Durov in France and the SEC’s latest action against Opensea, which dampened sentiment, and continued outflows from BTC and ETH ETFs (10 of the past 12 days), and there’s little to celebrate.

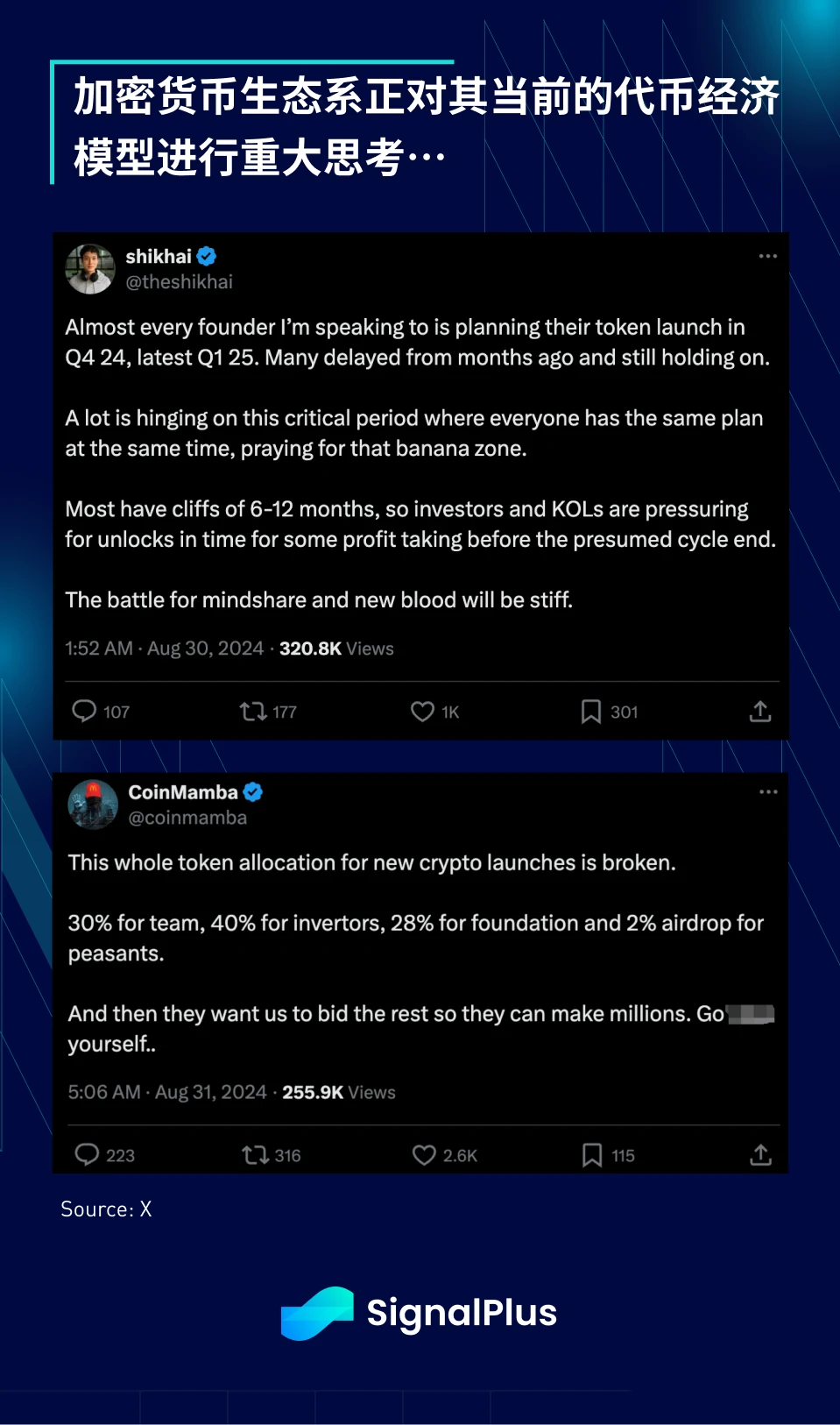

Ethereum’s structural problems are too numerous to mention (unattractive L1 token economics, over-proliferation of L2, divergence in protocol direction between core foundation members and users, lack of recent DeFi breakthroughs), the entire cryptocurrency ecosystem is facing liquidity challenges (lack of exit liquidity), and the busy token generation activities in the fourth quarter (such as Eigenlayer, ZCircuit, Babylon, Solv, Soneium, Scroll, Berachan, Monad, Gross, Elixir, Hyperliquid, Dolomite, Polymarkets, Symbiotic, Solayer, etc.) seem to make the situation more difficult.

The situation may not improve in the short term, so please be safe when trading!

您可以使用 t.signalplus.com 上的 SignalPlus 交易风向标功能获取更多实时加密货币资讯,若想第一时间收到我们的更新,请关注我们的推特账号@SignalPlusCN,或加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram 群和 Discord 社区,与更多朋友交流互动。

SignalPlus 官方网站: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240902): Seasonally Worst

Original author: Tang Han, founder of SeeDAO Crypto nihilism has been prevalent in the industry recently. But this is not surprising at all. For some experienced practitioners, as early as last year or even the year before, they had doubts about the current industry path. In my opinion, the biggest reason for the current crypto nihilism is that a large number of funds and builders have poured into a bunch of artificially conceived pseudo-demands. This pseudo-demand cannot bring real users, nor can it solve real problems. Instead, it has caused more and more smaller pseudo-problems, and has caused funds and people to run around in the split pseudo-problems. Because the problem is artificially constructed, the result is naturally nihilistic. Its like a person has created an enemy, and after a…