在过去的24小时内,市场上出现了许多新的热门货币和主题,这可能是下一个赚钱的机会, 包括:

-

The sectors with strong wealth-creating effects are: BGB;

-

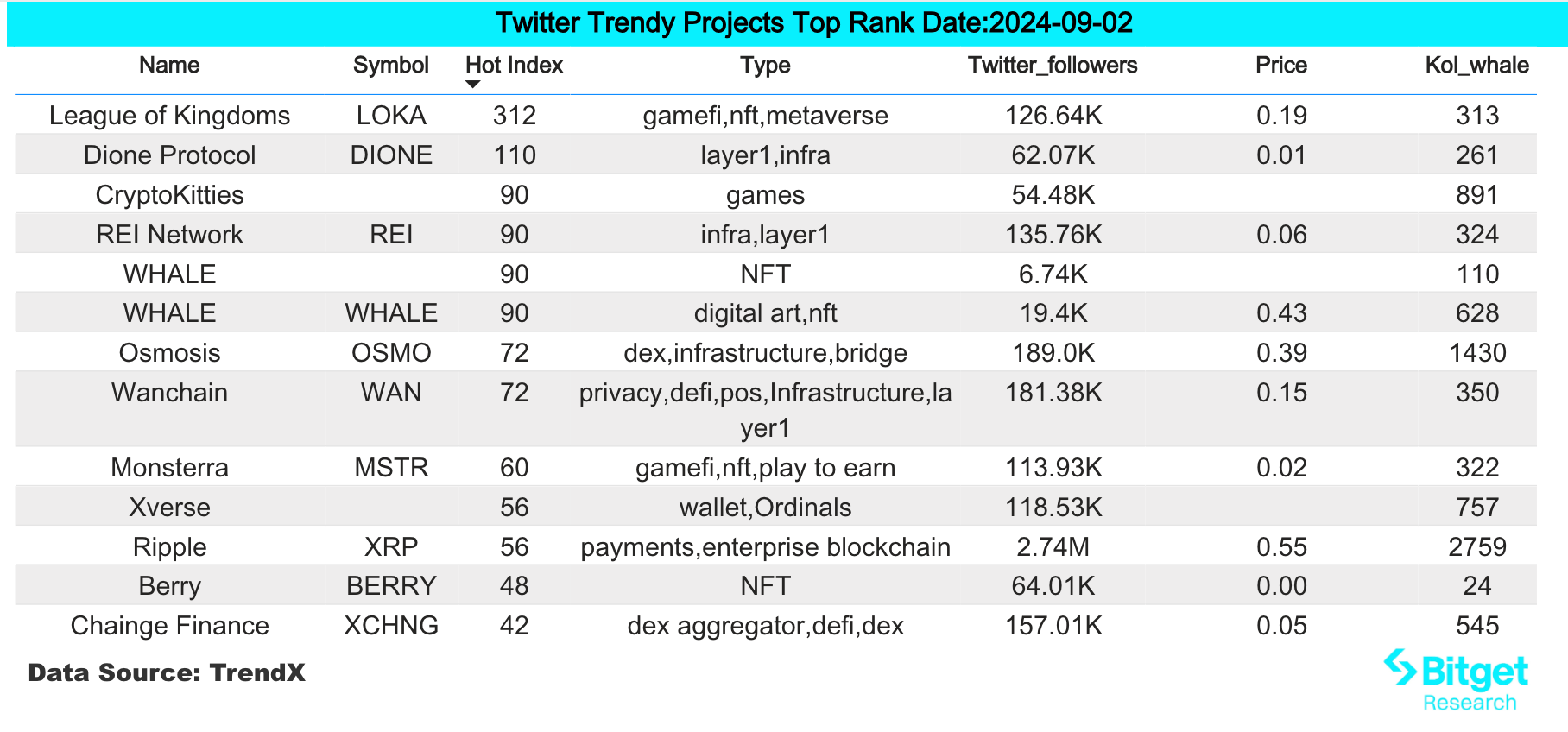

The most popular tokens and topics searched by users are: CARV, CryptoKitties, TON, etc.

-

潜在的空投机会包括:燃料、Story Protocol;

Data statistics time: September 2, 2024 4: 00 (UTC + 0)

1. 市场环境

It is basically certain that the Federal Reserve will start cutting interest rates in September: CME Fed Watch data shows that the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 67%, and the probability of cutting interest rates by 50 basis points is 33%.

BTC led to a sharp drop in the overall market. The BTC spot ETF had a net outflow of $277 million last week, and the ETH spot ETF had a net outflow of $12.6 million last week. The gas fee on the ETH chain continued to be lower than 1 gwei, and the ETH/BTC exchange rate has fallen to 0.042. Market sentiment and on-chain activity have fallen to the freezing point. At present, there is no sign of a rebound in the market in the short term.

Bitget opened three Launchpools in two weeks. BGB became the fifth best performing token among the top 100 tokens by market capitalization in the past seven days of market decline, excluding stablecoins (down 4.69% in seven days, better than BTCs 10.8%).

2. 财富创造领域

1) The sectors that need to be focused on in the future: BGB

主要原因:

-

Bitget launched three Launchpool projects in two weeks: Orderly Network (ORDER), Counterfire Economic Coin (CEC), and MetaCene (MAK), which continued to bring holding income to BGB Holders during the market decline and kept the price of BGB strong.

-

The fundamentals of the Bitget platform continue to strengthen. Currently, the monthly traffic of the Bitget website has increased by +284% compared with a year ago. On August 19, it was reported that the ranking of Bitget App in Apples iOS App Store has risen significantly. It has now entered the top ten of the financial list in 11 countries, including second in Nigeria, sixth in Ukraine, and eighth in Belarus.

影响后市的因素:

-

Whether Bitget can continue to provide benefits such as Launchpool to BGB Holders in the coming months will be the most direct driving factor for the increase in BGB prices.

-

The Bitget platforms continued brand development and user growth remain the biggest moat to stabilize BGBs price.

3. 用户热搜

1)热门 Dapp

中型货车:

CARV 是一个以游戏为中心的 ID 基础设施,旨在建立用户拥有的游戏身份,可以实现成就展示、好友和游戏发现、直接货币化,并且可以随处携带。在过去一周,这款 Dapp 的独立活跃钱包数量已超过 445 万。近期,该项目表现活跃:4 月 26 日,CARV 宣布完成 $ 千万级 A 轮融资;5 月 31 日,Animoca Brands 宣布对 CARV 进行战略投资,成为其节点运营商。

2)Twitter

CryptoKitties:

The long-established NFT project CryptoKitties has launched a new project, egg. The NFT series was recently minted at a price of 0.008 ETH. A total of 3,134 NFTs were minted during the minting period. The series floor price is now 0.1121 ETH, with a 24-hour increase of 261.67%.

3)Google 搜索区域

从全球角度来看:

Why is crashing:

The crypto market has generally fallen recently, and market investors are searching for reasons related to the decline. The current reasons for the market decline are mainly due to lack of liquidity and lack of hot spots in the market. The market may show significant improvement after the Federal Reserves interest rate increase or the US presidential election, and may continue to fluctuate and fall in the short term.

从各地区热搜来看:

(1) Asia and Africa: The attention is scattered, with Blum, Solana, etc. The common searches are about why they often fall, the overall market value of the crypto market, and the fear and greed index.

(2) English area: Search results in the English area include ONDO, PEPE, TON, FLOKI and other projects that have certain support in the recent decline, which shows that users in the English area have a certain interest in assets that have support in the decline.

潜在的 空投 机会

燃料

Fuel 是一个基于 UTXO 的模块化执行层,为以太坊带来了全球可访问的规模。作为模块化执行层,Fuel 可以实现单片链无法实现的全球吞吐量,同时继承以太坊的安全性。

2022年9月,Fuel Labs成功募集$8000万美元融资,由Blockchain Capital和Stratos Technologies领投,多家领先投资机构跟投,包括CoinFund、Bain Capital Crypto、TRGC等。

参与方式:您可以将 Fuel 接受的代币直接存入您获得的积分中。参与者每存入以下资产 $1 即可每天获得 1.5 个积分:

积分:ETH、WET、eETH、rsETH、rETH、wbETH、USDT、USDC、USDe、sUSDe 和 stETH;7 月 8 日至 22 日期间,每天存入 ezETH 可获得 3 个积分。

故事协议

Story Protocol 是一个 IP 管理协议,该项目旨在通过利用区块链技术,将内容和 IP 记录在各种区块链上并将它们连接起来,从而改变人类记录历史的方式。

该项目近期完成由a16z Crypto领投的$8千万B轮融资,其他参投机构包括Foresight Ventures、Hashed等。截至目前,Story Protocol背后的开放团队PIP Labs已融资$1.4亿,估值$2.25亿,市场关注度极高,或将成为区块链新赛道的龙头项目。

具体参与方式:Story Protocol 目前已经和多个项目合作,包括 Colormp 等,用户可以参与这些项目的 Launch NFT 铸造,并持续维护项目进度和完成相应任务,还可能获得未来的 IP 代币空投。

原文链接: https://www.bitget.fit/zh-CN/research/articles/12560603815164

【免责声明】市场存在风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何观点、看法或结论是否适合自己的具体情况。根据此信息进行投资需自行承担风险。

This article is sourced from the internet: Bitget Research Institute: The market crash shows no signs of rebounding, Bitgets third Launchpool in two weeks keeps BGB price strong

相关:Cube Exchange:探索 Solana 生态系统中的下一个万亿美元市场机会

FTX的崩盘不仅摧毁了无数投资者的信任,也动摇了整个加密市场的根基。许多投资者因为这次事件对加密货币不再有任何信任,开始质疑整个行业的可靠性。曾经光鲜亮丽的中心化交易平台一瞬间成为过去。这种信任的崩盘引发了市场的剧烈波动,加密货币的价格在短时间内暴跌,市场的流动性几乎枯竭,用户资金遭到大规模损失。如此灾难性的事件凸显了过度依赖中心化交易平台的巨大风险,也让加密市场的用户对加密货币的安全性、可靠性和稳定性充满疑虑。