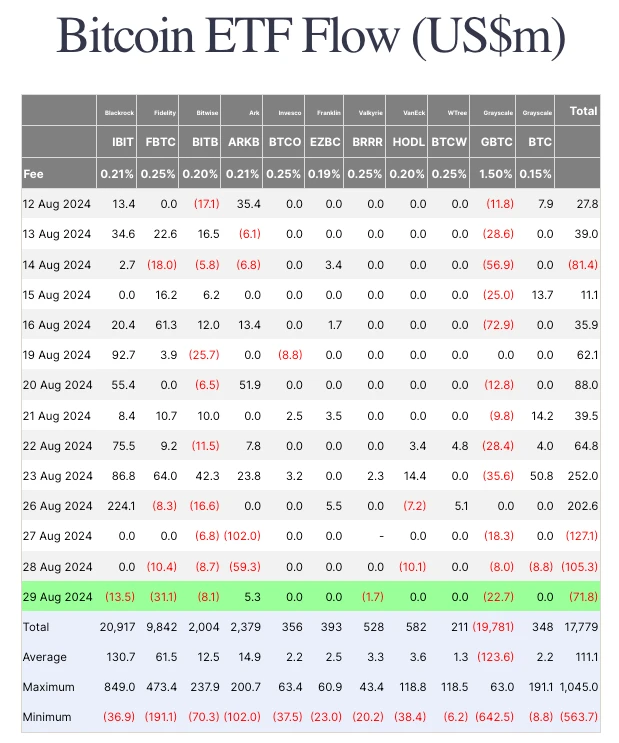

In the past day, the price of BTC rose 4% to $61,000 during the Asian session, but fell sharply to $59,000 during the US session, giving up all the gains during the day. In fact, a large amount of funds have flowed out of BTC ETF in the past three days. The increasingly stringent regulatory actions of the US SEC are also threatening the crypto industry and NFT. The markets selling pressure and bearish sentiment have increased, trading volume has decreased, and the decline in perpetual contract funding rates also indicates a decrease in participation and increased fear among traders. If the price falls below the strong support level of 58,000, bulls may face a large number of liquidations again.

来源:Farside Investors

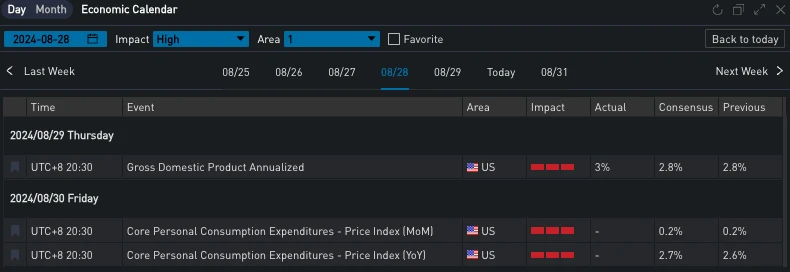

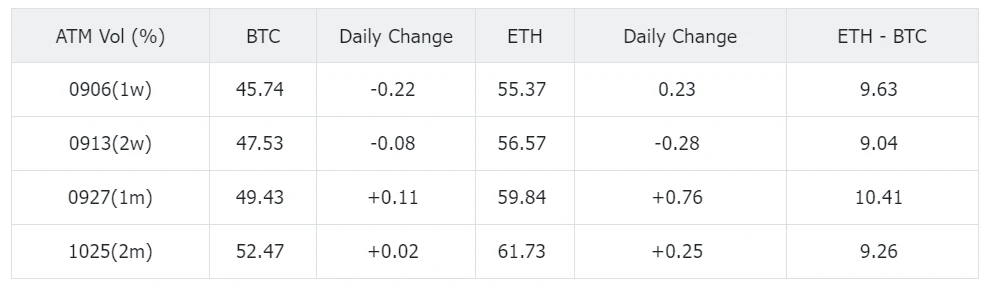

In terms of options, the PCE data that the Federal Reserve favors the most will be released at 8:30 tonight. The IV of Doomsday has risen slightly to about 50% due to the advance pricing of this part of uncertainty, while the Forward IV of the next weekend is approximately in the range of 36%-38%. The overall volatility level has not changed much, and the situation of ETH is similar.

资料来源:SignalPlus,经济日历

Source: Deribit (as of 30 AUG 16: 00 UTC+ 8)

来源:SignalPlus

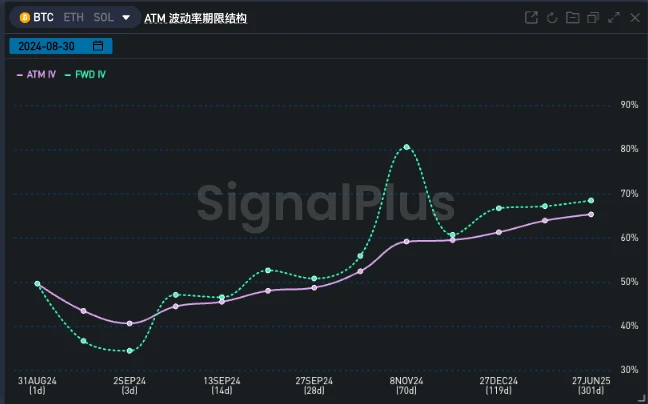

Although the overall IV change is not significant, there are still noteworthy changes in the shape of the surface. First of all, Fly, the smile curvature of BTC/ETH has increased significantly in the last two months of the year. In terms of trading, we see a bullish spread strategy represented by BTC 27 DEC 80000 vs 100000, with a single-leg trading volume of more than 200 BTC.

On the other hand, the Vol Skew of ETH has returned to a low level. The decline in perpetual contract funding rates and changes in ETF inflows have caused Ethereum to continue to face a bearish trend. Although the price of the currency has tried to rebound from 2400 recently, it has not been able to break through the strong resistance of 2600.

来源:SignalPlus

Other obvious flows on BTC include the 6 SEP Long Put Spread and the calendar spread on 13 SEP/20 SEP 66000. Their influence is also seen in the term structure of Forward IV. For some traders, since Powell鈥檚 speech at the global central bank meeting in August, the non-farm payrolls data released on the evening of September 6th seems extremely critical. Although the 6 SEP options have expired at that time and the exchange has no closer expiration date, this date may also cover the uncertainty that can be explained by the small non-farm (ADP employment) data of the previous day.

数据来源:Deribit,BTC交易总体分布

您可以使用 t.signalplus.com 上的 SignalPlus 交易风向标功能获取更多实时加密货币资讯。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlusCN,或加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram 群和 Discord 社区,与更多朋友交流互动。SignalPlus 官方网站:https://www.signalplus.com

欢迎加入Odaily官方社区

Telegram订阅群: https://t.me/Odaily_News

电报聊天群: https://t.me/Odaily_CryptoPunk

官方推特账号: https://twitter.com/OdailyChina

This article is sourced from the internet: SignalPlus Volatility Column (20240830): Painting Door Market

Related: Web3 growth in 2024: Over 100 startups have raised over $1 billion

Original author: SAFARY Original translation: TechFlow Web3 Growth Landscape: Interactive Map and Database Insight Summary 101 Web3 Growth and Social Startups That Have Raised Over $1 Billion¹ 23 startups raised $277 million in new funding since last year There aren’t many new Series A rounds; VCs are investing more in successful projects Attribution/analytics, loyalty, and social startups received the most new funding, accounting for 80% of funds raised across all 10 categories Messaging was the second most funded category at $245 million, behind Social and Publishers ($400 million), but the category only received $7 million in new funding. Ad Networks and Community Tools are the most crowded categories with 19 teams, followed by Messaging and Loyalty with 18 teams each. The loyalty category has shrunk dramatically from more than 40…