原文作者:BitpushNews Mary Liu

On August 28th local time, OpenSea disclosed that it had received a Wells notice from the U.S. Securities and Exchange Commission (SEC), which means that the leading NFT company may be prosecuted for violating securities laws.

The NFT market is home to tens of thousands of collectibles, ranging from on-chain artworks created by independent artists to digital and “physical” collectibles, as well as PFP projects such as CryptoPunks and Bored Ape Yacht Club, which have accumulated huge valuations over the past few years.

If OpenSea is sued, this would not be the first time the SEC has taken action against NFT projects. Last September, the NFT animation series Stoner Cats, voiced by many Hollywood stars such as Mila Kunis, reached a settlement with regulators for $1 million. The SEC accused the production entity Stoner Cats 2 LLC of conducting an unregistered crypto asset securities offering.

But the potential lawsuit against OpenSea signals a broader crackdown on centralized 市场s like these.

In response, OpenSea CEO Devin Finzer said that in order to ensure that creators can continue to innovate without fear, the company has pledged $5 million to pay legal fees for NFT artists and developers who may receive Wells notices from the U.S. SEC.

The crypto community reacted strongly, with many industry figures publicly speaking out in support of OpenSea.

Tyler Winklevoss, founder of Winklevoss Capital Management and Gemini exchange, said:

“The SEC is now trying to claim that NFTs are securities. What’s next? Baseball cards? Comic books? Gary Gensler’s malicious and un-American war on crypto is expanding. Digital web3 creators and artists are now in the crosshairs.”

Sheila Warren, CEO of trade group Crypto Council, wrote:

This latest round of regulatory enforcement was initiated by the anti-crypto army GG. We support opensea and creators around the world and commend @dfinzer for his leadership.

(Note: GG = Gary Gensler; leading an “anti-cryptocurrency army” is the political ambition of Gensler’s ally, Massachusetts Democratic Senator Elizabeth Warren)

Variant Fund CLO Jake Chervinsky believes that NFTs should not be subject to laws written decades ago (the Securities Act was passed in 1933):

“The SEC has completely lost its mind. The idea that a financial markets regulator founded in the 1930s would have jurisdiction over digital art in the 2020s goes against not only common sense but also the SEC’s statutory authority. Thank you Opensea for fighting for what is right.”

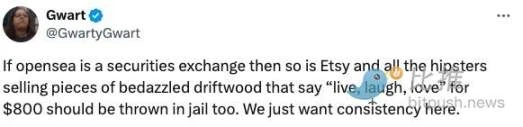

Gwart, who calls himself the “crypto Twitter troll,” discussed the broader implications of the SEC’s crackdown on NFTs:

If Opensea is a stock exchange, then so is Etsy, and all the sellers of wooden art pieces engraved with Live, Laugh, Love for $800 should also be in jail if there is any hope of maintaining consistency.

Bankless co-founder Ryan Sean Adams wrote an angry essay:

“The SEC is now planning to sue OpenSea on the grounds that NFTs are securities, and apparently Gary Gensler does think that tokenized Pokemon cards are securities. OpenSea is now the sixth successful case of a US crypto company that the SEC has cracked down on this year – they are now hitting the FANNG in the US crypto industry: Metamask, OpenSea, Coinbase, Kraken, Uniswap, Robinhood (MOCKUR for short), Gensler is destroying your constitutional right to own cryptocurrency. In attacking our healthiest and most legitimate companies, they are actually attacking ordinary American citizens. This is all happening under the leadership of the Biden administration, and the faction in the White House is planning all this, and they want to kill cryptocurrency in the United States.

I can’t overstate how bold it is for the Biden administration (should we call it the Harris administration?) to do this less than 90 days before the election. If they are suing a sixth cryptocurrency company before the election, what do they plan to do with crypto after the election? Kamala Harris said nothing about crypto.

No, shes not just the vice president – her campaign has enormous influence as the presidential election approaches. They could stop Gensler if they wanted to. So at this point, we have to assume that shes tacitly allowed this to happen. If she wins, it means shell continue to try to strangle the life out of cryptocurrency in the United States. Enough is enough. I got into cryptocurrency because I believe its the greatest freedom technology of my generation, and watching my home country methodically try to strangle it over the past few years has been one of the deepest disappointments of my adult life.

We’ve been fighting hard this year. We can’t let up now, crypto is going to be fine — it’s the future of America that I’m worried about.”

VC Adam Cochrane:

“This is undoubtedly one of Gensler’s dumbest gambles and another reason why he must go under any new administration. It’s clear that NFTs are art. Can you sell art as a security? Masterworks can. Can OpenSea do that? No.

And once their popularity, investment, and revenues decline, the SEC will target them too, hoping to eliminate them like a wounded beast at the back of a herd. If the SEC was concerned that NFTs were securities on OpenSea, it would have been addressed to “protect users” when a celebrity posed with a Bored Ape avatar on a talk show, not now. But if Gary keeps doing this, he’s going to get his ass beat in court again, because this is his weakest argument yet.”

Former CFTC Commissioner Brian Quintenz (now at a16z):

“The current SEC crusade against the cryptocurrency industry continues. This is in stark contrast to what Vice President Harris said when she announced her economic agenda two weeks ago.

Despite strong bipartisan support for clear crypto regulation in the U.S., and explicit condemnation of the SEC’s approach to SAB 121 by both the House and Senate, the SEC’s legal battle strategy against the industry has not diminished.

Multiple Democratic members of Congress have repeatedly stated that a thoughtful, legislative approach to cryptocurrencies is far better than arbitrary and capricious legal attacks on the emerging industry.

Vice President Harris needs to not only condemn the SEC’s actions, but also lay out a detailed plan for how her future administration will support this innovation while providing customer protections. Now more than ever, she needs to clarify her strategy in this regard.”

Bitcoin holder Jameson Lopp believes that if the SECs intention is to protect investors, it is already several years late.

Roham Gharegozlou, CEO of Dapper Labs, which supports multiple NFT projects, said:

Non-financial NFTs are clearly not securities, and most lawmakers we have engaged with understand this – we are working to provide legal clarity for NFTs through legislation upcoming in Congress and support OpenSea in their fight.

Anthony Scaramucci said Gensler is undermining the Democratic Party’s recent efforts to build alliances in the cryptocurrency community, and he questioned the SEC chairman’s approach: “Gensler wants Harris to lose the election (?)”

Some members of Congress and scholars also expressed opposition to the SECs approach.

Democratic Congressman Wiley Nickel (D-NC) called the SECs heavy-handed enforcement approach and criticized the SECs excessive use of enforcement regulation, saying it blatantly abuses its power and erodes trust and transparency in the regulatory system.

Wiley Nickel accused the regulator of threatening to “undermine the progress of digital innovation in the United States” and called on the SEC to work with Congress to develop “clear, fair regulations” governing digital assets and Web3 technologies.

Brian Frye, a law professor at the University of Kentucky who specializes in NFTs and securities law, said in an interview with Bloomberg: The NFT market is exactly the same as the art market, which existed long before the SEC was established and the SEC has never regulated it. If the SEC believes that the art market is a securities market, it should say so and try to regulate it. If not, it should allow OpenSea to continue to develop.

This article is sourced from the internet: NFT is considered a security? The US SECs new move angers the public again

Related: The Darkest Illusion of the Crypto Bull Market: Is Innovation Really Useless?

Original author: Haotian (X: @tmel0211 ) Although this round of Crypto bull market is still in its prime, looking at the distorted values of innovation is useless in the primary market and MEME everything in the secondary market, I feel like its the darkest moment. Why? 1) Originally, I was immersed in the big and small things in the industry all day long, fearing to miss any technological innovation. However, in the past two months, under the influence of garbage market sentiment, there are very few updates from project parties, new narrative hotspots, etc. that can make people excited. Maybe its because of the lack of innovation, maybe its because the repetitive narratives have numbed people, or maybe its because the disconnect between the primary and secondary markets makes people…