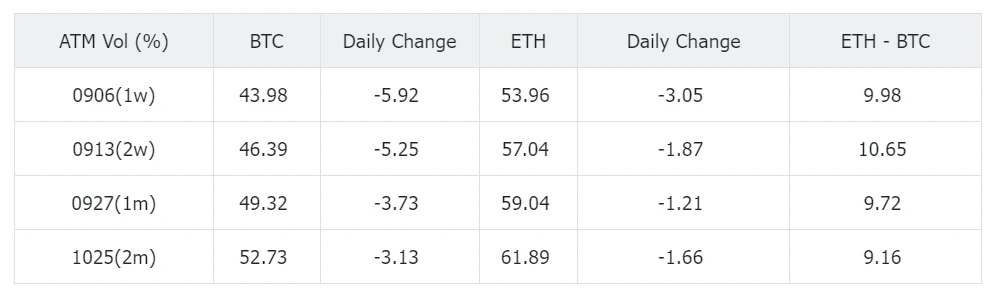

Yesterday (25 AUG) was not a peaceful Sunday. In the Middle East, Israel declared a 48-hour state of emergency, and the risks caused by geopolitics were injected into the market, causing the front-end IV to rise for a time. In terms of digital currency, TGs founder Pavel Durov was arrested in France on charges including terrorism and fraud, causing TON Coin to plummet by more than 16% + within the day, triggering global attention to freedom of communication and privacy. In addition, the Ethereum Foundation transferred 35,000 ETH to the Kraken wallet, triggering market speculation about potential price fluctuations, causing the currency price to fluctuate slightly over the weekend, with an actual intraday volatility of about 50%. Subsequently, its executive director came out to clarify that the transfer was only part of routine financial management, aimed at balancing the foundations accounts, and calming market sentiment. Under the influence of recent news, the bullish sentiment of digital currencies has continued to weaken, and the risk aversion sentiment that has spread in the market has caused the leverage on the contract to continue to decline. The perpetual contract funding rates of various exchanges are all declining, and even negative values have appeared.

来源:SignalPlus

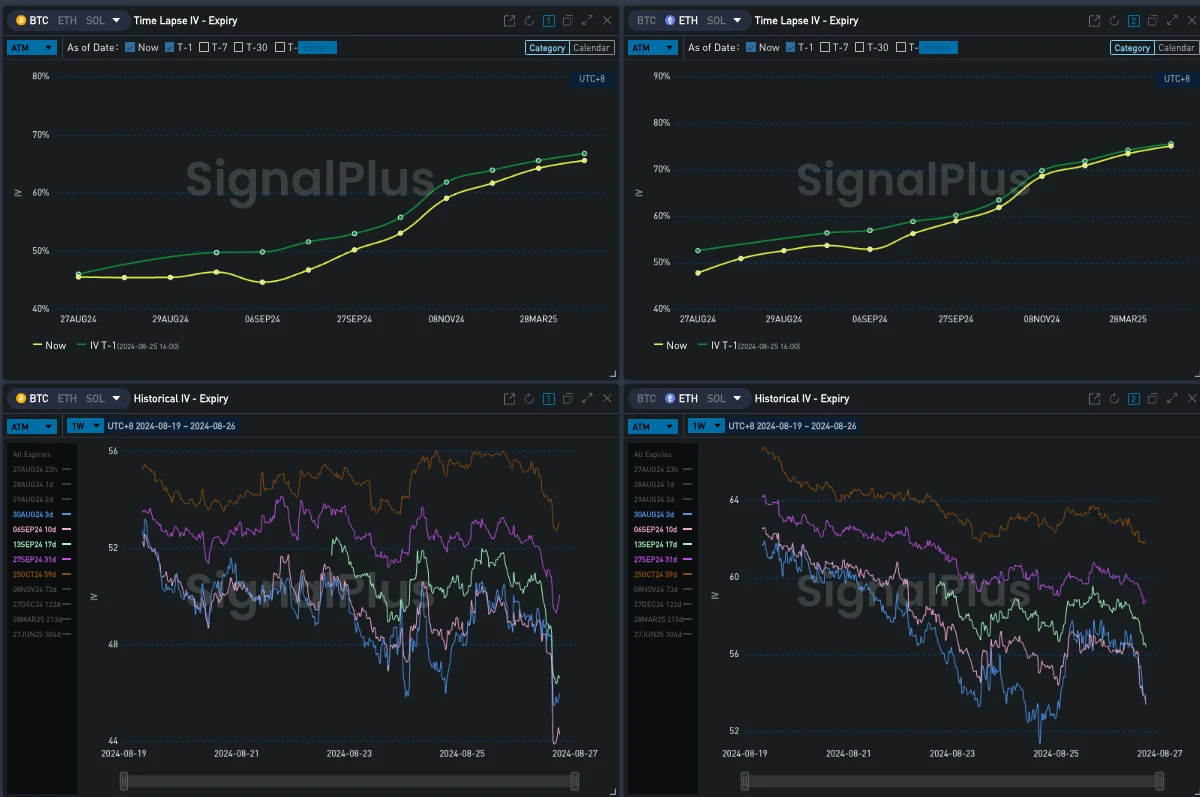

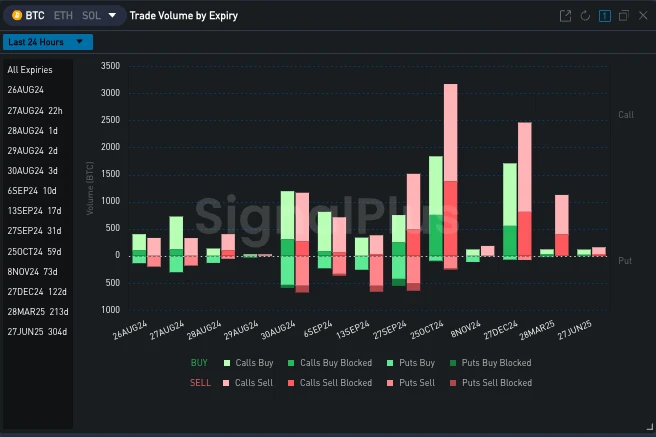

For BTC, with the increasing influence of macro news and the lack of new narratives in the crypto community, the actual volatility of the coin price has remained at a low level of 20-25% in the past two days, and the IV that rose briefly at the front end was quickly reduced to its original shape. On the other hand, the overall implied volatility level also dropped significantly during the day. In addition to the fact that the Realized Vol is low, a large amount of Top Side selling of BTC during the day, especially at the far end, is also the reason for the decline in IV. We can also see that this wave of Flow also caused a decline in the far-end Vol Skew. From the perspective of the volatility cone, it is already significantly lower than the historical 25% percentile, the curvature of the smile curve is also flattened, and the FLY value has dropped significantly.

来源:SignalPlus

来源:SignalPlus

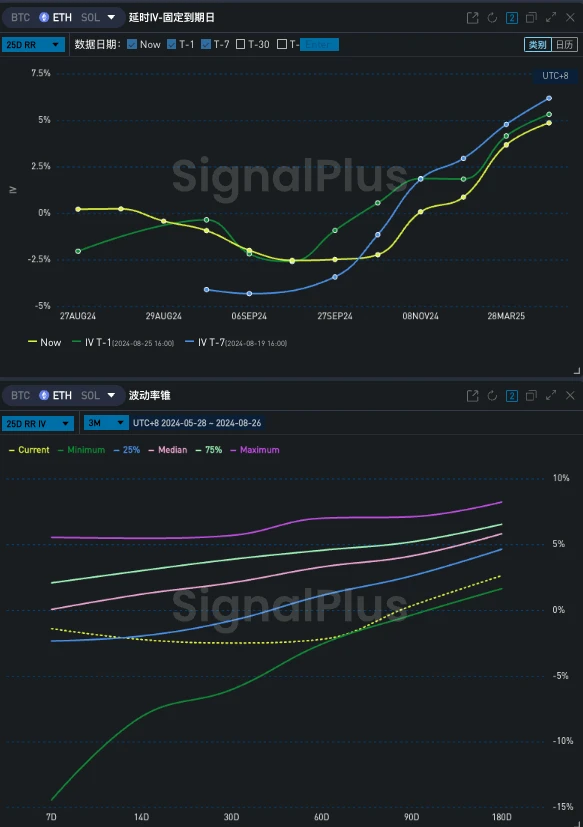

We have seen similar changes in ETH. Due to the decline in realized volatility, the IV Term Structure has become steeper, but since ETH does not have the Top Side Selling Flow that occurs on BTC, the forward IV has not dropped much. Similarly, although Convexity has dropped, it is still relatively mild compared to BTC. From the perspective of Vol Skew, the mid- to long-term RR has also dropped. In addition to the consideration of correlation with BTC, the impact of buying put options from sep and oct cannot be ignored.

来源:SignalPlus

您可以使用 t.signalplus.com 上的 SignalPlus 交易风向标功能获取更多实时加密货币资讯,若想第一时间收到我们的更新,请关注我们的推特账号@SignalPlusCN,或加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram 群和 Discord 社区,与更多朋友交流互动。

SignalPlus 官方网站: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240826): Skew

Related: Encourage Binance MVB, explain Blackwing protocol business and interaction methods

Original | Odaily Planet Daily ( @OdailyChina ) Author锝淣an Zhi ( @Assassin_Malvo ) Yesterday, BNB Chain announced the winners of the first BNB Incubation Alliance event jointly organized with Binance Labs. They are Payman , BalloonDogs , and Blackwing . These three projects will be admitted to Binance鈥檚 MVB program and receive funding from BNB Chain, as well as potential investment opportunities from Binance Labs . The first two projects are still in the early conceptual stage of the white paper, and the Blackwing white paper has clearly stated that there will be token airdrops , so Odaily will analyze the protocol and interactions of Blackwing in this article. Blackwing Interpretation Protocol Definition There are two official definitions of the Blackwing protocol, one is a modern DEX abstraction layer and…