Yesterday, the US employment data was significantly lowered as expected, but BTC did not react to it at the beginning of the US market, indicating that the market has already digested this information. The current focus is still on the speech delivered by Federal Reserve Chairman Powell at the global central bank conference held in Jackson Hole, Wyoming on Friday. Economists believe that the theme word this time may be gradual, and Powell may only give the green light for future interest rate cuts in a relatively cautious and general manner. According to Jinshi, Carl Tannenbaum, chief economist of Northern Trust, believes that Powell will convey another message to investors, telling them not to overreact to the data. The non-agricultural report at the beginning of this month shook the global financial markets, but he believes that the reaction to the employment report is one of the worst market overreactions I have seen in a long time. The market rushed to accept the idea that the economy is in recession, and this is just based on one data point. They are just looking for a narrative, and then they create one based on a job data. For Powell, the current Fed is in the final stage of fighting inflation against the backdrop of the US election. To reduce inflation and complete a soft landing without a recession, the next few months will be crucial, so he will be extremely cautious.

资料来源:TradingView

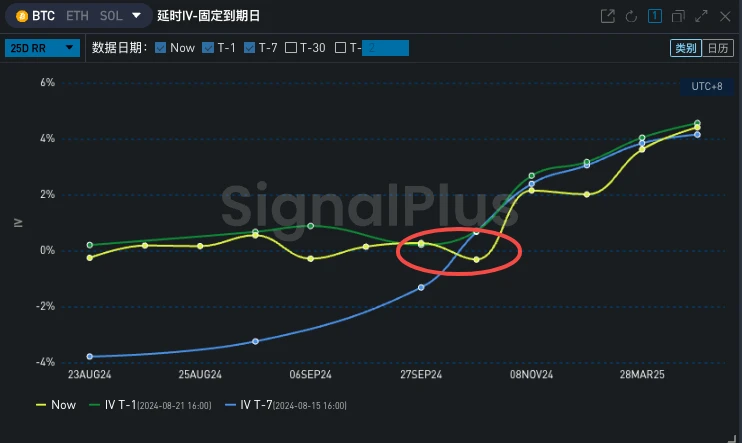

Back to digital currency, BTC formed a V-shaped trend during the day. At 3 a.m., liquidity collapsed and triggered a spike, falling below 6 w. In terms of options, the IV of 25 Aug formed a local high on the surface under the uncertainty brought by the upcoming global central bank annual meeting, but because most economists expected Powell to take a relatively cautious stance, there was no excessive risk premium.

Source: Deribit (as of 22 AUG 16: 00 UTC+ 8)

来源:SignalPlus

In the past two days of transactions, the demand on the bearish side in September and late October continued to rise, concentrated on the two support levels of 55000/56000, causing the local Skew to tilt to the bearish side. In August, there were large-scale bearish selling on Wing, which may be the markets positive response to the recent price increase and the sharp return of the front-end RR.

Source: SignalPlus, BTC Skew and Transaction Distribution

您可以使用 t.signalplus.com 上的 SignalPlus 交易风向标功能获取更多实时加密货币资讯。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlusCN,或加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram 群和 Discord 社区,与更多朋友交流互动。SignalPlus 官方网站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240822): Playing Tai Chi

原文作者 | Arthur Hayes (BitMEX 联合创始人) 编译:Odaily星球日报(@OdailyChine) 译者|Azuma(@azuma_eth) 编者按:本文为 BitMEX 联合创始人 Arthur Hayes 今晨发布的新文章 Water, Water, Every Where。在文中,Arthur 概述了美国财政部长耶伦利用国债回笼美联储逆回购资金和银行准备金的倾向,并解释了这些资金的流动将如何改善市场流动性状况。Arthur 还提到了这一趋势对加密货币市场的影响,并预测了市场下一步的走势以及 BTC、ETH、SOL 等主流代币的价格表现。以下为 Arthur 原文,由 Odaily 翻译。由于 Arthur 的文笔过于洒脱,…