Original author: Arthur, founder of DeFiance Capital

原文翻译:Ismay、BlockBeats

Editors Note: This article delves into Aaves dominance in the decentralized lending market and its future growth prospects. With the launch of Bitcoin and Ethereum ETFs, Aave is expected to benefit from the continued growth of crypto assets as an emerging asset class. In addition, as the global market demand for stablecoins increases, Aaves revenue and TVL will continue to climb. This article also analyzes Aaves upcoming V4 version and its token economic model upgrade, which will further consolidate its market position and bring more attractive risk-adjusted returns to investors. Through a comprehensive analysis of Aaves current status and potential, this article shows readers the core competitiveness of this leading project and its growth potential in the future.

以下为原文内容:

Aave is the largest and most battle-tested lending protocol currently available.

As the undisputed leader in on-chain lending, Aave has a very defensible and sticky moat. We believe that Aave is severely undervalued as a leader in this important crypto industry and has huge growth potential in the future, which the market has not yet fully reflected.

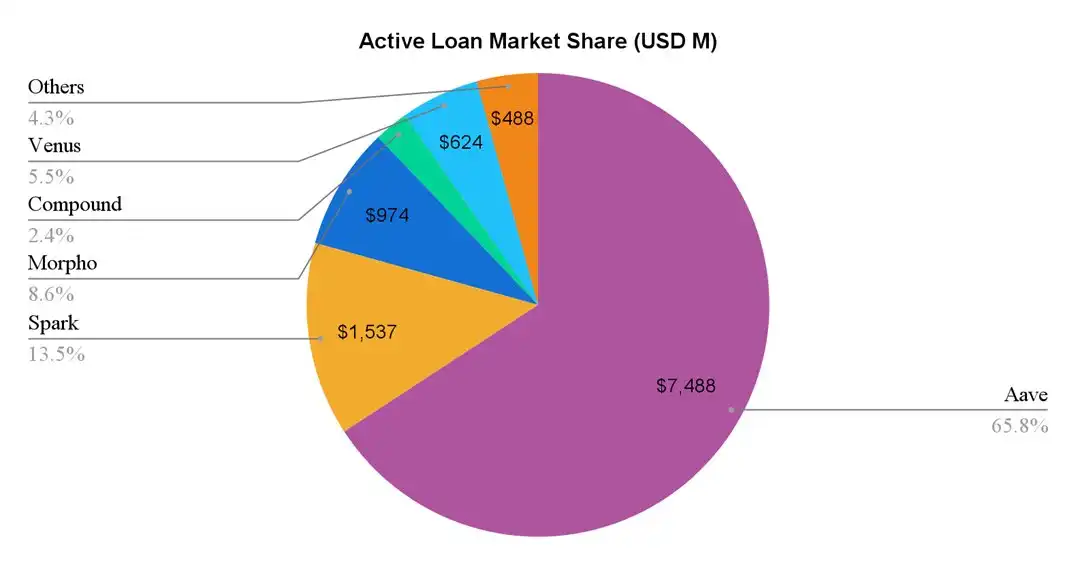

Aave launched on the Ethereum mainnet in January 2020 and is now in its fifth year of operation. Since its launch, Aave has firmly established itself as one of the most reliable protocols in the DeFi and lending space. As a testament to this, Aave is currently the largest lending protocol with a total active loan volume of $7.5 billion, five times that of the second largest protocol, Spark.

(Data as of August 5, 2024)

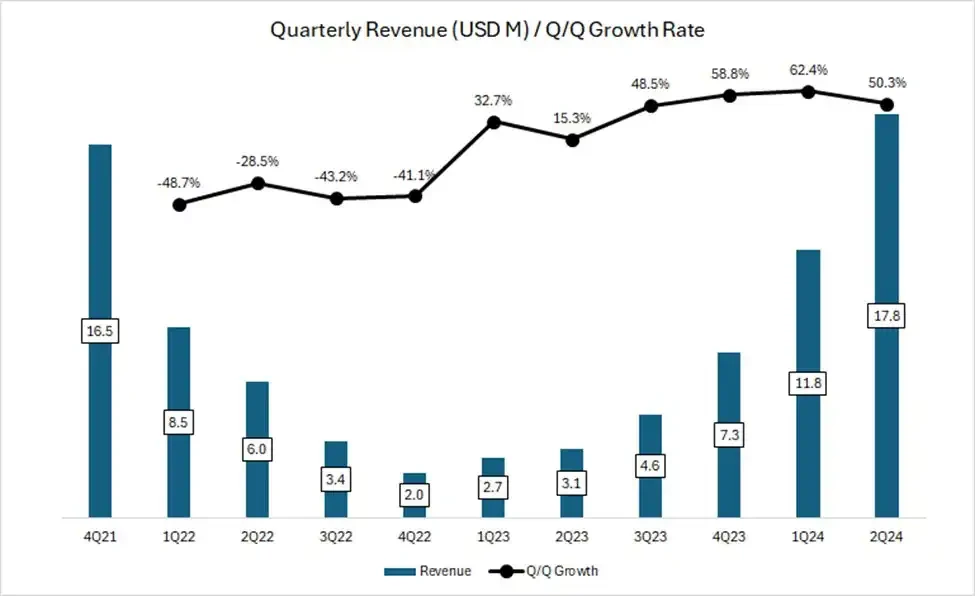

The protocol index continues to grow and has surpassed the high point of the previous cycle

Aave is one of the few DeFi protocols that has surpassed the 2021 bull run metrics. For example, its quarterly revenue has exceeded its Q4 2021 peak. Notably, even as the market remained sideways between November 2022 and October 2023, Aaves revenue growth continued to accelerate quarter-over-quarter. When the market picks up in Q1 and Q2 2024, its growth rate continues to be strong, increasing by 50-60% per quarter.

(Source: Token Terminal)

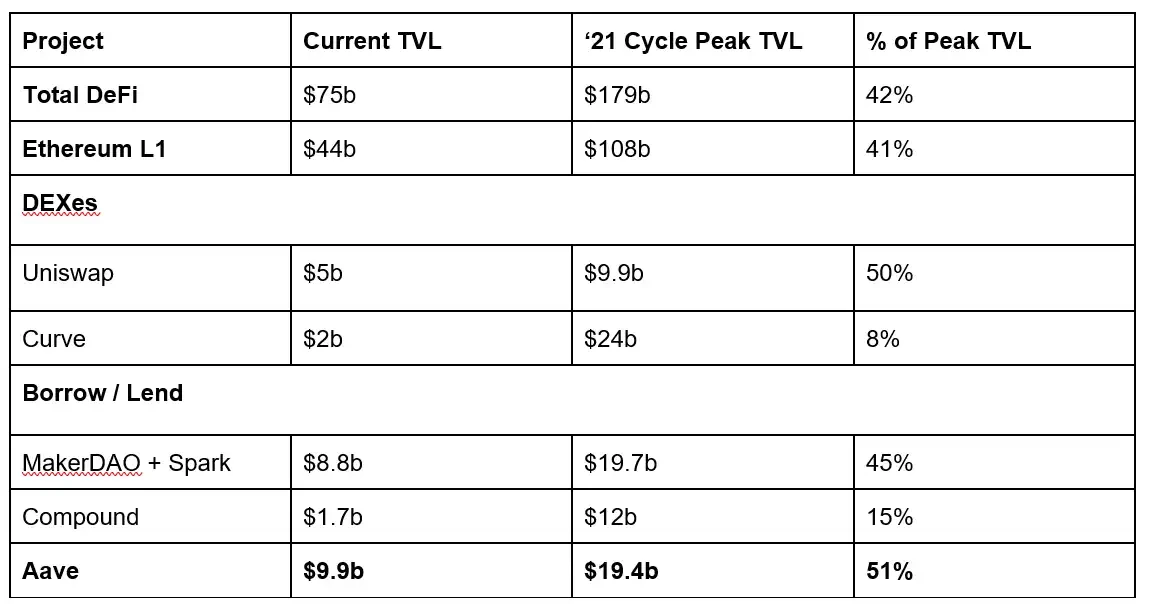

Aave’s TVL has almost doubled year-to-date due to increased deposits and rising prices of underlying collateral assets such as WBTC and ETH tokens. As a result, TVL has recovered to 51% of its 2021 cycle peak, demonstrating its resilience compared to other top DeFi protocols.

Data as of August 5, 2024.

Excellent earnings quality demonstrates product-market fit

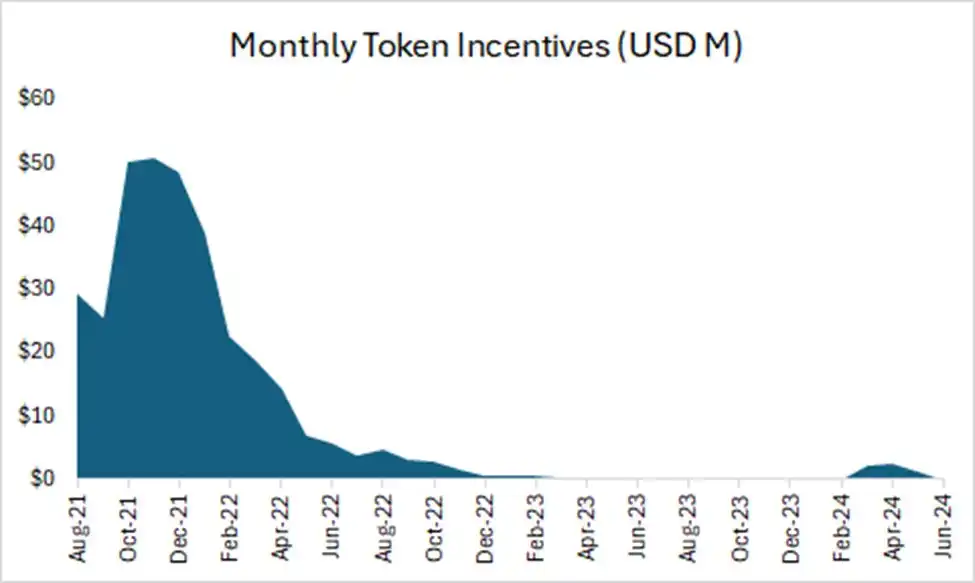

Aaves revenue peaked in the last cycle, when multiple smart contract platforms (such as Polygon, Avalanche, and Fantom) attracted users and liquidity through massive token incentives. This led to an unsustainable influx of hot money and leverage, which pushed up the revenue figures of most protocols during that period.

However, today, the token incentives of major chains have basically dried up, and Aave’s own token incentives have dropped to almost negligible levels.

(Source: Token Terminal)

This suggests that the indicators growth over the past few months is organic and sustainable, driven primarily by a pickup in market speculation, which has boosted active lending and borrowing rates.

Furthermore, Aave has demonstrated its ability to grow its fundamentals even during periods of subdued speculative enthusiasm. During the widespread global crash in risk assets in early August, Aave’s revenue remained resilient as it successfully captured liquidation fees as loans were repaid. This also demonstrates its ability to navigate market volatility across different collateral bases and on-chain.

(Data as of August 5, 2024 Source: TokenLogic)

Aave’s P/E ratio is at its lowest level in three years despite strong fundamental recovery

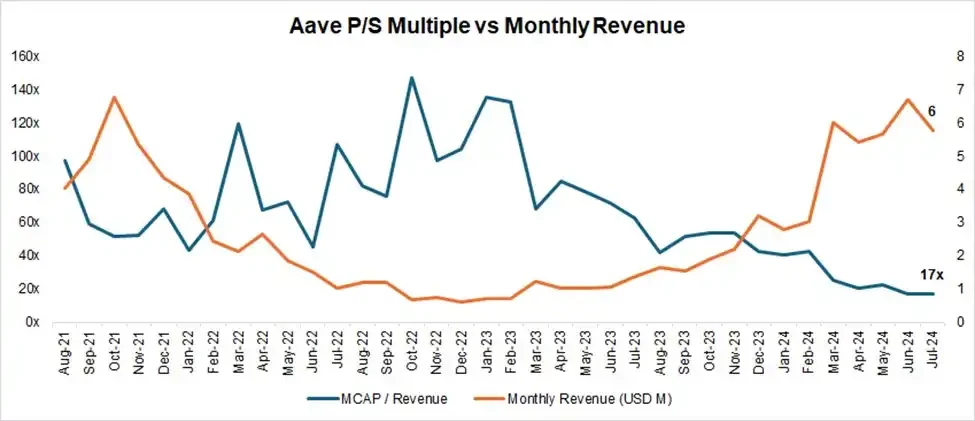

Despite Aaves strong recovery in various indicators in the past few months, its price-to-sales ratio (P/S) remains low, currently at 17 times, which has fallen to its lowest level in three years and is well below the three-year median of 62 times.

(Source: Coingecko, Token Terminal)

Aave is expected to continue to consolidate its dominance in the decentralized lending space

Aaves moat mainly consists of the following four aspects:

Good record of protocol security management : Most emerging lending protocols will encounter security incidents within the first year of operation, while Aave has not had any major smart contract-level security incidents so far. For DeFi users, especially large users with a lot of funds, a platforms security record brought by robust risk management is usually the primary consideration when choosing a lending platform.

Two-way network effect : DeFi lending is a typical two-sided market, with depositors and borrowers constituting the supply and demand sides respectively. The growth of one side will stimulate the growth of the other side, making it increasingly difficult for latecomers to catch up. In addition, the more abundant the overall liquidity of the platform, the smoother the liquidity in and out of depositors and borrowers, which makes the platform more attractive to large capital users, further promoting the growth of the platform business.

Excellent DAO management : Aave Protocol has fully implemented DAO-based management. Compared with the centralized team management model, DAO management provides more comprehensive information disclosure and has more in-depth community discussions on important decisions. In addition, Aaves DAO community includes a group of professional institutions with high governance levels, including top risk management service providers, market makers, third-party development teams, and financial advisory teams. These diverse sources of participants promote active governance participation.

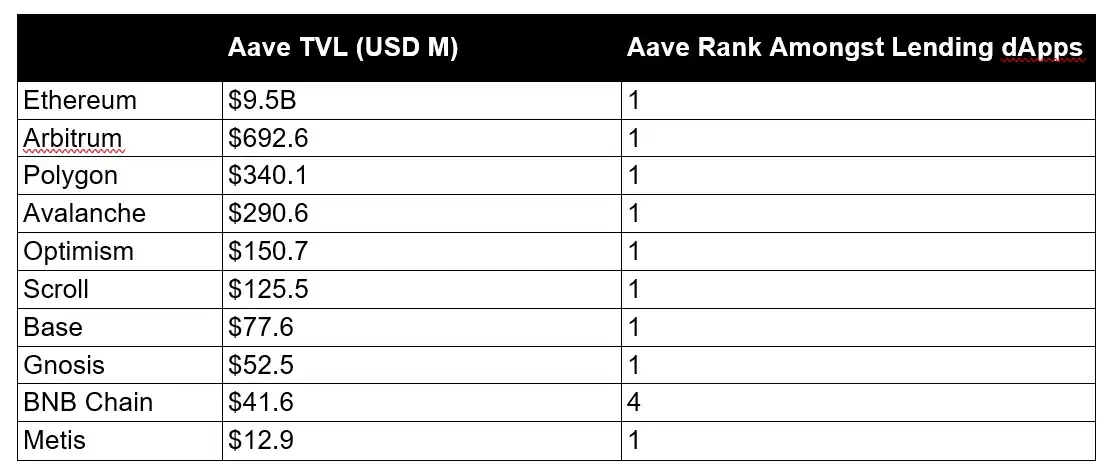

Multi-chain ecosystem positioning : Aave is deployed on almost all major EVM L1/L2 chains, and its TVL (total locked volume) is in a leading position on all deployed chains except BNB Chain. In the upcoming Aave V4 version, cross-chain liquidity will be connected, making the advantages of cross-chain liquidity more prominent. See the figure below for details:

(Data as of August 5, 2024, source: DeFiLlama)

Redesigned token economics model will drive value accumulation and eliminate slashing risk

The Aave Chan Initiative has just released a proposal to overhaul $AAVE’s token economics model to enhance the token’s utility by introducing a revenue sharing mechanism.

The first major change is the removal of the slashing risk faced by $AAVE when the Safety Module is activated.

Currently, $AAVE stakers (stkAAVE – $228M locked value) and $AAVE/$ETH Balancer LP tokens held in the Security Module (stkABPT – $99M locked value) may have their tokens slashed to cope with a shortfall event.

However, stkAAVE and stkABPT are not ideal covering assets due to their lack of correlation with the collateral assets that generate bad debts. In such an event, the selling pressure of $AAVE will in turn reduce the coverage ability.

Under the new Umbrella security module, stkAAVE and stkABPT will be replaced with stkaTokens, led by aUSDC and awETH. Suppliers of aUSDC and awETH can choose to stake their assets to earn additional fees (paid in $AAVE, $GHO, protocol revenue) on top of the interest paid by borrowers. These staked assets are subject to slashing and destruction in a shortage event.

This arrangement is beneficial to both platform users and $AAVE token holders.

Additionally, through the revenue sharing mechanism, more demand drivers for $AAVE will be introduced.

Introducing Anti-GHO mechanism:

Currently, stkAAVE users receive a 3% discount when minting and borrowing $GHO.

This will be replaced by a new “anti-GHO” token, which is generated by users staking $AAVE when they mint GHO. The generation of anti-GHO is linear and proportional to the interest accumulated by all GHO borrowers.

Users can use anti-GHO in two ways:

Burn anti-GHO to mint GHO, thus repaying debt for free

Store it in the GHO security module to get stkGHO

This will increase the alignment of interests between AAVE stakers and GHO borrowers and serve as a preliminary step in a broader revenue sharing strategy.

Burning and distribution plan

Aave will allow redistribution of net excess protocol revenue to token stakers , subject to the following conditions:

Aave Collector’s net holdings reach the recurring costs of two-year service providers in the last 30 days.

Aave Protocol’s 90-day annualized revenue reaches 150% of YTD all protocol spend, including AAVE acquisition budget and aWETH aUSDC Umbrella budget.

Through this program, we will begin to see consistent eight-figure buybacks on the Aave Protocol, a trend that will expand further as the Aave Protocol grows further.

Additionally, $AAVE is almost fully diluted with no major supply unlocks in the future, in stark contrast to recent launches where many new tokens faced severe price declines after a Token Generation Event (TGE) due to low circulating supply and high fully diluted valuation (FDV) dynamics.

Aave’s Significant Growth Prospects

Aave has multiple growth factors in the future and is well positioned for the long-term growth of cryptocurrency as an asset class. Fundamentally, Aaves revenue can grow in multiple ways:

Aave V4

Aave V4 will further enhance its capabilities and put the protocol on the path to introduce DeFi to the next billion users. First, Aave will focus on revolutionizing the experience of users interacting with DeFi by building a unified liquidity layer. Aave will eliminate the complexity of cross-chain lending by enabling seamless access to liquidity on multiple networks, including EVM and future non-EVM networks. The unified liquidity layer will also rely on account abstraction and smart accounts, allowing users to manage multiple positions across isolated assets.

Secondly, Aave will increase the accessibility of the platform by expanding to other blockchains and introducing new asset classes. In June, the Aave community supported the deployment of the protocol on zkSync, marking Aaves entry into the 13th blockchain network. Then in July, the Aptos Foundation put forward a proposal to recommend that Aave be deployed on Aptos. If the proposal is passed, this will be Aaves first foray into non-EVM networks and further consolidate its position as a true multi-chain DeFi giant. In addition, Aave will also explore products based on real-world assets (RWA), which will be built around GHO. This move has the potential to connect traditional finance with DeFi, attract institutional investors and bring a lot of new capital to the Aave ecosystem.

These developments culminated in the creation of the Aave Network, which will serve as the core hub for stakeholders to interact with the protocol. GHO will be used to pay fees, while AAVE will become the primary staking asset for decentralized validators. Given that the Aave Network will be developed as either an L1 or L2 network, we expect the market to reprice its tokens accordingly to reflect the additional infrastructure layers being built.

Growth is positively correlated with the growth of BTC and ETH as an asset class

The launch of Bitcoin and Ethereum ETFs this year marks an important turning point in the popularity of cryptocurrencies, providing investors with a regulated and familiar tool that allows them to gain exposure without directly holding digital assets. By lowering the barrier to entry, these ETFs are expected to attract a large number of funds from institutional investors and retail participants, further promoting the integration of digital assets into mainstream investment portfolios.

For Aave, the overall growth of the crypto market is a boon as over 75% of its asset base consists of non-stable assets (primarily BTC and ETH derivatives). Therefore, Aave’s TVL and revenue growth are directly correlated to the growth of these assets.

Growth is tied to stablecoin supply

We can also expect Aave to benefit from the growth of the stablecoin market. As global central banks signal a shift to a rate cut cycle, this will reduce the opportunity cost for investors seeking sources of yield. This may drive capital away from yield instruments in traditional finance and towards stablecoin farms in DeFi for more attractive yields. Additionally, in a bull market, we can expect higher risk appetite behavior, which will increase the utilization of stablecoin lending on platforms such as Aave.

最后的想法

To reiterate, we are optimistic about Aave’s prospects as a leading project in the decentralized lending market. We further outline the key drivers supporting future growth and detail how each factor can further expand Aave’s impact.

We also believe that Aave will continue to dominate market share with its strong network effects, thanks to the liquidity and composability of its tokens. The upcoming token economic model upgrade will further improve the security of the protocol and enhance its value capture capabilities.

Over the past few years, the market has lumped all DeFi protocols together and priced them as if there is not much room for future growth. This is reflected in the trend of Aaves TVL and revenue run rate rising while its valuation multiple compressing. We believe that this valuation divergence from fundamentals will not last long, and $AAVE currently offers some of the best risk-adjusted investment opportunities in crypto.

This article is sourced from the internet: Is Aave, the core pillar of decentralized finance, undervalued?

相关:回顾加密风险投资的 15 年演变:艰难但总体呈上升趋势

原文作者:insights 4.vc 原文翻译:Felix, PANews 本文将呈现过去 15 年来区块链相关实体的风险投资动态演变,重点关注一些公司向流动性投资的转变,其中 VC 收购的不是股权,而是具有归属时间表的代币。此外,它将列出 a16z 等知名投资机构在加密领域的首批投资,例如他们在 2013 年 4 月对 OpenCoin(后来的 Ripple Labs)的投资。在比特币的早期,即 2009 年至 2012 年间,VC 对加密领域几乎没有兴趣。因此,本文将从 2012 年开始。还值得注意的是,比特币价格与融资额之间的长期相关性直到 2023 年才消失。风险投资与比特币价格 2009-2018:…