原作者:0x Edwardyw

介绍

The US cryptocurrency exchange-traded fund (ETF) space has seen significant progress in the past year, with spot Bitcoin and Ethereum ETFs being approved. Despite these developments, even with a well-known asset management company recently submitting an application for a spot Solana ETF, the likelihood of approval by the US Securities and Exchange Commission (SEC) in the near future remains uncertain. This article explores the current status of the Solana ETF application, the regulatory environment, the political impact, and the impact it may have on the price of SOL if approved.

Solana ETF Application Current Status

In June 2024, VanEck and 21 Shares applied to the U.S. Securities and Exchange Commission (SEC) for approval to launch an ETF tied to Solana. These applications represent the first serious attempt to launch a Solana-based ETF in the U.S. market. VanEck filed its Form S-1 on June 27, 2024, and 21 Shares followed suit on June 28, 2024.

Timeline

Initial Application:

-

June 2024: VanEck applies to the SEC for the first spot Solana ETF

-

July 2024: 21 Shares follows suit and submits its own spot Solana ETF application

Review period:

-

The SEC has a statutory period to review the application, which typically involves several rounds of feedback and revisions. This period can last up to 240 days from the initial application date.

Key dates and expectations:

-

Mid-March 2025: The SEC is expected to make a decision on the spot Solana ETF application by this date

Regulatory environment

The regulatory environment for cryptocurrency ETFs in the United States has been characterized by caution and strict scrutiny, especially from the Securities and Exchange Commission (SEC).

The SEC has historically been cautious about cryptocurrency ETFs. It took the SEC nearly a decade to approve the first Bitcoin ETF, and approval for an Ethereum ETF didn鈥檛 come until May 2024.

Classification Problem

The significant hurdles facing the approval of the Solana ETF are primarily due to the SEC鈥檚 classification of the SOL token as a security under certain circumstances. This classification introduces a host of regulatory complexities that are more stringent than the regulations governing commodities such as Bitcoin and Ethereum.

Source: CryptoRank

Regulatory framework: Securities are subject to a different set of rules than commodities. This includes more comprehensive compliance measures, which can be challenging for cryptocurrency projects.

Disclosure requirements: If SOL is classified as a security, Solana and related products will need to comply with stricter disclosure and reporting standards, which will increase the regulatory burden on the Solana Foundation and any potential ETF issuers.

Legal Ambiguity: The SEC鈥檚 classification creates uncertainty about Solana鈥檚 legal status, potentially discouraging institutional investors and complicating the ETF approval process.

The Solana Foundation has publicly opposed the SECs classification of SOL as a security. They believe that SOL should not be considered a security, arguing that it is used within the network for staking, transaction validation, and governance. However, the SECs position is based in part on the way the token is marketed and the expectation of profit from the efforts of others, which is a criterion used in the Howey Test to determine securities.

A changing political environment

The process of the SEC approving the Solana spot ETF is closely tied to the broader political environment in the U.S. Political changes can significantly impact financial regulations, including those governing crypto assets.

Cryptocurrency has become a major topic in American politics, with both major political parties showing varying degrees of support and opposition. Republican candidate and former President Donald Trump pledged to end the war on cryptocurrencies as part of his campaign. At the Bitcoin 2024 Conference in Nashville, Tennessee, Trump said the United States would become the cryptocurrency capital of the world. While the Democratic Party has long been seen as opposed to cryptocurrencies, views on cryptocurrencies are beginning to shift. On July 27, Democratic members of the U.S. House of Representatives signed a letter calling on the party to take a forward-looking approach to blockchain and digital assets.

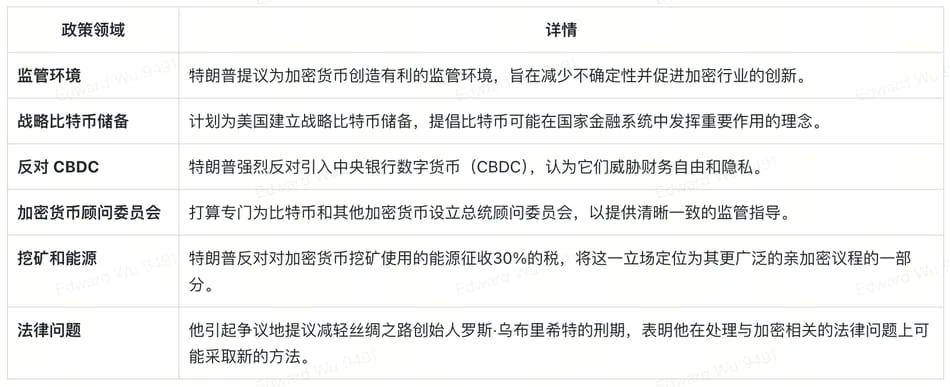

Here is a summary of Donald Trump鈥檚 current cryptocurrency policies and proposals in the 2024 presidential election campaign:

The outcome of the 2024 presidential election could profoundly impact how the SEC approves the Solana spot ETF. A victory by a pro-crypto candidate, such as Donald Trump, who openly supports cryptocurrencies and accepts crypto campaign donations, could lead to a more favorable regulatory environment for crypto assets.

Other factors affecting approval

Lack of futures contracts

A key factor in facilitating the approval of spot ETFs for Bitcoin and Ethereum is the existence of mature, regulated futures markets for these cryptocurrencies. Futures contracts provide a regulated framework that helps mitigate some of the risks associated with trading in the spot market.

A major advantage of these futures markets is that they offer a regulated framework that is more recognized by the U.S. Securities and Exchange Commission (SEC). Bitcoin futures were launched on the Chicago Mercantile Exchange (CME) in December 2017, followed by Ethereum futures in February 2021. This regulatory oversight helps ensure that trading practices adhere to established standards, which is critical to obtaining SEC approval for investment products.

In contrast, Solana currently lacks a similar futures framework. There are no Solana futures contracts trading on major regulated exchanges such as CME or Cboe. This absence limits the tools available for risk management and price discovery and creates regulatory uncertainty.

Concerns about Solana鈥檚 stability

Concerns about Solana鈥檚 stability have been an ongoing issue since its inception. Solana has experienced multiple network outages ranging from a few hours to over 18 hours, with the most recent major outage occurring on February 6, 2024, and lasting nearly 5 hours. These frequent outages raise significant questions about the reliability and robustness of the network, which could affect how regulators, such as the SEC, view it when considering approving financial products such as ETFs.

The reasons for Solana鈥檚 instability are multifaceted, including high transaction loads overwhelming the network, issues with network upgrades and software updates, bugs in the blockchain code, and difficulty maintaining stability during major updates.

If approved, how high could the SOL go?

Solana faces several hurdles in getting a spot ETF approved, but the SEC could still approve it next year if a pro-crypto candidate wins the U.S. election in November. Analysts have outlined various scenarios for the potential impact that could have on the price of Solana if it gets spot ETF approval.

A report from GSR Markets states that the approval of the Solana spot ETF could drive the price of SOL to nearly nine times its current value. This estimate assumes that the Solana spot ETF will attract 14% of the investment flow of the Bitcoin spot ETF since its launch. In this blue sky scenario, the price of SOL could soar from current levels to over $1,320, significantly increasing its market capitalization to $614 billion. Even in a more conservative scenario, if the ETF only attracts 2% to 5% of the Bitcoin ETFs flow, the price of SOL could still grow to 1.4 to 3.4 times its current value.

综上所述

The path to SEC approval for the Solana ETF is fraught with challenges, including the lack of a regulated futures market and ongoing concerns about blockchain stability. The SEC has historically been cautious about cryptocurrency ETFs, and the classification of SOL as a security further complicates the approval process. However, changes in the political environment, particularly the upcoming U.S. election, could create a more favorable regulatory environment. If a pro-cryptocurrency president is elected, the likelihood of a more favorable regulatory environment would increase significantly. Such a change in leadership could accelerate the approval process for the Solana ETF.

This article is sourced from the internet: Is a Solana Spot ETF Coming?

Related: Understanding Chromia in one article: A data-centric Layer 1 platform

summary Chromia is a data-centric Layer 1 platform that aims to optimize and enable high-performance AI and gaming applications by horizontally scaling to handle parallel tasks. Chromia will launch its mainnet in early Q3 2024 and recently completed integration with AI-driven gaming studio Ultiverse. Applications built on Chromia will run as sidechains, and the Chromia database-centric approach is well suited for applications that require complex queries and indexing. Project Description As Ethereum鈥檚 gas fees continue to rise, various Layer 1 alternative solutions that aim to optimize scalability continue to emerge. Chromia uses relational databases to achieve efficient data storage and retrieval, which has become its differentiating competitive point. Just as Ethereum adopted a modular approach to address its shortcomings, the design space for Layer 1 alternatives has also expanded significantly.…