在过去的24小时内,市场上出现了许多新的热门货币和主题,这可能是下一个赚钱的机会, 包括:

-

Sectors with strong wealth-creating effects are: New public chain sector, Solana Meme coin;

-

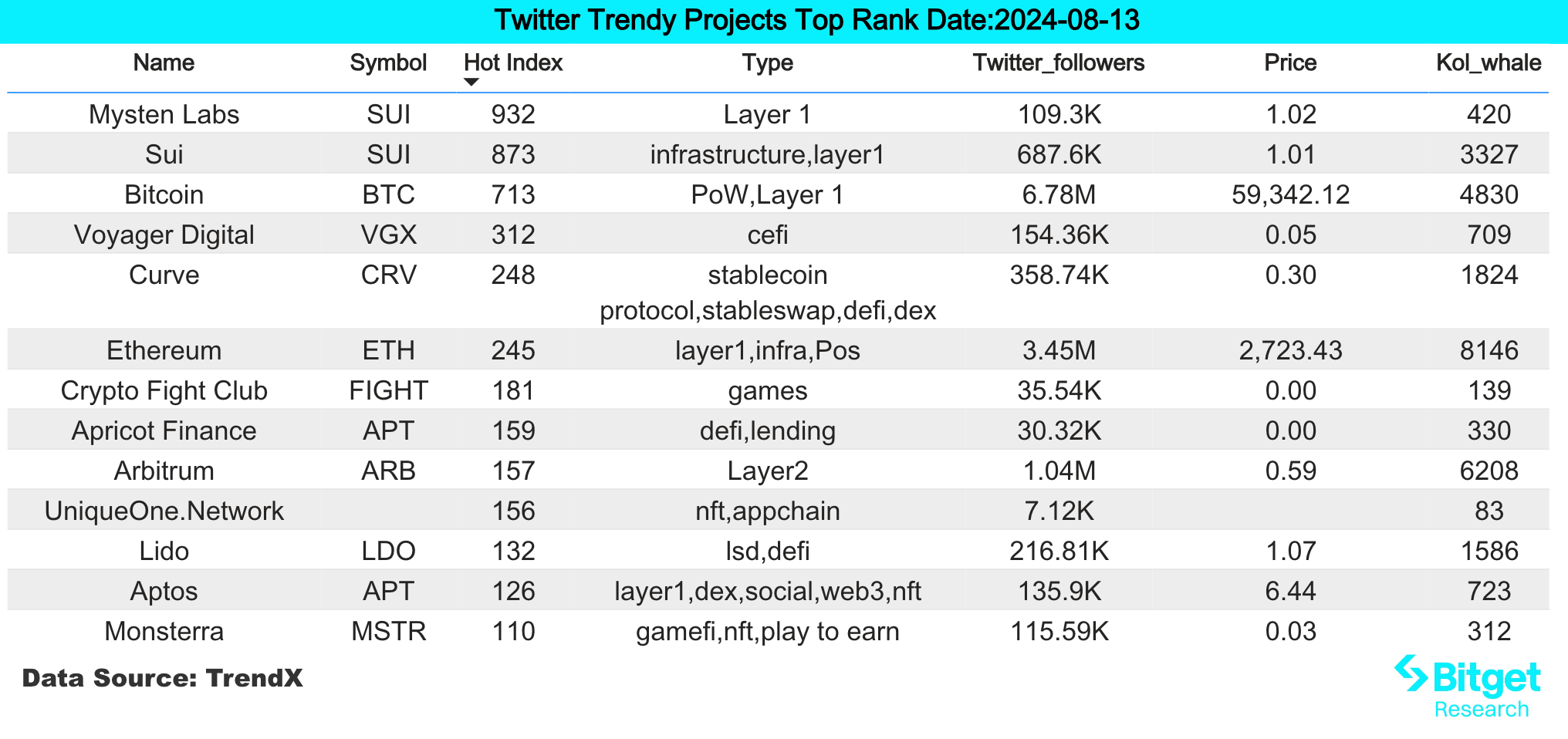

Hot search tokens and topics among users are: SUI, Optimism;

-

Potential airdrop opportunities include: Symbiotic, Yescoin;

Data statistics time: August 13, 2024 4: 00 (UTC + 0)

1. 市场环境

In the past 24 hours, BTC fluctuated around $59,000, and the intraday fluctuations narrowed significantly, indicating that the staged rebound may encounter pressure. The ETH/BTC exchange rate has rebounded significantly. The community is worried that Bitgo may have centralization risks due to its control by Justin Sun; this directly caused WBTC to be weakly decoupled from BTC. AAVE directly closed the WBTC pool, and large investors directly sold WBTC on the chain for ETH, which led to a rebound in the exchange rate.

From a macro perspective, the United States will release the July PPI and CPI data on Tuesday and Wednesday of this week, with the PPI expected to grow by 0.2% monthly and the CPI expected to grow by 3.0% annually. According to CME data, the market currently predicts that the probability of the Federal Reserve cutting interest rates by 25 and 50 basis points in September is 49.5% and 50.5% respectively. The PPI and CPI data will greatly affect the markets prediction of the extent of future interest rate cuts, and the impact on the US dollar index and US bonds is more obvious. Crypto assets may have the risk of downward adjustment before the data is released, and investors need to be alert to the risks.

2. 财富创造领域

1) Sector changes: New public chain sectors (SUI, SEI, APT)

主要原因:

-

The new public chain sector has been falling and consolidating for a long time. In the environment of oversold market rebound, it was the first to attract the attention of funds;

-

ETH has been too weak recently, and institutions have frequently sold ETH in the secondary market. Funds have deployed new public chains, and there is a consensus among funds.

-

Grayscale recently launched SUIs crypto investment trust, which may directly bring in net capital inflows in the future

Rising situation: SUI, SEI, and APT rose by 71%, 21%, and 20% respectively in the past week;

影响后市的因素:

-

ETH subsequent trend: ETH is the core competitor of the new public chain. If institutions continue to sell ETH and the ETH/BTC exchange rate continues to fall, funds will form a consensus that the next public chain ecosystem that can carry users is needed. Therefore, the layout space of the new public chain is generated;

-

Trend of ecological assets: Pay attention to whether the tokens within the ecosystem follow the rise. For example, the rise of SUI tokens will lead to a general rise in its ecological assets. Generally speaking, the trend can continue. However, if SUI rises and the ecological tokens begin to fall, it will generally lead to a fall in the public chain tokens.

2)未来需要关注的领域:SOL Meme Coin(WIF、BONK、POPCAT)

主要原因:

-

The price of SOL is relatively stable, standing firmly at the integer mark of 140 US dollars; the DEX trading volume on Solana has reached a new high recently, and funds are relatively active, driving the rise of ecological projects.

具体货币列表:

-

WIF: Solana ecosystem鈥檚 Meme coin, which was previously listed on Robinhood. The SOL token has risen, and generally the MEME coins at the top of Solana have risen more rapidly.

-

BONK、POPCAT:Solana 上的核心 meme 币,近期交易量有所增加,交易需求较高,有 token 布局空间。

3. 用户热搜

1)热门 Dapp

Optimism:

Optimism developers have unveiled a roadmap to build an interoperable communication layer between Layer 2 chains in their Superchain ecosystem, which will include a messaging protocol, a Superchain token standard (Superchain ERC 20), interoperable fault proofs, and a set of interoperable chains.

2)Twitter

SUI:

SUI has been active recently, rising 65% in the past 7 days. Grayscale launched new crypto investment products for SUI and TAO; a week ago, SUI will integrate the DAG-based consensus algorithm Mysticeti, which not only decouples latency from throughput, but also maintains extremely high throughput to improve network performance and security. The TVL of SUIs leading lending projects NAVI Protocol and Scallop have risen by +120% and +50% respectively in the past 7 days. With SUI subsidies, the USDC and USDT Supply APY on NAVI Protocol and Scallop have reached 15%-25%.

3)Google 搜索区域

yw

从全球角度来看:

SUI has been explained above.

从各地区热搜来看:

(1) In Asia: The event of Musk and Trump opening a Twitter Space attracted a lot of attention, and DOGE was on the hot search in Indonesia and Malaysia; the top hot search in Singapore was SHIB, followed by AI tokens OLAS and FET; RWA Crypto and ONDO tokens were on the hot search in Hong Kong, Vietnam, the Philippines and Singapore.

(2) In European and American countries, the hot search terms are relatively scattered and have no universal characteristics. For example, in France, MAGA, ORDI, SUI, and VRA are on the hot search list; in Belgium, SHIB and ONDO; in Switzerland, RENDER, CELO, FLOKI, and PEPE are on the hot search list.

(3) In addition to the TON ecosystem buzzwords in the CIS region, Solana ecosystem LST projects Sanctum and Debank also became popular searches in Russia.

潜在的 空投 机会

共生

Symbiotic is a general-purpose Restaking project that has completed its seed round of financing, with Paradigm and Cyber Fund participating in the investment. The financing amount is US$5.8 million, and Symbiotics TVL has exceeded $1 B.

The project has launched its development network on the Ethereum Holesky testnet, with a mainnet launch planned for later in Q3. The team noted that projects including Ethena, LayerZero, and Bolt are already exploring the platform, which also features a customizable modular design that can accommodate any combination of tokens as collateral for re-hypothecation.

Specific participation method: Go to the projects official website, link your wallet, and deposit ETH and ETH LSD assets. Currently, Symbiotics pledge quota is full, and you can wait for the project to open the deposit quota next time.

耶斯币

TG Mini App high traffic project Yescoin will hold Yes Summer from August. The Yes Summer event announcement will cooperate with a large number of project parties and exchange wallets to distribute a total of 1,000,000 USD rewards: https://x.com/Yescoin_Fam/status/1818913140295581817

Currently working with Bitget Wallet: https://x.com/BitgetWallet/status/1821870001504317941, you can get future token airdrops and 100,000 $BGB rewards by completing activities such as opening treasure chests, inviting friends, and learning blockchain in Bitget Wallet.

原文链接: https://www.bitget.fit/zh-CN/research/articles/12560603814253

【免责声明】市场存在风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何观点、看法或结论是否适合自己的具体情况。根据此信息进行投资需自行承担风险。

This article is sourced from the internet: Bitget Research Institute: The U.S. July PPI and CPI data will be released this week, and the market is at risk of falling in the short term due to risk aversion

Coinbase released its second quarter financial report today, with revenue of $1.45 billion, down 11% from the previous month and up more than 100% year-on-year, almost the same as analysts expectations of $1.37 billion. Net income was $36 million, down 97% from the previous month. Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) was $596 million. Coinbase has achieved positive revenue growth for four consecutive quarters. Coinbases total trading volume in the second quarter was $226 billion, down 28% from the first quarter, trading revenue was $781 million, down 27% from the previous quarter, and subscription and service revenue increased 17% to $599 million. Total operating expenses were $1.1 billion, up 26% from the previous quarter. Coinbase made good progress in revenue diversification in the second quarter, with subscription…