最初发布者: Pavun Shetty

Original translation: Spinach Spinach|bocaibocai

前言

When blockchain games just started to explode, punters used real money to participate in many Play to Earn games, but they basically lost everything in the end. At that time, there was a very obvious feeling that the first players to enter the market could get the most dividends, and they only needed to dig, withdraw and sell every day to suck the blood of later players. After the new players entered the market, they had to take over the high prices and find ways to continuously attract new players to enter the market, making GameFi basically only Fi but no Game. There are also problems with the design defects of the token model. However, this recent paper from Yale University proposed two new token economic models and conducted a series of simulations, providing GameFi with some new ideas for sustainable development.

Spinach translated the Yale University paper and extracted some of the essence to share with you:

概括

Blockchain-based games have introduced new economic models that combine traditional games with decentralized ownership and financial incentives, leading to the rapid rise of the GameFi space. However, despite their innovative appeal, these games face significant challenges in terms of market stability, player retention, and sustainability of token value. This paper explores the evolution of blockchain games and identifies the main flaws of current token economic models through the theory of entropy increase. We propose two new models – ServerFi, which emphasizes privatization through asset synthesis, and a model that focuses on providing continuous rewards to high-retention players. These models are formalized into a mathematical framework and validated through experiments simulating group behavior. Our results show that ServerFi is particularly effective in maintaining player engagement and ensuring the long-term viability of the gaming ecosystem, providing a promising direction for future blockchain gaming development.

Introduction As technology continues to advance, the gaming industry has thrived on the journeys of adventurers and outdoor enthusiasts [1]. Starting in the 1970s, Atari introduced Pong, an arcade table tennis game that captivated consumers during the turbulent 1970s and inspired many inspiring imitators. With the advent of more powerful microprocessors, dedicated graphics chips, and personal computers such as the Commodore 64, it became possible to create complex, visually appealing, and sound-rich games. Following in the footsteps of these pioneers, Nintendo quickly captured a large share of the console market with its home console, the Nintendo Entertainment System (NES), which released games such as Duck Hunt and Motocross. At the same time, Sega and Sony also emerged as competitors with their own outstanding products. Sega launched the Genesis and Game Gear, while Sony launched the PlayStation 2 and 3, which featured CD-ROMs for enhanced game storage and together defined the future of gaming consoles after 1994. The last important milestone in game development was the wave of adoption of the DirectX API driven by Microsoft that resounded in the gaming community.

Online multiplayer games such as World of Warcraft and Fortnite have revolutionized the way players interact with each other and, driven by Internet technology, marked a leap forward for the gaming industry. These games have become cultural phenomena, enabling millions of players to share virtual worlds and fully enjoy the fun of technology. The rise of Google Stadia and Microsoft xCloud is also remarkable. They stream games directly to players devices, providing high-quality gaming experiences without the need for powerful hardware support [2]. These groundbreaking innovations have brought players into a highly social and interconnected world of experience, which, relying on the development of Internet technology, has undoubtedly pushed the gaming industry into the next era. These visionary changes have refocused the publics attention on the issues of decentralization and data ownership. In the traditional gaming era, players data and assets were absolutely centrally stored on servers run by gaming companies, even including virtual items purchased by players. The ownership of these controversial items has never been in the hands of the players who purchased them, which is subject to the continued influence of the classic economic model. This traditional model has operated around player spending and company profits for decades, and players have received almost no return on their investment in valuable resources such as time and money, except for a small amount of direct returns. Often referred to as “walled gardens,” these games host in-game items, characters, and currencies on the developer’s servers, with players unable to gain ownership of their accounts, content, and in-game assets. This period of time narrows the scope of players’ rights, even though their time and financial investment in the game is significant, and even generates no economic value to those who keep the in-game financial cycle running steadily and providing sustainability.

The emergence of GameFi has reshaped economic production relations and brought real-world incentives. When it comes to combining games and finance in a smoother way than expected, play-to-earn (P2E) games built on blockchain networks are well prepared for a remarkable debut. Blockchain-based games generally create crypto assets in two mainstream ways: marking in-game items as NFTs and granting homogeneous tokens the qualification to become in-game currency [3]. By combining traditional games with on-chain assets, these games achieve decentralized ownership, transparency, and bring tangible economic incentives to players. However, there are still major challenges in terms of market stability, player retention, and sustainability of token value. This paper first outlines the development background and pioneering cases of blockchain games. We then use the entropy increase theory to analyze the potential causes of current challenges and clarify the factors driving market dynamics. Based on these insights, we introduce two innovative token economic models: the ServerFi model that achieves privatization through asset synthesis, and a model that continuously rewards highly retained players. These models are formalized into mathematical frameworks and their effectiveness is verified through group behavior simulation experiments. Our findings highlight the potential of the ServerFi model to sustain player engagement and ensure the long-term viability of gaming ecosystems.

Background: The Rise of GameFi Blockchain-based games create crypto assets in two main ways: marking in-game items as NFTs and granting homogeneous tokens the right to be used as in-game currency. 2013 saw some key moments, such as Meni Rosenfeld’s concept of Colored Coins, which brought attention to the importance of virtual asset ownership and mapped real-world assets onto the Bitcoin blockchain [4]. Four years after Meni Rosenfeld, Larva Labs launched the CryptoPunks NFT series. This series marked an important milestone in the development of NFTs and inspired the ERC-721 standard for digital art and collectibles on Ethereum through its 10,000 unique, randomly generated character images [5, 6].

NFT technology has undoubtedly been embraced by visionary founders. Dapper Labs launched the first blockchain game on Ethereum, called CryptoKitties, which briefly congested the network and caused significant transaction delays. In this game, players can buy, breed, and trade virtual cats, each with unique visual characteristics and varying degrees of rarity. The huge success of CryptoKitties highlights the appeal of NFT-based gameplay. CryptoKitties taps into the psychological appeal of real ownership and potential financial gains, attracting avid collectors and savvy investors through an in-game financial loop, providing incentives to breed and trade rare cats, creating a speculative environment. In the same year, discussions about CryptoKitties almost became a mainstream topic. This innovative GameFi game attracted millions of players who not only owned these rare cats, but also gained social identity and belonging through the CryptoKitties community.

Among crypto games involving NFTs and the “play to earn” (P2E) model, Axie Infinity, developed by Sky Mavis, has emerged as a significant successor to CryptoKitties and has quickly become a popular game with players often staying up late into the night due to its engaging gameplay loop. Axie Infinity allows players to collect, breed, and battle fantasy creatures called Axies[7]. Each Axie is backed by an NFT with unique attributes and abilities that can be enhanced through strategic breeding and gameplay[8]. This delightful GameFi game not only offers economic incentives similar to CryptoKitties, but also introduces more complex game mechanics and a robust in-game economy. Its far-reaching design concept attracted a wide player base, setting a new standard for this era’s darling and setting a benchmark for all future blockchain games.

Challenges of Token Economics and Our SolutionsFaced with a lot of competition from traditional online games running on centralized devices, blockchain-based games are getting used to storing digital assets on the blockchain, allowing player-owned items to be sold or even transferred to other games or used in specific DeFi applications. Incentive models are gradually being refined with the mass adoption of blockchain technology. This opens up a whole new path for building cutting-edge production relations between players and developers. Times have changed, and these innovations aim to restructure the electronic society, with the potential to change the post-gaming era to thrive. Against the backdrop of these major developments, we have to ask: Why would game developers choose a new production relationship that originated in the GameFi field in the context of the leap to the Web3 era, where players have different demands for assets and the traditional, easy gaming experience is put on the back burner?

Most games have a certain life cycle, and CryptoKitties is no exception. Among the important mechanisms of its operation, the breeding mechanism allows players to produce new cats, but this inadvertently increases the supply, thereby reducing the rarity and value of individual cats over time. As more players participate and breed cats, the secondary market quickly becomes oversaturated. The scenario is novel and players are intrigued, but the dilemma is very familiar: how to maintain the price of circulating tokens? If there are not enough active players, demand cannot keep up with the growing supply, and this depreciation problem will be further exacerbated. Therefore, individuals who invest a lot of time and resources in breeding may find that the output of their efforts is decreasing. As the game collectively advances, the initial scarcity may lead to a loss of interest and reduced participation by players as the abundance continues to emerge.

The application of entropy theory combined with token economics provides a professional and in-depth perspective on the dynamics of token flows and value fluctuations in blockchain projects. Entropy theory is based on the second law of thermodynamics, which states that in a closed system, entropy (a measure of disorder) tends to increase over time. This concept can be applied analogously to economic systems, especially token economics, to enhance our understanding of token distribution, usage, and market fluctuations. In token economics, the initial distribution of tokens is usually orderly. In this stage, tokens are relatively concentrated, prices remain stable, and player expectations are high [9]. Over time, more tokens are generated through game mechanisms and enter the market. The increase in player transactions and token flows subsequently increases the entropy (disorder) of the market. In this intermediate stage, the disorder within the system surges, leading to high volatility in token prices. Challenges that token economics may face include inflation caused by an oversupply of tokens in the market and price instability caused by a large influx of speculators. Without effective market regulation and incentive mechanisms, the system may reach a high entropy (disorder) state, at which the value of tokens generally decreases and player participation decreases. In order to maintain the long-term health of the system, it is crucial to have a way to link new incentive mechanisms and regulatory measures. These actions can slow the increase in entropy, thereby maintaining relative order and stability in the market and sustaining player engagement.

We often think of token economics as isolated events, like a single point of failure with a specific cause and effect. But from this perspective, the story is less about any one company than about the global entropy of token circulation. Certain factors are always destructive, and certain gameplay always fails. Take Axie Infinity as an example. Its token economics design has several shortcomings from the players perspective: First, Axie Infinitys token economy is highly dependent on the continuous generation of new tokens (such as Smooth Love Potion, SLP). As more players participate and breed Axies, the number of newly generated tokens in the market increases, causing the market token supply to expand rapidly. This supply and demand imbalance causes the value of tokens to decline over time, and the tokens held by players to depreciate. Second, during the token generation event (TGE), many players and investors flood the market to try to make a quick profit by buying and selling tokens. This speculative behavior can cause large price fluctuations and affect market stability. In the long run, the profit exit of early speculators may cause token prices to plummet, which will have an adverse impact on ordinary players. Third, Axie Infinitys economic model lacks a continuous incentive mechanism to maintain player participation after the TGE. As the initial novelty wears off, player enthusiasm may wane due to limited economic incentives. Addressing any flaws in the game will help attract new users and potentially increase token demand. Participating in Axie Infinity requires players to purchase Axies, which involves a high initial investment cost. This high cost poses a barrier to new players, limiting the games accessibility and widespread adoption. Additionally, the market price of rare Axies may be prohibitively high, making them unaffordable for the average player.

Based on the above discussion, we propose two suggestions to improve the GameFi token economic model:

ServerFi: Privatization through asset synthesis

In line with the spirit of Web3, players can be allowed to combine their in-game assets to ultimately gain sovereignty over future servers. This concept, called ServerFi, involves players accumulating and merging various NFTs and other digital assets in the game to gain control over the game server. This form of privatization not only incentivizes players to invest more deeply in the game, but also fits in with the decentralized and community-driven spirit of Web3. By granting players ownership and control over game servers, we can foster a more engaged and loyal player base because they have a substantial stake in the game ecosystem. For example, we can design a game where players receive a chance to draw a lottery every day based on the value of their contribution to the game server. Players can use these lottery opportunities to draw fragments. When players have collected all the necessary fragments, they can synthesize an NFT. By staking this NFT, players can share in the value of other users contributions to the game server.

Continuous Rewards for High-Retention Players

Another approach is for project teams to continually identify and nurture high-retention players to keep the token alive and ensure the health of the game ecosystem. By implementing sophisticated algorithms and data analytics, projects can monitor player behavior and engagement, providing targeted rewards and incentives to those players who demonstrate strong commitment and high activity. This approach ensures that the most loyal players stay engaged, driving continued engagement and interaction, which supports the overall stability and growth of the game token economy. For example, we could design a game that airdrops a portion of the game server revenue every day to top users based on the value of their contribution to the system. This approach would create a play and earn dynamic that rewards players for their participation and contribution.

实验

To evaluate the effectiveness of our proposed token economic models, we conducted group behavior simulation experiments for each model. These experiments aim to compare and analyze the differences in value capture capabilities of blockchain games built on two different token economic frameworks. In order to model more accurately, we first formalize the definitions of these token economic mechanisms as follows.

1. ServerFi: Privatization through asset synthesis

-

Let vi denote the contribution of player i to the system at each iteration.

-

The function f(v) = λv represents the number of draws a player can get with contribution value v, where λ is a scaling constant greater than 1.

-

Suppose there are k prizes in the raffle, and the probability of drawing each card is 1/k.

-

Assuming the number of new players on the first day is n, and considering the growth dynamics of the game, we define the number of new players in the i-th iteration as n/α(i− 1).

-

We assume that all players in the game are rational. Therefore, if a player calculates that the cost of synthesizing NFTs exceeds the current staking rewards, they will choose to exit the game. Specifically, for a new player, the expected cost of collecting all fragments is λΣ(1/k). When this cost exceeds the staking rewards of a single NFT, no new players will join the game.

-

The total value of the system in the i-th iteration (day) is Ti = Σvi, where n is the number of players in the i-th iteration.

Continue to reward high retention players

-

Let vi denote the contribution of player i to the system at each iteration.

-

We stipulate that the system will reward the top 20% of players with 80% of the total revenue based on their cumulative contributions over the past five days.

-

We assume that all players in the game are rational. Each player has a randomly initialized tolerance threshold, and if they fail to get rewards too many times in a row, they will choose to quit the game.

-

The total value of the system at iteration i is Ti = Σvi, where n is the number of players in iteration i.

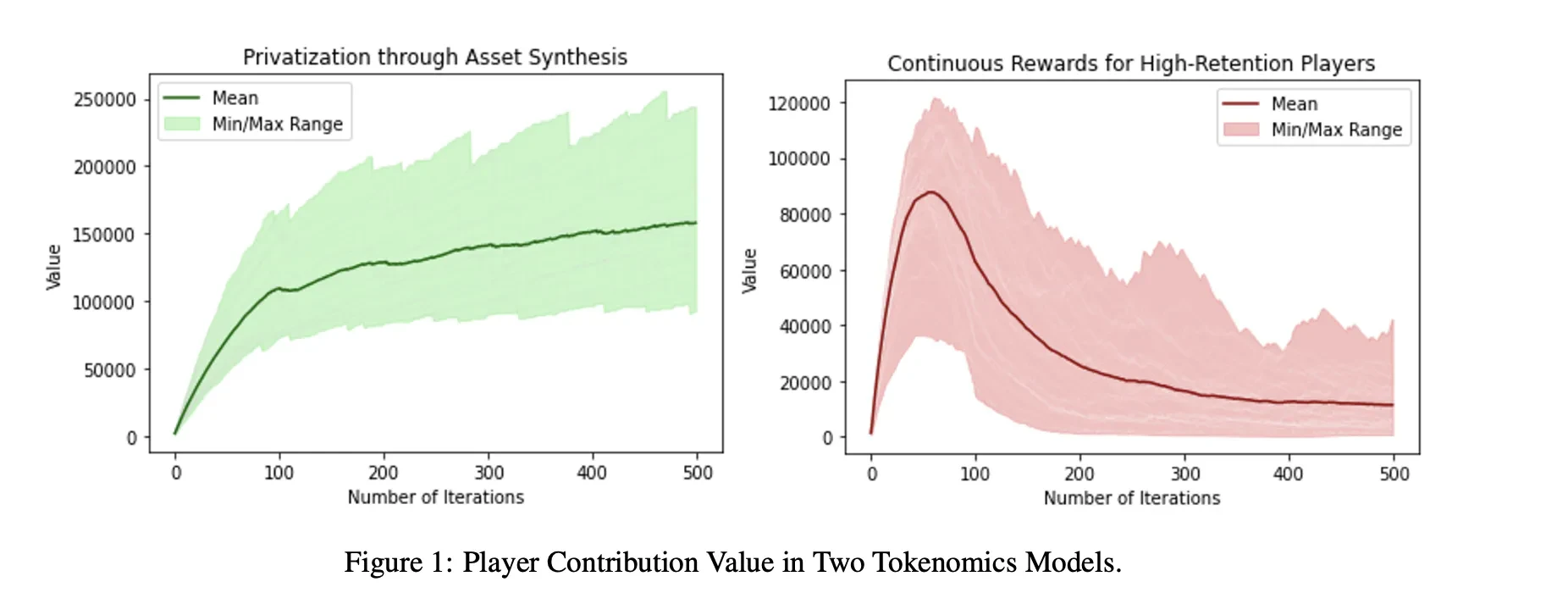

Given the inherent randomness in real-world scenarios, our actual simulation experiments introduce random noise from various angles, including individual behavior and population growth. For example, we introduce mutation operators in individual modeling to capture the random fluctuations in the productivity of players in the game. To ensure a fair comparison between the two strategies, the experiment designed the same parameters in the two experimental groups, such as the maximum number of iterations and the initial population size. The population of each economic model was subjected to 500 iterations, and each experiment was repeated 100 times. The experimental results are shown in Figure 1. The horizontal axis represents the number of iterations, and the vertical axis represents the total value contributed by the players at each iteration. The light-colored band represents the range between the maximum and minimum values, and the dark-colored line represents the average value.

In the asset synthesis privatization model (left), we observe that the total player contribution value shows a continuous upward trend as the number of iterations increases, indicating that the model is able to effectively maintain player engagement and drive long-term value growth. In contrast, in the continuous reward high retention player model (right), player contributions initially show a significant increase, but then decline significantly. Although the model shows high player contributions in the early stages, the decline in subsequent iterations indicates challenges in maintaining player engagement in the long term.

Based on the modeling results, we believe that while the strategy of continuously rewarding highly retained players may drive significant engagement in the early stages, this approach will inherently exacerbate player stratification in the long run. Specifically, this approach may marginalize tail players due to the lack of sufficient positive feedback, eventually causing them to quit the game. This stratification phenomenon also tends to set a high entry barrier for new players. As a result, the reduction in new players, coupled with the departure of tail players, reduces the rewards for existing top players, leading to the formation of a vicious cycle.

In contrast, the ServerFi mechanism is based on fragment synthesis, which introduces a degree of randomness through the fragment lottery process, thereby enhancing social mobility within the player community. For existing NFT holders, the continuous synthesis of new NFTs ensures that even top players cannot sit back and enjoy the fruits of their labor; they must continuously contribute value to maintain their status. For new players or players with less contributions, there are still plenty of opportunities to synthesize NFTs and share server rewards, promoting upward liquidity. Therefore, the ServerFi model more effectively promotes social mobility between players, activates the entire system and cultivates a more sustainable ecosystem.

综上所述

In this article, we take an in-depth look at the challenges of token economics in current blockchain-based games. Our analysis shows that traditional economic models often lead to market instability, declining player engagement, and unsustainable token value. To address these pressing issues, we propose and analyze two promising token economic models, with a particular emphasis on the ServerFi model based on asset synthesis privatization. Through extensive experiments with group behavior simulations, ServerFi shows significant potential in maintaining player engagement and ensuring the long-term sustainability of gaming ecosystems. Unlike traditional models, ServerFi effectively promotes social mobility among players by introducing a dynamic and competitive environment where sustained value contribution is necessary to maintain status. This model not only fosters a more vibrant and inclusive community, but also provides a scalable and resilient framework for future blockchain games. As the industry evolves, the ServerFi approach may represent an important shift in token economics structure, providing a more sustainable path for the integration of decentralized technologies in gaming.

This article is sourced from the internet: Yale University: ServerFi, a new symbiotic relationship between games and players

Related: Specialization vs. generalization, which is the future of ZK?

Original author: mo Original translation: Luffy, Foresight News Specialization or generalization, which one is the future of ZK? Let me try to answer this question with a picture: As shown in the figure, is it possible that we will converge to a magical optimal point in the trade-off coordinate system in the future? No, the future of off-chain verifiable computation is a continuous curve that blurs the lines between specialized and general purpose ZK. Allow me to explain the historical evolution of these terms and how they will converge in the future. Two years ago, dedicated ZK infrastructure meant low-level circuit frameworks such as circom, Halo 2, and arkworks. ZK applications built using these frameworks are essentially handwritten ZK circuits. They are fast and cheap for specific tasks, but are…