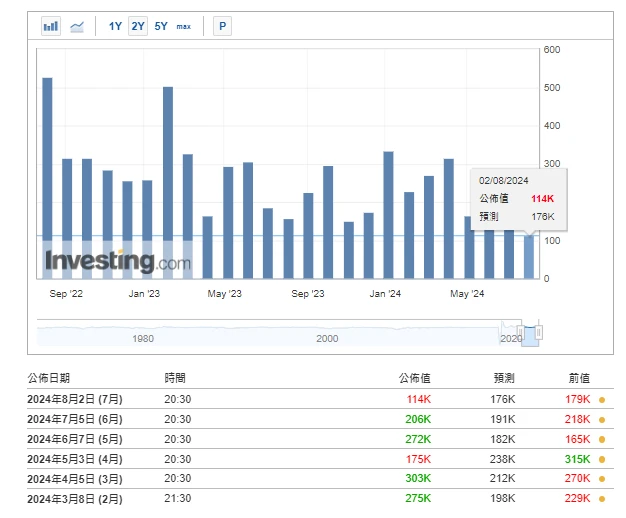

Recession has arrived? US non-farm payrolls in July fell far short of expectations

图片来源: https://hk.investing.com/economic-calendar/nonfarm-payrolls-227

The US non-farm payrolls report for July surprised the market, with the number of new jobs hitting a three-and-a-half-year low and the unemployment rate rising to a three-year high, triggering the Sams Rule, a recession indicator with 100% accuracy. Panic spread rapidly, and traders began to bet on the possibility of a 50 basis point rate cut in September, and predicted that the rate cut this year would exceed 110 basis points. This week, both US stocks and Bitcoin rebounded after a significant decline.

-

The Sahm Rule is an indicator proposed by economist Claudia Sahm to predict economic recessions. The rule is based on changes in the unemployment rate and has a trigger condition: if the three-month moving average employment rate is 0.5 percentage points lower than the highest employment rate in the past 12 months, then the indicator is triggered, indicating that the economy may be about to or has entered a recession.

There are about 40 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

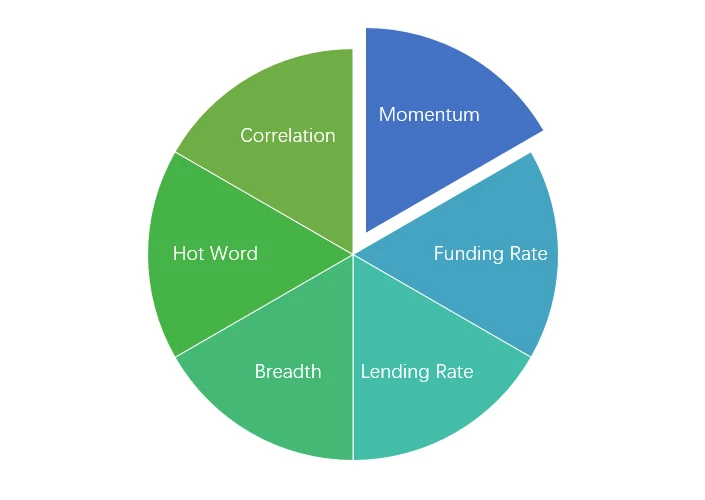

市场技术和情绪环境分析

情绪分析组件

技术指标

价格趋势

BTC price fell -5.61% and ETH price fell -16.26% in the past week.

上图是近一周BTC价格走势图。

上图是近一周ETH的价格走势图。

表格显示的是过去一周的价格变化率。

价量分布图(支撑位与阻力位)

In the past week, BTC and ETH fell to a low level and formed a new dense trading area before rebounding.

上图为近一周BTC密集交易区分布。

上图为近一周ETH密集交易区分布。

表格展示了过去一周BTC与ETH的周密集交易区间。

交易量和未平仓合约

In the past week, both BTC and ETH had the largest trading volume when they fell to 8.5; the open interest of BTC and ETH both fell sharply.

上图上方为BTC价格走势,中间为成交量,下方为持仓量,浅蓝色为1日均线,橙色为7日均线。K线颜色代表当前状态,绿色表示成交量支撑价格上涨,红色表示平仓,黄色表示缓慢加仓,黑色表示拥挤状态。

上图上方为ETH的价格走势,中间为交易量,下方为持仓量,浅蓝色为1日均线,橙色为7日均线。K线的颜色代表当前状态,绿色表示价格上涨受到交易量支撑,红色为平仓,黄色为缓慢增仓,黑色为拥挤。

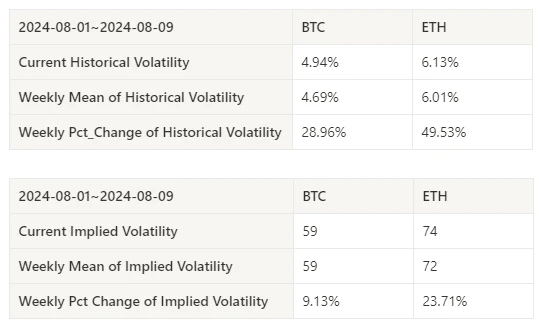

历史波动率与隐含波动率

This past week, historical volatility for BTC and ETH was highest at 8.5, while implied volatility for both BTC and ETH increased.

黄线是历史波动率,蓝线是隐含波动率,红点是其 7 天平均值。

事件驱动

The non-farm data of the past week was significantly lower than expected, which pushed the mainstream currencies to continue to decline for several days after the data was released.

情绪指标

动量情绪

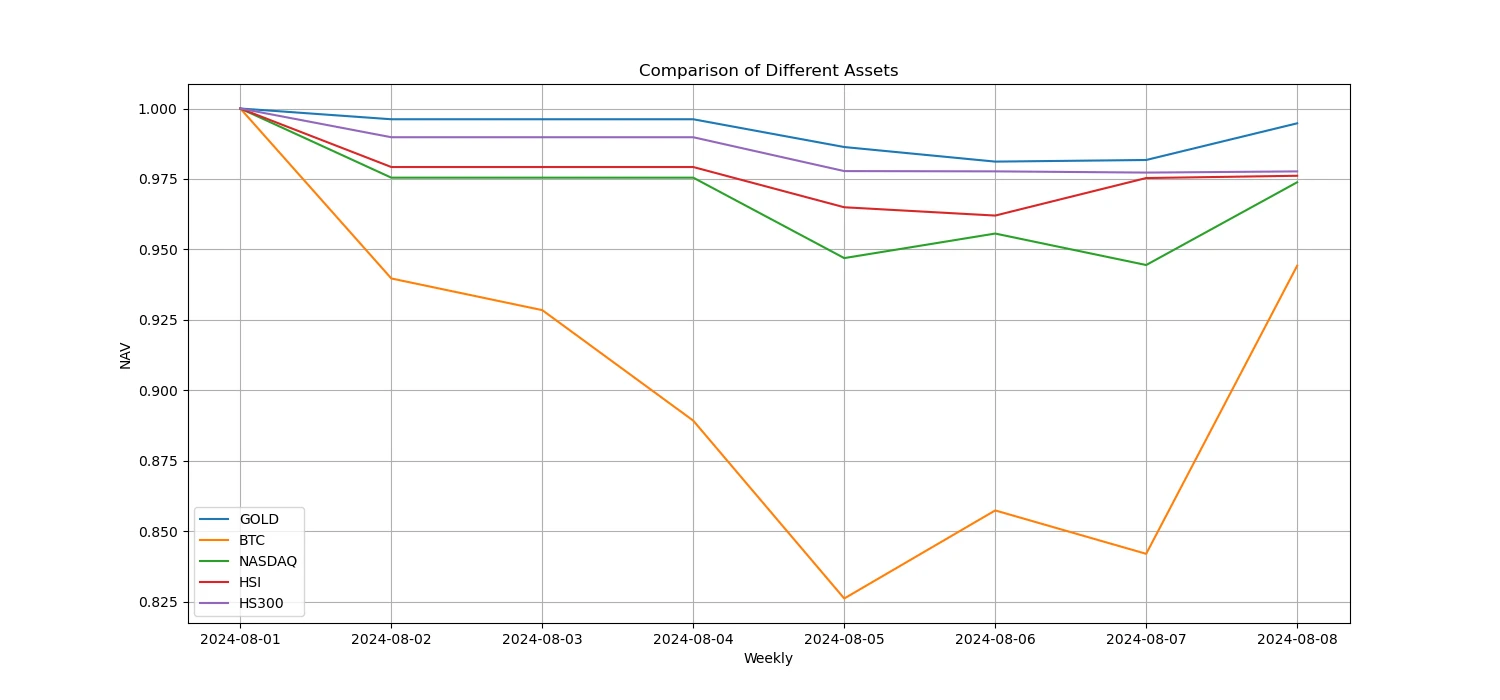

过去一周,比特币/黄金/纳斯达克/恒生指数/上证300中,黄金表现最强,比特币表现最差。

上图为近一周不同资产的走势。

贷款利率_贷款情绪

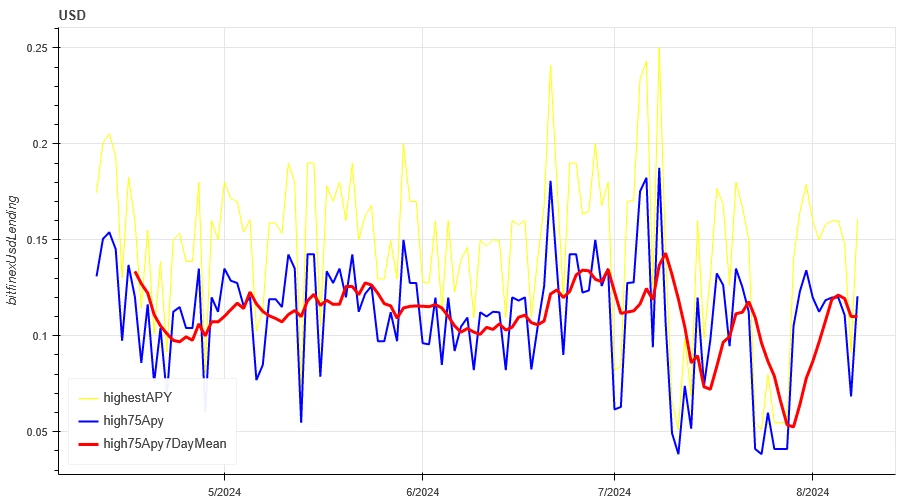

The average annualized return on USD lending over the past week was 11.1%, and short-term interest rates remained at 12.1%.

黄线为美元利率最高价,蓝线为最高价75%,红线为最高价75%的7日均线。

表格显示了过去不同持有日的美元利率平均收益

资金费率_合约杠杆情绪

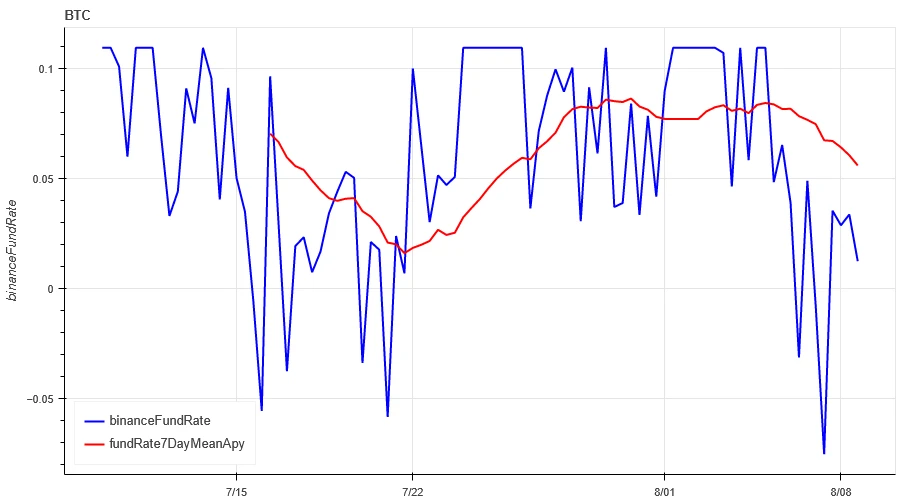

The average annualized return on BTC fees in the past week was 5.8%, and contract leverage sentiment was gradually declining.

蓝线为币安 BTC 资金费率,红线为其 7 天平均值

表格展示了过去不同持有日的BTC手续费平均回报率。

市场相关性_共识情绪

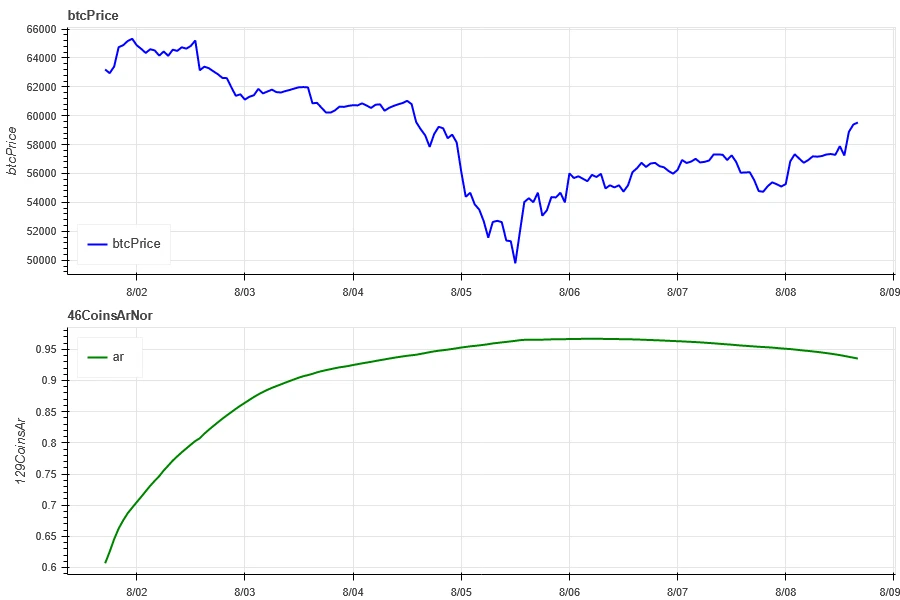

The correlation among the 129 coins selected in the past week was around 0.95, and the consistency between different varieties rose to a high level.

上图中蓝线为比特币价格,绿线为[1000 floki, 1000 luunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj、iot、iotx、jasmy、kava、klay、ksm、ldo、link、loom、lpt、lqty、lrc、ltc、luna 2、magic、mana、matic、meme、mina、mkr、near、neo、ocean、one、ont、op、pendle、qnt、qtum、rndr、rose、rune、rvn、sand、sei、sfp、skl、snx 、sol、ssv、stg、storj、stx、sui、sushi、sxp、theta、tia、trx、t、uma、uni、vet、waves、wld、woo、xem、xlm、xmr、xrp、xtz、yfi、zec、zen、zil、zrx]总体相关性

市场广度_总体情绪

Among the 129 coins selected in the past week, 6.3% of them were priced above the 30-day moving average, 12% were priced above the 30-day moving average relative to BTC, 9% were more than 20% away from the lowest price in the past 30 days, and 10% were less than 10% from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market maintained a downward trend.

上图是[bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt、arb、ar、astr、atom、avax、axs、bal、band、bat、bch、bigtime、blur、cake、celo、cfx、chz、ckb、comp、crv、cvx、cyber、dash、doge、dot、 dydx、egld、enj、ens、eos 等、fet、fil、flow、ftm、fxs、gala、gmt、gmx、grt、hbar、hot、icp、icx、idu、 imx、inj、iot、iotx、jasmy、jto、jup、kava、klay、ksm、ldo、链接、loom、lpt、lqty、lrc、ltc、luna 2、magic、mana、manta、mask、matic、meme、mina 、 mkr、近、neo、nfp、海洋、一、ont、op、ordi、pendle、pyth、qnt、qtum、rndr、robin、rose、rune、rvn、sand、sei、sfp、skl、snx、ssv、stg 、storj、stx、sui、寿司、sxp、theta、tia、trx、t、uma、uni、兽医、波浪、wif、wld、woo、xai、xem、xlm、xmr、xrp、xtz、 yfi, zec, zen, zil, zrx ] 各宽度指标30天占比

总结

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) fell sharply on August 5, when the volatility and trading volume of these two cryptocurrencies reached a peak. The volume of open contracts decreased significantly, while the implied volatility increased simultaneously. Bitcoins funding rate continued to decline, which may reflect the weakening interest of market participants in its leveraged trading. Market breadth indicators show that the prices of most cryptocurrencies fell, and the entire market continued to be under pressure. In addition, the non-agricultural data was significantly lower than expected, which pushed the mainstream currencies to continue to decline for several days after the data was released.

推特:@ https://x.com/CTA_ChannelCmt

网站: channelcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (August 2–9, 2024): Has recession arrived? U.S. non-farm payrolls in July fell far short of expectations

原作者:Biteye核心贡献者Viee 原编辑:Biteye核心贡献者Crush 你开始FOMO TON了吗? 这两天疯狂发黑白狗MEME,炫耀积分,还以为牛市回来了。 今天Biteye就来教大家如何玩转TON生态,抓住潜在的空投机会。 我们将这个话题整理成了思维导图,有需要的请拿走。 01 钱包介绍 参与TON生态的第一步就是使用钱包,目前支持TON链的钱包有49个,下面介绍其中最受欢迎的两个:Wallet和TON Space Wallet Wallet是Telegrams原生的中心化托管钱包,类似微信钱包,…