On August 7, the U.S. Treasury Department announced the issuance of $58 billion in 3-year Treasury bonds, with a winning yield of 3.810%, lower than the pre-issuance trading level (3.812%). Except for the two-year Treasury bond, the benchmark yield rose slightly to an intraday high. The yield is close to ending the inversion, and the 10-year U.S. Treasury yield has erased the decline since the release of non-farm payrolls data last Friday, and is now at 3.908%.

On the other hand, the Bank of Japan turned dovish again, with Deputy Governor Shinichi Uchida saying that it would not raise interest rates when the market is unstable. Some factors have made the central bank more cautious about raising interest rates, and the yen has come under pressure to fall.

Source: Investing US 10-year Treasury yield; USD/JPY exchange rate

In terms of digital currency, Ripple and the SEC reached a settlement, with the fine significantly reduced from the $2 billion initially proposed by the SEC to $1.25 billion. After the announcement, market confidence was boosted, with XRP trading volume increasing by 254% to $5.3 billion and prices rising by 20%.

As for BTC, after the price rebounded from 56,000 to 57,000 the day before yesterday, the convergent actual volatility caused IV to briefly show a steep bear trend, but the price did not last long at the high point. After 10 oclock in the evening, a new round of decline began and was supported near 54,800. After the start of the Asian session, it rose again to recover all the lost ground. The intraday volatility expanded significantly, and the implied volatility rose overall.

资料来源:TradingView

From the details, the daily rise of BTCs far-end IV needs more attention. The uncertainty brought by the US presidential election and the subsequent Fed rate hike route are factors that increase market bets. Compared with the trend of ETH, this change is obvious. Yesterdays fluctuations caused ETH IV to flatten significantly. The front end of 1w-1m rose by about 4.5%, and the far end, such as December, only moved 0.94% (compared to BTCs 3.07%). On the other hand, the decline in the price of the currency has caused an increase in the demand for put options, and the Vol Skew of the two currencies has fallen across the board.

Source: Deribit (As of 8 AUG 16: 00 UTC+ 8)

来源:SignalPlus

Source: SignalPlus, Vol Skew fell across the board

数据来源:Deribit,ETH 交易总体分布

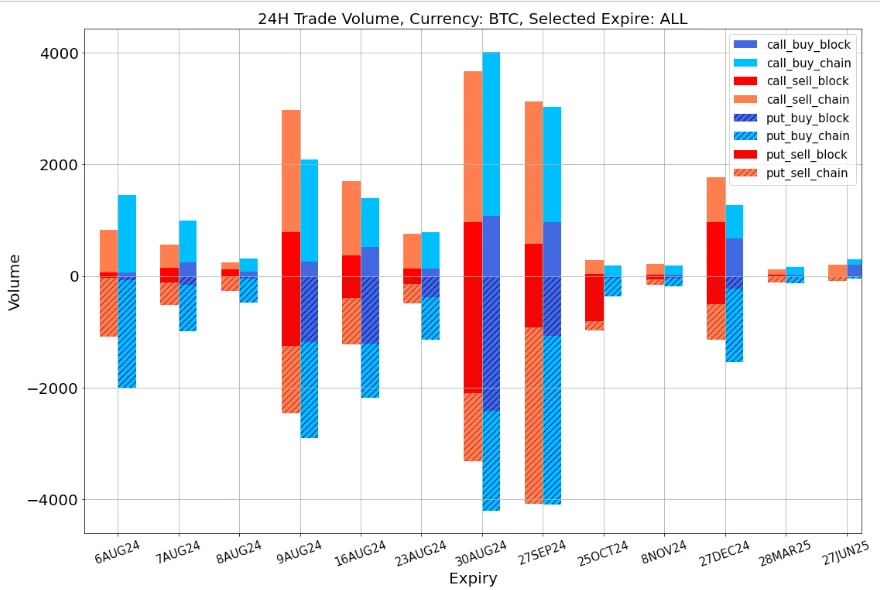

数据来源:Deribit,BTC交易总体分布

来源:Deribit Block Trade

来源:Deribit Block Trade

您可以使用 SignalPlus 交易风向标功能 t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240808): Volatility is back

Related: How to understand Vitalik thoughts on Ethereum transaction confirmation method?

Original author: Haotian Related Reading: Vitaliks Pick: Epoch and Slot: Providing Faster Transaction Confirmation Time for Ethereum How to understand @VitalikButerins thoughts on Ethereum transaction confirmation method? Because the transaction confirmation time of 5-20 seconds on the main network is close to the speed of credit card consumption, it seems to be enough from the users perception. But compared with the millisecond confirmation time of layer 2, the difference in transaction confirmation between the main network and layer 2 will have certain security risks. Therefore, optimizing the transaction confirmation time of the main network is more of a consideration to cater to the overall development strategy of layer 2? 1) Ethereums current Gasper consensus mechanism adopts the core concepts of Slot (time slot) and Epoch (period). Each Slot lasts for…