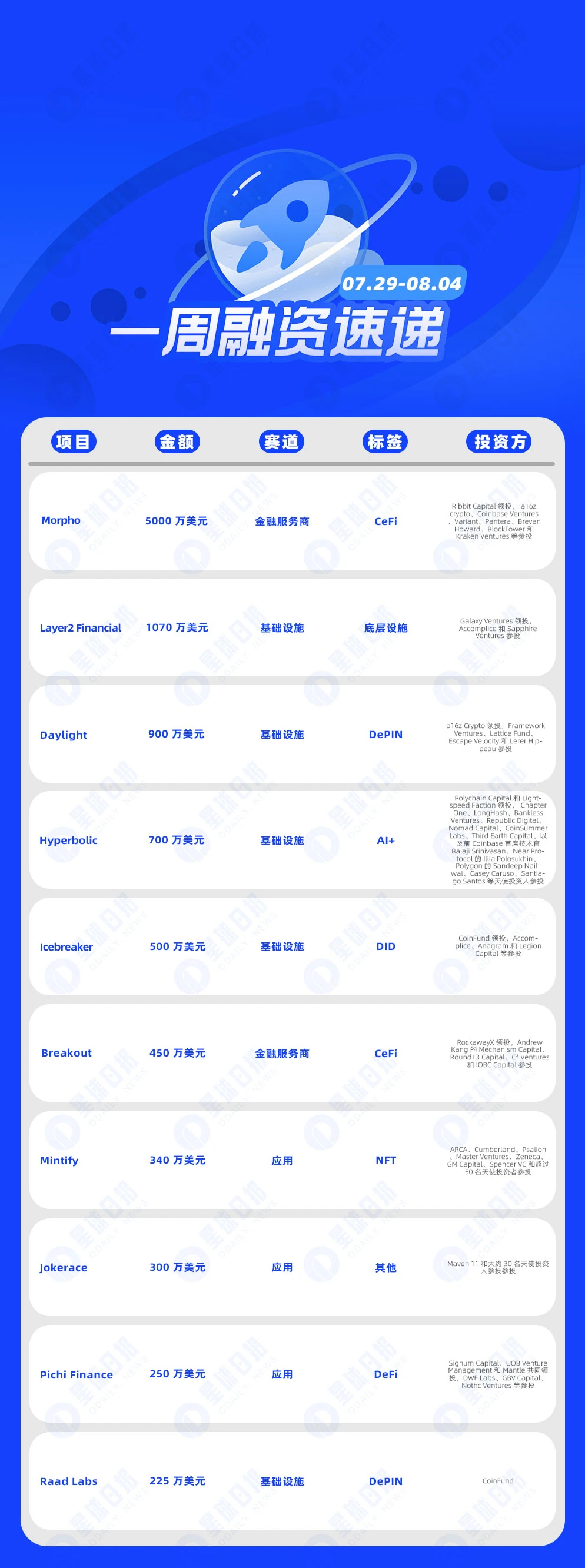

According to incomplete statistics from Odaily Planet Daily, there were 15 blockchain financing events announced at home and abroad from July 29 to August 4, which was a decrease from last weeks data (23). The total amount of financing disclosed was approximately US$102 million, which was a decrease from last weeks data (US$129.5 million).

Last week, the project that received the most investment was crypto lending company Morpho ($50 million); followed by cross-border payment infrastructure Layer 2 Financial ($10.7 million).

以下为具体融资事件(注:1.按公布金额排序;2.不包括募资和并购事件;3.*表示业务涉及区块链的传统公司):

On August 1, crypto lending company Morpho announced the completion of a $50 million strategic round of financing, led by Ribbit Capital, with participation from a16z crypto, Coinbase Ventures, Variant, Pantera, Brevan Howard, BlockTower and Kraken Ventures. The specific valuation information has not been disclosed yet.

Layer 2 Financial Completes $10.7 Million Series A Funding, Led by Galaxy Ventures

On July 31, cross-border payment infrastructure Layer 2 Financial announced the completion of a $10.7 million Series A financing round led by Galaxy Ventures, with participation from Accomplice and Sapphire Ventures. The company plans to use the funds to expand in new jurisdictions, expand its team, and advance its product development.

DePIN project Daylight completes $9 million Series A financing, led by a16z Crypto

On August 1, DePIN project Daylight completed a $9 million Series A financing round, led by a16z Crypto, with participation from Framework Ventures, Lattice Fund, Escape Velocity and Lerer Hippeau. However, its co-founder and CEO Jason Badeaux refused to disclose the structure, valuation and other information of this round of financing. As of now, the companys total financing amount has reached $13 million.

Web3 AI company Hyperbolic completes $7 million seed round of financing, led by Polychain Capital

On July 30, Web3 AI company Hyperbolic announced the completion of a $7 million seed round of financing, led by Polychain Capital and Lightspeed Faction, with participation from Chapter One, LongHash, Bankless Ventures, Republic Digital, Nomad Capital, CoinSummer Labs, Third Earth Capital, as well as former Coinbase CTO Balaji Srinivasan, Near Protocol’s Illia Polosukhin, Polygon’s Sandeep Nailwal, Casey Caruso, Santiago Santos and other angel investors.

On July 31, Icebreaker, the on-chain “LinkedIn” company, announced the completion of a $5 million seed round of financing, led by CoinFund, with participation from Accomplice, Anagram and Legion Capital. The post-investment valuation reached $21 million.

On July 31, cryptocurrency proprietary trading company Breakout completed a $4.5 million seed round of financing, led by RockawayX, with participation from Andrew Kang’s Mechanism Capital, Round 13 Capital, C² Ventures and IOBC Capital. The company’s co-founder and CEO Alex Miningham declined to comment on the valuation.

On July 30, NFT startup Mintify completed a new round of financing of US$3.4 million. ARCA, Cumberland, Psalion, Master Ventures, Zeneca, GM Capital, Spencer VC and more than 50 angel investors participated in the investment. Mintify’s total financing amount is US$5 million. It is currently building infrastructure for NFT order books for gaming, art and real-world asset markets.

On July 31, the on-chain competition event project Jokerace completed a $3 million financing, with Maven 11 and approximately 30 angel investors participating. Jokerace is a no-code project that allows blockchain projects to initiate competitions, debates, and hackathons. The project was launched last year and is currently online on more than 90 blockchains.

PointsFi Marketplace Pichi Finance Completes $2.5 Million Funding, Led by Signum Capital and Others

On August 1, according to official news, PointsFi market Pichi Finance announced the completion of US$2.5 million in financing, led by Signum Capital, UOB Venture Management and Mantle, with participation from DWF Labs, GBV Capital, Nothc Ventures and others.

It is reported that Pichi Finance provides price discovery services for tokens before and after TGE.

DePIN project Raad Labs completes $2.25 million seed round of financing, led by CoinFund

On August 2, CoinFund announced on the X platform that it had led a $2.25 million seed round for Raad Labs.

Raad Labs is building a decentralized, incentive-based network to improve weather data management and collection on local, regional, and large-scale models.

MetaDAO Completes $2.2 Million Funding, Paradigm Leads Investment

On August 1, Solanas ecological governance experimental project MetaDAO announced that it had completed a $2.2 million financing, led by Paradigm. It is reported that the project is similar to the prediction market Polymarket. MetaDAOs anonymous founder Proph 3 According to t, Paradigm will hold 3,035 META tokens, becoming the largest single holder of META, accounting for 14.6% of the total supply.

On July 30, DeFi liquidity and trading engine service provider Liquorice announced on the X platform that it had completed a $1.2 million Pre-Seed round of financing, led by Greenfield Capital, with participation from Polymorphic Capital, L2 Iterative Ventures (L2 IV), 1inch, HASH CIB, Efficient Frontier, Follow the Seed, and Horadrim.Capital. The specific valuation information has not been disclosed yet.

Web3 integrated platform Agent Exchange completes $1 million in financing

On July 29, according to official news, the Web3 integrated platform Agent Exchange announced the completion of a $1 million financing on the X platform. Larry Cermak, CEO of The Block, Domo, founder of BRC 20, Web3 developers Cygaar, Mr. Block, Caladan and others participated in the investment. It is reported that Agent can support the flexible creation and management of sub-accounts through the ERC-6551 standard, helping users earn and trade points in the pre-market.

On July 31, Mycel, a decentralized cross-chain asset management platform, announced the completion of its seed round of financing on the X platform. CV Labs, FLICKSHOT, gumi Cryptos Capital, Arriba Studio, double jump.tokyo Inc., Incubate Fund, ??═⋯⋯⋯, and Gavin Birch participated in the investment. The specific amount has not been disclosed. Mycel provides cross-chain settlement infrastructure, using transferable accounts (TA) to connect and synchronize state machines, aiming to accelerate the optimization of token market prices.

DeFi protocol Chateau completes Pre-Seed round of financing, led by Hack VC

On August 2, Hack VC announced on the X platform that it had led Chateau’s Pre-Seed round of financing.

This article is sourced from the internet: One-week financing express | 15 projects received investment, with a total disclosed financing amount of approximately US$102 million (7.29-8.4)

相关:允许众议院和总统相互否决的 SAB 121 如何影响加密资产

原创|Odaily星球日报 作者:jk 本周,美国众议院举行投票,推翻了拜登对美国证券交易委员会加密货币会计政策SAB 121的支持,但投票结果远未达到推翻总统决定所需的三分之二票数。 背景:发生了什么?什么是SAB 121? 员工会计公告121(SAB 121)是美国证券交易委员会(SEC)发布的一项指南,要求持有加密货币的公司在其资产负债表上记录这些资产,并披露相关风险。 该公告适用于所有受SEC监管的实体,特别是银行和金融机构,并可能导致它们面临更高的资本要求,从而影响其提供加密货币托管服务的能力。 SEC表示,SAB 121是非约束性的员工指南,旨在加强披露……