After a weekend, Bitcoin fell below $60,000 yesterday and continued to fall today to hit $49,000, a 24-hour drop of 18.5%. Ethereum plummeted 25% to below $2,100, and the crypto market fell across the board.

The market crash has made the already sluggish crypto market even worse, and the already sluggish DeFi sector has been hit hard. According to DeFiLlama data, Ethena Labs revenue has been negative in the past month. If the annual revenue is calculated based on this (revenue in the past 30 days x 12), Ethena Labs annual revenue is about negative $32.95 million.

The algorithmic stablecoin USDe launched by Ethena Labs currently relies on collateral BTC, stETH and its inherent income, while creating short positions in Bitcoin and ETH to balance Delta and use perpetual/futures funding rates to maintain anchoring and provide income. That is, using the income from spot to hedge the loss of one short order to achieve a balance, but you can harvest ETH pledge income and short order funding rates.

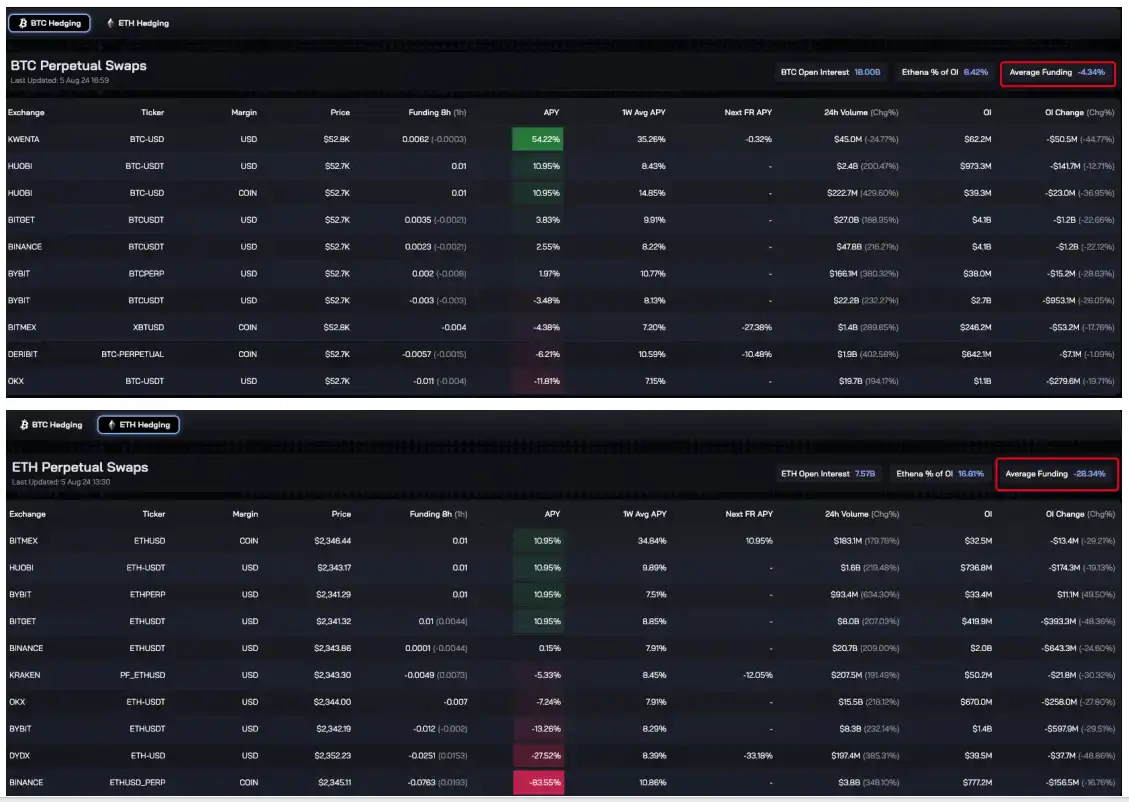

Bitcoin and Ethereum funding rates are both negative

For Ethena to succeed, the demand for long leverage must remain high to keep funding rates high, as this is where the majority of the project鈥檚 revenue comes from. Otherwise, the protocol needs to pay fees to CEXs to maintain its contract positions.

In other words, the USDe model can only work well when the market is in a bullish mood. The bull market in early 2024 drove high short fees, which supported the adoption of USDe in early 2024, but according to 官方数据 , the supply of USDe shrank slightly in April and then increased rapidly until the beginning of July, when the cryptocurrency market fell into a downward trend and the supply of USDe continued to decline.

Image source: Ethena Labs

Overseas KOL @OP Michael recorded the overall position fee status of Ethena on April 13 when market sentiment was extremely pessimistic. At that time, the comprehensive fee rate of ETH was -9% and the comprehensive fee rate of BTC was only 2%. Both the protocol and sUSDe holders began to face losses.

Due to the poor performance of Ethereum, in order to prevent further decline in returns, Ethenas pledged assets have gradually shifted to Bitcoin. Official data shows that the current TVL of the Ethena Labs platform is 3.18 billion US dollars, and the reserve funds are 46.5 million US dollars. 48% of the collateral is BTC, 30% is ETH, 10% is ETH LST, and 12% is USDT.

Image source: Ethena Labs

However, the market quickly pulled back, and the market spike led to a general decline in crypto assets, and the amount of long orders liquidated increased. According to Coinglass data, the total liquidation of the entire network in the past 24 hours reached 1.02 billion US dollars, of which long orders were liquidated 889 million US dollars and short orders were liquidated 130 million US dollars. The interest rate of short-selling funds continued to decline. According to the official website of Ethena Labs, the average fee rate of Bitcoin has dropped to -4.34%, while the average fee rate of Ethereum has reached -28.34%.

Image source: Ethena Labs

Although it is usually extremely rare for fees to remain negative throughout the year, the decline in Ethereum has led to the liquidation of staked Ethereum. According to PeckShield monitoring, several ETH whales have been liquidated today, and their value exceeds millions of dollars. As the situation changes, ENA has also ushered in a certain amount of selling pressure. According to CoinMarket data , ENA briefly touched $0.232, a 24-hour drop of 21%.

沙丘数据 shows that USDe has been destroyed for tens of millions of dollars several times in the past month, which means that the collateral has been redeemed in large quantities. It can also be seen from the supply of sUSDe (USDe pledge certificate token) that in the past week, nearly 60 million US dollars of sUSDe have been released from pledge.

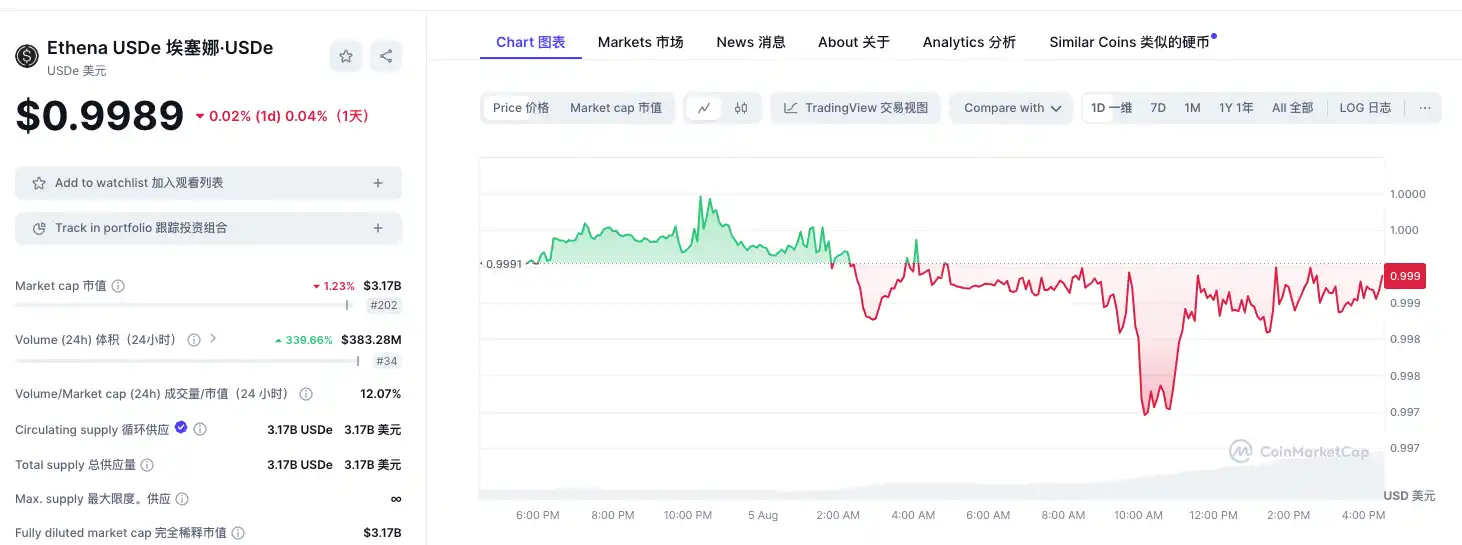

This also led to the depegging of USDe to a certain extent. According to CoinMarket data , its price briefly touched $0.997 and was still depegging at the time of writing.

Ethena can鈥檛 run in a bear market?

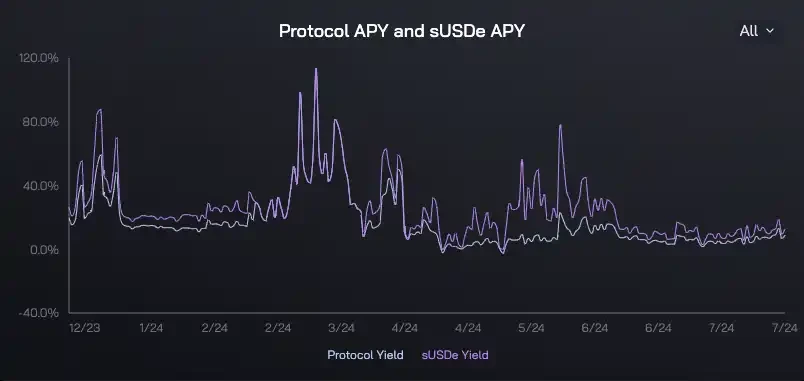

During the bull market, the staking income and short funding rate achieved considerable returns for USDe. According to official data, Ethenas yield was quite amazing in March. The protocol yield and sUSDe reached a maximum of 113.34% and a minimum of 8.55%.

However, as the market continued to fall, the protocol yield briefly fell to -2.09% in mid-April, and then immediately rebounded, reaching highs of 22.77% and 77.58% respectively. But since June, the Ethena protocol yield and sUSDe yield have both fallen below 20%. (Due to the delay in the update of Ethena official data, only data up to July 31 are included)

Image source: Ethena Labs

Objectively speaking, Ethenas stabilization mechanism is a major innovation of DeFi. MakerDAO founder Rune Christensen once considered allocating 600 million DAI to USDe and pledging USDe (sUSDe) through the DeFi lending agreement Morpho Labs, but the plan was opposed by many parties.

相关阅读: ENAs market value exceeds $1 billion, but some people worry that it is creating the next black swan

Ethena has made TVL exceed billions of dollars in a very short time, and the rapid growth has caused panic in the community. Opponents views are nothing more than questioning the environmental risk of USDe and believing that its value is greatly affected by market conditions. Among them, analyst Duo Nine (@DU 09 BTC) once pointed out that it is only a matter of time before USDe depegs, and the bigger the bubble, the greater the probability of this happening.

Ethena was born at the last moment of the bull market, but the ensuing bear market continues to test Ethenas ability to withstand pressure. Now the funding rates of Bitcoin and Ethereum are negative, and the annual revenue of the protocol is also in a loss state. Whether Ethena can withstand the huge market correction and prove the availability of its mechanism still needs time to consider.

This article is sourced from the internet: With annual revenue in the red, can Ethena survive the huge market correction?

原作者:Biteye核心贡献者Viee 原编辑:Biteye核心贡献者Crush 你开始FOMO TON了吗? 这两天疯狂发黑白狗MEME,炫耀积分,还以为牛市回来了。 今天Biteye就来教大家如何玩转TON生态,抓住潜在的空投机会。 我们将这个话题整理成了思维导图,有需要的请拿走。 01 钱包介绍 参与TON生态的第一步就是使用钱包,目前支持TON链的钱包有49个,下面介绍其中最受欢迎的两个:Wallet和TON Space Wallet Wallet是Telegrams原生的中心化托管钱包,类似微信钱包,…