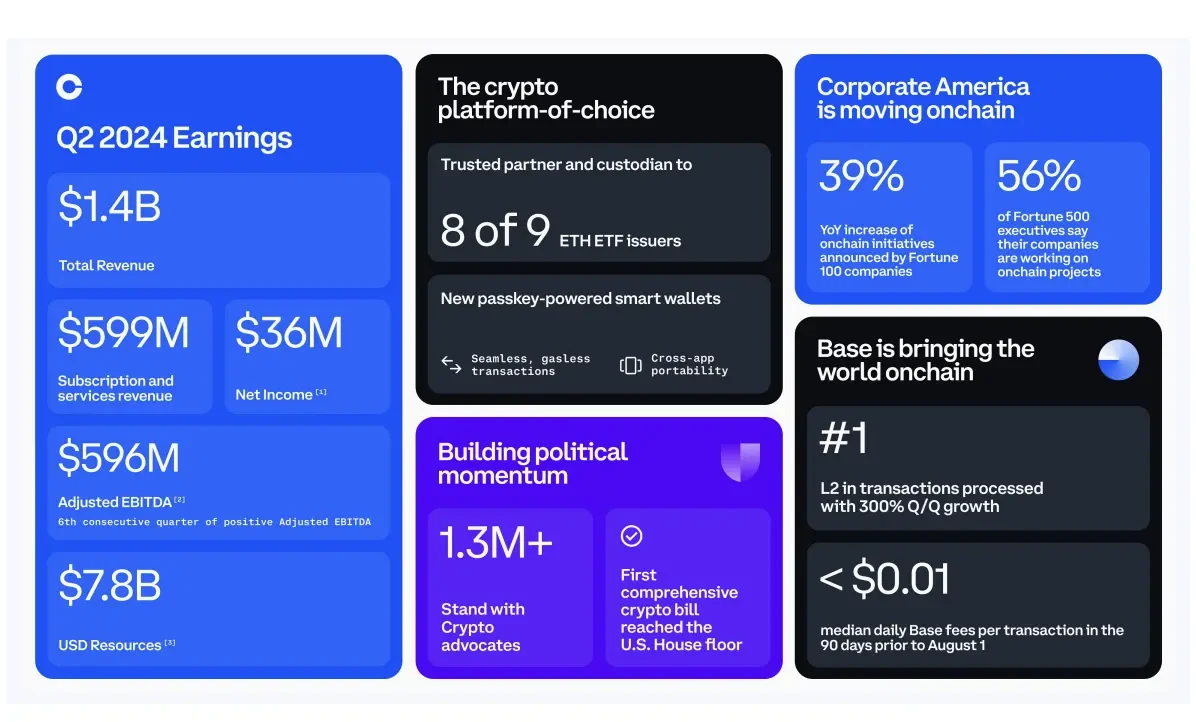

Coinbase released its second quarter financial report today, with revenue of $1.45 billion, down 11% from the previous month and up more than 100% year-on-year, almost the same as analysts expectations of $1.37 billion. Net income was $36 million, down 97% from the previous month. Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) was $596 million. Coinbase has achieved positive revenue growth for four consecutive quarters.

Coinbases total trading volume in the second quarter was $226 billion, down 28% from the first quarter, trading revenue was $781 million, down 27% from the previous quarter, and subscription and service revenue increased 17% to $599 million. Total operating expenses were $1.1 billion, up 26% from the previous quarter. Coinbase made good progress in revenue diversification in the second quarter, with subscription and service revenue reaching nearly $600 million. The balance sheet increased to $7.8 billion.

It is worth mentioning that Coinbases custody fee income in the second quarter was US$35 million, a 7% increase from the previous quarter. The main driving force was that the average price of crypto assets in the second quarter was higher than that in the first quarter, and it also benefited from the related fund inflows as the custodian of BTC ETF products. In addition, Coinbase generated US$240 million in USDC stablecoin interest income in the second quarter, a 22% increase from the previous quarter.

Coinbase also emphasized the significant performance improvement of Base in its Q2 financial report: speed increase and fee reduction – the basic fee is less than 1 cent, and the processing speed is less than 1 second. The transaction volume processed by Base increased by 300% in the second quarter. In addition, Coinbase also launched the upgraded version of Coinbase Wallet, the self-hosted wallet Smart Wallet, in the second quarter to simplify the user experience.

Revenue diversification: transaction fee revenue decreased, subscription and service revenue increased

Overall, Coinbase made good progress in diversifying its revenue in the second quarter. Total transaction volume in Q2 was $226 billion, down 28% from the previous quarter. Total transaction fee revenue was $780 million, down 27% from the previous quarter and up 138% from the previous year. The revenue share decreased from 65% in Q1 to 54%, but it is still the main source of revenue. Subscription and service revenue reached nearly $600 million, up 17% from the previous quarter. The companys interest and other income was $69.7 million, up 40% from the previous quarter.

-

Retail transaction fees

Retail transaction fee revenue in Q2 2024 was $665 million, down 29% from the previous quarter and up 130% from the previous year. Retail transaction volume in Q2 was $37 billion, down 34% from the previous quarter. Coinbase transaction fees are directly affected by the crypto market conditions. The cryptocurrency spot market trading conditions in the second quarter were weaker than in the first quarter, especially in the United States.

-

机构交易费

Institutional trading slowed down in the second quarter compared to the first quarter. Institutional trading revenue in Q2 was $64 million, down 25% from the previous quarter and up 272% from the previous year. Institutional trading volume in the second quarter was $189 billion, down 26% from the previous quarter.

In the first quarter, thanks to the approval of the Bitcoin ETF in January 2024, Coinbase attracted a large influx of institutional investors, and the trading volume and number of active customers of the institutional platform Coinbase Prime in Q1 2024 hit a record high. Although trading revenue decreased in the second quarter, in July, the Ethereum spot ETF was officially approved, and Coinbase was authorized as a custodian by 8 out of 9. Coinbases institutional trading fee income continues to benefit from the listing of crypto ETFs.

Subscription and services revenue

Coinbases subscription and service revenue in Q2 was $599 million, up 17% year-on-year. Subscription and service revenue benefited from higher average USDC platform balances and USDC market capitalization as well as higher average crypto asset prices, especially SOL and ETH.

-

Stablecoin revenue was $240 million, up 22% quarter-over-quarter. The main drivers were higher average USDC platform balance and higher average USDC market cap. The value of USDC on the platform was $5.7 billion, up just 2% from $5.5 billion at the end of Q1.

-

The blockchain鈥檚 reward revenue was $185 million, up 23% month-over-month. The main driver of the growth was higher average prices for SOL and ETH.

-

Interest and finance fee income was $69 million, up 4% sequentially. The increase was primarily driven by higher average escrow statutory balances.

-

Custody fee revenue was $35 million, up 7% quarter-over-quarter. The main driver of the second quarters growth was higher average crypto asset prices than in the first quarter. In addition, the growth in custody fee revenue also benefited from inflows related to our role as custodian of the BTC ETF product.

-

Other subscription and services revenue was $70 million, up 9% year-over-year, driven primarily by growth in Coinbase One revenue.

Balance Sheet

As of the second quarter, Coinbase held $7.8 billion in assets, a 10% increase from the previous quarter, or an increase of $733 million. The specific composition is shown in the figure below.

Third quarter outlook

Coinbases subscription and service revenue in the third quarter will be between $530 million and $600 million. In July 2024, Coinbase has generated about $210 million in total transaction revenue and said it will continue to push for the goal.

In addition, Coinbase will continue to promote the global adoption of USDC in the third quarter, making it the most compliant stablecoin. Therefore, the expenses related to USDC in Q3 will increase. As of the second quarter, Coinbase had 3,486 full-time employees, an increase of 2%. In the next six months of this year, Coinbase will continue to increase employees to support businesses such as product development and international expansion.

This article is sourced from the internet: Coinbase 2024 Q2 financial report interpretation: revenue of US$1.45 billion, net profit fell 97% month-on-month

Original | Odaily Planet Daily ( @OdailyChina ) Author | Asher ( @Asher_0210 ) As the German government has sold all its BTC, the price of BTC continues to rise , and the GameFi sector has also seen a good increase. This week, many popular blockchain game projects will have new moves. Therefore, Odaily Planet Daily has summarized and sorted out the blockchain game projects that have been popular recently or have popular activities. Secondary market performance of blockchain gaming sector According to Coingecko data, the Gaming (GameFi) sector rose 17.0% in the past week; the current total market value is $ 16,902,790,122 , ranking 40th in the sector ranking, down six places from the total market value sector ranking last week. In the past week, the number of tokens…