原创 | Odaily星球日报( @OdailyChina )

作者:淣安之( @Assassin_Malvo )

Yesterday, Binance Labs announced the first batch of projects selected for the seventh season of incubation , including Astherus, CYCLE NETWORK, DILL and EigenExplorer. Their concepts and businesses are relatively cutting-edge, and the former two have launched early interactive activities, which are linked to future airdrops. Odaily will analyze the business, characteristics and interactive activities of each protocol in this article.

Astherus: Liquidity Center for LRT Assets

Agreement business

The re-staking market space for BTC and ETH is as high as $20 billion and is still growing rapidly. Re-staking allows blockchain validators to deposit ETH or Liquid Staking Tokens (LST) into the platform, receive APR rewards and protect the network. But Astherus believes that most re-staking protocols on the market have not seriously considered: What is the use of re-staking assets?

According to the official introduction, Astherus is building a comprehensive DApp ecosystem for re-pledged assets such as LST and LRT. Users assets can not only obtain pledge APR, but also be used to trade spot and derivatives, stablecoin Yield and other profit strategies. Astherus supports multi-chain re-pledged assets, including Arbitrum, BNB Chain and Ethereum.

The Astherus protocol consists of 3 module layers:

-

DApp layer: includes various DApps for practical use cases of re-pledged assets, such as cryptocurrency spot and derivatives exchange AstherEx and DeFi, CeFi profit strategy protocol AstherEarn, etc.

-

Defi infrastructure layer: Aggregates liquidity from multiple LST and LRT pools, can build stablecoin and spot yield aggregation protocols based on this infrastructure and establish innovative derivatives clearing houses, and also allows developers to easily build LST-based DApps.

-

L1 Chain: AstherLayer is a Layer 1 blockchain built using the Cosmos SDK and will be linked to multiple other chains. The specific details are to be disclosed later.

Interactive Activities

A month ago, Astherus launched the Stage 0 interactive event, which aims to increase the TVL of the protocol, and explicitly stated that the points of the event are related to future airdrops .

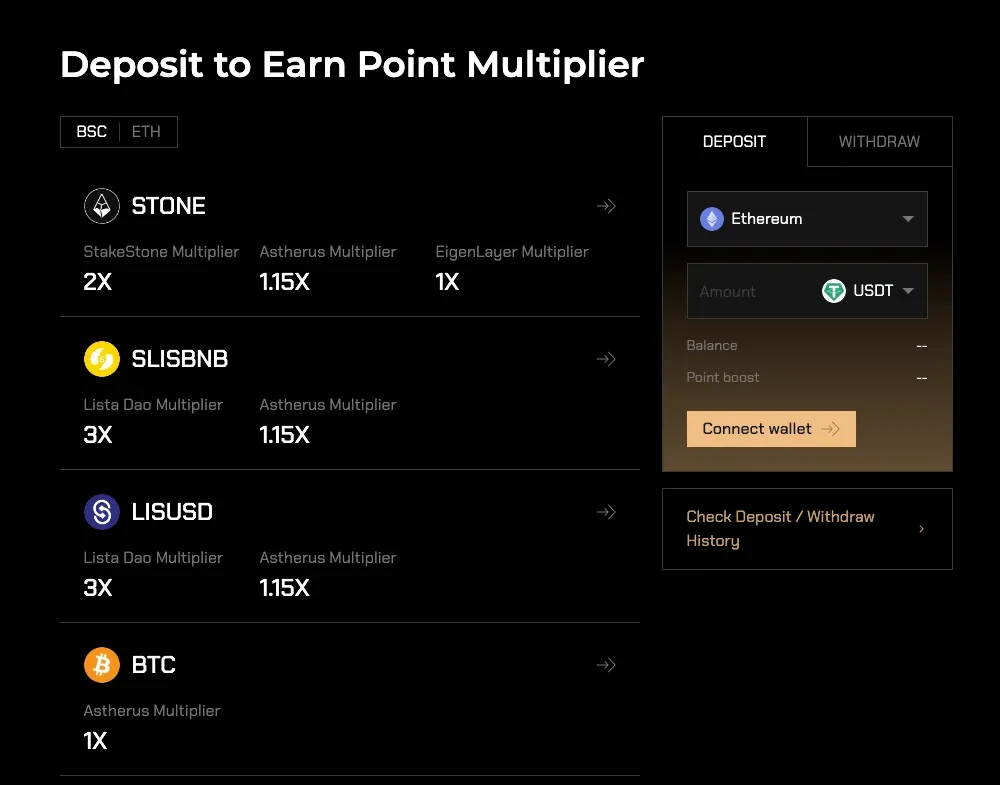

The activity method is very simple and direct. You only need to deposit specific assets into the protocol . Supported chains include BNB Chain and Ethereum mainnet.

Supported assets include BNB, USDT, BTC, ETH, lisUSD, slisBNB, WBETH, STONE, CAKE, LISTA on BNB Chain, and USDT, BTC, ETH, USDC, rsETH on Ethereum.

Among them, staking slisBNB , lisUSD, LISTA, STONE, and rsETH will receive an additional 15% score bonus.

(Odaily Note: Binance announced today that the slisBNB deposited in its Web3 wallet will also be counted into Launchpool, achieving three benefits with one stone.)

CYCLE NETWORK

According to Binance Labs, CYCLE NETWORK is a universal, secure and verifiable chain abstraction that provides a bridgeless aggregated liquidity network for all blockchains, whether L1, L2, EVM or non-EVM.

Project vision, functions and features

With the rapid development of Web3 and blockchain technology, many different blockchain platforms have emerged, each with its own protocols and assets, resulting in liquidity being dispersed across different chains, affecting user experience and the efficiency of market operations.

In a multi-chain environment, users need to manage their assets through complex bridges and solutions, while developers need to repeatedly deploy their applications in different ecosystems to meet the needs of different users. In addition, cross-chain security risks and the complexity of multi-chain operations exist.

Cycle Network is an innovative solution designed to achieve interoperability, security, and efficiency between blockchains. It uses Verifiable State Aggregation (VSA) technology to build a universal, secure, and verifiable on-chain abstract architecture. In this way, Cycle Network can achieve seamless interaction between different blockchain platforms without relying on traditional cross-chain bridging technology.

The core features of Cycle Network include:

-

Decentralized Application Center Infrastructure (DACI): Facilitates the development of decentralized applications and the popularization of Web3.

-

Omni State Channel Indexer (OSCI): A decentralized multi-chain indexer that enables trustless verification and confirmation of the state of the Cycle ledger.

-

Zero-knowledge hardware acceleration: Accelerate the generation and verification of zero-knowledge proofs (ZKPs) through dedicated hardware, improving efficiency and scalability.

-

Fully Homomorphic Encryption (FHE): Allows computations to be performed on encrypted data without decryption, enhancing data privacy and security.

Points system

Cycle Networks current interactions are all external joint activities. Previously, it has cooperated with projects such as BEVM, Macaron, and IoTex to launch activities. The latest activity is a joint activity with TapUp . Completing tasks can earn Cycle points and TapUps U prize pool.

The activity method is also very simple. You only need to link and follow the social media, so it will not be elaborated in this section.

DILL: Improving DA network scalability by a hundred times

Dill is a highly scalable and secure next-generation data availability (DA) network. It is consistent with the full sharding technology solution in Ethereums future roadmap, and adopts core technologies such as subnet sharding, 2D erasure coding, KZG (Kate-Zaverucha-Goldberg) and DAS (Data Availability Sampling). Dill provides scalability 10 to 100 times greater than other current DA networks.

Dill is a permissionless, decentralized Proof of Stake (PoS) network that supports millions of validators. It allows the staking and re-staking of Bitcoin (BTC) to participate in the PoS network consensus, further improving the security of the network.

融资

On July 16, the modular network DILL announced the completion of its Pre-Seed round of financing , led by FSL Ecosystem, with participation from LayerZero Labs, Modular Capital, Pendle co-founder TN Lee, Mantas victorji.eth and others. The specific amount has not been disclosed yet.

It is reported that Dill is a data availability layer and proposes a paradigm-shifting scalability solution, which uses the same technology stack as the Ethereum Go client to ensure high performance, and its validity proof guarantees fast finality by aggregating KZG polynomial commitments. Since applications accumulate a large number of user behavior data points, data sovereignty is very important for these applications. In extreme cases, when a licensed DA (such as a DA with only 100 nodes) stops functioning for some reason, most chains will not be able to do anything, and Dill will allow consumers of any application chain to allow permissionless network participation through light clients, thereby protecting the data sovereignty of the product.

EigenExplorer: A nesting doll or another new asset class?

EigenExplorer is a platform dedicated to serving the core entities in the EigenLayer ecosystem, including re-stakeholders, AVS and Operators. EigenExplorer is an innovative asset class Liquid AVS Token (LAT) designed specifically for the EigenLayer ecosystem.

LAT was launched to solve the problem that users are currently unable to directly support AVS. Users must allocate their staked assets through operators or use the LRT platform to control AVS participation and reward distribution. LAT allows users to bypass the operator selection step and directly support any AVS they choose.

Features of LAT include:

-

Directly pledge to another AVS;

-

Automatic selection of operators;

-

While maintaining the staking status, it is a liquid token that can be used for other DeFi activities;

-

Improved utility, efficiency, and user experience. Users can build their own liquid re-staking portfolio to match different risk preferences. Choose the protocols to support based on their preferences, rather than packaging their staking contributions for general verification.

According to the official tweet, the testnet will be launched in mid-August 2024 .

This article is sourced from the internet: A quick look at the first batch of projects incubated by Binance Labs in Season 7 (with an early interactive guide)

Original author: Mason Nystrom Original translation: Luffy, Foresight News The combination of tokens and innovative products has been proven to effectively alleviate the cold start problem. However, this strategy also raises new challenges: how to achieve sustainable user retention and activity in the face of short-term liquidity waves brought by speculation and those user groups that do not grow organically? Marketplaces and networks that launch with tokens early on (or before building enough organic demand) must find product-market fit in a tight timeframe, or they will burn through the cash needed for subsequent business growth. My friend Tina calls this the “hot start problem”, where tokens limit the window of time in which startups can find PMF and gain enough organic traction, making it difficult for startups to retain users…