Original author: SoSOValue

The U.S. Ethereum spot ETF will be officially listed and traded on July 23, 2024, which is exactly the 10th anniversary of Ethereums initial public offering (ICO) on July 22, 2014. Whether the listing date of the Ethereum ETF was deliberately chosen at this memorable moment or just a coincidence, this event will have epic significance for the future sustainable development of the entire crypto world, because it has taken an important step for the POS public chain to enter the mainstream financial world. It will surely attract more dimensions and numbers of builders to join the construction of the Ethereum ecosystem, and it will pave the way for subsequent crypto world infrastructure such as Solana to enter the mainstream world, which has substantive significance for the popularization of the blockchain ecosystem.

On the other hand, since Ethereum ETFs are not currently allowed to be pledged from a regulatory perspective, investors holding ETFs will lose 3%-5% of the staking mining income (the risk-free rate of return in the Ethereum world) compared to directly holding Ethereum tokens. In addition, the threshold for public investors to understand Ethereum is higher than that of Bitcoin. 所以, the short-term impact of this US Ethereum spot ETF on the Ethereum price may not be as great as the short-term impact of the Bitcoin spot ETF on the BTC price after its approval. It will more likely improve the relative stability of the Ethereum price and reduce volatility.

The following article will analyze the short-term impact on the power of both Ethereum token buyers and sellers after the Ethereum spot ETF is listed, and the long-term impact on the crypto ecosystem.

1. In the short term: The power of both buyers and sellers is not as strong as that of Bitcoin ETF, and the impact of Ethereum ETF is expected to be smaller than that of Bitcoin

According to SoSoValues continuous tracking of Bitcoin spot ETFs, the factor that has the greatest impact on the price of the currency is the daily net inflow , that is, the actual increase in the scale of buying/selling orders brought to the crypto world by the cash subscription and redemption of Bitcoin spot ETFs (see Figure 1 for details), which affects supply and demand and determines the price. According to the S-1 document, the subscription and redemption mechanism of the US Ethereum spot ETF is the same as that of the Bitcoin spot ETF, and both only support cash subscription and redemption. Therefore, the daily net inflow will also be the most important observation indicator for the Ethereum spot ETF; there are two main differences:

• Selling: Due to the more than 10-fold difference in management fees of Grayscale Ethereum Trust (ticker ETHE), the selling caused by the relocation effect is still there; and after experiencing the Bitcoin mistake caused by the outflow of Grayscale GBTC, the market is also prepared for the outflow of Grayscale ETHE. However, unlike the Bitcoin ETF, the Grayscale Ethereum Trust split 10% of its net assets to establish a low-fee Grayscale Ethereum Mini Trust (ticker ETH) during the conversion process to an ETF, so the selling may be slightly reduced.

• Buying: Since Ethereum ETFs do not allow staking from a regulatory perspective, holding Ethereum ETFs will result in 3%-5% less staking mining income (the risk-free rate of return in the Ethereum world) than directly holding Ethereum tokens. At the same time, the public investors’ awareness of Ethereum is lower than that of Bitcoin. If they are optimistic about cryptocurrencies, they will still prefer Bitcoin ETFs, which have a clear scarcity and only 21 million in existence.

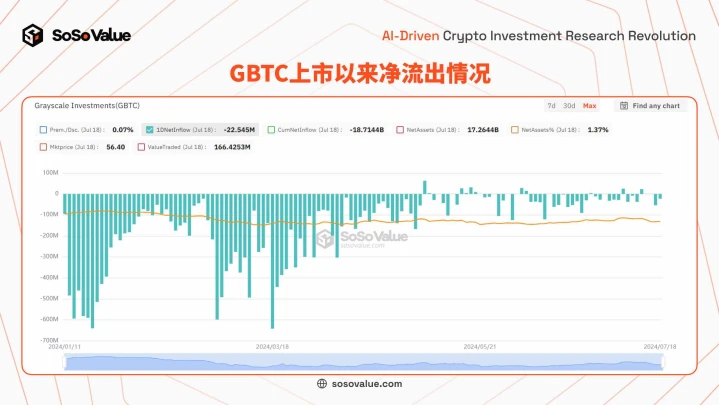

Figure 1: Decomposition of the impact of net outflows on Bitcoin prices in the initial stage of Ethereum spot ETF listing (data source: SoSoValue)

1. Selling: Grayscale ETHE with $9.2 billion has a 10-fold difference in management fees from competitors, which will still bring early relocation selling, but will be less than the impact of GBTC outflow

Looking back at the reasons why the Grayscale Bitcoin ETF (GBTC) caused a large net outflow in the early days, there are two reasons: on the one hand, the management fee was significantly higher than that of competitors, which brought about a relocation effect. Investors redeemed from the Grayscale Bitcoin ETF with a management fee of 1.5% and bought other ETFs with a management fee of about 0.2%; on the other hand, the previous trust discount arbitrage, after the ETF price was flattened, led to selling. At the beginning of the year, the ETF directly converted from the Grayscale Bitcoin Trust (GBTC asset management scale of US$28.4 billion) saw a continuous large-scale net outflow of funds as soon as it was listed. There are two main reasons. First, Grayscale GBTCs management fee is 1.5%, which is about 6 times that of its competitors, causing investors who are optimistic about Bitcoin assets in the long term to move their positions to other ETFs. Second, before GBTC was converted to ETF, the discount remained at around 20% for a long time, stimulating investors to arbitrage the discount rate by buying discounted GBTC and shorting BTC over the counter. After the discount basically disappeared when the trust was converted to ETF, this type of arbitrage funds sold the ETF and took profits. According to SoSoValue data, GBTC had a net outflow from January 11 to May 2, and then slowed down. During this period, its Bitcoin holdings decreased by 53%.

Figure 2: Net outflow of GBTC since its listing (data source: SoSoValue)

Unlike the direct conversion of GBTC, Grayscale will simultaneously split 10% of its net assets to form a low-fee Ethereum Mini ETF (stock code ETH) during the conversion of the Ethereum Trust to an ETF. That is, Grayscale will have two Ethereum ETFs with management fees of 2.5% and 10% respectively.

0.15%, slightly easing the pressure of outflow caused by high fees. According to the S-1 document, Grayscale Ethereum Trust (stock code: ETHE) will transfer about 10% of Ethereum to Grayscale Ethereum Mini Trust (stock code: ETH) as the initial capital of the Mini Trust ETH; after that, the two Grayscale Ethereum ETFs will operate independently. For investors who already hold ETHE, on July 23, each share of Ethereum Trust ETHE they hold will automatically be allocated 1 share of Ethereum Mini Trust ETH, and the net value of ETHE will be adjusted to 90% of the previous value. Considering that the management fee rate of ETHE is 2.5% and the management fee rate of ETH Mini Trust is 0.15% (no management fee within 2 billion USD in the first 6 months), that is to say, for existing ETHE investors, 10% of their assets will be automatically allocated to low-fee ETFs. With reference to the final fund transfer ratio of GBTC being around 50%, it is expected that the launch of the Ethereum Mini Trust ETH and the early bird discount of management fees will ease the short-term fund outflow pressure of Grayscale ETHE.

On the other hand, because the ETHE discount converged ahead of time, the outflow pressure caused by the liquidation of discounted arbitrage positions is also expected to be smaller than that of GBTC. Grayscale ETHE was once greatly discounted, reaching 60% at the end of 2022, and the discount exceeded 20% in April-May 2024, but the discount began to converge to 1%-2% from the end of May, and converged to less than 1% in July; while GBTC’s discount rate remained at 6.5% 2 days before its conversion to ETF (January 9). Therefore, for arbitrage, the motivation for ETHE to take profits is greatly reduced.

Figure 3: Comparison of Ethereum spot ETF rates (data source: S-1 filing)

Figure 4: Grayscale Ethereum Trust ETHE historical discount (data source: Bloomberg)

2. Buying power from the stock market: The public consensus on Ethereum is far less than that on Bitcoin, and the asset allocation momentum is smaller than that of BTC spot ETF

For the general public, Bitcoin logic is simple and easy to understand, and consensus has been reached: Bitcoin is the gold of the digital world, with clear scarcity and a total of 21 million coins, so it fits their existing investment framework very well; Ethereum, as the first major basic public chain, has a relatively complex mining mechanism, and its development is affected by multiple ecological forces. The most important thing is the supply quantity as an investment target, which involves inflation and deflation at all times, and the calculation process is dynamic and complex, with a high cognitive threshold, which is difficult for ordinary investors to understand intuitively. In simple terms, on the one hand, from the supply perspective, Ethereum has an unlimited supply in principle. Under the latest POS mechanism, the staking income from block rewards drives its supply to increase, and the user transaction gas fee burning affected by the on-chain ecological activity drives its supply to decrease, thus forming a dynamic supply and demand balance mechanism; the latest supply is about 120 million, and the recent annualized inflation rate is 0.6% -0.8%. On the other hand, from a conventional fundamental perspective, as a public chain, it faces competition from other public chains, and the general public investors do not have faith in the final outcome of the competition. There are public chain ecosystems such as Solana and Ton on the market, which are also known to the general public investors. However, a specific analysis of their competitiveness shows that the threshold for general public investors is extremely high. Therefore, if ordinary investors are optimistic about the investment value of cryptocurrencies, they may still prefer to configure Bitcoin spot ETFs with scarce supply and no competition.

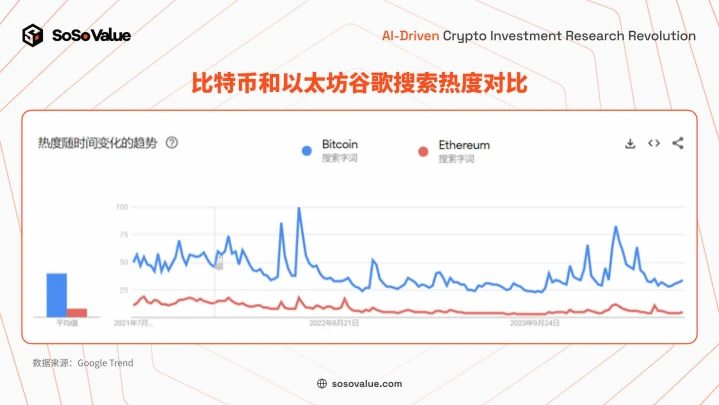

Public data also shows that there is a significant difference in popularity between Ethereum ETF and Bitcoin ETF. Compared with the popularity of Google searches, which represents the publics attention, Ethereum is only about 1/5 of Bitcoin (see Figure 5 for details); and observing the seed funds issued by the Ethereum ETF (usually funded by fund managers/underwriters), the seed fund scale of Fidelitys Ethereum ETF (stock code FETH) is only 1/4 of its Bitcoin ETF (stock code FBTC), and other issuers such as VanEck and Invesco also have a large gap (see Figure 6 for details).

Figure 5: Comparison of the popularity of Bitcoin and Ethereum searches on Google (data source: Google Trend)

Figure 6: Comparison of seed fund size of Ethereum ETF and Bitcoin ETF under the same issuer (data source: S-1 filing)

3. Buying from the crypto community: Due to the lack of a 3%-5% basic staking yield on the ETH chain, demand is basically non-existent

Crypto investors also contribute to some of the buying of Bitcoin spot ETFs, mainly due to the need for proof of real-world assets. Crypto investors holding Bitcoin ETFs only need to pay an annual fee of 0.2%-0.25% to have proof of assets in the traditional financial market, which is convenient for economic life in the public world, balancing financial assets and Bitcoin holdings, and using this to conduct various leverage operations, such as mortgage lending, building structured products , etc., which is attractive to some high-net-worth crypto investors. And because Bitcoin is a POW mining mechanism, there is no stable POS asset pledge income. Considering that the average cash in and out cost of cryptocurrencies and fiat currencies is 0.2%-2%, the difference in income between holding Bitcoin ETFs and holding Bitcoin directly is not large.

However, for Ethereum spot ETFs, since regulation does not allow ETFs to obtain staking income, for crypto investors, holding ETFs will result in 3%-5% less risk-free annualized returns than directly holding Ethereum spot. Ethereum adopts the PoS (Proof of Stake) mechanism, which verifies transactions and maintains the network by staking Ethereum assets through validator nodes, and obtains block rewards, which is the so-called POS mining mechanism. Since this income comes from the network protocol and the systems built-in reward mechanism, it is regarded as the Ethereum ecosystem, the on-chain risk-free basic yield. Recently, the Ethereum staking yield has stabilized at more than 3%. Therefore, if the Ethereum top configuration is achieved through ETFs, the annualized yield will be at least 3% less than directly holding Ethereum spot. Therefore, the buying of Ethereum spot ETFs by high-net-worth people in the crypto circle can be ignored.

Figure 7: Staking yield since Ethereum switched to POS mechanism (data source: The Staking Explorer)

2. In the long term: Ethereum ETF paves the way for other crypto assets to enter the mainstream world

As the largest public chain at present, the approval of Ethereums spot ETF is an important step for the public chain to integrate into the mainstream financial world. After reviewing the SECs standards for approving cryptocurrency ETFs, Ethereum meets the SECs requirements in terms of anti-manipulation, liquidity, and pricing transparency . In the future, we can expect more crypto assets that meet the requirements to enter the public investors field of vision through spot ETFs.

• Anti-manipulation: On the one hand, the nodes on the chain are sufficiently decentralized, and ETF assets are not pledged. The number of Ethereum nodes exceeds 4,000, which prevents a single node from controlling the entire network; in addition, Ethereum spot ETFs do not allow pledges, which prevents a small number of entities from excessively controlling the network due to the pledge mechanism. On the other hand, in the financial market, Ethereums basic trading facilities are relatively mature, especially its rich futures products on the Chicago Mercantile Exchange (CME), which provides investors with more hedging options and price predictability, reducing the risk of market manipulation.

• Liquidity pricing transparency: Ethereum’s market value is approximately $420 billion, and it ranks among the top 20 U.S. stocks by market value alone. Ethereum’s 24-hour trading volume is $18 billion, and it is listed on nearly 200 exchanges, ensuring sufficient liquidity and fair and transparent pricing.

sex.

In contrast, Solana in the public chain also meets the above indicators to a certain extent (see Figure 8 for details). Vaneck and 21 Shares have successively submitted applications for Solana spot ETF. With the continuous enrichment of traditional financial market tools such as cryptocurrency futures, we can expect more crypto asset ETFs to be approved in the future, thereby further occupying the minds of traditional investors, entering the mainstream, and accelerating development.

Figure 8: Comparison of core data of representative Layer 1 public chains (data source: public data compilation)

总之, since the buying and selling power of Ethereum spot ETF is weaker than that of Bitcoin ETF, and the market has experienced the Bitcoin mistaken killing caused by the outflow of Grayscale GBTC, the market is also prepared for the outflow of Grayscale ETHE. In addition, it has been 6 months since the listing of Bitcoin spot ETF. The positive effect of the approval of Ethereum spot ETF has been reflected in the current Ethereum price to a large extent after repeated market transactions. It is expected that the short-term impact on the Ethereum price will be smaller than the impact of the previous listing of Bitcoin spot ETF on Bitcoin, and the volatility of Ethereum may also be smaller. If there is another mistaken killing due to the outflow of Grayscale in the early stage of listing, it will be a good layout opportunity. Investors can pay attention to it through the US Ethereum spot ETF dashboard ( https://sosovalue.com/assets/etf/us-eth-spot ) specially launched by SoSoValue.

In the long run, the crypto ecosystem and the mainstream world are moving from their past independent development to integration, and there will be a long period of cognitive adjustment in the middle. The difference in cognition between new and old participants in the crypto ecosystem may be the core factor affecting the price fluctuations of cryptocurrencies and creating investment opportunities in the next 1-2 years. Historically, the process of emerging assets integrating into the mainstream world has always seen divergences and transactions, and large fluctuations have continuously brought investment opportunities, which is worth looking forward to.

The approval of Ethereum ETF further opens the way for crypto-ecosystem applications to enter mainstream asset allocation. It is foreseeable that other public chains with a large number of users and ecosystems such as Solana will gradually integrate into the mainstream world. While the crypto world is entering the mainstream world, the other side of the times, that is, the process of the mainstream world entering the crypto world, is also quietly developing. Mainstream financial assets, mainly U.S. Treasury bonds, are also on the chain in the form of RWA (Real World Assets) tokens, gradually entering the crypto world, realizing the efficient circulation of global financial assets.

If the approval of Bitcoin ETF is the opening of the door to a new world of integration of encryption and tradition, then the approval of Ethereum ETF is the first step into the door.

This article is sourced from the internet: US Ethereum spot ETF is listed, with long-term significance greater than short-term impact

Original author: Gargoyle Compiled by: TechFlow Why did the $BTC sell-off occur? This is the result of a combination of factors, including the Mt. Gox incident, ETFs, halving, Germany, etc. I have prepared a comprehensive analysis of the current situation. In the past week, Bitcoin has fallen from $71,000 to $57,000, a drop of about 20%, which is something we have not seen in a long time. Today, we’ll take a look at why this is happening and what the outlook for BTC holds. Mentougou The cryptocurrency exchange collapsed in 2014 following a hacker attack. At the end of last month, there were reports that Mentougou was about to start repaying its creditors. Representatives of the exchange plan to distribute 142,000 BTC (0.68% of the total Bitcoin supply) to customers.…