The following analysis of Mt.Gox fund transfers is provided exclusively by iChainfo, a Web3 data infrastructure service provider:

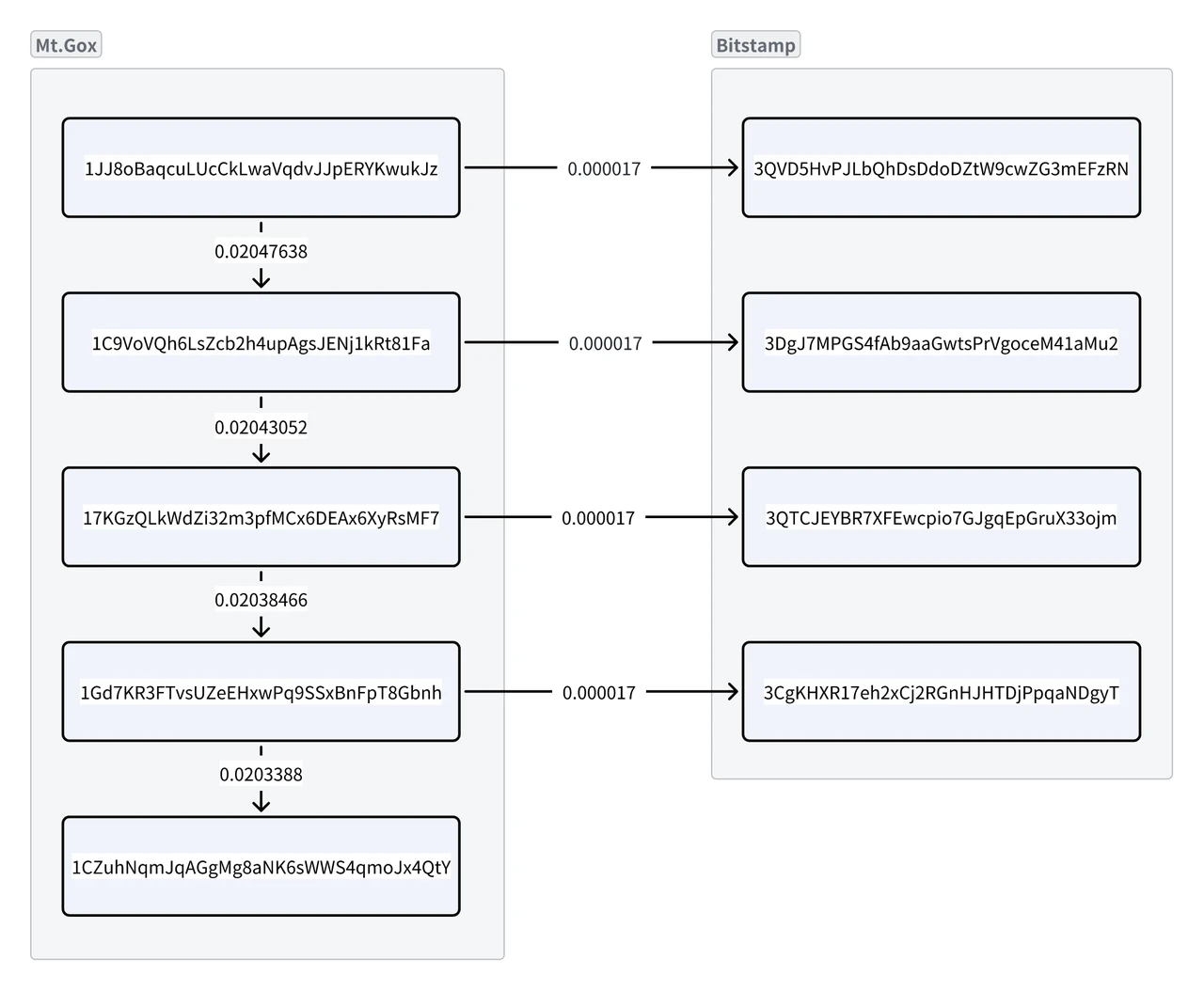

On July 22, the Mt.Gox wallet address changed again. The Mt.Gox address 1JJ8oBaqcuLUcCkLwaVqdvJJpERYKwukJz transferred 0.000017 BTC to four wallets belonging to Bitstamp.

Figure 1: Analysis of Mt.Gox fund transfers on July 22

Although the transaction amount is low, it is very likely that Mt.Gox is testing the address before transferring a large amount of money. Mt.Gox has previously performed such operations before transferring money to the Kraken exchange.

Since last week, the highly anticipated compensation work of the Mt.Gox exchange has begun. Mt.Gox has transferred Bitcoin to Kraken, BitBank and SBI VC Trade. Among all five exchanges that can handle compensation, only Bitstamp and Bitgo have not received Bitcoin. Todays operation may mean that Mt.Gox will transfer funds to the last two exchanges.

搜索.ichaininfo.com 跟踪分析了Mt.Gox交易所的资金流出情况,通过资金流向分析发现,Mt.Gox钱包中的资金主要流入了6个地址,其中4个地址后续的资金变化情况需要投资者特别关注。

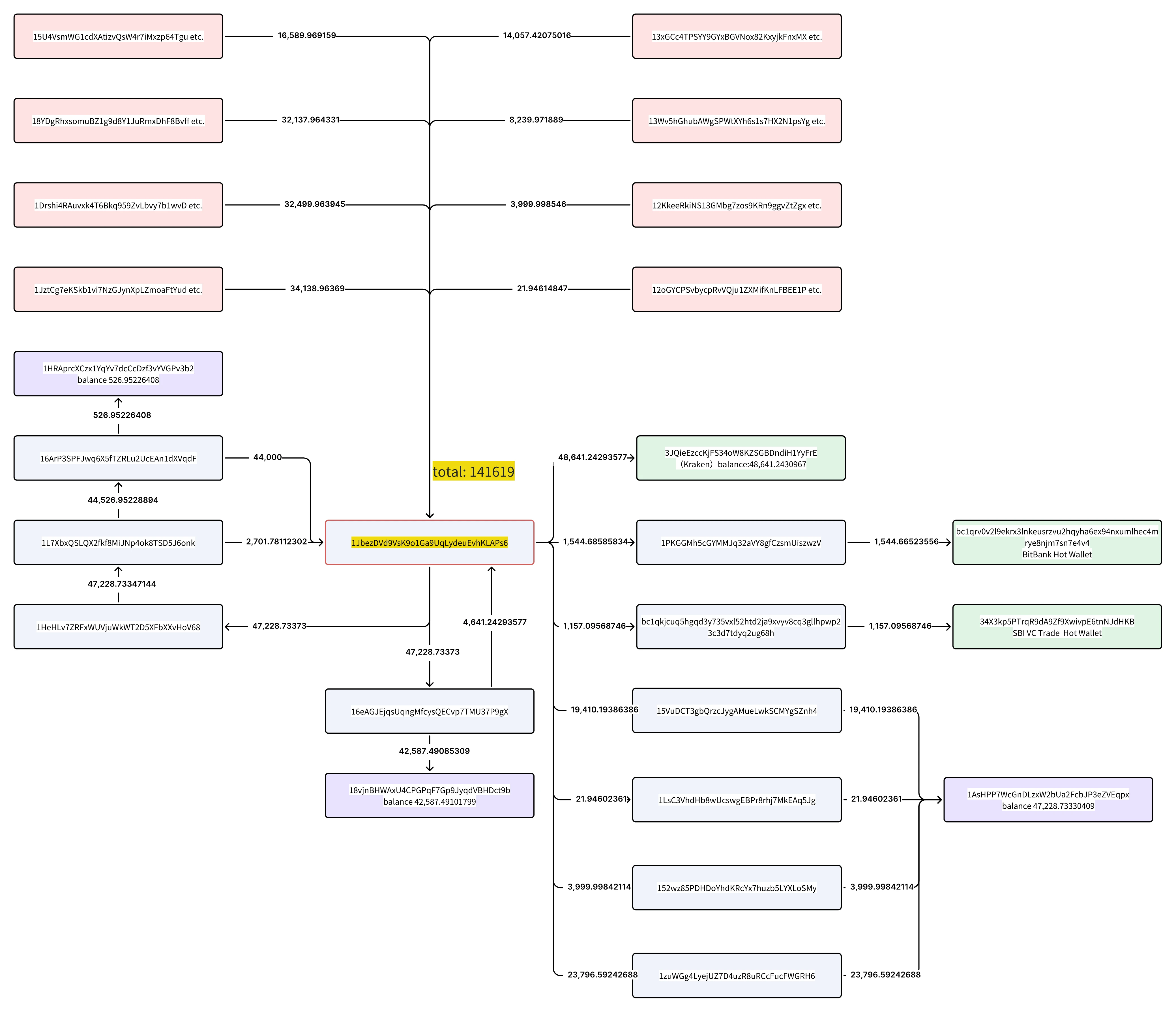

我们分析的核心地址为1JbezDVd9VsK9o1Ga9UqLydeuEvhKLAPs6,该地址为Mt.Gox交易所资金早期收款地址,今年5月28日,该地址通过8笔交易共收款141619枚比特币。

Figure 2: Mt.Gox fund analysis chart, source: 搜索.ichaininfo.com

该地址中的比特币全部被转出,例如7月16日Kraken交易所收到的转账地址就来自该地址,该地址中的资金主要去向有两个,一是转入支持Mt.Gox赔偿的交易所,包括Kraken、BitBank和SBI VC Trade,二是其他受Mt.Gox控制的地址。

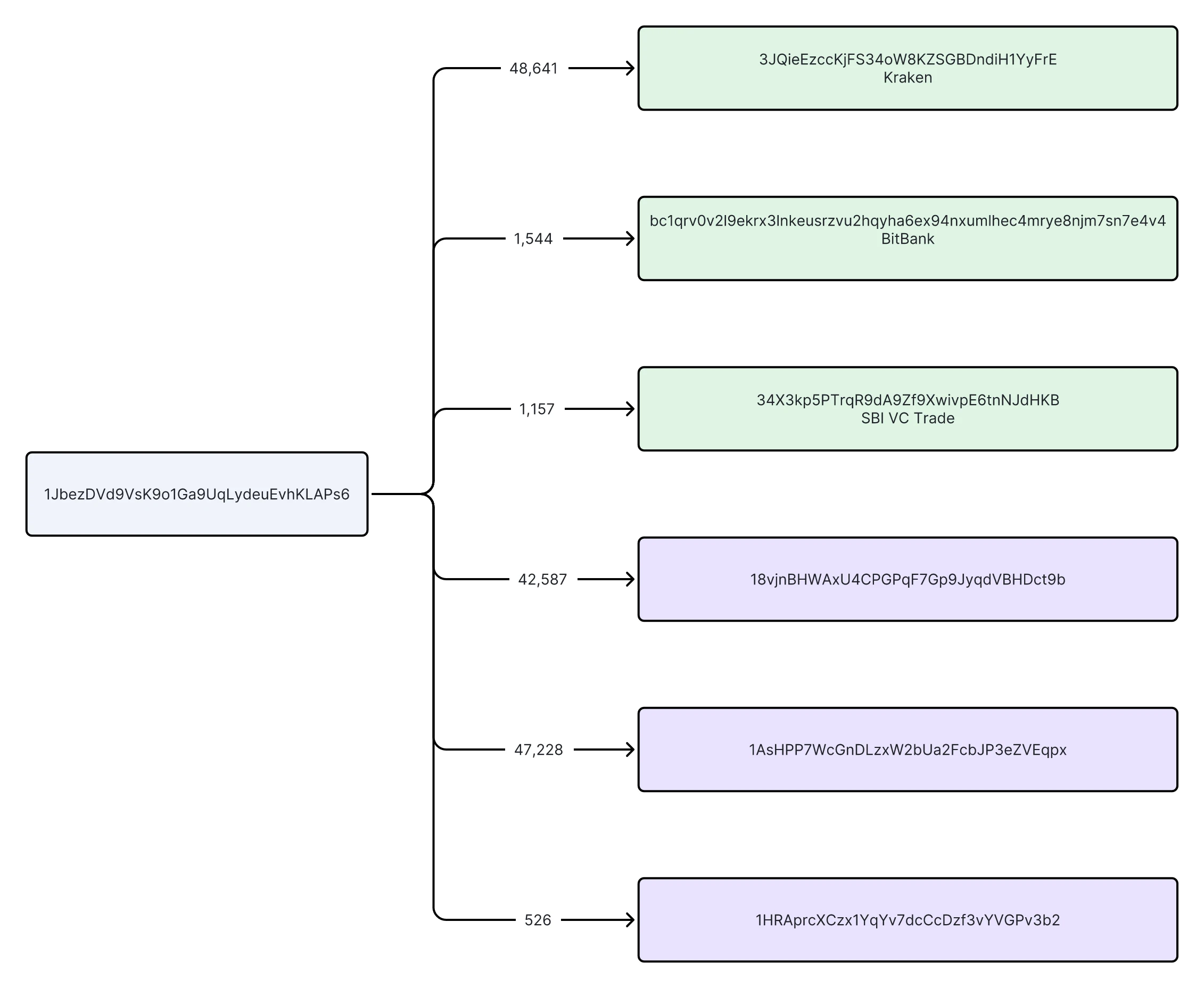

Figure 3: There is no bitcoin in the address 1JbezDVd9VsK9o1Ga9UqLydeuEvhKLAPs6 , source: 搜索.ichaininfo.com

在这些目的地中, 搜索.ichaininfo.com 发现Mt.Gox的资金主要流入了以下6个地址:

3JQieEzccKjFS34oW8KZSGBDndiH1YyFrE疑似为Kraken交易所地址,7月16日向该地址转入48641个BTC,目前资金未发生转移,后续需密切关注,该地址资金转移可能意味着Kraken开始对用户进行比特币补偿。

bc1qrv0v2l9ekrx3lnkeusrzvu2hqyha6ex94nxumlhec4mrye8njm7sn7e4v4为BitBank热钱包地址,共转入1544BTC。

34X3kp5PTrqR9dA9Zf9XwivpE6tnNJdHKB 是 SBI VC Trade 热钱包地址,共转入 1,157 BTC。

18vjnBHWAxU4CPGPqF7Gp9JyqdVBHDct9b 为 Mt.Gox 冷钱包地址,目前持有 42,587 BTC,该地址的资金转移需要密切监控。

1AsHPP7WcGnDLzxW2bUa2FcbJP3eZVEqpx 为 Mt.Gox 冷钱包地址,目前持有 47,228 BTC,该地址的资金转移需要密切监控。

1HRAprcXCzx1YqYv7dcCcDzf3vYVGPv3b2为Mt.Gox冷钱包地址,目前持有526BTC,虽然持币量不大,但从该地址转出资金也需要注意。

Figure 4: Mt.Gox main funds destination address, source: 搜索.ichaininfo.com

We divide the market selling pressure caused by Mt.Goxs Bitcoin compensation into three stages: the initiator, the outbreak, and the harvest. From the recent trend of Bitcoin, after the German governments selling pressure ended on July 12, the price of Bitcoin is gradually coming out of the previous low. However, when investors began to regain their optimism, the selling pressure of Mt.Gox had just begun.

As of press time, the Mt.Gox address has started the transfer test of small amounts of Bitcoin again. Currently, the compensation is in the early preparation stage, and most customers have not received the Bitcoin paid by the exchange. After nearly ten years of passive lock-up, the income of these customers has exceeded 20 times. Obviously, after these years of difficult appeal and compensation process, most customers will choose to sell and cash in the profits as soon as they get the coins. If nearly 100,000 Bitcoins are sold in August, it will once again have a huge impact on the market. It is believed that the shorts will use the Mt.Gox incident to attack the market. 搜索.ichaininfo.com will closely monitor the on-chain transfer trends of these addresses. Please pay attention to the follow-up tracking and analysis.

作者:奥古斯特

This article is sourced from the internet: Mt.Gox fund transfer clues tracking and market interpretation

相关:MT Capital 研究报告:Privasea,将全同态加密引入大规模采用

原文作者:信伟,MT Capital MT Capital一直致力于投资具有颠覆性技术潜力的创新型公司。我们认为将全同态加密(FHE)与AI相结合的去中心化物理基础设施网络(DePIN)是未来的重要赛道。FHE技术可以在保持数据加密的同时进行计算,确保整个数据处理过程的隐私和安全。AI与DePIN的结合不仅可以高效利用外部计算资源,还可以执行复杂的数据分析和机器学习任务,而不必担心数据泄露。Privasea在该领域的领先地位和技术优势与MT Capitals的投资策略高度一致。我们相信通过支持Privasea,将推动FHE AI DePIN赛道的发展,为安全做出贡献……