In the past 24 hours, many new popular currencies and topics have appeared in the market. It is very likely that they will be the next opportunity to make money . Currently:

-

Sectors with relatively strong wealth effects: blue chip public chain sector, Ethereum Layer 2 sector, ETH ecological projects

-

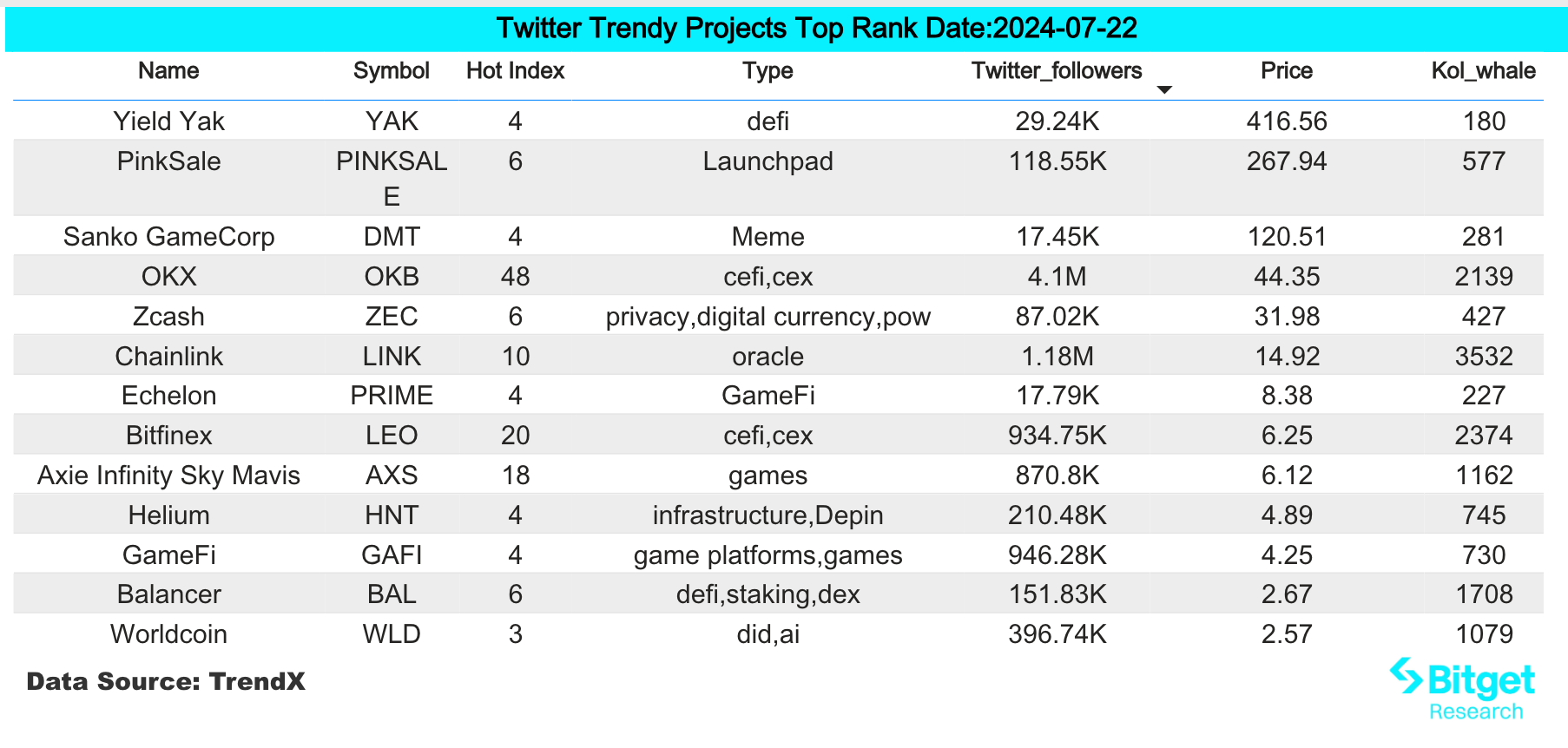

Hot search tokens and topics among users are: Particle Network, Helium;

-

Potential airdrop opportunities include: Particle Network, Movement;

Data statistics time: July 22, 2024 4: 00 (UTC + 0)

1. 市场环境

BTC briefly rose above $68,000, with a 0.8% increase in the past 24 hours. The U.S. Bitcoin spot ETF achieved a net inflow of $1.196 billion last week, which was also its third consecutive week of net inflow. Among them, the U.S. Bitcoin spot ETF received inflows of $300.9 million, $422.5 million, and $383.6 million on Monday, Tuesday, and Friday last week, respectively. The net inflow of U.S. Bitcoin spot ETFs has reached $17 billion for the first time since the beginning of the year. These ETF products were first launched only six months ago. Currently, BlackRocks Bitcoin ETF IBIT has a trading volume of nearly $1.2 billion, and Fidelitys FBTC has a daily trading volume of more than $410 million. These figures all show that investors confidence and recognition of Bitcoin spot ETFs are increasing, which is the accumulation of real demand from investors for Bitcoin spot ETFs, rather than market speculation.

Currently, in the process of BTC leading the market rebound, there is no strong rebound track. The AI sector, Solana ecosystem and public chain sector, which have performed well in several rebounds, have shown certain rebound momentum in recent days. At the same time, as the Ethereum spot ETF is likely to be approved tomorrow, it will mark a new shift in encryption regulation. The performance of the Layer 2 sector led by Ethereum is worth looking forward to.

2. 财富创造领域

1) Sector changes: blue chip public chain sector (AVAX, APT, SOL)

主要原因:

As BTC returns to the $68,000 mark, the market wealth effect will spill over to the major public chain tokens. At the same time, some L1/L2 projects will see favorable cashing out, and the wealth effect will circulate in their ecosystem, constituting potential buying power for the public chain assets.

Rising situation: APT rose by 5% + in the past 24 hours; AVAX rose by 12% in the past 24 hours; SOL rose by 5% + in the past 24 hours;

影响后市的因素:

-

Continued rise in TVL: Deflama data shows that Solana TVL reached $5.15 billion, second only to Ethereum and Tron, with a 7-day increase of 13.7%. In the past 24 hours, Solana chain NFT sales were close to $6 million, surpassing Ethereum to rank first. According to the data, Solana chain NFT sales in the past 24 hours reached $5,821,706, an increase of 55.7%, while Ethereum was $3,666,892, a decrease of 21.53%; Bitcoin ranked third, with sales of approximately $2.902 million, a decrease of 19.89%. Avalanche TVL is $710 million; NFT sales exceeded $28.3 million, a 10-fold increase year-on-year; the total market value of stablecoins reached $1.6 billion, of which USDT and USDC increased by 10.1% and 4.4% month-on-month respectively.

-

Ecosystem construction continues to gain momentum: In the second quarter, although Solanas DeFi TVL in US dollars fell 9% month-on-month to $4.5 billion, ranking fourth in the network, DeFi TVL in SOL increased by 26% month-on-month, indicating that capital still has confidence in Solana in the second quarter and there has been no large-scale outflow. At the same time, the Blinks function that appeared at the end of the second quarter means that the Solana ecosystem is still continuing to expand.

2) Sector changes: Ethereum Layer 2 sector (ARB, OP, STRK)

主要原因:

Influenced by the news that the Ethereum ETF will be traded on July 23, Ethereum Layer 2 tokens have generally risen. Currently, the passage of the Ethereum ETF is generally interpreted by the market as a positive for Layer 2 tokens. Therefore, while investors are paying attention to the passage of the Ethereum ETF, they can also pay attention to investment opportunities in related Layer 2 tokens.

Rising situation: ARB rose 8% in the past 7 days, OP rose 8.5% in the past 7 days, and STRK rose 7% in the past 7 days;

影响后市的因素:

-

Whether the ETH ETF will be successfully listed: The current market conditions generally pre-empt the Ethereum ETF. If there is an unexpected situation when the Ethereum ETF is listed tomorrow, the market will generally reverse;

-

Layer 2 project development status: As the most widely used ecological public chain, the subsequent development of Layer 2 depends on its cooperative projects, user expansion, etc.

3) Sectors that need to be focused on in the future: ETH ecosystem projects (UNI, LDO)

主要原因:

The S-1 filing for the ETH spot ETF may be officially launched in the U.S. capital market on July 23, and there may be room for speculation in the ETH ecosystem. The president of ETF Store said that the U.S. Securities and Exchange Commissions approval of the Ethereum spot ETF strongly suggests that ETH is a commodity, not a security. This is a milestone moment because it shows that crypto assets can transform from being classified as securities to commodities over time.

具体货币列表:

-

UNI: The first DeFi Swap project on blockchain applications. Uniswap鈥檚 average daily revenue in the past was around $1 million, which is a considerable income.

-

LDO: The leading LSD project in the ETH ecosystem, with a TVL of 29.6 billion US dollars and a valuation of less than 1.8 billion US dollars, is relatively undervalued;

3. 用户热搜

1)热门 Dapp

-

粒子网络

Modular blockchain Particle Network announced the completion of a $15 million Series A financing round, with Spartan Group and Gumi Cryptos Capital co-leading the round, and SevenX Ventures, Morningstar Ventures, Flow Traders, HashKey Capital and others participating. This round of financing brings Particles total financing amount to $25 million.

2)Twitter

Helium:

The Helium project is a decentralized wireless network project that aims to provide low-power Internet of Things (IoT) device connections through a distributed network. Helium uses blockchain technology and token incentives to build a community-operated wireless network. The network consists of devices called hotspots that provide both wireless network coverage and blockchain mining capabilities. Hotspot device owners receive HNT (Helium Token) as a reward by providing network coverage. With the recent popularity of the DePin concept, Helium has also attracted widespread attention from investors.

3)Google 搜索区域

从全球角度来看:

Tapswap

Tap-2-Earn Telegram mini-app TapSwap was recently launched on the TON blockchain. Ton said that TapSwap was launched on February 15, 2024. Users earn in-game tokens by clicking and completing tasks. Today, the app has more than 50 million users worldwide and nearly 1 million active users online. Yesterday, Twitter announced that it would hold an AMA event with OKX Wallet. At the same time, many users participated in the USDT-USDC exchange on tapswap. Twitter was abuzz with the search popularity.

从各地区热搜来看:

(1) There are no obvious characteristics in the Google Trends hot searches in Asian countries. Tokens with strong wealth effects such as Doge and RWA have become the focus of market attention. Assets such as BTC and ETHFI are also on the list of hot searches in Asian countries.

(2) The hot search terms in the CIS region include Tapswap, Blum, etc., while the hot search terms in Europe and the United States are mainly MAGA, AI tokens and SOL.

潜在的 空投 机会

粒子网络

Particle Network is a development platform that connects multiple blockchains (such as Bitcoin, EVM, and IBC) through a unified account system, providing modular interfaces to enhance wallet connection and transaction execution capabilities. The platform focuses on chain abstraction, wallet abstraction, liquidity abstraction, and gas abstraction, aiming to simplify the development and deployment process of Web3 applications.

Particle Network announced the completion of a $15 million Series A financing round, which was jointly led by Spartan Group and Gumi Cryptos Capital, with participation from SevenX Ventures, Morningstar Ventures, Flow Traders, HashKey Capital, etc. This round of financing brings Particles total financing amount to $25 million.

How to participate: Log in to the website https://pioneer.particle.network/, bind your social account and claim test tokens, sign in daily and complete related tasks, and use Universal Gas for transactions. Here you can use the test network tokens of the Little Fox wallet to interact with the Particle Network wallet.

移动

Movement Labs was founded in 2022 and previously completed a $3.4 million seed round of financing in September 2023. In addition to its flagship product Movement L2, Movement Labs will also launch Move Stack, an execution layer framework compatible with rollup frameworks such as Optimism, Polygon and Arbitrum.

近日,Movement Labs完成16.38亿美元A轮融资,由Polychain Capital领投,Hack VC、Foresight Ventures、Placeholder等多家知名机构跟投。

具体参与方式:进入运动热情任务界面(注:社交任务有时间段和任务持续上线),可以与DEX互动,随意互动几个测试,等待官网的后续操作。

原文链接: https://www.bitget.com/zh-CN/research/articles/12560603813062

【免责声明】市场存在风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何观点、看法或结论是否适合自己的具体情况。根据此信息进行投资需自行承担风险。

This article is sourced from the internet: Bitget Research Institute: BTC briefly broke through $68,000, and Solanas ecological wealth-creating effect is significant

Related: Beginners Guide: How to Play with TON Ecosystem

Original author: dt Original editor: Lisa The crypto market is still sluggish this week. In addition to the continuous decline in prices since June, the TVL on the blockchain has also fallen slightly. Only the TON ecosystem stands out from the crowd with TVL continuing to reach new highs. After Tether announced the issuance of native USDT on the TON chain on April 20, it was like a tiger with wings, and its TVL increased by nearly three times. In this week’s CryptoSnap weekly report, Dr.DODO will take everyone to explore the TON ecosystem step by step! wallet To play on the chain, you must first prepare a wallet. Since TON is not an EVM public chain, you need to use an independent wallet. The most popular ones are Wallet…