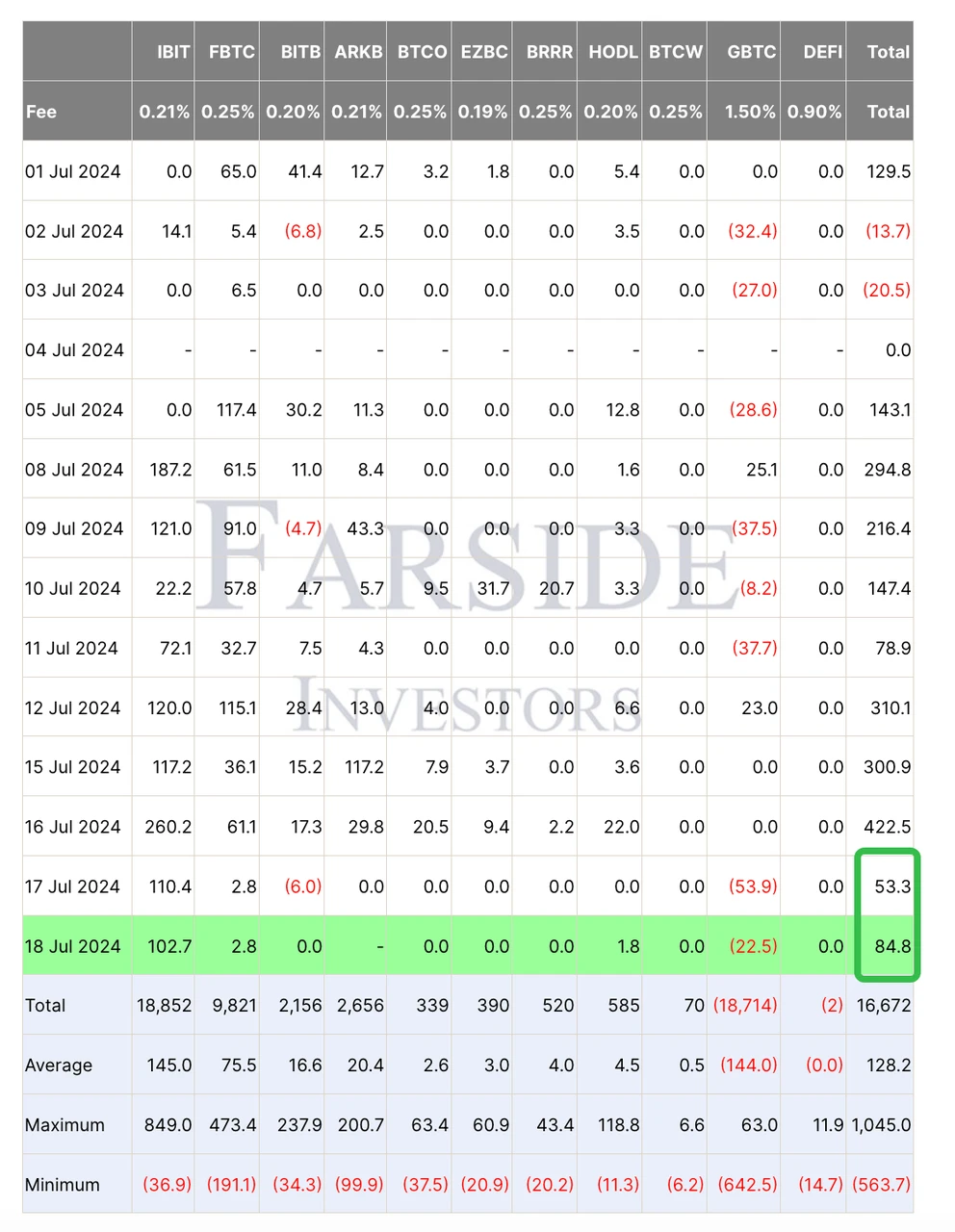

The bankrupt Bitcoin exchange Mt.Gox reported multiple unauthorized attempts to log into creditor accounts in the past 24 hours, causing creditors to worry about the safety of their remaining assets and possible selling pressure on the currency price. The market may be worried that the incident will have an adverse impact on the short-term currency price. Coupled with the sharp drop in ETF traffic in the past two days, the gradually spreading risk aversion has spawned a sell-off of assets, causing the BTC price to pull back below $64,000, testing the key support level again.

Source: TradingView; Farside Investors

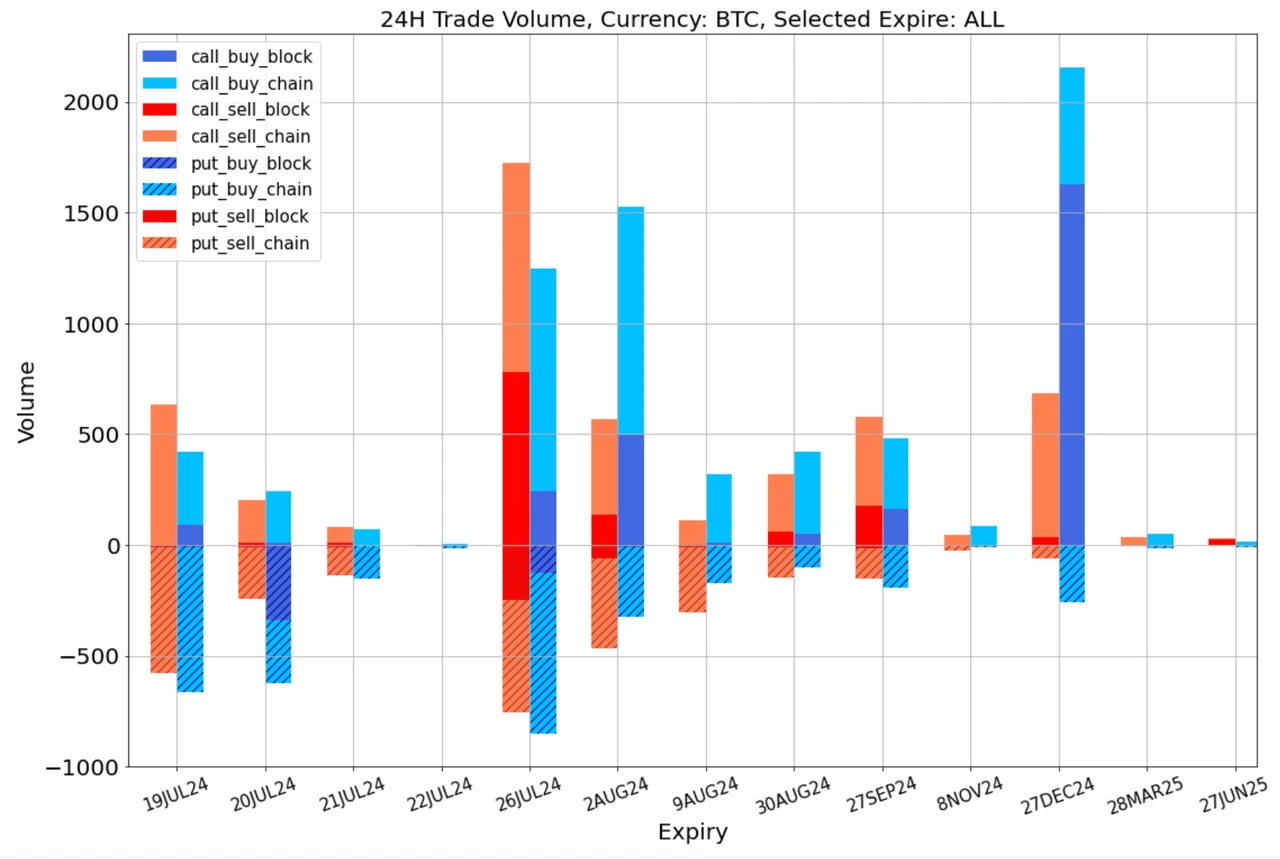

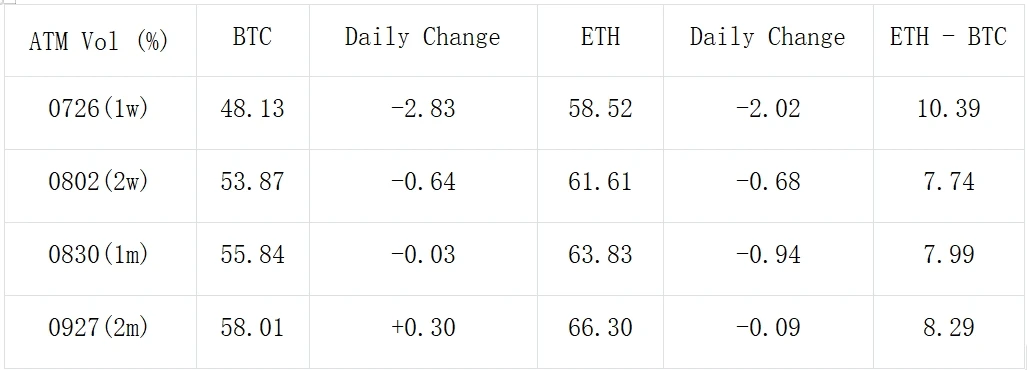

In terms of options, the overall implied volatility level has been relatively stable since yesterdays sharp decline, but it is still at a recent high. There are three changes worth noting. First, BTCs IV and RR at the end of December were significantly higher, which may be affected by the flow of buying a large number of 100,000-C on the Deribit market on that expiration date (see the figure below).

Data Source: Deribit, BTC transaction distribution

Secondly, the steepening of the BTC IV maturity curve is more obvious than that of ETH. Similarly, compared with the end of July and other more distant maturity dates, the gap between BTC maturity dates is more significant, providing a better tool for cross-period volatility hedging.

Source: Deribit (as of 19 JUL 16: 00 UTC+ 8)

来源:SignalPlus

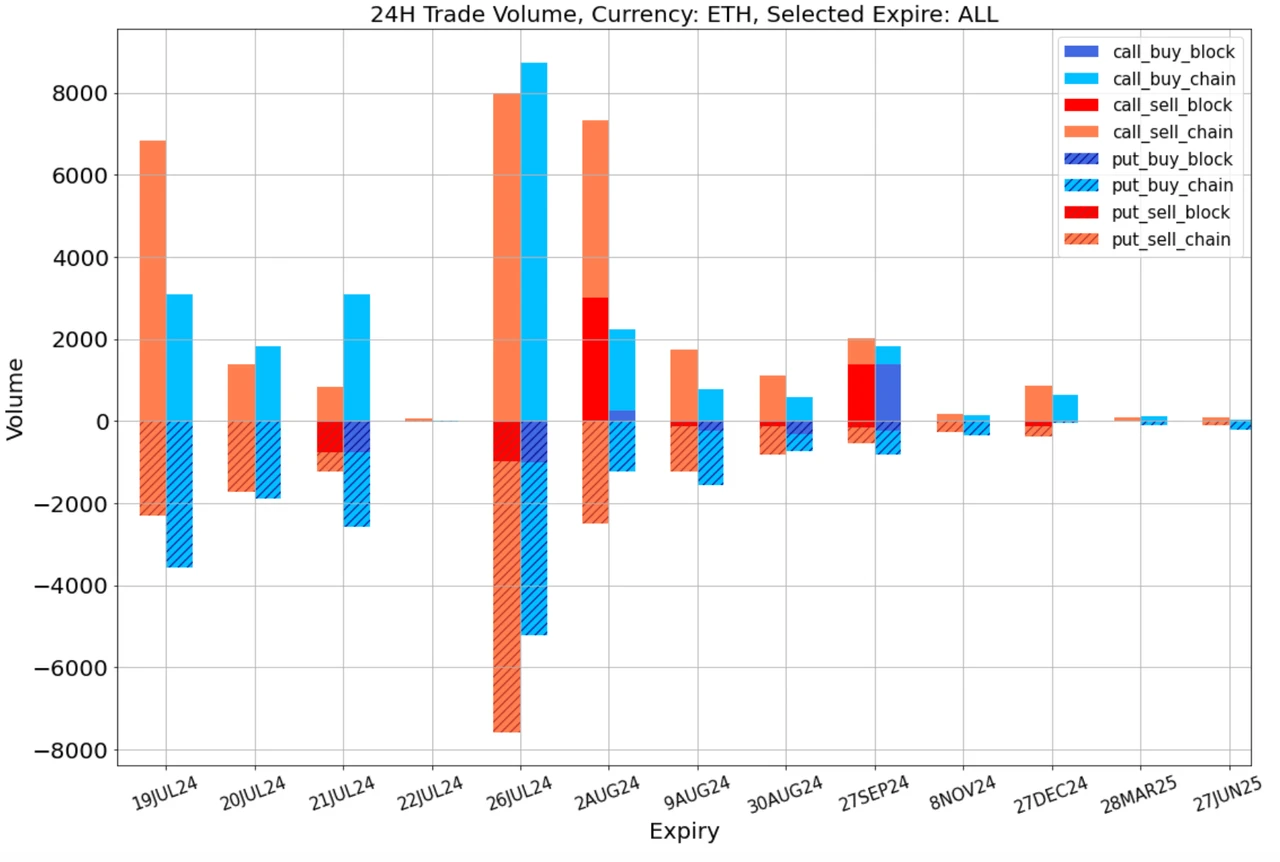

Finally, we also notice that the vol skew of 2 AUG 24 formed a local high compared to surrounding maturities, however BTC and ETH traded very differently on this expiration date, with BTC being heavily bought at 70000 C, while ETH was under strong selling pressure at 3400 C.

来源:SignalPlus

数据来源:Deribit,ETH 交易总体分布

来源:Deribit Block Trade

来源:Deribit Block Trade

您可以在ChatGPT 4.0的插件商店中搜索SignalPlus获取实时加密信息。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlus_Web3,或者加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram群和Discord社区,与更多朋友交流互动。SignalPlus官方网站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240719): A Basin of Cold Water

Related: 100,000 NFTs sold out, will SEND be the potential leader of the Solana Blink ecosystem?

Original author: TechFlow Two weeks ago, Solana’s Blink became popular. We have introduced in detail in Interpreting Solana Blink: One-click embedding of on-chain operations into social media, the end of going out of the circle is socialization? Blink allows on-chain functions to be embedded directly on Twitter. With just one click on a tweet, you can complete various on-chain actions such as swap, mint, and donate. But at that time, Blink only demonstrated the ability of what I can do, and how to do it specifically was left open to the community and developers to explore. Therefore, it is even more necessary for us to pay attention to new projects that work around Blink. Speed is of the essence. Just a few days after Blink was released, an account named…