Since its launch, Worldcoin has been daunting due to its extremely high FDV, and even triggered a long-lasting discussion on whether FDV is a meme.

After the baptism of various high FDV/low circulating market value tokens in the first half of this year, we now know that FDV is not a meme. High FDV means a big cut!

But there are ways to make big cuts. When the internal unlocking was about to begin, Wolrdcoin suddenly 宣布 at 9 pm on July 16 that the unlocking period of tokens allocated to the development company Tools for Humanity team members and investors would be extended from 3 years to 5 years.

Just this simple announcement caused WLD to rise from 2.1 to a maximum of 3.2 within 24 hours, an increase of more than 50%. Some people think that this is an epic positive and WLD still has room to rise; others think that this is just a trick by the dealer to facilitate the unlocking and shipping.

Just when everyone was at a loss, a top trader @DefiSquared (hereinafter referred to as Brother D) took action. At 5:30 pm on July 17, he released his most comprehensive research report on Worldcoin to date, Worldcoin Money-making Plan Part 2: Price Manipulation, Misleading Propaganda and Accidental Victims .

This is not the first time he has published a research post about Worldcoin. He has been following up on this project since Wolrdcoin went online on July 24, 2024. And every time he publishes the results of his investigation, it is on the eve of a drastic fluctuation in the price of WLD. It can be said that he has witnessed the prosperity of Wolrdcoin, and foresaw that the inherent defects of this project will inevitably lead to its destruction. What he plans to do now is to push this project into the abyss with his own hands.

BlockBeats will combine his previous investigation reports below to tell you the love-hate relationship of this top trader with Worldcoin.

First survey: the confusing economics of tokens

On July 24, 2023, the Worldcoin protocol was officially launched on the OP (formerly Optimism) mainnet. WLD was immediately launched on top CEXs such as Binance and OKX and stabilized its price above $2.

From day one, the economics of Worldcoin’s confusing tokens have confused D, a top trader. He 问 on social media: “Worldcoin distributed about 25 WLD tokens to each of the 90,000 participants, and a total of 2.25 million to the global community. So who is selling orders of 400,000 WLD, equivalent to 20% of the entire global community supply? Can anyone provide more information about today’s token distribution, or where these supplies come from?”

The picture attached by Brother D shows that someone placed a sell order for 397,400 WLD at $2.83.

In the comments section, Blue Fox and Wintermute CEO Evgeny Gaevoy gave the answer: These are tokens that Wolrdcoin lends to experienced participants in the financial market. The large order of 400,000 WLD above is Wolrdcoins market maker making the market. And how many tokens do market makers have in total? According to CoinDesks 报告 on the same day, Worldcoin stated that the maximum circulating supply of WLD at launch is 143 million. Of these, 43 million will be allocated to users who complete verification before launch, and another 100 million will be provided to non-US market makers in the form of loans due in three months.

But what’s interesting is that according to the Optimism browser data that BlockBeats checked on the same day, the maximum supply of WLD-Optimism reached 175,500,064 coins when it was first launched, 32 million more than the official announcement. It can be said that from the first day, the token economics of Worldcoin was full of doubts.

In addition, Brother D specifically quoted a netizens comment on the market maker agreement, saying that this aroused his interest. It turns out that the market maker agreement of the WLD token allows them to buy back the tokens they sold at a price slightly higher than $2 when the contract ends three months later, so that they can sell the tokens arbitrarily above $2 to lock in profits. This is why the price of WLD on CEX can always be stable above $2. It was this discovery that allowed Brother D to accurately bet on the first price surge of WLD in mid-December 2023.

Second survey: First high FDV/low flow plate in 2023

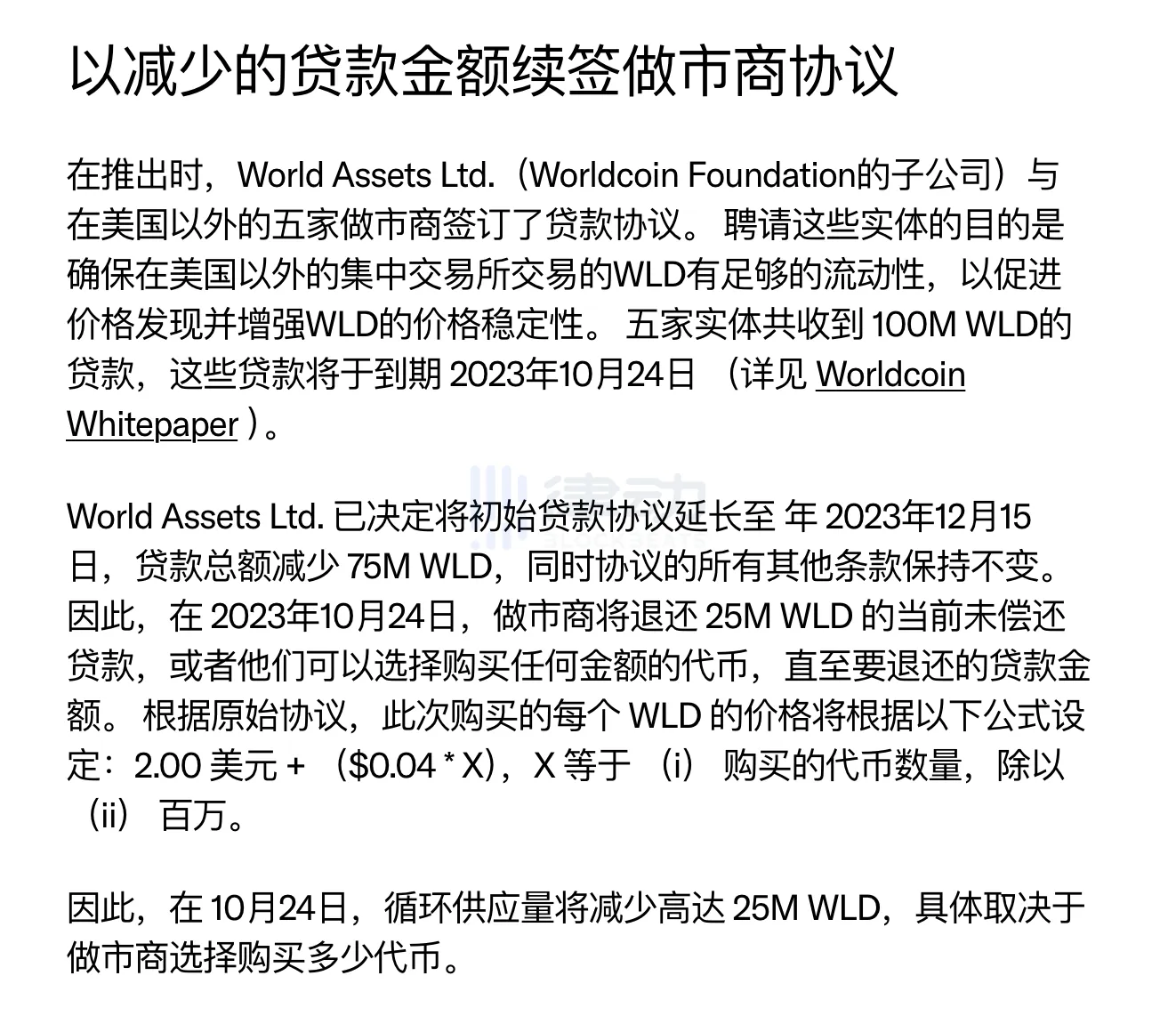

As mentioned earlier, Worldcoins market maker agreement aroused Ds interest. However, Worldcoin issued an announcement on the extension of the market maker agreement at the end of October, but it did not attract his attention. We would like to add some information here.

Simply put, Worldcoin extended the market maker agreement, which was originally only for 3 months, for another 2 months. The 5 market makers only need to repay 2,500 WLD on October 24, and the remaining 75 million will be repaid on December 15.

On December 16, the above agreement officially ended. Brother D excitedly 声明 on social media that there was news that Worldcoin was updating its agreement with market makers, and this updated Worldcoin market maker agreement was one of the most favorable news he had ever seen.

What benefits did he specifically analyze? First, according to the new market maker agreement, WLD market makers can no longer make money by selling WLD risk-free as before, because they can no longer buy back the sold WLD from the foundation at a price of about $2 per coin. In other words, for the first time, the price of WLD has the opportunity to rise without market maker suppression.

Secondly, the size of market makers loans was reduced from 75 million to 10 million WLD, and 65 million WLD were removed from circulation by the foundation. As a result of these changes, Worldcoins market cap dropped to just $190 million, which is severely undervalued given its current AI narrative and associations.

In short, WLD has become a typical high FDV/low circulation plate. And this time is still 2023, and the leeks have not seen such a scene. Seeing an AI concept coin with such a low market value and a relationship with Sam Altman of OpenAI, how can they not be tempted?

On that day, WLD rose by 54% in one day, from 2.4 to 4.6. But this rise was not sustained, and it soon fell back to 2.4 from 4.6. Many people who don’t know the inside story will mistake this rise as a news pull, because Worldcoin 发布 the World ID 2.0 protocol update on December 13.

The third investigation: Hidden emissions sound the horn of short selling

On February 16, 2024, OpenAI released the Wensheng video model Sora. Compared with ChatGPTs update from 3.5 to 4, this video model attracted more attention from people inside and outside the circle. Thanks to the OpenAI concept, WLD, LPT and ARKM started a crazy rise in February. WLD directly rose from $2 to a maximum of $12, an increase of nearly 5 times in one month.

Just when everyone was going crazy for WLD, Brother D sent a warning – WLDs extremely low circulation and Meme status were being broken. He pointed out that new hidden emissions have begun to increase exponentially. Starting from the last week of February, Worldcoin will distribute more than 10 million WLD (about 92 million US dollars at current prices) directly to retail wallets, and will continue to distribute at a higher rate every two weeks.

At the same time, the Worldcoin Foundation has full control over the liquidity of the unlocked Foundation Treasury. Considering that the co-founder of Worldcoin stated in August last year that the original intention of the market-making protocol was to prevent the price from skyrocketing to something like $10, it is very likely that the Foundation will conduct over-the-counter (OTC) transactions at the current overvalued price, thus forming a permanent top in an instant.

Brother D reminded that according to previous bull market data, about 97% of the top 200 altcoins eventually fell by 90% or more. WLD, as a meme coin with a higher valuation than OpenAI, will not be an exception.

Although he said this was a once-in-a-generation shorting opportunity, he also emphasized that such currencies tend to rise to prices beyond expectations, and most people may not have the patience, margin, or willpower to withstand the pressure of shorting. Indeed, as he said, the madness of the market sometimes defeats everyones reason. After he released the results of this survey, WLD continued to rise from $8 to $12.

Fourth survey: Kill you when you are sick

On May 14, two and a half months after he published his last survey, the price of WLD had fallen by more than 50% from its peak.

However, Brother D may not be satisfied with his short-selling results, and he found another handle to attack Worldcoin.

On April 24, Worldcoin issued an announcement announcing that it expects to sell WLD tokens from the Worldcoin Foundation subsidiary treasury within the next 6 months to meet the growing demand for Orb-verified World IDs around the world.

Although Worldcoin emphasizes that it sells an average of 500,000 to 1.5 million WLD per week, which is less than 0.1% to 0.4% of the current weekly trading volume, Brother D calculated that Worldcoin will sell a total of $200 million worth of tokens to trading companies in these six months, which is equivalent to 18% of the current circulating supply. This part of the funds clearly belongs to the part of the WLD token supply called community, but it is sold to counterparties to benefit the foundation.

More importantly, after 70 days, the VC and team tokens will begin to unlock, and the supply of WLD will increase by 4% every day. Based on a fully diluted market value of $60 billion, this is equivalent to nearly $50 million in continuous selling pressure every day. Brother D complained that WLD was designed with predatory token economics from the beginning, just to make the team and early investors rich. He also reminded that if we see strategic announcements in the next few months, this is just to ensure that insiders can get exit liquidity at high valuations.

Fifth Survey: Wolrdcoin Crusade

As D expected, when the early contributors’ tokens were unlocked on July 24, Worldcoin indeed issued a strategic announcement to pull the price up: the unlocking period of tokens allocated to the development company Tools for Humanity team members and investors was extended from 3 years to 5 years. Everything seemed to have been written in advance.

Brother D also presented his most comprehensive WLD short report ever, which can be described as a culmination. In addition to reviewing how Worldcoin manipulated the price of WLD tokens through various means, he pointed out that Wolrdcoin will start internal unlocking at 2.7%, the lowest supply circulation in the industrys history. This is the only factor that can keep WLD at $30 billion FDV, and all this is not for the purpose of achieving universal basic income (UBI) as the team said.

In fact, the token economics designed by the team results in the majority of all issuance going to insiders rather than UBI beneficiaries next year. Even with the latest unlocking schedule, almost 1 billion tokens will go to the team/VC after one year, while only 600 million tokens will be distributed to UBI beneficiaries by then based on the current UBI issuance rate forecast. This means that within one year, WLD issued by insiders is expected to account for more than 60% of the total circulating supply of Worldcoin.

In addition, there are multiple other sources that increase the circulating supply, including the previously mentioned tokens sold to trading companies at a discount, and rewards received by Orb operators. These “rats” are stealing the rights that belong to UBI beneficiaries.

So the question is, who are the losers in this high FDV feast? Brother D said it was Koreans (he also dissed Koreans for not being able to speak English to understand the actual situation). Nearly 25% of the circulating WLD is on Bithumb, and the holdings are still growing.

Brother D concluded that Worldcoin’s decision to release good news a week before the unlocking was intentional in order to influence the market at a critical moment. Only when retail investors provide higher prices and more liquidity can insiders exit smoothly when the unlocking occurs. There are even rat warehouses that use inside information to buy in advance before the announcement.

The chart provided by Brother D shows that there was a coincidental spike in the price of WLD in the 24 hours before the announcement.

Brother D said that all of the above are the reasons why he will short WLD in the next few months. I have loved you, I have hated you, now let me personally send you back to zero.

After sorting out the love-hate relationship between D and WLD, we can find that there is nothing new under the sun, and high FDV is never a meme. Can you dance with the dealer?

This article is sourced from the internet: A top traders love-hate relationship with Worldcoin

Original author: Crypto_Painter (X: @ @CryptoPainter_X ) With BTC recent brief drop below the $60,000 mark, market sentiment did a 180-degree turn overnight, going from 75% greed a week ago straight to 30% fear; Is the market really that fearful? Since many people are talking about this index, let鈥檚 analyze it thoroughly today and see what kind of guidance the market sentiment index provides for trading. First, we need to understand how the FG index is calculated? It is calculated using 5 main weights: 1. Volatility: The current volatility of BTC price relative to the past 30 and 90 days. An abnormal increase in volatility can sometimes be a sign of excessive fear in the market. 2. Momentum and Volume: Momentum and volume relative to the past 30 and 90…