The Dubai government has long provided strong support for the blockchain and Web3 industries in all aspects, laying a solid foundation for digital opportunities through initiatives such as the Dubai Blockchain Strategy launched in 2016, the UAE Center for the Fourth Industrial Revolution established in 2019 by the Dubai Future Foundation in collaboration with the World Economic Forum, and the Dubai Metaverse Strategy in 2022.

Ambitious government strategies and a world-class business-friendly environment support Dubais attractiveness as a digital innovation hub, especially for entrepreneurs and investors in the blockchain and Web3 industries. Dubais Virtual Asset Service Providers (VASP) system is well-known for its clear regulatory framework, professional and high-level regulatory standards, approachable regulatory attitude, and regulatory guidelines that encourage innovation and prevent risks. It not only continues to attract a steady stream of blockchain and Web3 entrepreneurs and investors from all over the world, but also industry giants have flocked here to set up camp.

Dubai Virtual Assets Authority and its regulatory framework

The Virtual Assets Regulatory Authority (VARA) was established in March 2022 as the competent authority for regulating virtual assets and virtual asset activities in all areas of the Emirate of Dubai (including special development areas and free zones, but excluding the Dubai International Financial Centre) in accordance with Law No. (4) of 2022 Regulating Virtual Assets in the Emirate of Dubai. VARA plays a central role in creating an advanced legal framework in Dubai to protect investors and establish international standards for the governance of the virtual asset industry, while supporting the vision of a borderless economy.

Dubais regulatory framework for virtual assets consists of a complete set of laws and rules from top to bottom. At the legal and regulatory level, Law No. (4) of 2022 Regulating Virtual Assets in the Emirate of Dubai is at the highest level, and the Virtual Assets and Related Activities Regulations 2023 provides a detailed virtual asset regulatory framework covering various aspects such as licensing, anti-money laundering and counter-terrorism financing, and regulation of marketing practices, aiming to provide regulatory certainty. The framework is based on the principles of economic sustainability and cross-border financial security. The UAE has been committed to safely enabling these drivers, updating its supervisory and regulatory approaches, and addressing global money laundering (ML) and terrorist financing (TF) risks arising from the abuse of new technologies.

Part V of the Regulations, the VA Activities Rulebook, is a complete set of comprehensive compliance guidelines. It is divided into two parts: the Mandatory Rulebook, which applies to all VASPs, and the VA Activities and Other Rulebook, which are specific codes of conduct for the eight different VASP license types mentioned above.

As a universal compliance guide, the importance of the mandatory rulebook is self-evident. Among them, the Corporate Rulebook sets out how VASPs organize and manage their companies, boards, executives and employees, and continuously maintain appropriate internal controls and management systems. In addition, the Corporate Rulebook also covers corporate governance requirements and ESG responsibilities. The Compliance and Risk Management Rulebook sets out general principles for regulatory compliance and the implementation of compliance management systems, including the appointment of compliance officers and record keeping and audit requirements. The Compliance and Risk Management Rulebook also stipulates that VASPs must always comply with all applicable laws, regulations, rules and guidance and all tax reporting obligations under national, international and industry best practices, including the applicable US Foreign Account Tax Compliance Act (FATCA). The Technology and Information Rulebook sets out technology governance, control and security, including cybersecurity (and other legal and regulatory) obligations, as well as personal data protection compliance requirements and compliance programs. The Market Conduct Rulebook provides guidance on marketing, advertising and promotion regulations and requirements.

VASP licenses and their classification

Dubai Virtual Asset Regulatory Authority (VARA) has identified eight different regulated virtual asset (VA) activities and categorized the scope of regulation. Any Virtual Asset Service Provider (VASP) that wishes to provide the following virtual asset activities (whether to clients who are residents of the emirate or, where the activities are permitted, to clients globally) must apply for and obtain a license from VARA before commencing operations within the emirate of Dubai.

Dubai Virtual Asset Service Provider (VASP) license includes:

1. Virtual asset consulting services

Advisory services means providing advice to a client on one or more actions or transactions related to any virtual asset, either at the request of the client or at the initiative of the entity providing the advice. Such services are intended to help clients understand and navigate the complexities of the virtual asset market, providing professional advice and strategies so that they can make informed decisions. Advisory services may include market analysis, risk assessment, investment strategy advice, regulatory compliance guidance, etc., to ensure that clients operations in the virtual asset field are safe and legal.

2. Virtual Asset Broker Services

“Broker Services” means any of the following:

[a] arranging orders for the purchase and/or sale of virtual assets between two entities; [b] soliciting or accepting orders for virtual assets and accepting currency or other virtual assets for such orders; [c] facilitating the matching of virtual asset transactions between buyers and sellers; [d] acting as a dealer on behalf of the entity for its own account in virtual asset transactions; [e] using customer assets to conduct market transactions in virtual assets; or [f] providing placement, distribution or other issuance-related services to customers who issue virtual assets. These services are intended to provide customers with a convenient channel for virtual asset trading and ensure the smooth conduct of transactions and the safe management of assets through professional brokerage services.

3. Virtual asset custody services

Custody services means keeping virtual assets for or on behalf of another entity and acting only in accordance with verified instructions issued by or on behalf of that entity. Note: Only VASPs that store each customers assets in a separate VA wallet are eligible for a custody services license. Custody services provide a secure way to keep assets, reduce the risk of asset theft or loss, and ensure that customers assets are strictly managed and protected at all times.

4. Virtual asset trading services

Transaction Services means any of the following:

[a] exchange, trade or convert virtual assets and currencies; [b] exchange, trade or convert one or more virtual assets; [c] match orders between buyers and sellers and exchange, trade or convert [i] virtual assets and currencies or [ii] one or more virtual assets; or [d] maintain an order book to further the above [a], [b] or [c]. The trading service aims to provide a variety of virtual asset trading options to meet the different trading needs of customers and improve market liquidity and trading efficiency.

5. Virtual asset lending services

Lending Service means the performance of a contract under which a virtual asset shall be transferred or loaned from one or more parties (lenders) to one or more parties (borrowers), and the borrower shall promise to return the virtual asset for its own benefit or on behalf of others at the request of the lender within the agreed period or at any time at the end of the period. Lending Service provides users with a flexible way to manage funds to meet short-term or long-term funding needs while ensuring the interests and security of both borrowers and lenders.

6. Virtual asset management and investment services

Virtual asset management and investment services means acting as an agent or trustee on behalf of an entity, or otherwise responsible for the management, administration or disposal of the entitys virtual assets. This includes but is not limited to:

[a] provide investment management services or otherwise manage virtual assets; and [b] be responsible for “staking” virtual assets to earn fees or other value paid to validators and/or node operators of “proof-of-stake” distributed ledger technologies.

These services are designed to help clients effectively manage and increase the value of their virtual assets and maximize the returns on their assets through professional investment strategies and management methods.

7. Virtual asset transfer and settlement services

“Transfer and settlement services” include companies engaged in the transmission or transfer of virtual assets from one entity to another or from one entity to another VA wallet, address or location. Transfer and settlement services ensure the safe and efficient transfer of virtual assets, reduce risks in the asset transfer process, and enhance customer experience.

8. Virtual asset issuance category 1

Issuance Category 1 refers to the issuance of fiat currency-pegged virtual assets (FRVA), commonly known as stablecoins. This type of virtual asset claims that its value maintains a stable relationship with one or more legal currencies, but does not have legal tender status in any jurisdiction. The issuance of stablecoins provides the market with a relatively stable medium of exchange, helps reduce market volatility, and improves the stability and predictability of transactions.

These VASP license types and corresponding service specifications provide detailed operating guidelines for virtual asset service providers to ensure compliance with relevant regulatory requirements in the process of providing services and to protect the legitimate rights and interests of customers and the security of their assets.

The overview of Dubai Virtual Asset Service Provider (VASP) license is as follows.

VASPs can apply for licenses for multiple activities and aggregate them under a single umbrella license, unless they involve virtual asset custody services. VASPs licensed for multiple activities must fully meet the requirements for each activity and remain compliant at all times.

Virtual asset custody services are the only regulated activity that needs to be separated from other virtual asset service licensing categories. In this case, the virtual asset custodian must be established as a separate legal entity, remain independent and unaffiliated in governance, and hold a separate license.

In addition, licensed VASPs are prohibited from conducting proprietary trading or trading their groups portfolio of assets under a regulated activity license. In order to ensure fair and transparent market operations, a separate firm must be established for proprietary trading. Proprietary trading and group asset management require a clear separation to prevent potential conflicts of interest and ensure that all clients can trade in a fair and protected environment.

申请流程

Any company wishing to conduct virtual asset activities in or from Dubai (excluding the Dubai International Finance Centre (DIFC)) is legally obliged to obtain a license from VARA before commencing operations.

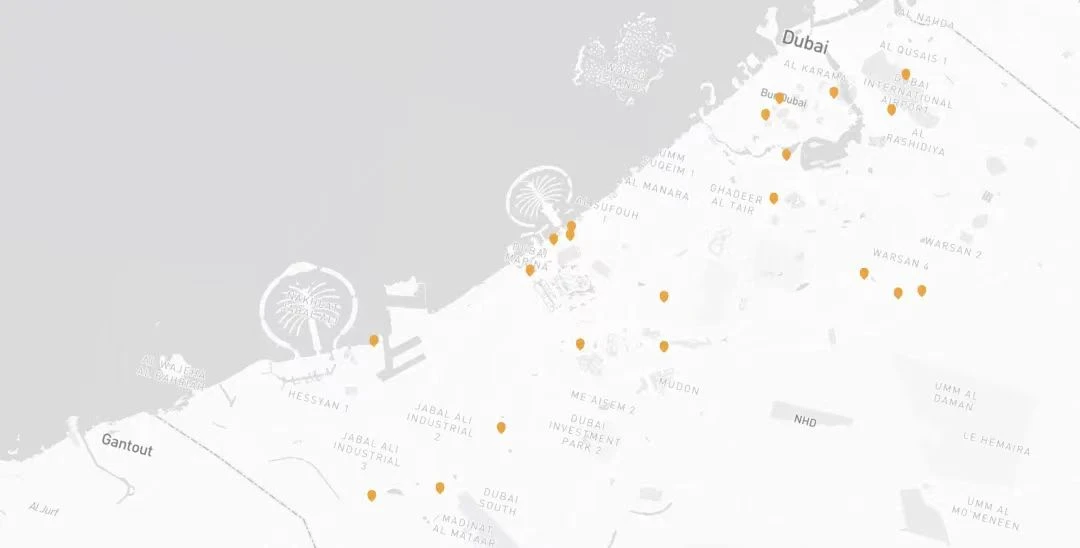

Mainland companies can submit applications through Dubais Department of Economy and Tourism (DET) or through any of the Dubai Free Zones (FZs) in the Emirate of Dubai (except DIFC). Free zones are special economic zones that offer tariff benefits and tax breaks to investors, each governed by a unique set of rules and regulations. The benefits of setting up a company in a free zone include 100% foreign ownership, 100% repatriation of capital and profits, and quick and easy business establishment. There are more than 20 free zones operating in Dubai, most of which focus on one or more specific sectors and provide business licenses to companies in these sectors, usually covering trade, services and industrial activities.

For newly established companies, the application process is as follows:

第一阶段

-

Submit an Initial Disclosure Questionnaire (IDQ) to Dubai Economy Tourism (DET) or the relevant Free Zone (FZ).

-

Other documents as required, including but not limited to business plan and details of the actual owners and officers of the company.

-

Pay the initial fee required to start the application review (usually 50% of the license application fee).

-

Obtain preliminary approval to finalize the company’s legal formation and complete operational setup, including leasing office space, onboarding employees, etc.

It is important to note that in the first phase, even companies that have obtained preliminary approval are not yet allowed to engage in virtual asset activities.

第二阶段

-

After receiving preliminary approval, prepare and submit the documents following the guidance provided by VARA.

-

Get feedback on your submission directly from VARA, which may include meetings, interviews, and submission of further documentation.

-

Pay the remaining licence application fee and first years regulatory fee.

-

Obtain a VASP license, but may be subject to operating conditions.

VARA reserves the right not to issue a VASP license if the company’s activities fall outside the regulatory scope or if the company may not meet appropriate regulatory standards.

The VASP license application process flow chart is as follows.

For companies conducting virtual asset business before February 2023 (legacy VA operators), VARA has invited all such companies to apply for the Dubai Legacy Program. The program enables organizations to seamlessly transition to VARA’s regulatory framework. VARA has conducted various training sessions and awareness programs in this regard in collaboration with the Ministry of Economy and Tourism and the Free Zones Council.

As part of the regulatory process, VARA has required all legacy VA operators in Dubai to register by completing an Initial Disclosure Questionnaire (IDQ). VASPs that receive an Application Acknowledgement Notice (AAN) can proceed with obtaining a legacy License to Operate (LOP) or No Objection Certificate (NOC).

The Legacy Operating License (LOP) provides VASPs with the opportunity to transition to a comprehensive virtual asset regulatory regime within a limited time, provided they meet basic regulatory requirements. It also has other benefits, including a discount of up to 50% on licensing fees and reduced capital requirements. This license is valid for 12 months, giving VASPs sufficient time to develop and comply with comprehensive licensing and regulatory requirements.

Summary and Outlook

The establishment of the VASP system is a well-thought-out layout of Dubais financial technology innovation. On the one hand, it provides investors with a safe, transparent and efficient market environment with strict compliance requirements and advanced risk management framework. On the other hand, as more compliant VASPs settle here, Dubai is expected to become a digital asset hub connecting the East and the West, promoting the flow and integration of global financial resources.

The VASP system is expected to become a catalyst for financial technology innovation in Dubai, further promoting the development of Web3 technologies such as blockchain and virtual assets. The VASP system is also a beneficial attempt by Dubai to promote technological and business innovation under a compliant framework. We look forward to Dubai ushering in a new era of a more open, inclusive and win-win digital economy.

This article is sourced from the internet: Crypto Oasis in the Desert: Overview and Application Guide for Dubai VASP License

相关:MT Capital 研究报告:Privasea,将全同态加密引入大规模采用

原文作者:信伟,MT Capital MT Capital一直致力于投资具有颠覆性技术潜力的创新型公司。我们认为将全同态加密(FHE)与AI相结合的去中心化物理基础设施网络(DePIN)是未来的重要赛道。FHE技术可以在保持数据加密的同时进行计算,确保整个数据处理过程的隐私和安全。AI与DePIN的结合不仅可以高效利用外部计算资源,还可以执行复杂的数据分析和机器学习任务,而不必担心数据泄露。Privasea在该领域的领先地位和技术优势与MT Capitals的投资策略高度一致。我们相信通过支持Privasea,将推动FHE AI DePIN赛道的发展,为安全做出贡献……