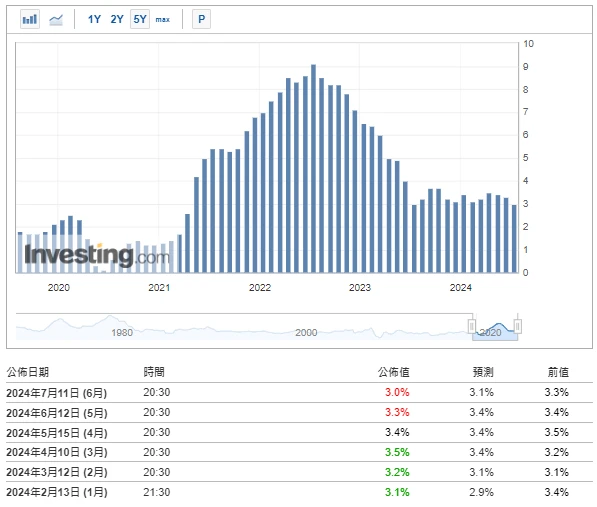

Crypto Market Sentiment Research Report (2024.07.05–07.12): CPI declines, mainstream currency prices rise and fall

CPI data fell, m人工智能nstream currency pr冰s rose and fell

数据源: https://hk.investing.com/economic-calendar/cpi-733

Expectations for interest rate cuts have increased significantly this year, with the probability of the first rate cut in September rising to 80%, and the probability of a rate cut in July reappearing. The prices of Bitcoin and Ethereum continued to rise before the release of CPI data, and then fell back after the data was released. Data released by the U.S. Department of Labor showed that the year-on-year growth rate of the U.S. Consumer Price Index (CPI) slowed from 3.3% in May to 3% in June, the lowest growth rate since June last year; month-on-month, it turned from flat in May to a decline of 0.1% in June, a 0.1 percentage point drop from the previous month, the first negative growth since May 2020, showing signs of continued slowdown in inflation.

There are about 17 days until the next Fed meeting (August 1, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

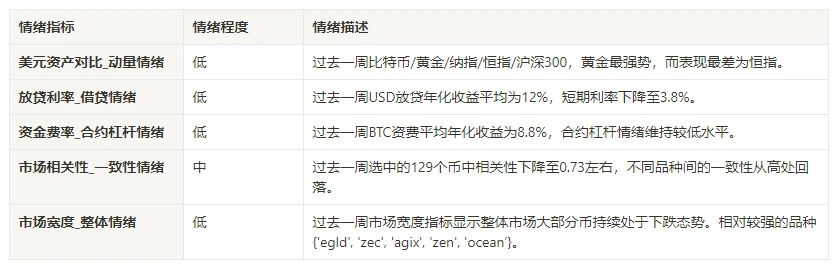

市场技术和情绪环境分析

情绪分析组件

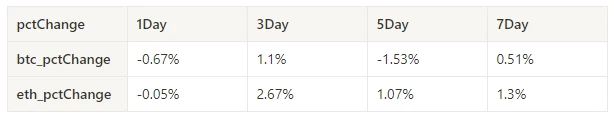

技术指标

价格趋势

BTC prices rose 0.51% and ETH prices rose 1.3% over the past week.

上图是近一周BTC价格走势图。

上图是近一周ETH的价格走势图。

表格显示的是过去一周的价格变化率。

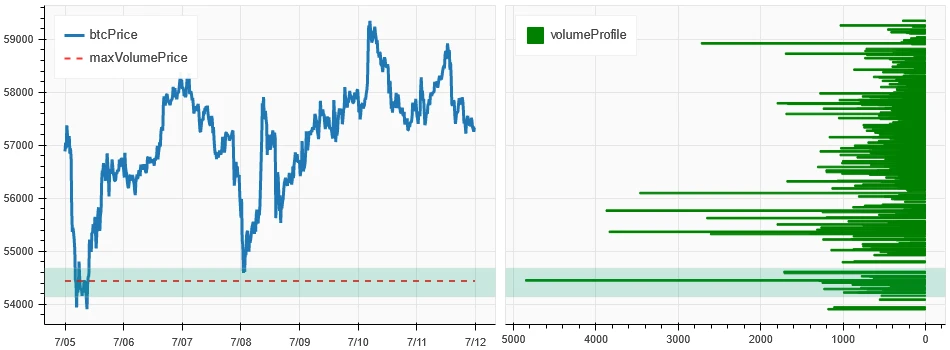

价量分布图(支撑位与阻力位)

In the past week, BTC and ETH fluctuated upward after forming a new dense trading area with large volumes at low levels.

上图为近一周BTC密集交易区分布。

上图为近一周ETH密集交易区分布。

表格展示了过去一周BTC与ETH的周密集交易区间。

交易量和未平仓合约

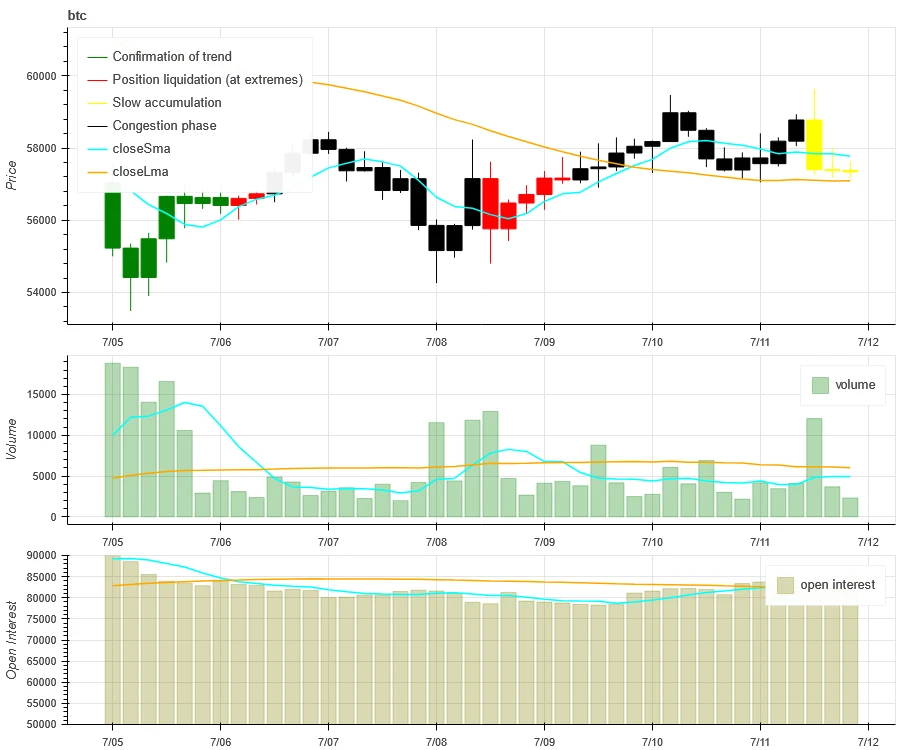

Over the past week, BTC and ETH had the largest trading volume when they fell on July 5; open interest for both BTC and ETH continued to decline.

上图上方为BTC价格走势,中间为成交量,下方为持仓量,浅蓝色为1日均线,橙色为7日均线。K线颜色代表当前状态,绿色表示成交量支撑价格上涨,红色表示平仓,黄色表示缓慢加仓,黑色表示拥挤状态。

上图上方为ETH的价格走势,中间为交易量,下方为持仓量,浅蓝色为1日均线,橙色为7日均线。K线的颜色代表当前状态,绿色表示价格上涨受到交易量支撑,红色为平仓,黄色为缓慢增仓,黑色为拥挤。

历史波动率与隐含波动率

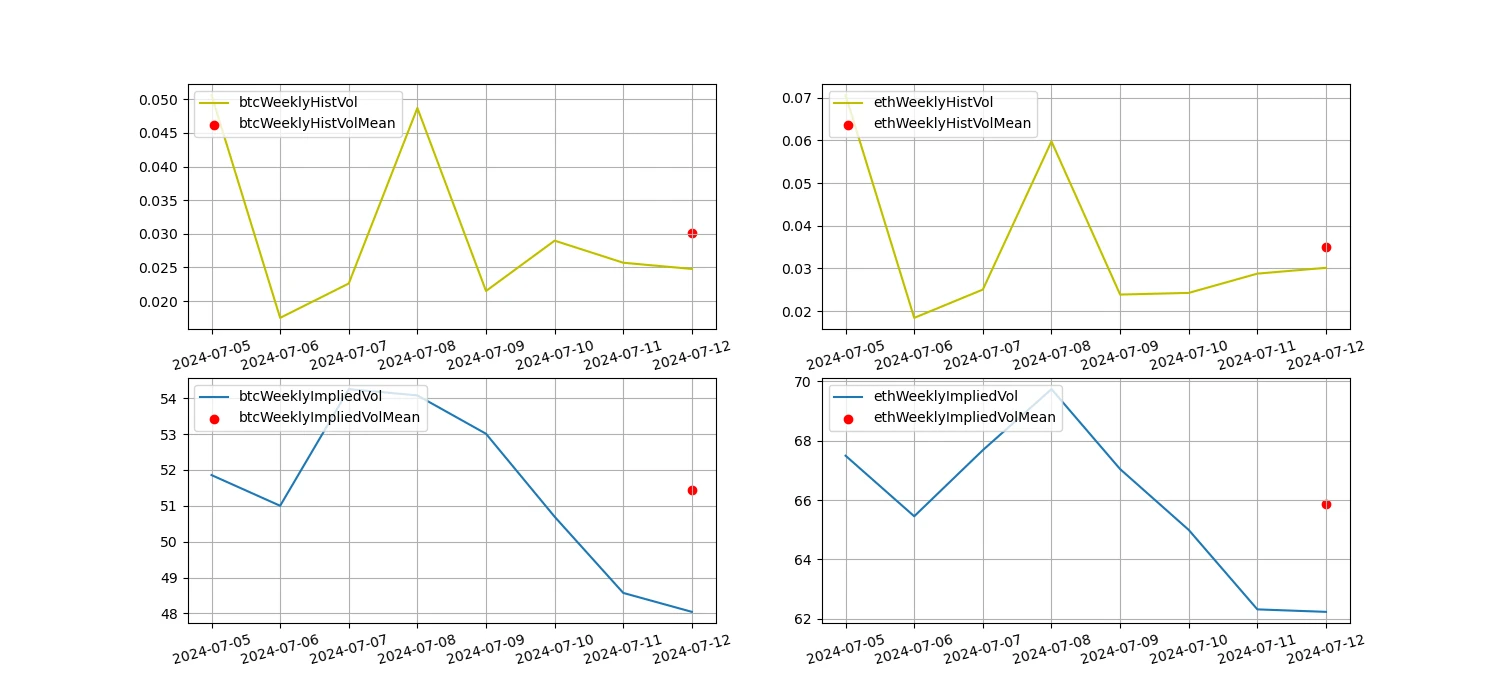

In the past week, the historical volatility of BTC and ETH was highest when it fell to 7.5; the implied volatility of BTC and ETH fell synchronously.

黄线是历史波动率,蓝线是隐含波动率,红点是其 7 天平均值。

事件驱动

Over the past week, the prices of Bitcoin and Ethereum continued to rise before the release of CPI data, and then fell back after the data was released.

情绪指标

动量情绪

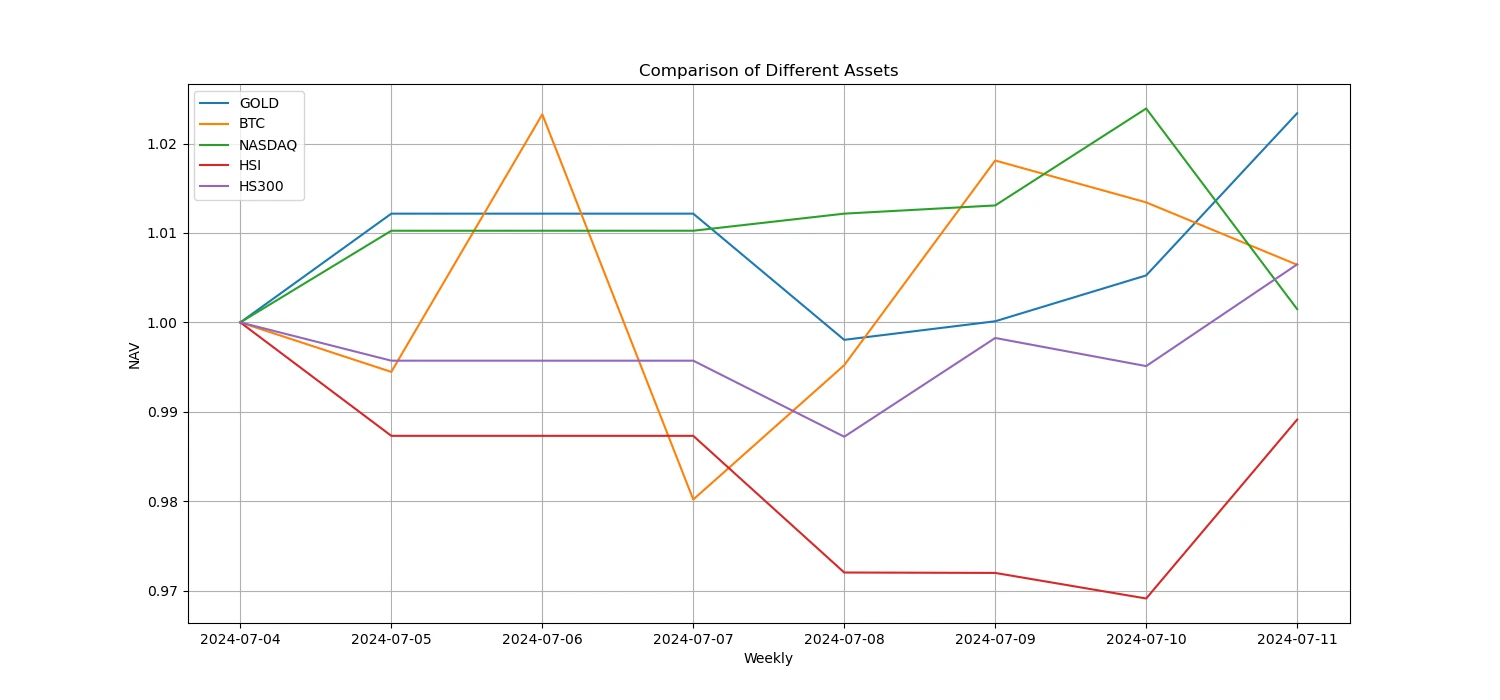

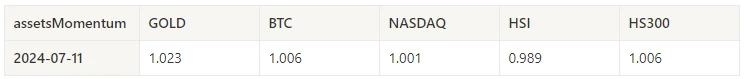

In the past week, among Bitcoin/gold/Nasdaq/Hang Seng Index/CSI 300, gold was the strongest, while Hang Seng Index performed the worst.

上图为近一周不同资产的走势。

贷款利率_贷款情绪

The average annualized return on USD lending over the past week was 12%, and short-term interest rates fell to 3.8%.

黄线为美元利率最高价,蓝线为最高价75%,红线为最高价75%的7日均线。

表格显示了过去不同持有日的美元利率平均收益

资金费率_合约杠杆情绪

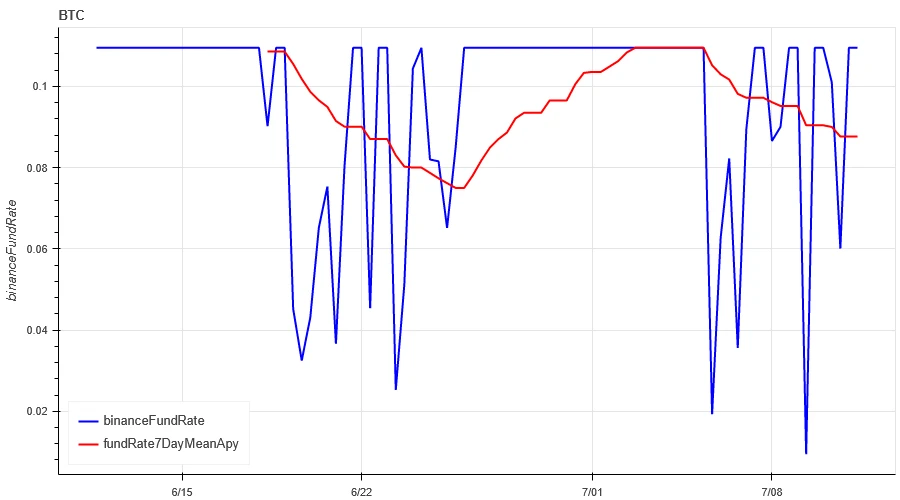

The average annualized return on BTC fees in the past week was 8.8%, and contract leverage sentiment remained at a low level.

蓝线为币安 BTC 资金费率,红线为其 7 天平均值

表格展示了过去不同持有日的BTC手续费平均回报率。

市场相关性_共识情绪

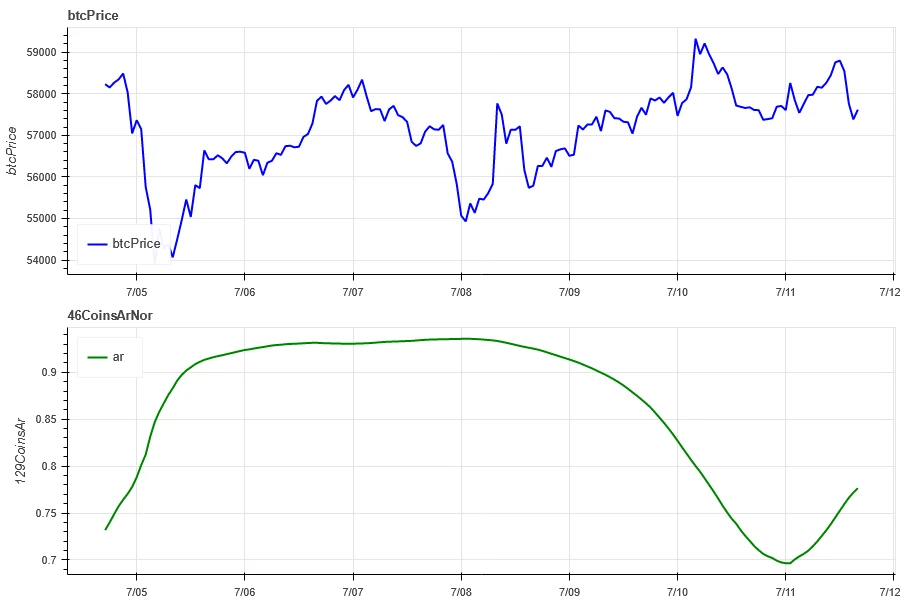

The correlation among the 129 coins selected in the past week remained at around 0.73, and the consistency between different varieties fell from a high level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx, sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

市场广度_总体情绪

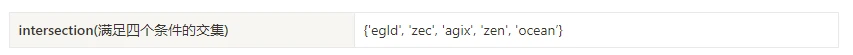

Among the 129 coins selected in the past week, 9.4% of the coins were priced above the 30-day moving average, 33.8% of the coins were priced above the 30-day moving average relative to BTC, 5.5% of the coins were more than 20% away from the lowest price in the past 30 days, and 10% of the coins were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market continued to fall.

The above picture shows [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

总结

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) fluctuated upward after heavy volume at low levels, while the volatility and trading volume of these two cryptocurrencies reached their highest levels when they fell to the low point on July 5. The open interest of Bitcoin and Ethereum is declining. In addition, the implied volatility of Bitcoin and Ethereum also fell simultaneously. Bitcoins funding rate remains at a low level, which may reflect the continued low leverage sentiment of market participants towards Bitcoin. The market breadth indicator shows that most cryptocurrencies continue to fall, indicating that the entire market has maintained a weak trend in the past week. CPI data fell, and the prices of mainstream currencies rose and fell when the data was released.

Twitter: @ https://x.com/CTA_ChannelCmt

网站: channelcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.07.05–07.12): CPI declines, mainstream currency prices rise and fall

Related: Giants Protocol: A UTXO-based BTC asset issuance protocol to expand Web3 application scenarios

Original|Odaily Planet Daily Author|LiaoLiao As digital gold, Bitcoins value storage attribute is widely recognized by the market, but its market application scenarios have never been expanded. More projects are still being developed on a large scale on blockchains such as Ethereum and Solana and launched into the market. Although last years inscriptions and the runes that emerged after the halving this year have brought some attention to the issuance of assets on the Bitcoin chain, it is limited to meme culture. The current asset protocol of the Bitcoin ecosystem is difficult to meet the more complex functions and requirements proposed by developers and creators, which is also the core reason why the Bitcoin chain ecosystem has not exploded on a large scale. Giants Protocol came into being and is bringing…