原创 | Odaily星球日报( @OdailyChina )

作者 | Asher ( @Asher_0210 )

Mocaverse, a metaverse product of Animoca brand with financing of more than US$3,000, will open airdrop applications at 17:30 Beijing time today. Moca NFT holders and Moca ID holders with RP greater than 1,500 points are eligible for airdrops. The token application qualification query website has been launched ( 点击此处跳转 ). For Moca NFT holders, they can receive it immediately or receive it additionally. They need to register before 4 am UTC on July 11, otherwise it will be defaulted to receive immediately; for Moca ID holders, they must register on the registration website before 4 am UTC on July 11 to obtain MOCA through TGE.

For those who missed the first round of airdrops, such as Moca ID holders with less than 1500 RP, don鈥檛 be discouraged, because the second round of airdrops will be launched in the near future. Next, Odaily Planet Daily will take you to understand the Mocaverse project, MOCA token economy and over-the-counter transactions.

Mocaverse full analysis

项目描述

图片来源: Mocaverse Foundation official Twitter

Mocaverse is a metaverse product of the Animoca brand. Moca people are a group of bold and infinitely creative creatures who call Mocaverse their home. The team is currently developing Web3 native tools to support products in the gaming, cultural and entertainment verticals, allowing users to create their own digital identities, accumulate reputations, and earn and spend points.

融资

ROOTDATA data shows that Mocaverse has completed two rounds of financing, with a total financing amount of up to US$31.88 million, namely:

-

On September 11, 2023, Mocaverse announced the completion of a $20 million financing round, led by CMCC Global, with participation from Liberty City Ventures, Kingsway Capital, GameFi Ventures, Koda Capital, Yat Siu, Aleksander Leonard Larsen, and Gabby Dizon;

-

On December 8, 2023, Mocaverse announced a $11.88 million financing, with OKX Ventures, Foresight Ventures, P2 Ventures, Dapper Labs, and Block1 participating.

Mocaverse has completed two rounds of financing, totaling US$31.88 million

代币经济模型

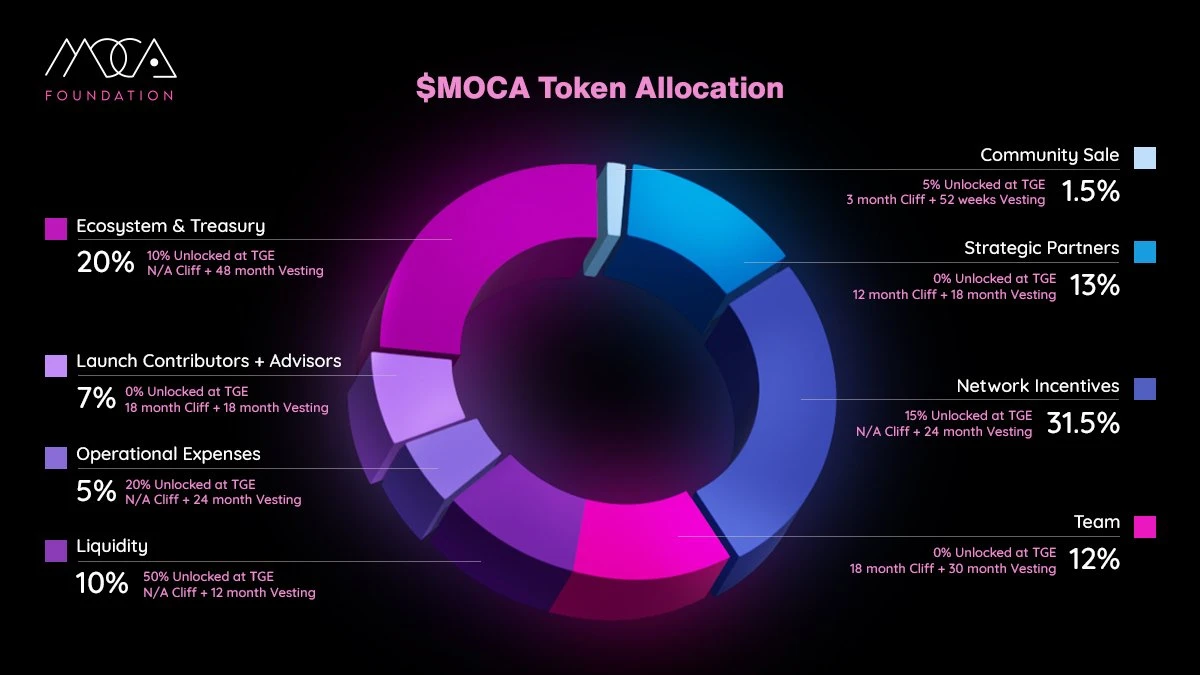

According to the relevant information released by the Mocaverse Foundation, the total supply of its native token MOCA is 8,888,888,888 ,具体分配比例如下:

-

Strategic partners: 1,155,555,555 MOCA, accounting for 13.00% of the total supply, 0% released by TGE, 12-month lock-up period, and then unlocked in 18 months. Incentive mechanism between major partners to bring benefits to strengthen the network;

-

Ecosystem and Treasury: 1,777,777,778 MOCA, accounting for 20.00% of the total supply, 10% released by TGE, and then unlocked in 48 months. Capital reserve to promote network expansion;

-

团队: 1,066,666,667 MOCA, accounting for 12.00% of the total supply, 0% released by TGE, 18-month lock-up period, and then unlocked in 30 months. Provide adjustment incentives for the team to achieve network expansion through development and marketing;

-

Liquidity: 888,888,889 MOCA, accounting for 10.00% of the total supply, 50% released by TGE, and then unlocked in 12 months. Token liquidity mitigates volatility and provides stability to the network;

-

Operating expenses: 444,444,444 MOCA, accounting for 5.00% of the total supply, 20% released by TGE, and then unlocked in 24 months. Provide initial liquidity for the project for key expenses required for network operation;

-

Network incentives: 2,800,000,000 MOCA, accounting for 31.50% of the total supply, 20% released by TGE, and then unlocked in 24 months. Provide initial liquidity for the project for key expenses required for network operation;

-

Issue Contributors and Advisors: 622,222,222 MOCA, accounting for 7% of the total supply, TGE release 0%, 18 -month lock-up period, and then unlocked in 18 months. Incentives for donors who help launch the Moca network;

-

Community sales: 133,333,333 MOCA, accounting for 1.5% of the total supply, TGE releases 5%, 3 -month lock-up period, and then unlocks in 52 weeks.

In the MOCA token economic model, regarding network incentives, that is, 31.5% of the project airdrop, the specific distribution details are as follows:

-

Moca NFT holders (circulating NFT only): 10% of MOCA supply. Users need to hold NFTs at the time of airdrop claim to be eligible. 1/3 of them will be unlocked at TGE, 1/3 will be vested weekly after 3 months, and completed in 12 个月。 1/3 will be reserved for Moca NFT for future incentives.

-

Moca ID holders: The airdrop to Moca ID holders will be executed in two rounds, the first round will have no vesting period, and the second round will be conducted after TGE, details to be announced. There will be a minimum RP threshold for airdrop qualification (the threshold is RP greater than 1500). RP is a form of proof of participation, and airdrops will be distributed in a non-linear manner based on participation assessment;

-

Use of Network Incentives: The remaining network incentives (and other network tokens) will be distributed to all participants, including MOCA holders, Moca IDs, and Moca NFT holders, according to the Moca network鈥檚 value-based mechanism.

MOCA airdrop distribution details

OTC

Currently, Mocaverse (MOCA) is listed on the over-the-counter markets AEVO and Whales Market. According to AEVO market data, with the release of MOCA airdrop application information, the MOCA over-the-counter price rose slightly and then fell significantly, temporarily reporting $0.0919, 24 小时 drop of nearly 20%, and 24 小时 trading volume of over $1.8 million.

This article is sourced from the internet: Animocas flagship product Mocaverse airdrop application will be launched soon after raising over $30 million

Related: What does the 230-page investigation report on the FTX bankruptcy case say?

Original author: Protos Staff Original translation: TechFlow The examiner appointed in the FTX bankruptcy case has released a report highlighting various bad practices by the company and its executives that led to its collapse. The report covers how whistleblowers were paid, the handling of the bank’s “capital issues,” and when various executives knew that the FTX Group entity was insolvent. Who knows? The report contains information about which executives and companies knew about the accounting flaws before FTX Group collapsed. The allegations allege that Ryan Salame participated in creating a backdated payment agency agreement, directed other FTX Group employees to misrepresent to banks the purpose of FTX Group bank accounts, misappropriated FTX Group assets to purchase real estate, restaurants and food service companies, and make other purchases and investments (including…