In the past 24 hours, many new popular currencies and topics have appeared in the market, and they may be the next opportunity to make money:

-

The sectors with relatively strong wealth creation effects are: Modular public chains

-

Hot search tokens and topics by users: Stargate, SSV, PEIPEI

-

Potential airdrop opportunities include: Symbiotic, Karak+Etherfi

Data statistics time: July 10, 2024 4: 00 (UTC + 0)

1. 市场环境

Fed Chairman Jerome Powell delivered his semi-annual monetary policy testimony to the Senate Banking Committee. Indicating that the FOMC is unlikely to cut interest rates when it meets at the end of this month, traders are pricing in a slightly higher than 70% chance of the Feds first rate cut in September. They expect two 25 basis point rate cuts in 2024.

BTC spot ETF has seen net inflows for three consecutive working days. The German governments move to transfer BTC to the exchange did not cause a significant drop in BTC yesterday. The panic in the market may be gradually being digested, and the market is fluctuating weakly.

Some altcoins rebounded from oversold levels, but market liquidity is still scarce. TIA, the leading modular public chain project, surged.

2. 财富创造领域

1) Sector changes: Modular public chains (TIA, DYM)

The main reason: The modular public chain sector bottomed out and rebounded, the annualized short-selling fee rate of TIA on multiple leading exchanges exceeded 100%, and TIA was forced to rise.

Rising situation: TIA and DYM, two well-known modular public chain projects, rose by 18% and 15% respectively in the past 24 hours;

影响后市的因素:

-

The actions and operational ideas of market makers before the TIA unlock in October may be the key to determining the trend of its token.

-

If a large number of projects based on modular public chains such as Celestia issue coins in a centralized manner in each cycle and make large airdrops to TIA and DYM pledgers, or if these projects obtain significant financing and give the market higher airdrop expectations, it may drive a rapid rise in tokens such as TIA and DYM.

3. 用户热搜

1)热门 Dapp

Stargate:

Stargate Finance is the first Dapp built on the LayerZero protocol. It has built the first fully composable native asset bridge, with the vision of making cross-chain liquidity transfer a seamless, single process. Yesterday, Coinbase Assets announced that it would re-enable Stargate Finance (STG) transactions (ERC-20 tokens) on the Ethereum network. Due to the news, STG rose by more than 9% in a short period of time, temporarily reporting $0.3778.

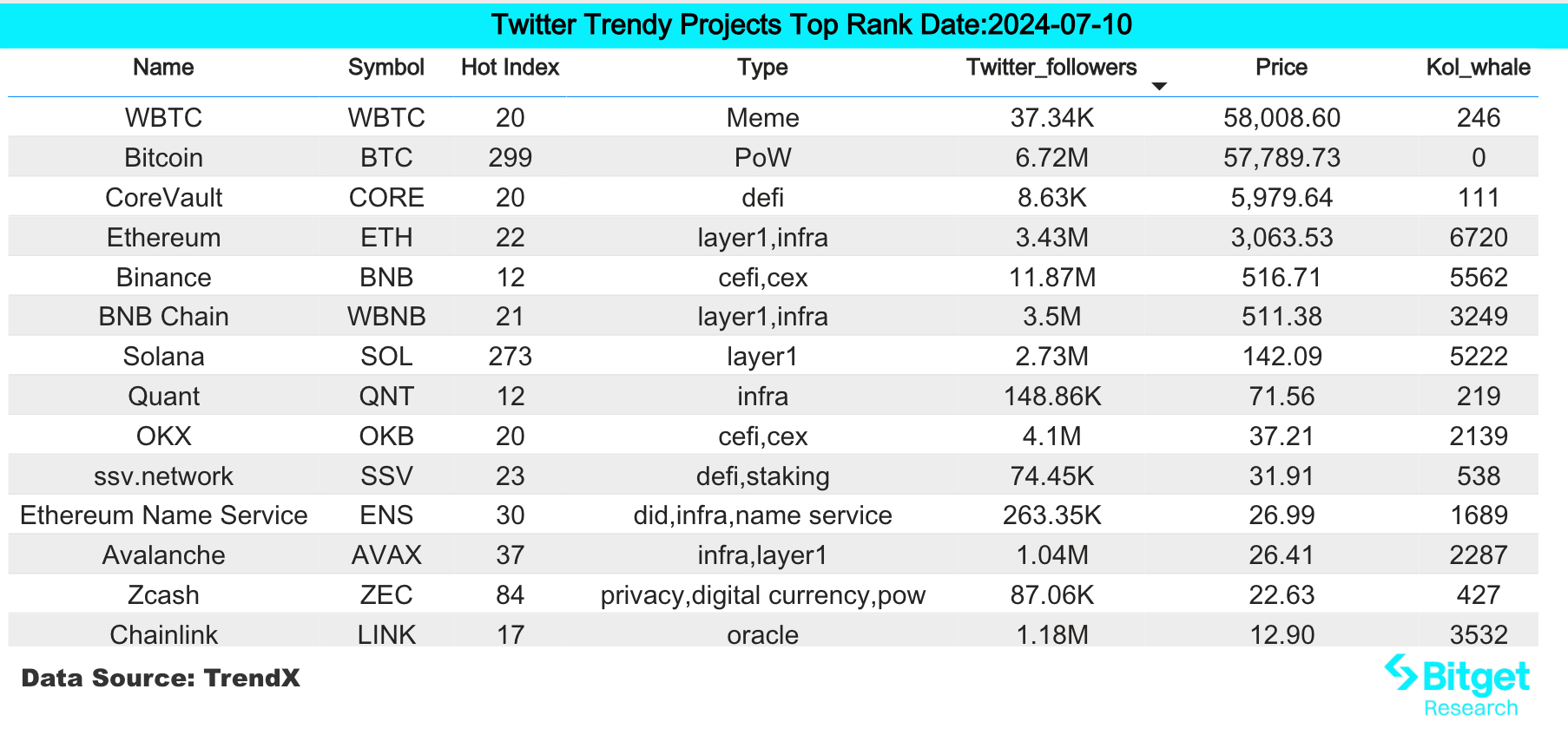

2)Twitter

SSV.Network:

The project is a decentralized, open ETH staking network for any individual or service provider who wants to run an Ethereum node. The network uses a privacy-sharing-based validator protocol to achieve secure and decentralized management of Ethereum validator node keys. Recently, SSV Network announced that more than 1,000,000 ETH have been staked in the protocol, with a TVL of more than $3 billion. Due to the high TVL and high degree of decentralization of the project, users can continue to pay attention.

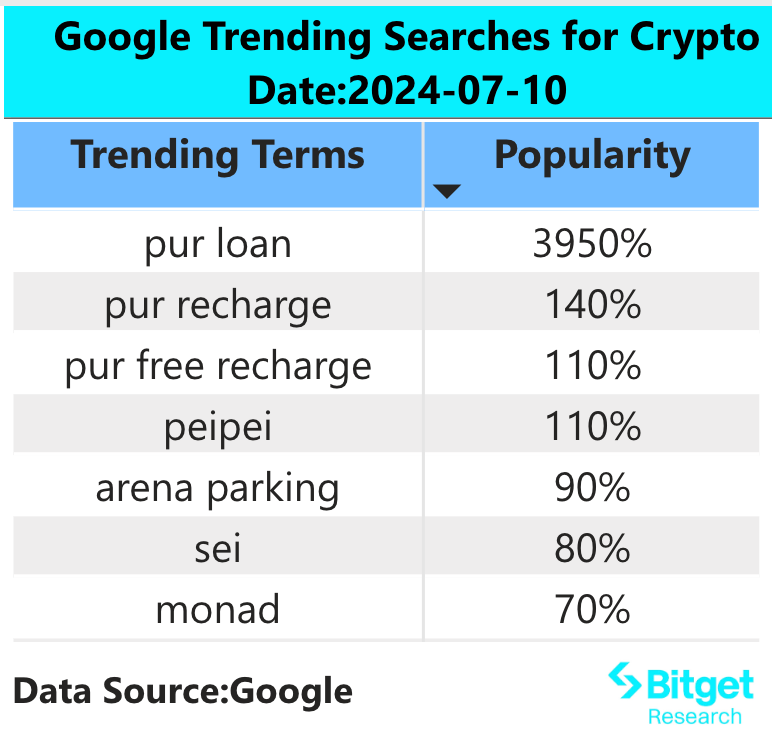

3)Google 搜索区域

从全球角度来看:

PEIPEI:

Chinese concept pepe token, according to coinmarketcap data, PEIPEI price rose 21.4% today, with a daily trading volume of 160 million US dollars. The number of holders is 26.32K, and the number of transactions on the chain is 4373. Due to the large trading volume and high increase, the community heat has increased.

从各地区热搜来看:

(1) There are no obvious characteristics in the Google Trends searches of Asian countries, but it is worth noting that the focus of Asian countries has gradually shifted from conceptual terms to specific projects. For example, Indonesia has shown its concern for the ETH ecosystem, and projects such as Etherfi have emerged. Singapore has also shown its concern for AI projects.

(2) There are no obvious characteristics in the hot searches in European and American countries, but the focus of the United States recently has been on meme tokens. There have been hot searches for cartoon character-type meme tokens such as Pepe and Floki, as well as political figure memes such as Boden and Trump.

潜在的 空投 机会

共生

Symbiotic 是一个通用的重新质押项目,它使去中心化网络能够引导强大、完全主权的生态系统。它为去中心化应用程序提供了一种称为主动验证服务 (AVS) 的方法,以共同确保彼此的安全。

Symbiotic 近日完成种子轮融资,Paradigm 与 Cyber Fund 参与投资,融资金额达 US$5.8 百万美元。

How to participate: Go to the project鈥檚 official website, link your wallet, and deposit ETH and ETH LSD assets.

Karak+Etherfi

Karak is Ethereum Layer 2, a re-staking layer with multi-chain advantages. Andalusia Labs behind it is a digital asset risk infrastructure provider, which has raised $51.2 million. Investors include Panetra, Lightspeed Capital, Framework Ventures, etc. Staking in Karak can get staking rewards + re-staking rewards + Eigenlayer points + staked LRT points + Karak XP at the same time. Currently, Karak has cooperated with Etherfi to launch a liquid pool. Staking various types of LRT or WETH into the liquid pool can get Eigenlayer points + staked LRT points + Karak XP + Etherfi Points triple points.

Specific participation methods: 1) Add the Karak network (you can go to chainlist to add Karak Mainnet); 2) Stake the coins in the Etherfi liquid pool.

原文链接: https://www.bitget.com/zh-CN/research/articles/12560603812574

【免责声明】市场存在风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何观点、看法或结论是否适合自己的具体情况。根据此信息进行投资需自行承担风险。

This article is sourced from the internet: Bitget Research Institute: BTC spot ETF has seen net inflows for three consecutive days, and market panic is being digested

Related: 10x Research points the way again: This time we鈥檒l look at 60,000 first, then 50,000

Original: 10x Research Compiled by: Odaily Planet Daily ( @OdailyChina ) Translator: Azuma ( @azuma.eth ) Six Ethereum spot ETF issuers have filed updated S-1 forms, meaning the U.S. Securities and Exchange Commission (SEC) could give final approval for Ethereum spot ETFs at any time. Meanwhile, cryptocurrencies appear to be on a rebound this week , a rebound we predicted in our report last weekend, driven by expectations of lower-than-expected U.S. CPI data on Thursday. Oversold indicators show that the market is looking forward to a possible small-scale rebound, which means that the market trend will reverse in the short term. At present, two of the three reversal indicators have shown bullish signals, and the RSI (Relative Strength Index) is temporarily reported at 38%, which means that shorts may also…