Original author: BITCOIN MAGAZINE PRO, LANDON MANNING

原文翻译:Block unicorn

The German and U.S. governments have both moved hundreds of millions of dollars in bitcoin from private wallets to exchanges after Germany suddenly sold a large portion of its bitcoin reserves, sparking speculation that a massive sale was imminent.

For all the speculation about Bitcoin’s performance in late June, it’s easy to forget that the crypto asset’s actual value is only a stone’s throw away from its all-time high valuation, and that this time span is very long. Certain world governments, especially the United States, have long acquired so many Bitcoins through criminal asset seizures that what would have been a paltry sum by the standards of a decade ago has grown into a treasure trove worth hundreds of millions of dollars. Even more pressing, the federal government has been particularly slow to auction off these assets while continuing to make new seizures, making it one of the largest whales in the entire industry.

This situation is already a well-known factor in the Bitcoin community and has led to a lot of speculation about the impact that future government sales may have on prices. After all, any relationship to the market or profitability is largely independent of the speed of these auctions, which are set by the bureaucracy that manages any confiscations. In short, these government hoards of Bitcoin are a real unknown factor that could be deliberately manipulated by specific actors in government power or sold without any regard for the market impact that could result.

While the US federal government is the largest government holder, claiming jurisdiction over heavy Bitcoin holders like Silk Road, and at one point holding over 1% of all Bitcoin in circulation, another auction process actually seemed to set off a chain reaction. Specifically, the German government shocked the community with a $325 million sale with virtually no prior announcements. These major transactions were completed within 2 days, and the resulting selling pressure on Bitcoin caused the price to drop by 3.5%. The price of Bitcoin was already wobbling before this event, and these sales certainly did not inspire further bullish sentiment among traders.

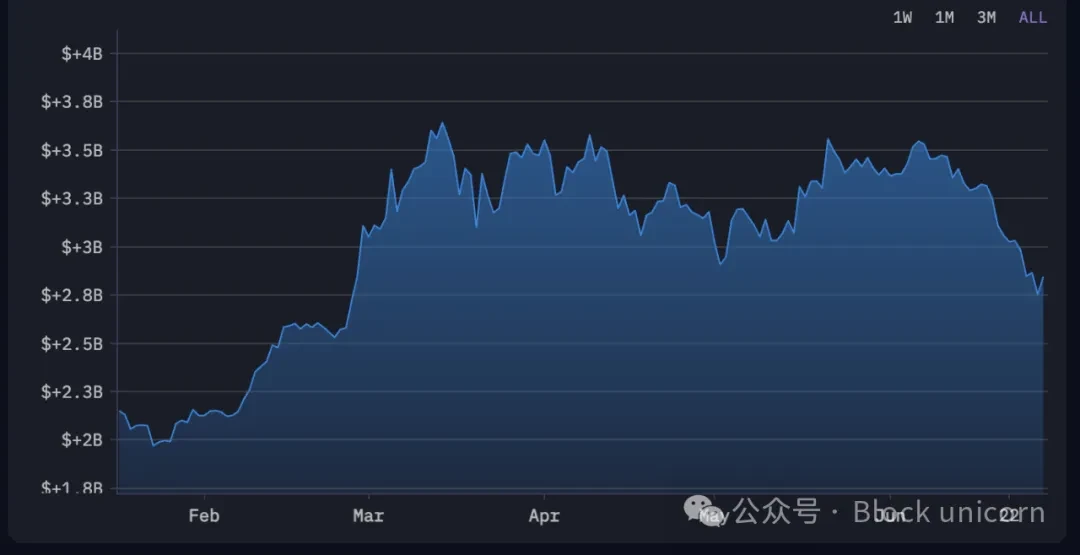

Robert Quartly-Janeiro, Bitrue’s chief strategy officer, even claimed that the decision was a deliberate strategy rather than a planned release of Bitcoin. “The German government released a large amount of Bitcoin due to seeing the BTC price decline,” Quartly-Janeiro said, even adding that the German government “believes that the Bitcoin price will remain weak for some time to come.” In other words, not every jurisdiction has to operate under the same protocols that the United States has in the past. The Bitcoin sold was obtained by Germany after an investigation in 2020, but the actual arrests did not result in the seizure of all the relevant Bitcoins. In fact, local officials claim that the seizure of this case is still ongoing, with more than $3 billion seized in January of this year. Obviously, unlike some of the assets seized by the US government a decade ago, these Bitcoins are just sitting idle in their pockets.

Which brings us to recent developments. As it turns out, there are clear signs that the Germans haven’t stopped. On June 25, the government moved more Bitcoin from private wallets to prominent exchanges. $24 million worth of assets were moved to Coinbase and Kraken’s platforms, while another $30 million was moved to an unknown wallet. To be clear, data shows that Germany still controls the vast majority of its overall seized Bitcoin reserves. Still, the fact that it moved more than $425 million in less than a week has spooked the market.

What really turned this incident from a minor episode into a source of panic was the US governments decision to take similar measures. On June 27, more than $240 million worth of Bitcoin was transferred from private wallets to the Coinbase platform, especially wallets associated with institutional traders. In addition, blockchain tracking shows that these Bitcoins were seized from drug dealer Banmeet Singh in 2024. Some of the federal governments Bitcoins have been in a bureaucratic deadlock for more than five years, but these Bitcoins may be auctioned in less than six months.

Of course, the fact that these assets are in the Coinbase wallet is no guarantee that an actual auction date is imminent. However, the move still strikes fear into the Bitcoin community at a time when prices have already plummeted. Has the U.S. government, a giant holding more than $13 billion in Bitcoin, finally decided to consciously manipulate the market? Or, more accurately, are they firmly shorting Bitcoin? The German officials who suddenly sold Bitcoin are clearly trying to make a quick buck before Bitcoin enters a long bear market. Such sentiments can have a particularly harmful effect on the collective behavior and attitudes of traders, and this effect is doubly so when these decisions are made by the industrys largest whales. If the U.S. government quickly sold off the $240 million in Bitcoin it acquired just a few months ago, who knows if it will continue this behavior and sell off billions more? Such selling pressure could trigger a real bear market.

It can be particularly difficult to discern the different motivations and actors within an opaque bureaucracy such as the one that actually makes these decisions. Therefore, it may be more effective to examine some practical limitations to understand why this sell-off scenario did not come to fruition. First, while Germany moved its Bitcoin to several different wallets, the United States sold them all onto Coinbase. As of June 27, the exchange is simultaneously suing the Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC). Coinbase accuses these regulators of intentionally stifling the cryptocurrency industry and cites a number of incidents that it claims are evidence of government mistrust. The most credible part of their argument seems to be a series of Freedom of Information Act (FoIA) requests filed by Coinbase, which the agencies have denied or postponed without explanation.

This lawsuit is a reminder that many exchanges that could potentially handle billions of dollars in quick auctions of Bitcoin are currently in legal battles with the federal government! Coinbase is currently embroiled in other legal battles; German alternative exchange Kraken was also targeted late last year; and Binance was embroiled in a devastating lawsuit that resulted in the incarceration of its CEO. These are just a few of the crypto-related businesses and exchanges that have faced various lawsuits over the past few months. In any case, it’s unlikely that such businesses will be able to completely prevent the government from conducting auctions, but the entire business may become more difficult. If there is a faction among the relevant agencies that seeks to make profits faster than the auction system can, they may not have a smooth journey.

Ultimately, there is simply no way of knowing the US’ intentions in moving these funds. Many questions remain unanswered and will likely remain so for the foreseeable future. However, Bitcoin holders can take comfort in the fact that the extremely pessimistic scenario is highly unlikely. The US government holds billions more in Bitcoin than Germany, and it is impossible to convert these Bitcoins into cash without being noticed. We will just have to see what happens to these and other confiscated Bitcoin reserves in the near future, but until then, any doomsday predictions are pure speculation.

This article is sourced from the internet: US and German governments transfer Bitcoin, sparking fears of massive sell-off

原文:Odaily星球日报 作者:Wenser 在上一篇文章《追踪链上聪明钱:Meme币PVP高手前10名地址及其战绩》中,我们追踪分析了部分在Meme币领域赚得盆满钵满的链上地址。相比之下,今年价值币领域(通常指有VC机构背书或者具备某些主流概念的价值币)相对冷清。尽管如此,仍有一些鲸鱼或者高阶玩家在这些主流价值币上取得了不俗的收益。Odaily星球日报将在本文中对部分链上聪明钱地址(主要是在价值币领域获利的)进行总结介绍,并将其中较为集中的币种进行归纳,供读者参考。…