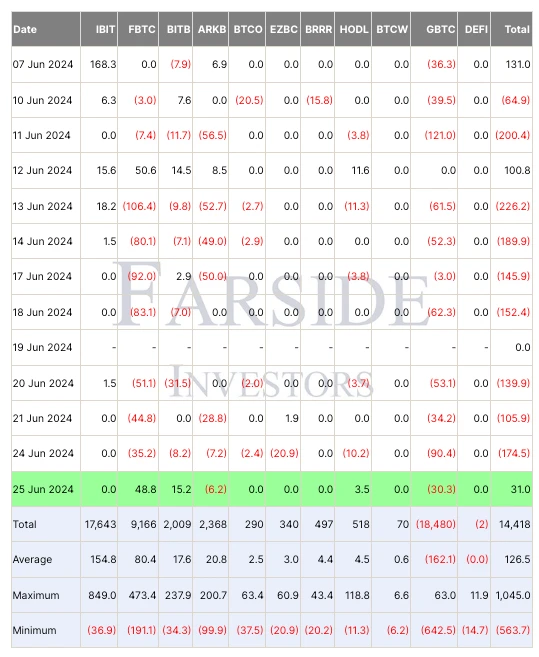

Yesterday (JUN 25), Bitcoin spot ETFs finally stopped outflows, and the uncertainty reflected in the options market also basically fell. Since the Mentougou Compensation Trustee announced on June 24 that repayments would be initiated in early July, the price of Bitcoin has fallen for a short time due to market panic. Alex Thorn, head of Galaxy Research, said in a post that the number of tokens ultimately allocated to individual creditors in the bankruptcy case was less than people thought, about 65,000 BTC (far lower than the 140,000 previously announced by the media), and the resulting Bitcoin selling pressure will be less than expected. This is mainly because some creditors chose debt acceptance (similar to FTXs packaged sale of debt) and received early payment, and the money eventually flowed to large institutions. In addition, the letter did not mention the specific repayment period, but it should not be too short, and these Mentougou creditors themselves are all early digital currency users who are proficient in technology. There is reason to believe that creditors clearly prefer long-term Bitcoin holders, so the maximum daily selling pressure is not exaggerated.

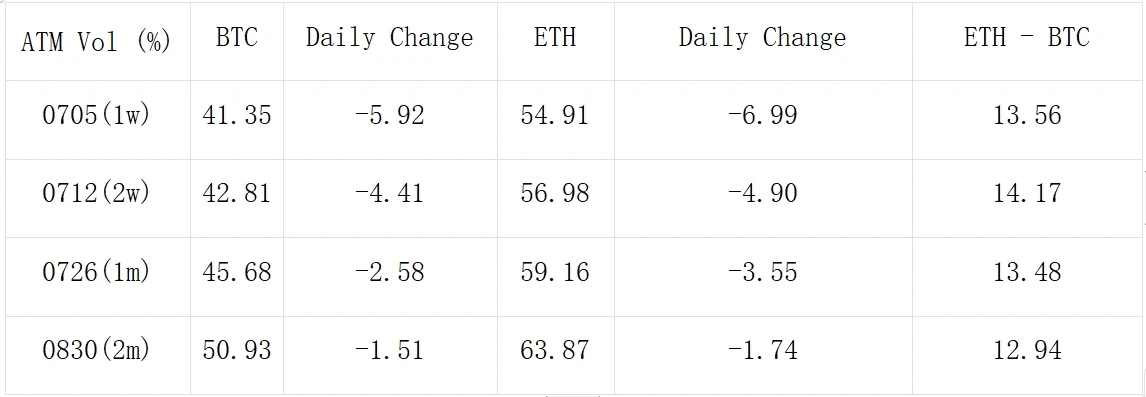

Source: Farside Investors; SignalPlus, ATM Vol.

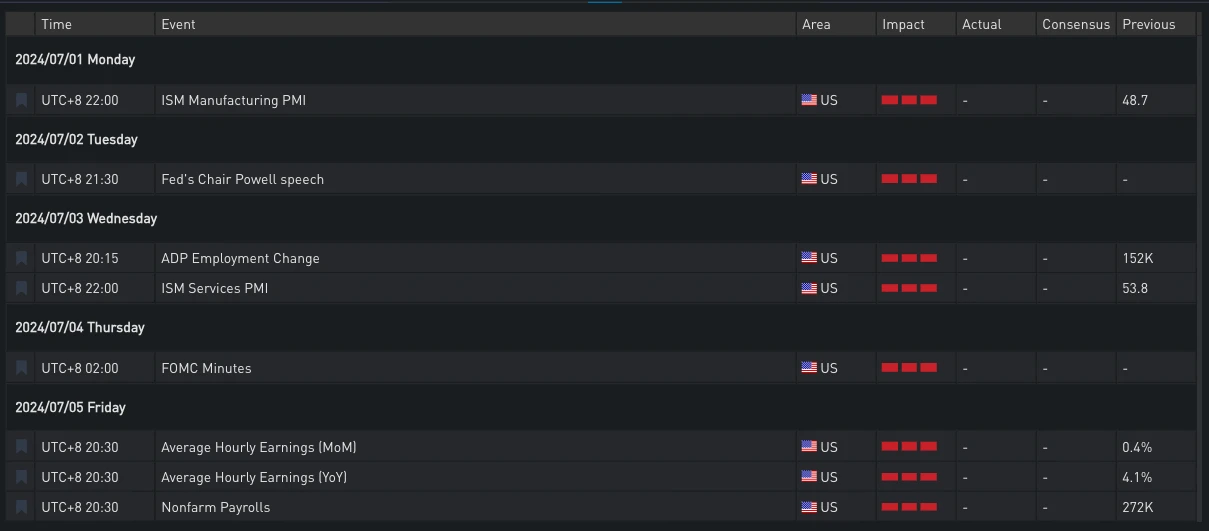

Judging from the price trend of the currency yesterday, although the price rebounded to around 62,000 and the ETF temporarily ended the outflow of funds, it still cannot change the current negative sentiment and poor liquidity. Therefore, the next macro trend should be paid attention to, such as PCE this Friday, the speech of Fed Chairman Powell next Tuesday, and the hourly wage and non-agricultural data next Friday, which will affect the market repricing and capital flow.

Source: SignalPlus Economic Calendar, Important US economic events this week

Source: SignalPlus Economic Calendar, important US economic events next week

Source: Deribit (as of 26 JUN 16: 00 UTC+ 8)

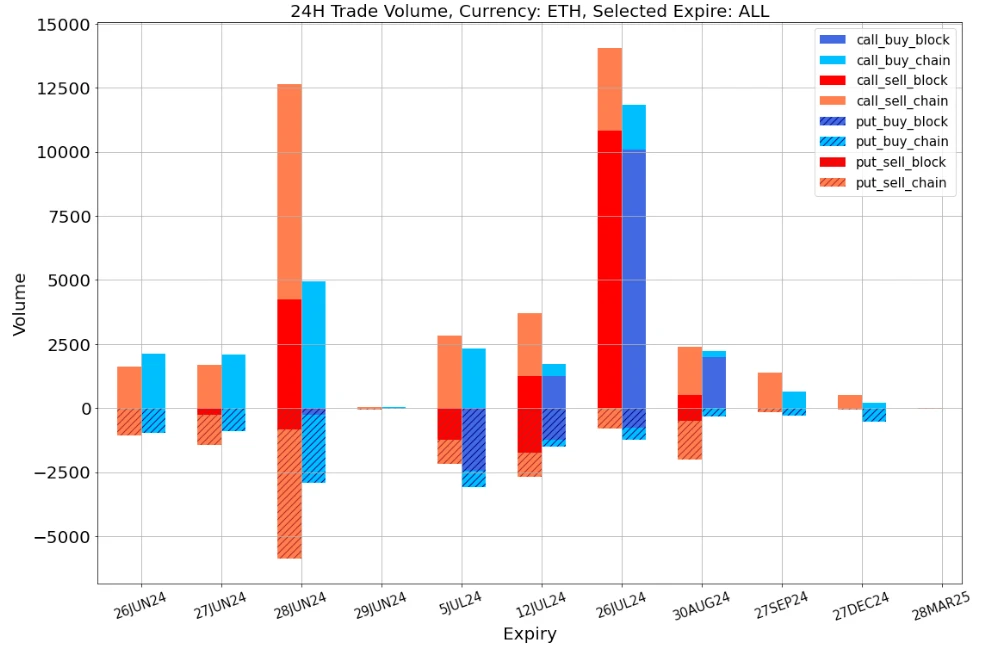

In terms of trading, after the panic subsided, BTC saw bargain-hunting of call options in late June and July. In addition, a large transaction at the end of September was also particularly eye-catching. This strategy protected the remote positions by selling 190 ATM Calls worth 62,000 in exchange for 1,140 Puts worth 48,000 at almost zero cost.

数据来源:Deribit,BTC交易总体分布

数据来源:Deribit,ETH 交易总体分布

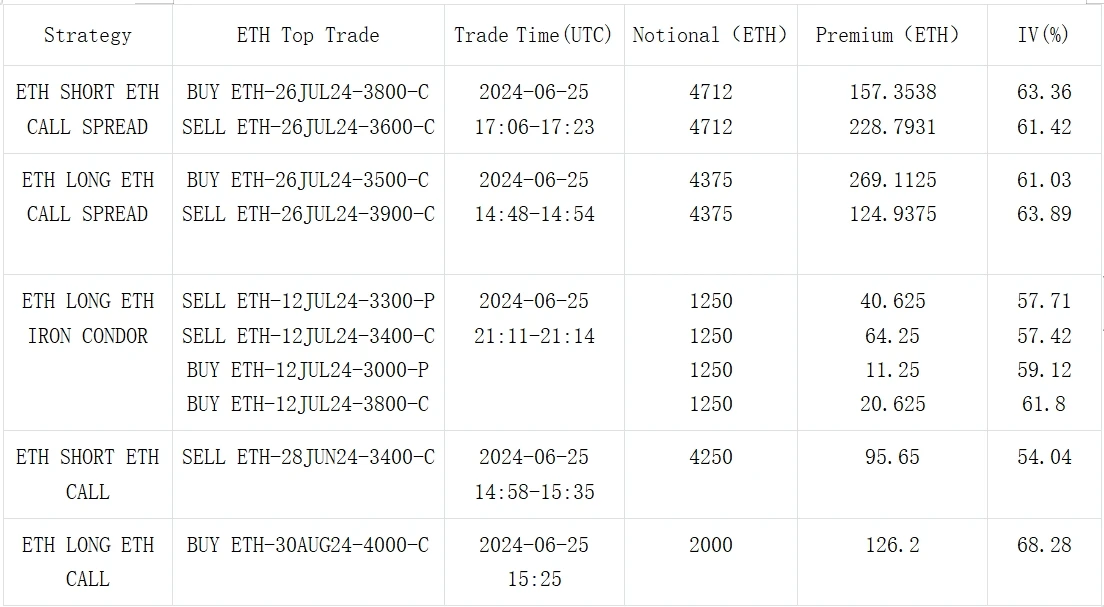

来源:Deribit Block Trade

来源:Deribit Block Trade

您可以在ChatGPT 4.0的插件商店中搜索SignalPlus获取实时加密信息。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlus_Web3,或者加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram群和Discord社区,与更多朋友交流互动。SignalPlus官方网站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240626): Panic subsides

相关:快速浏览 a16z、BlackRock 和 Coinbase 持有的 10 种有前途的代币

原文作者:Atlas , 加密 KOL 原文翻译:Felix, PANews 风险投资者每天向各种山寨币投入数百万美元,推高了这些山寨币的价格。跟踪顶级风险投资机构和鲸鱼的钱包并关注他们的持股情况可能会带来超额利润。加密 KOL Atlas 扫描了 100 多个基金钱包和盈利鲸鱼,分析了他们的钱包并审查了所有项目,并从中挑选出 Web3 中表现最好的基金,包括 a16z、BlackRock 和 Coinbase。以下是其持有的 10 个最有前景的代币。PANews 注:本文旨在提供市场信息,不构成投资建议,DYOR。Compound Labs (COMP) 一种用于借贷的 DeFi 协议,允许用户通过存入其一个池子的加密货币赚取利息。市值:$386…