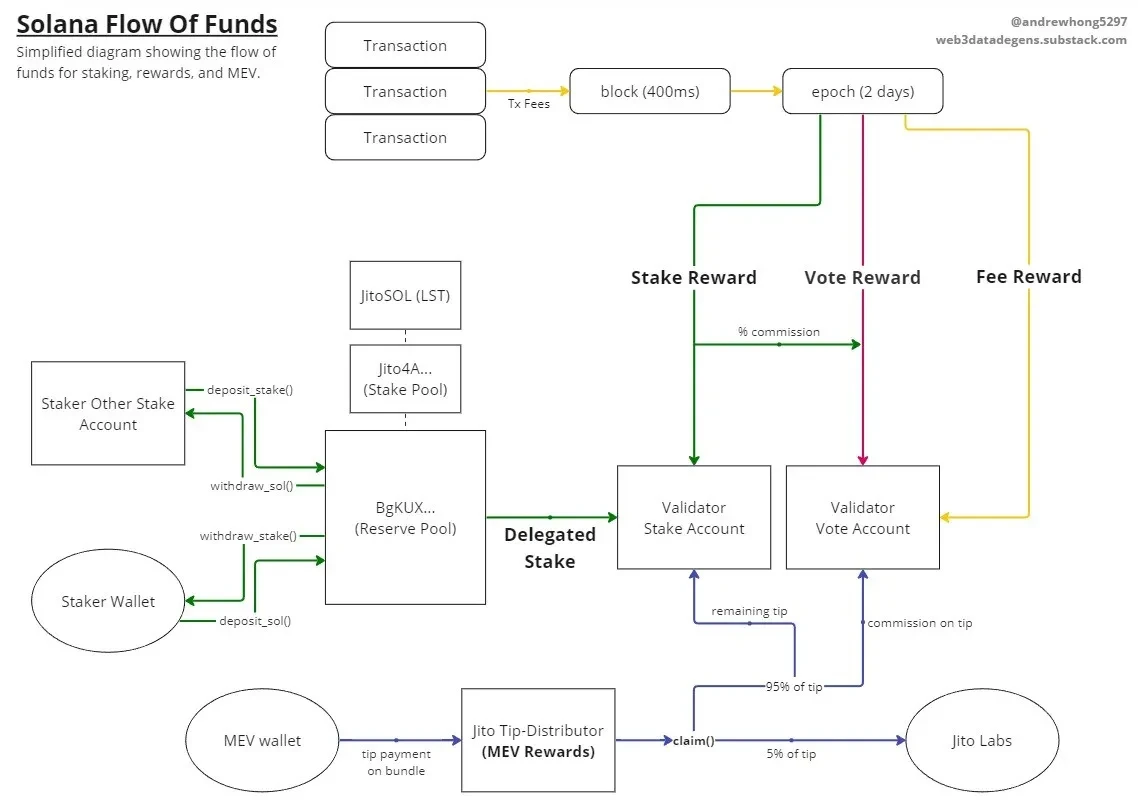

Jito Network is the first protocol in the Solana ecosystem that combines MEV and liquidity staking businesses, and uses MEV income as a staking reward, which increases the protocol staking income. The figure below is a high-level abstract of the Solana fund flow in the Jito protocol. Jito occupies an absolute leading position in both the MEV and liquidity staking businesses of the Solana ecosystem, and with the substantial growth of the Solana ecosystem in this round of the market, the two businesses of MEV and liquidity staking have also achieved rapid growth. This research report will analyze Jitos technical principles and business progress from the two aspects of MEV and liquidity staking, as well as possible growth points and investment points for Jitos future business.

1 MEV Leader: Reshaping Solana鈥檚 MEV Landscape

1.1 Solana MEV Dilemma and Solution

MEV (Maximal Extractable Value) refers to the maximum value that miners can extract by moving the order of transactions when generating blocks on the blockchain network. There are many examples of MEV, such as:

-

Sandwich attack: The most typical type of MEV, MEV searchers observe pending transactions that may affect asset prices, submit transactions before and after the transactions, and benefit by pushing up or down the price of the transaction token, which also makes the original transaction cost more.

-

Liquidation: Always monitor whether there are insufficiently collateralized loan positions, and quickly seize the qualification of liquidator to complete the strong acid and vitality after discovery.

-

NFT Minting: Earn high-value NFTs by grabbing a front-row minter spot during NFT minting events.

-

空投 collection and selling: After the airdrop is available, quickly collect the airdrop and sell it at a very early stage to obtain a relatively high selling price.

There are many other examples of MEV, but they are all essentially about preempting the order of transactions to maximize personal gains. Discussions on MEV initially focused on Ethereum, but it also exists in blockchain networks such as Solana. Because of the transaction processing mechanism of the Solana network itself, the MEV problem on Solana is not exactly the same as that on Ethereum.

Compared to Ethereum, Solana is different in that:

(1) There is no public mempool: transactions are sent directly to validators, who process them immediately, whereas on Ethereum they are first stored in a public transaction pool waiting for miners to include them in blocks;

(2) Transactions are processed according to the first-in, first-out (FIFO) principle, that is, they are processed in the order in which they arrive. Miners on Ethereum can freely select and sort transactions, and Ethereum will give priority to processing transactions with high gas fees.

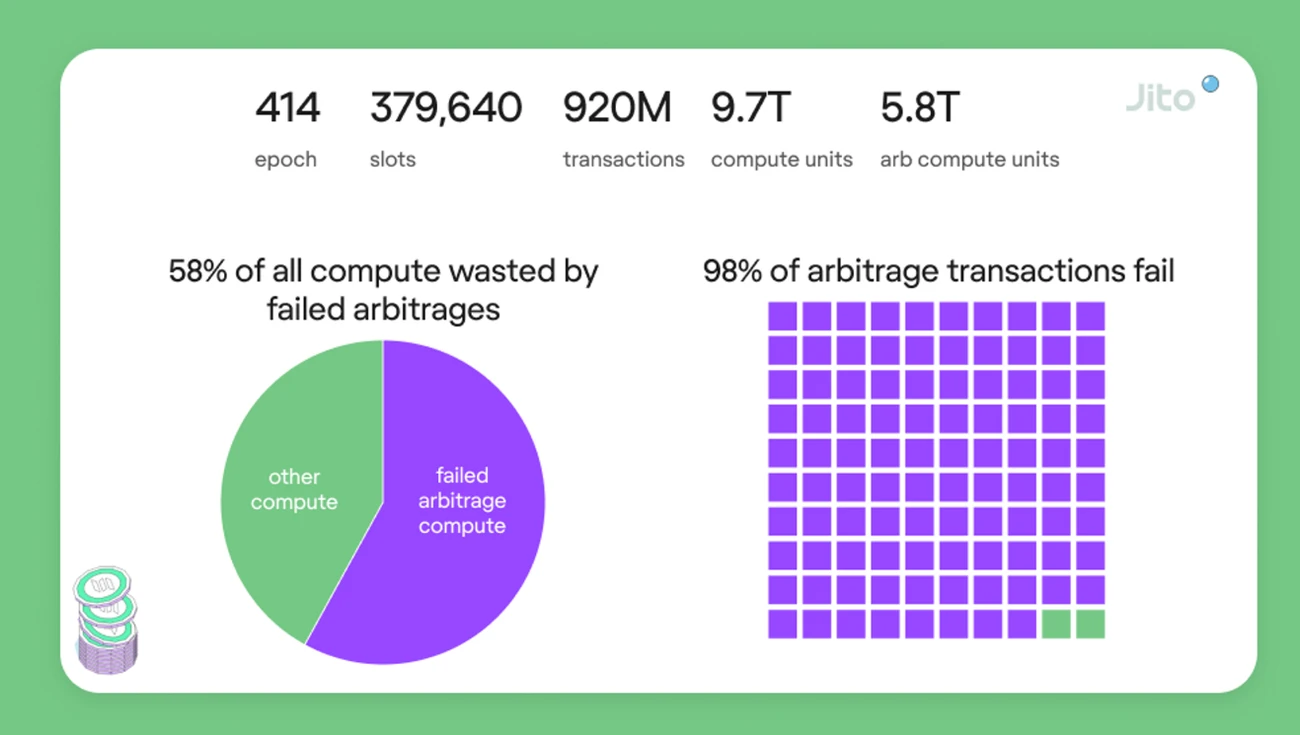

Therefore, Solanas competition for transaction order has changed from high fees to low latency, not through competition for gas fees, but to strive to reach the validator first. In addition, Solanas transaction fees are very low. In order to win priority, robots will send a large number of junk transactions to Solana, and only the first one executed among the same transactions will be completed, and the rest will fail. According to Jito Networks statistics, in Epoch 414, 60% of the block calculations were occupied by invalid arbitrage transactions, and more than 98% of arbitrage transactions failed, which caused Solana validators to use a large amount of computing resources to process failed transactions, greatly wasting computing resources and reducing network efficiency.

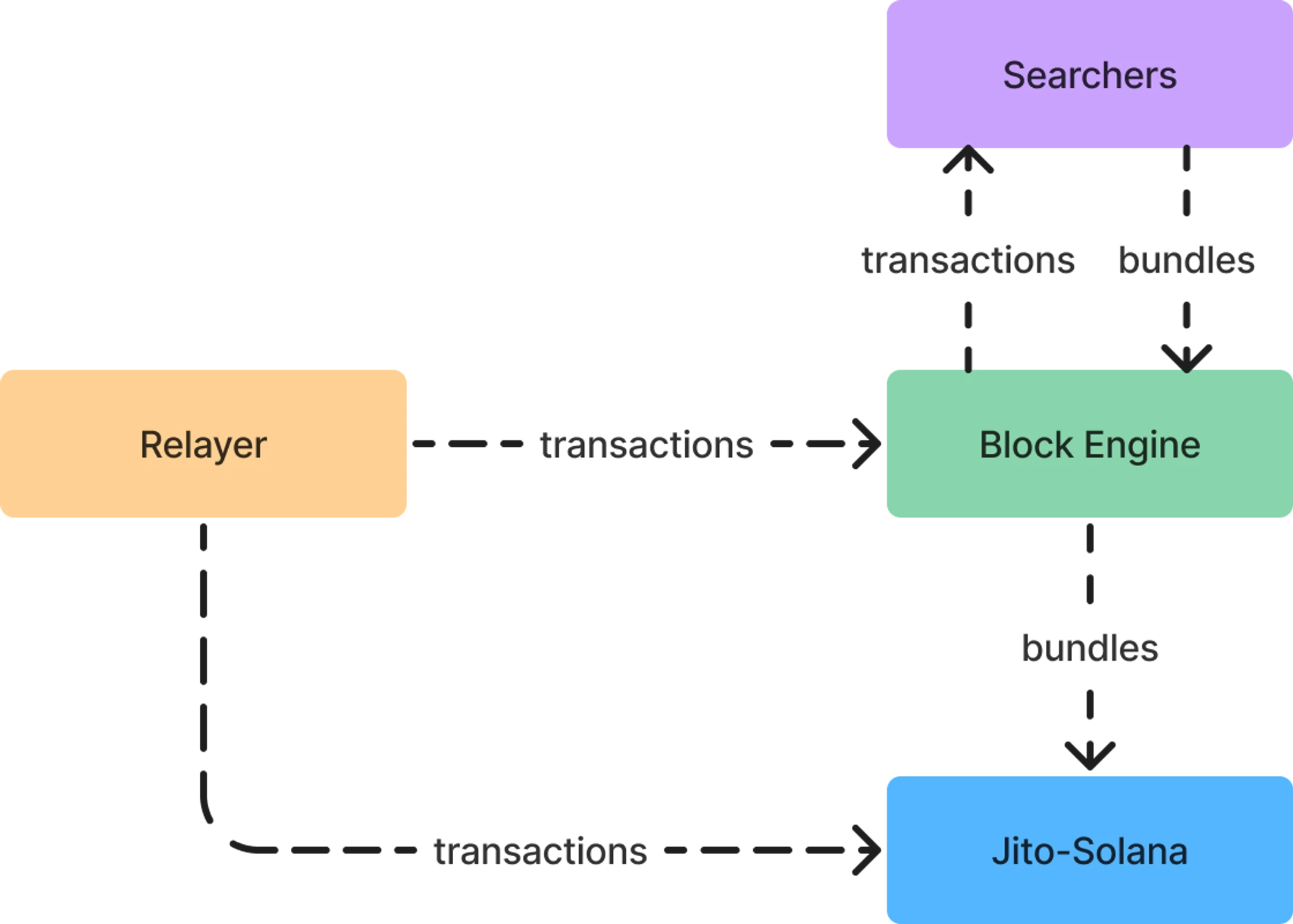

In order to reduce Solanas occupation by invalid junk transactions, Jito reshapes Solanas MEV landscape by introducing mempool and block space auctions. The basic architecture of Jitos solution is shown in the figure below, which includes four main components: Searchers, Relayers, Block Engines, and Jito-Solana verification clients. The relayer first completes the filtering of transaction data and the signature verification of transactions, and then hands the transaction data to the block engine and verification client; the searcher submits the expected execution Bundles (a set of transactions that have been sorted, and the verifier must execute the set of transactions completely in order. The execution of this set of transactions is atomic, that is, either all are executed, and once a transaction fails, the Bundle will not be executed) and Tips (that is, the fee to incentivize the verifier to execute the Bundle). The block engine finds the most profitable one among the many submitted Bundles and hands it over to the verifier, who completes the execution of the transaction.

1.2 MEV business data overview

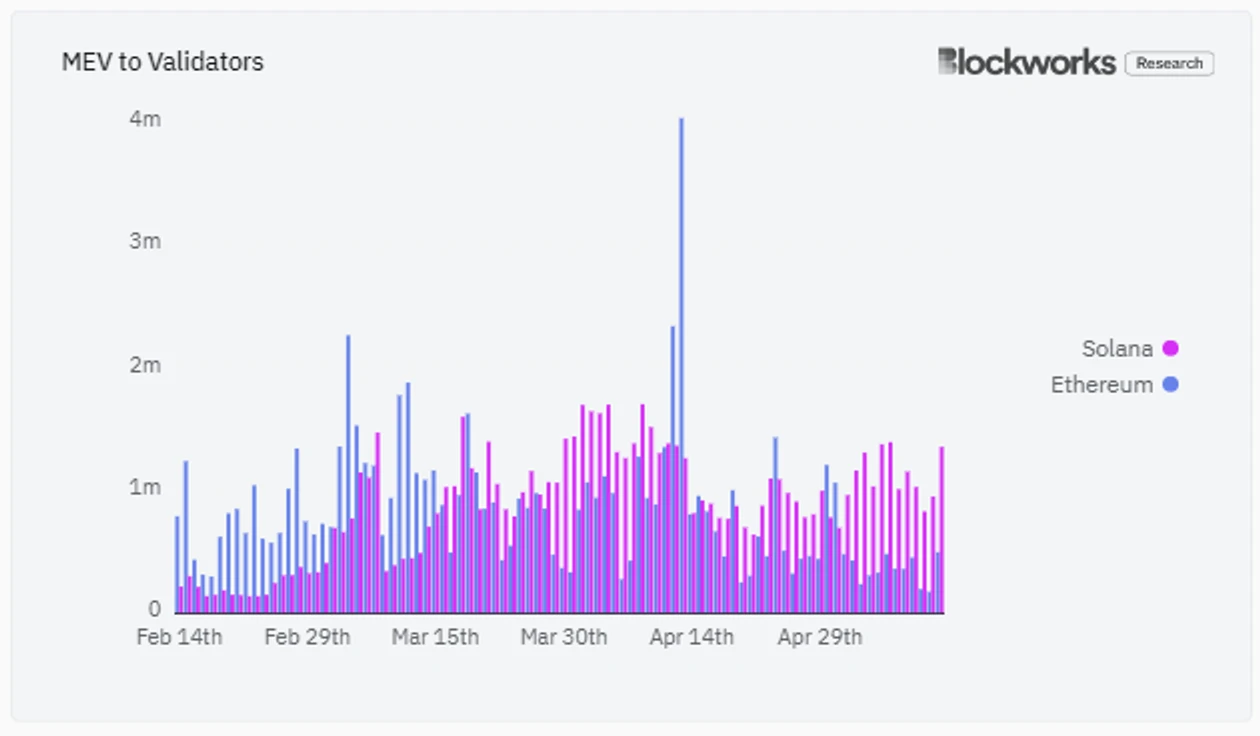

Judging from the data, MEV revenue on the Solana chain is growing rapidly, and Jito鈥檚 ability to capture MEV on Solana is also increasing.

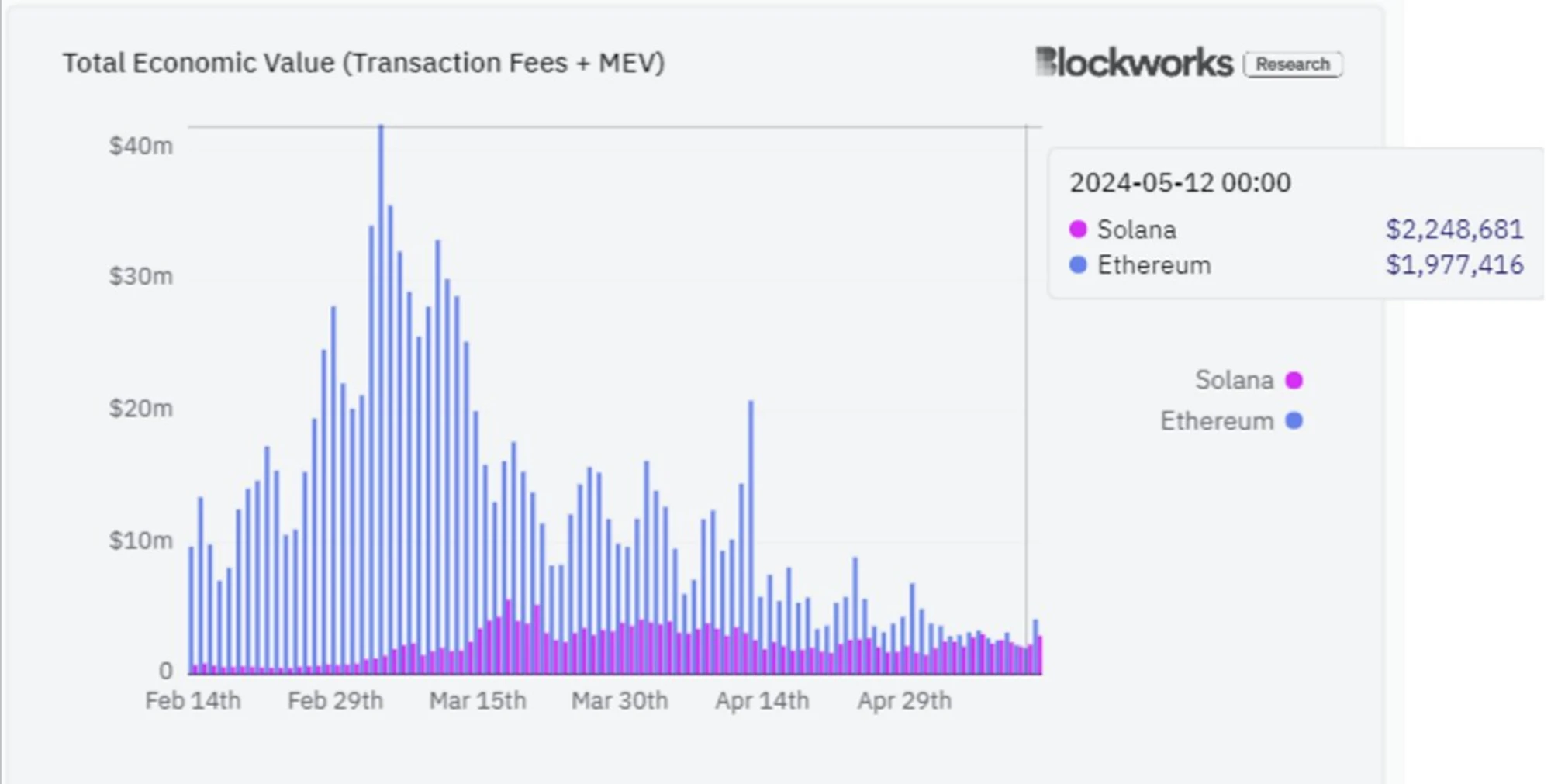

According to Blockworks Research data, starting in March 2024, the MEV income earned by validators on Solana began to exceed that of Ethereum, and began to significantly lead Ethereum in May. On May 12, the total economic value (transaction fees + MEV income) generated by Solana in one day exceeded that of Ethereum for the first time. The craze for meme tokens on Solana has increased the opportunities for MEV, especially after the birth of pump.fun. The life cycle of a meme token may be only a few minutes, which makes the transaction order particularly important. For example, some devs need to accumulate their own chips when creating tokens, and buy them in multiple wallets at the moment of token creation. This has strict requirements on the transaction order, and when encountering the transaction fomo period, jito tip will also fluctuate greatly.

Solana MEV growth has been largely captured by Jito Network. According to news data, the adoption rate of the Jito-Solana client has exceeded 78%, while this figure was only 31% at the end of 2023, which means that most validators have adopted Jito to provide MEV solutions. Jitos MEV revenue also reflects this. The number of bundles submitted daily on Jito is increasing rapidly, reaching more than 9M on June 14. The resulting daily Tips income and income rewards given to stakers are also increasing rapidly. The current daily Tips number has exceeded 10,000 SOL for many days, and even reached 16,000 SOL on June 7.

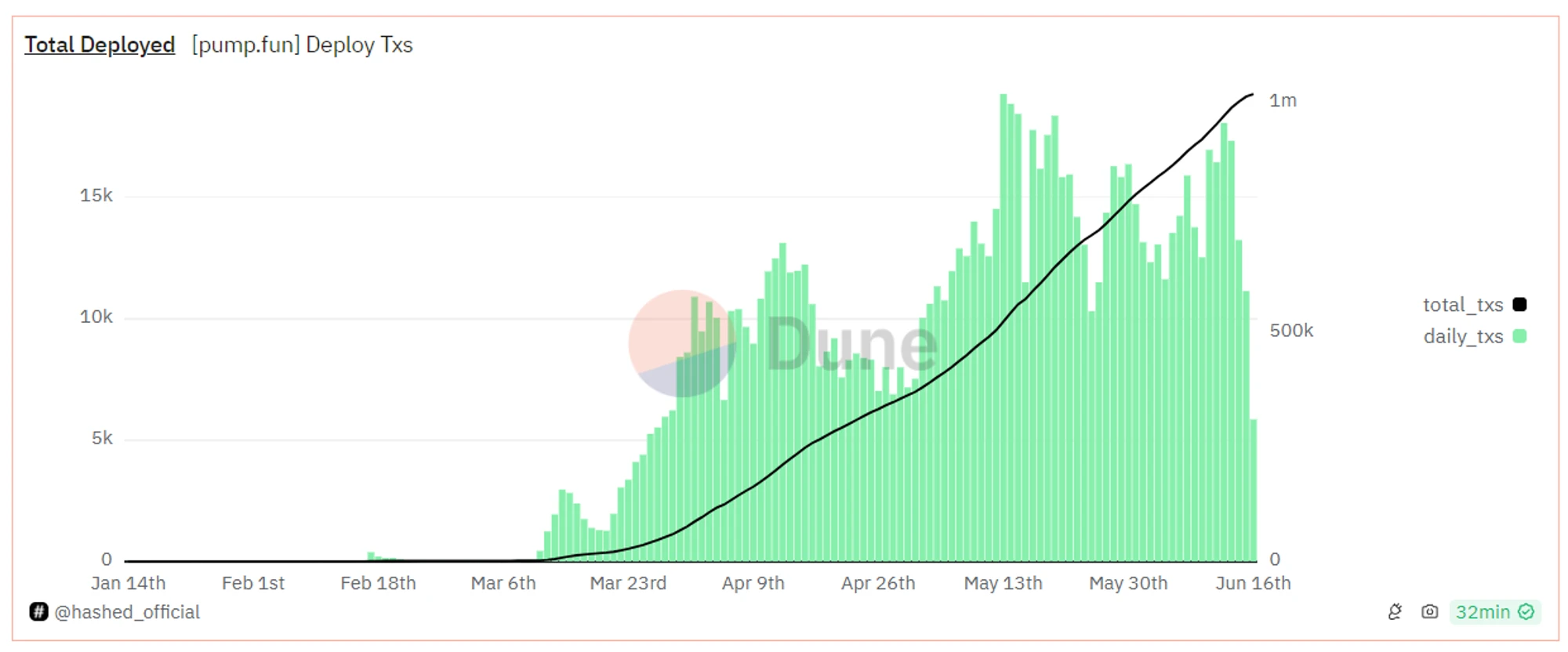

The recovery of the Solana ecosystem has brought about the recovery of MEV, and the surge in trading volume brought about by the MEME craze has directly driven the surge in MEV revenue. The enthusiasm for MEME token trading has not been frustrated by the cold market in recent months. Taking pump.fun data as an example, the tokens deployed since April have been at a relatively high level, and transaction fees and revenue have remained relatively stable. The enthusiasm for MEME token trading has ensured that MEV revenue has remained at a high level to a certain extent. On March 9, 2024, Jito Labs officially posted on social media that due to the negative externalities caused to users, Jito suspended the use of mempool, which reduced user losses caused by transaction sorting and sandwich attacks. From the data, this move did not have much impact on Jitos MEV revenue.

2 Liquidity pledge: quickly seize market share and become the leader

2.1 Solana Liquidity Staking Market Structure

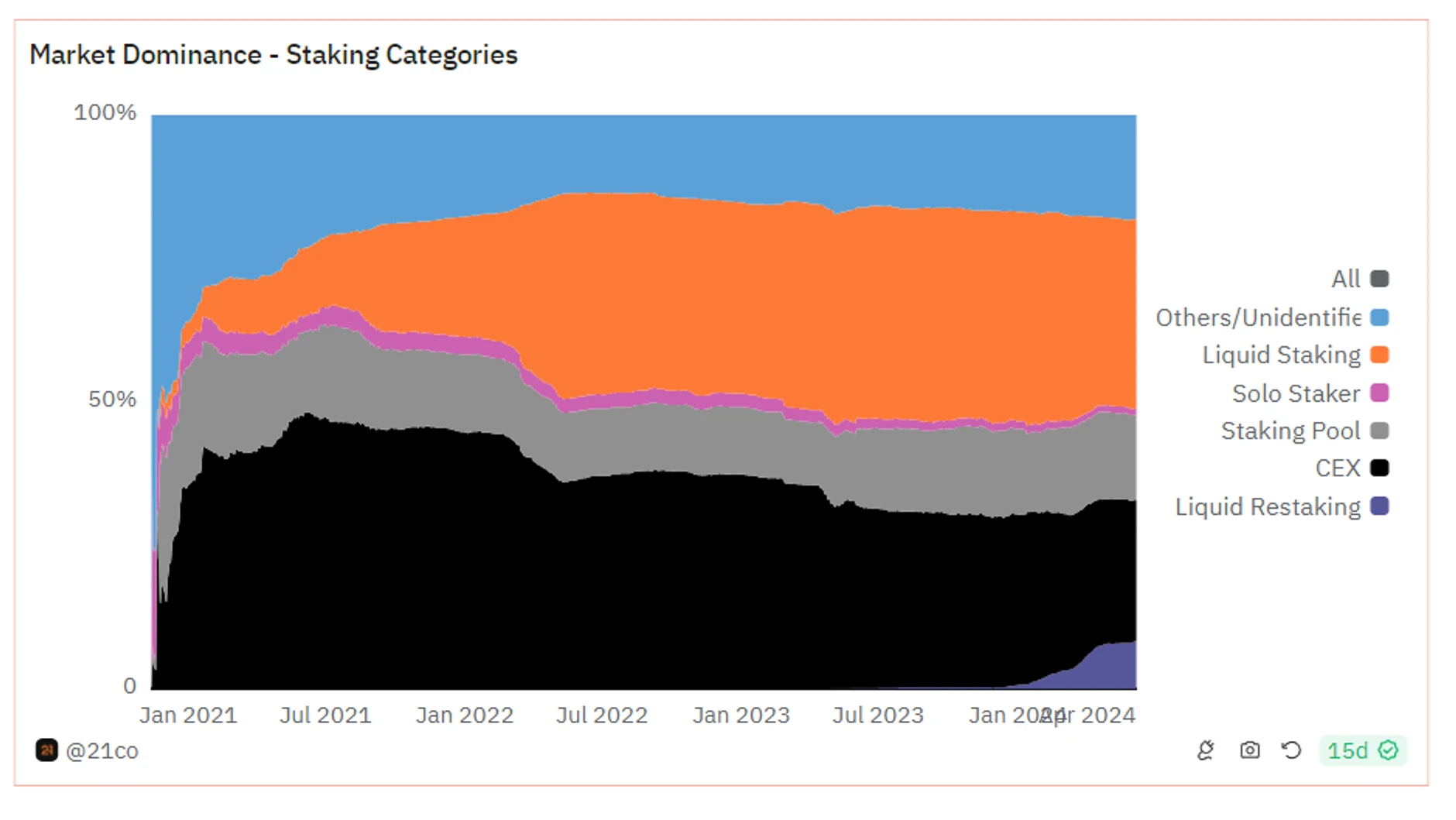

Compared to Ethereum, Solanas liquidity staking track has developed quite slowly. Lets look at a set of data: Solanas staking ratio exceeds 65%, while Ethereums staking ratio is only about 27% (Coinbase data), but about 95% of Solanas staking is native staking, and nearly half of Staked ETH chooses liquidity staking and liquidity re-staking.

This difference is determined by the technical and ecological differences between the two chains:

(1) Ethereum has a minimum staking requirement to become a validator: 32 ETH, while Solana has no minimum staking requirement, thus lowering the threshold to become a validator;

(2) The Ethereum native protocol does not support delegated staking, which means that ordinary users cannot directly delegate staking to a validator through Ethereum. They can only achieve delegated staking through other third-party protocols. If you want to achieve native staking, you can only run a validator yourself, which requires 32 ETH;

(3) The slashing mechanism has not yet taken effect on Solana, so for ordinary users, choosing a validator is not very important. However, due to the existence of the slashing mechanism on Ethereum, users must carefully choose validators, otherwise they will pay the price for the validators mistakes. This requires a third-party protocol to provide this service to ordinary users, namely the staking pool;

(4) The DeFi ecosystem on Solana is not yet mature, so even if you hold LST assets, there are few channels for farming. Without the temptation of sufficient yield, users have little demand for holding LST assets. However, the DeFi ecosystem on Ethereum is very rich. LST assets, led by stETH, have been used as basic underlying assets by most DeFi protocols. DeFi protocols are stacked layer by layer, and users leverage and yield can be multiplied.

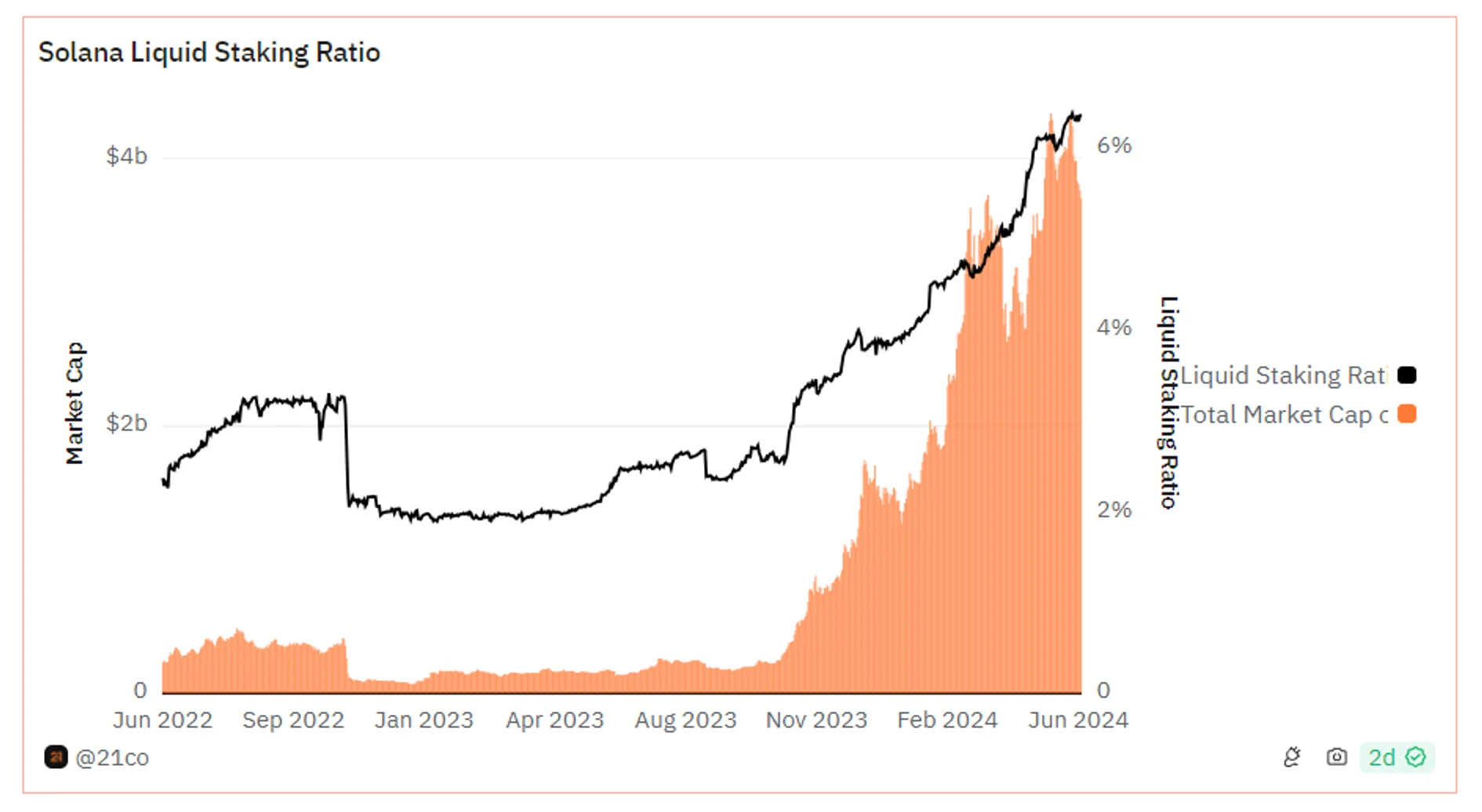

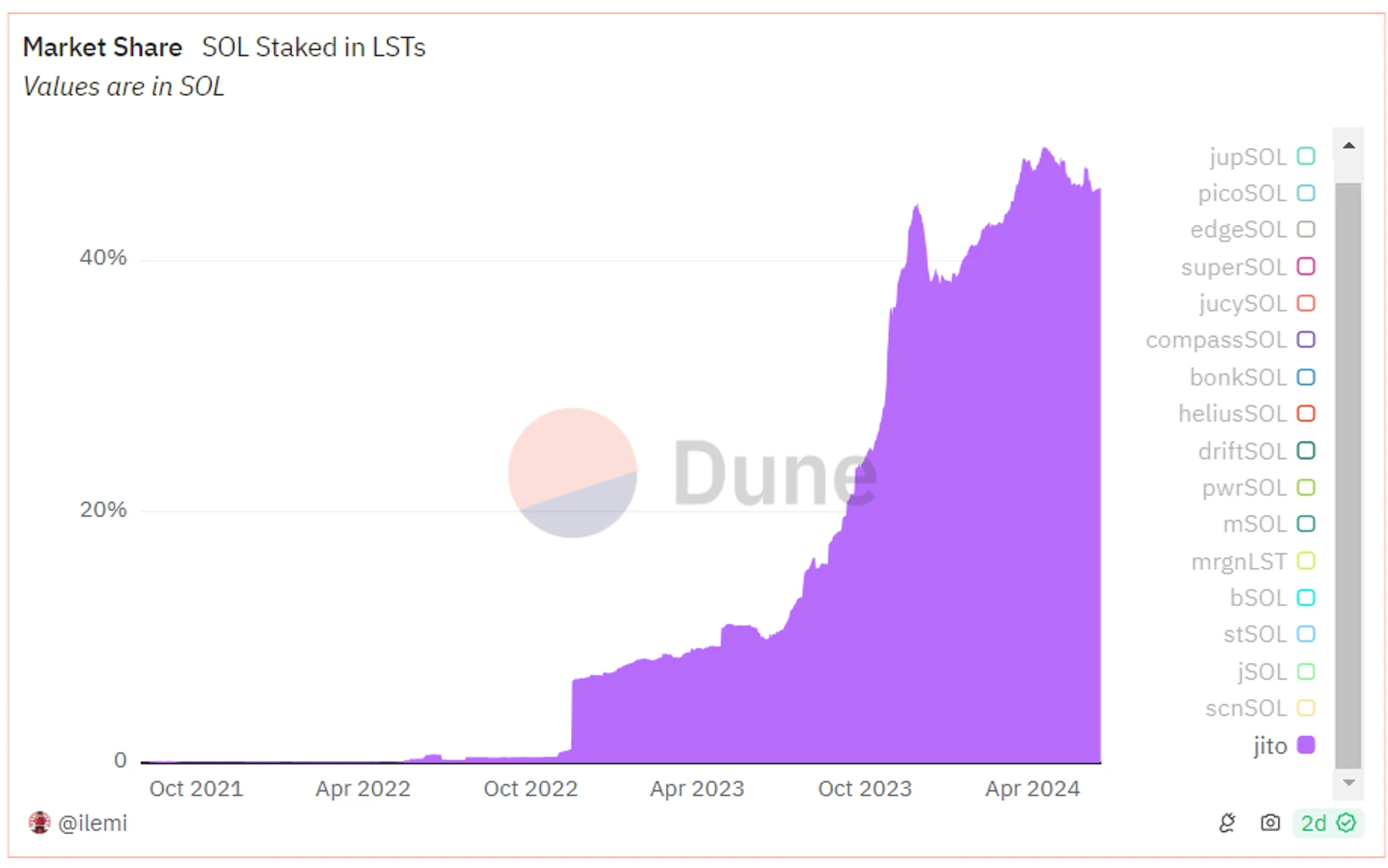

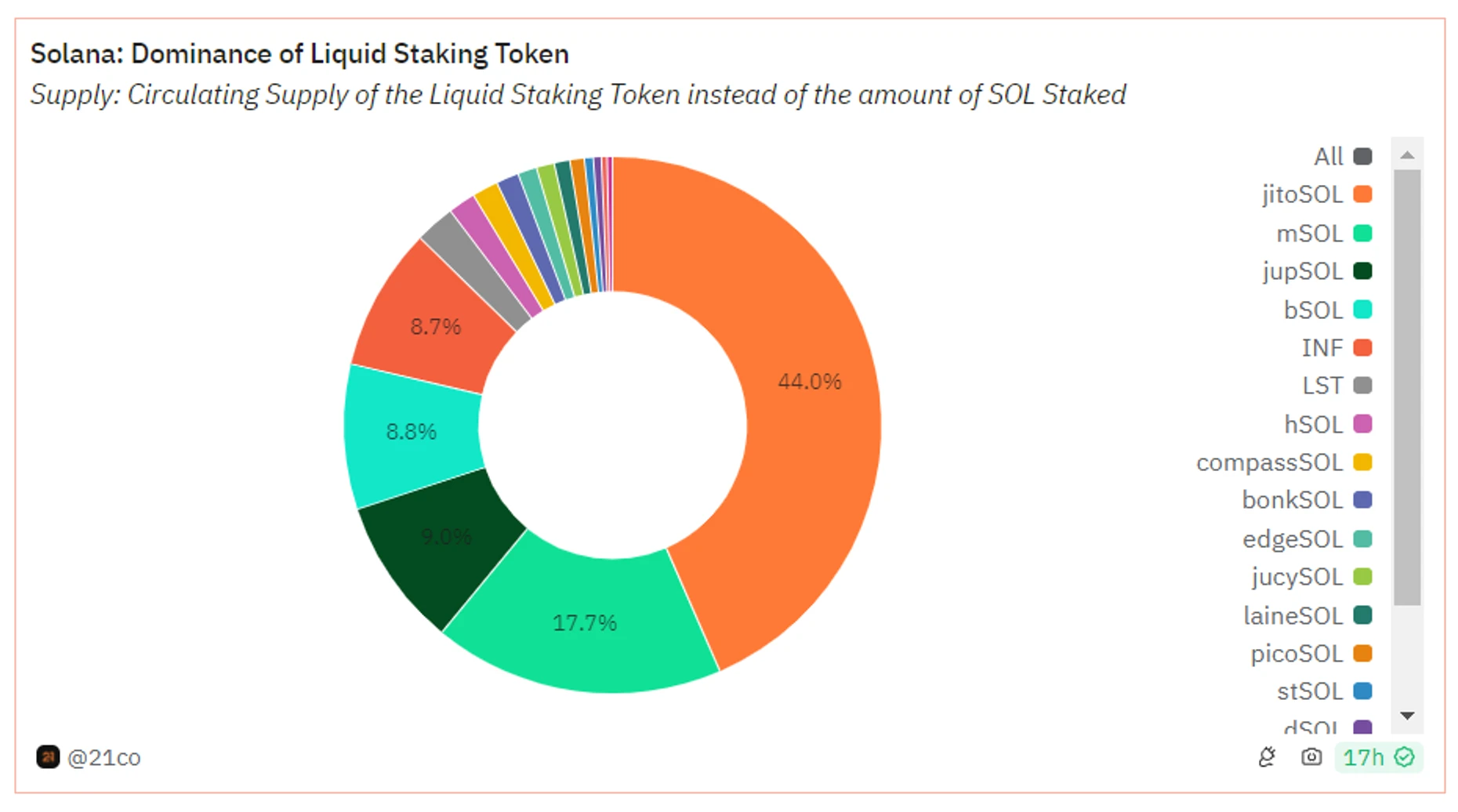

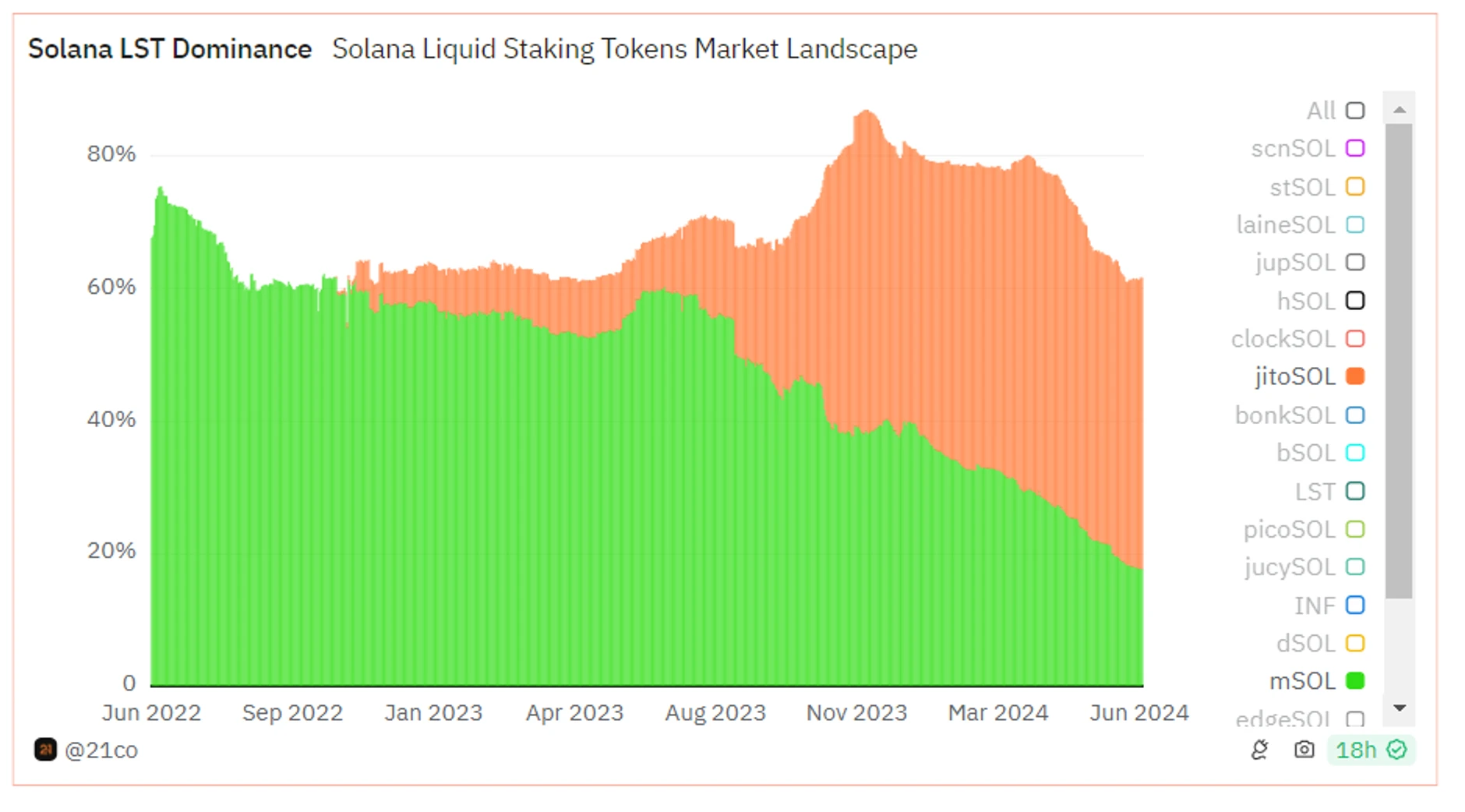

Therefore, users on Solana do not have a strong demand for liquidity staking, and user habits have not yet been cultivated. However, judging from the existing data, the proportion of liquidity staking on Solana is steadily increasing, from about 2% in June 2023 to the current 6.38%, an increase of about three times in one year. In terms of the market share of LST assets, stSOL and mSOL once divided the world, but with Lidos withdrawal from the Solana ecosystem and Jitos rapid competition for market share, JitoSOL currently accounts for more than 40%, which is about 2.5 times that of the second-place mSOL. The business landscape of Solanas liquidity staking proves Jitos dominance, and also shows through data that Jito still has great room for growth in its liquidity staking business.

2.2 Overview of Jito Liquidity Staking Business Data

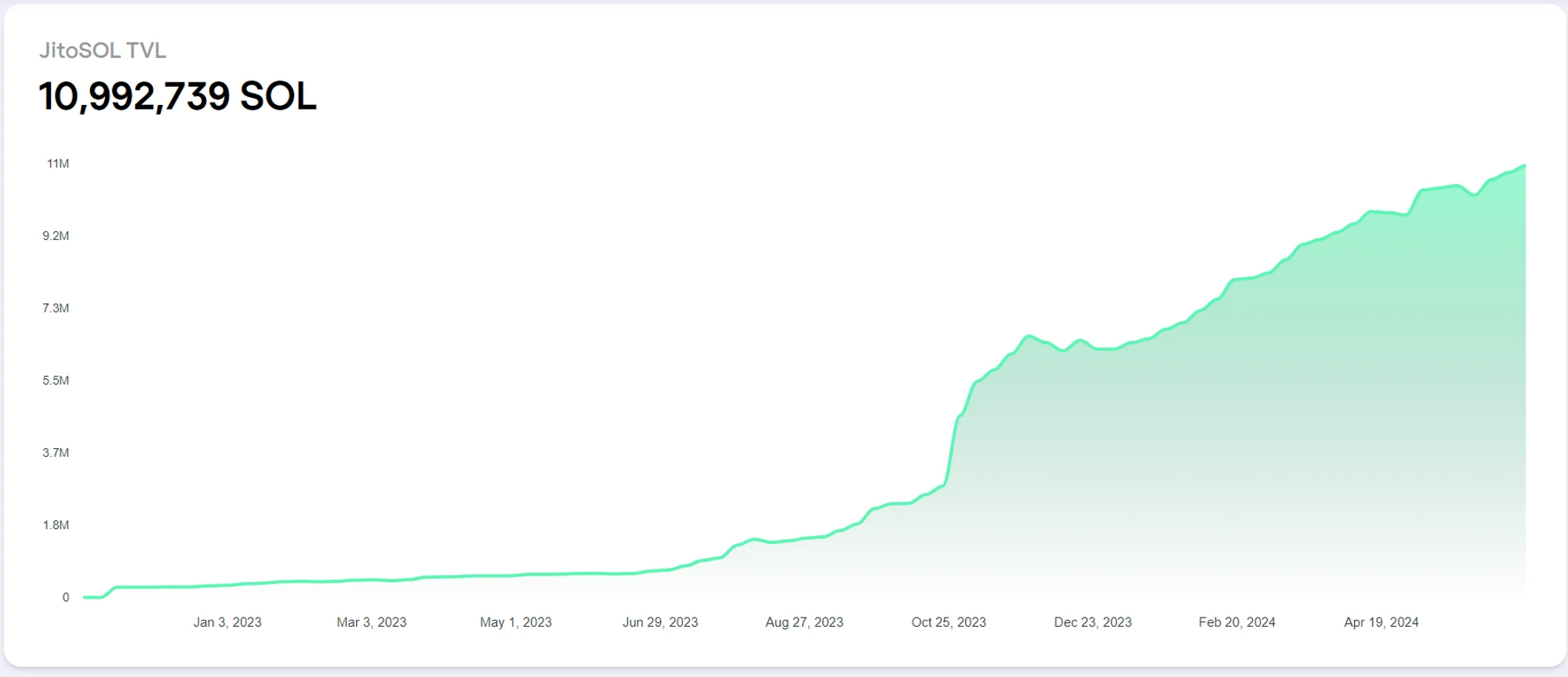

Jitos liquidity staking business is growing rapidly – JitoSOLs TVL and market share are both growing rapidly. From September 15, 2023 to November 25, 2023, Jito launched a points plan to reward users who hold and use JitoSOL in DeFi protocols, and corresponding airdrops will be distributed. This will cause JitoSOL TVL to enter a period of rapid growth after September 2023, and also complete the market surpassing mSOL. After the airdrop distribution, TVL and market share showed a slight decline and entered a relatively stable growth period. At present, Jitos TVL has exceeded 1.6 billion US dollars, becoming the protocol with the highest TVL in the Solana ecosystem.

JitoSOLs staking APY is currently 8.26%. This APY consists of two parts: Solana staking yield and MEV revenue sharing. 5% of the MEV Tips received by Jito go to the Jito protocol, and 95% go to the validator. Most of the MEV Tips received by the validator will be given to the delegated staker. MEV APY is relatively unstable, and can reach a yield of 1.5% when the on-chain transaction volume is large.

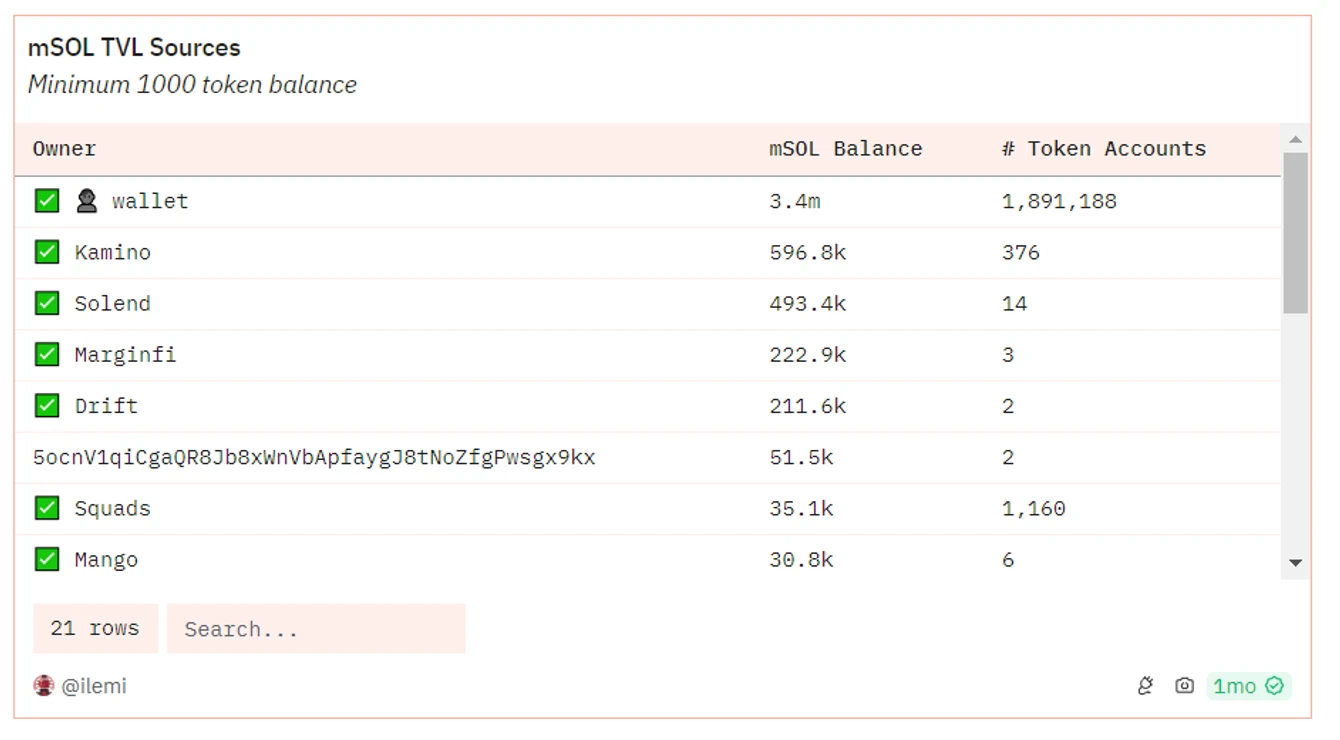

In terms of LST usage scenarios, JitoSOLs DeFi protocol integration is expanding rapidly. Currently, the protocols with the highest TVL are Kamino and Drift. However, it is noted that more than 60% of JitoSOL still exists in wallets, which means that the significance of liquid pledged assets has not been realized. If Jito wants to develop its business, its top priority is still to expand Farming channels and security and increase mining incentives.

2.3 Competition Landscape Analysis

According to the market share of Solana ecosystem liquidity staking protocols, the second protocol currently comparable to Jito is Marinade.Finance, while bSOL, jupSOL and INF each account for about one-fifth of JitoSOL, and their current competitiveness is relatively weak. Here we mainly conduct a comparative analysis of Marinade and Jito.

From the perspective of business differences, both Jito and Marinade support liquidity staking, and Marinade provides two service modes: liquidity staking and native staking. Marinade native staking can help users choose better validators and reduce user screening costs, but because Solana naturally supports native staking and has no penalty mechanism, third-party native staking services do not solve pain points and cannot generate revenue for the protocol. Jitos advantage is reflected in its leading position in the MEV field, but MEV revenue is not exclusive to JitoSOL holders. According to Marinade documents, as long as users stake to jito-solana validators through protocol delegation, they can get a share of MEV revenue, but considering the relationship between jito-solana validators and Jito Labs, relevant validators will still have stronger loyalty to Jito.

Judging from the changes in business data, jitoSOL has rapidly seized the market share of mSOL since August 2023. The airdrop points plan started in September accelerated this trend. The expansion trend of jitoSOLs market share entered a deceleration period after the airdrop was issued at the end of 2023, but mSOLs market share continued to decline, and there is no sign of easing at present, and business expansion has been obviously hindered.

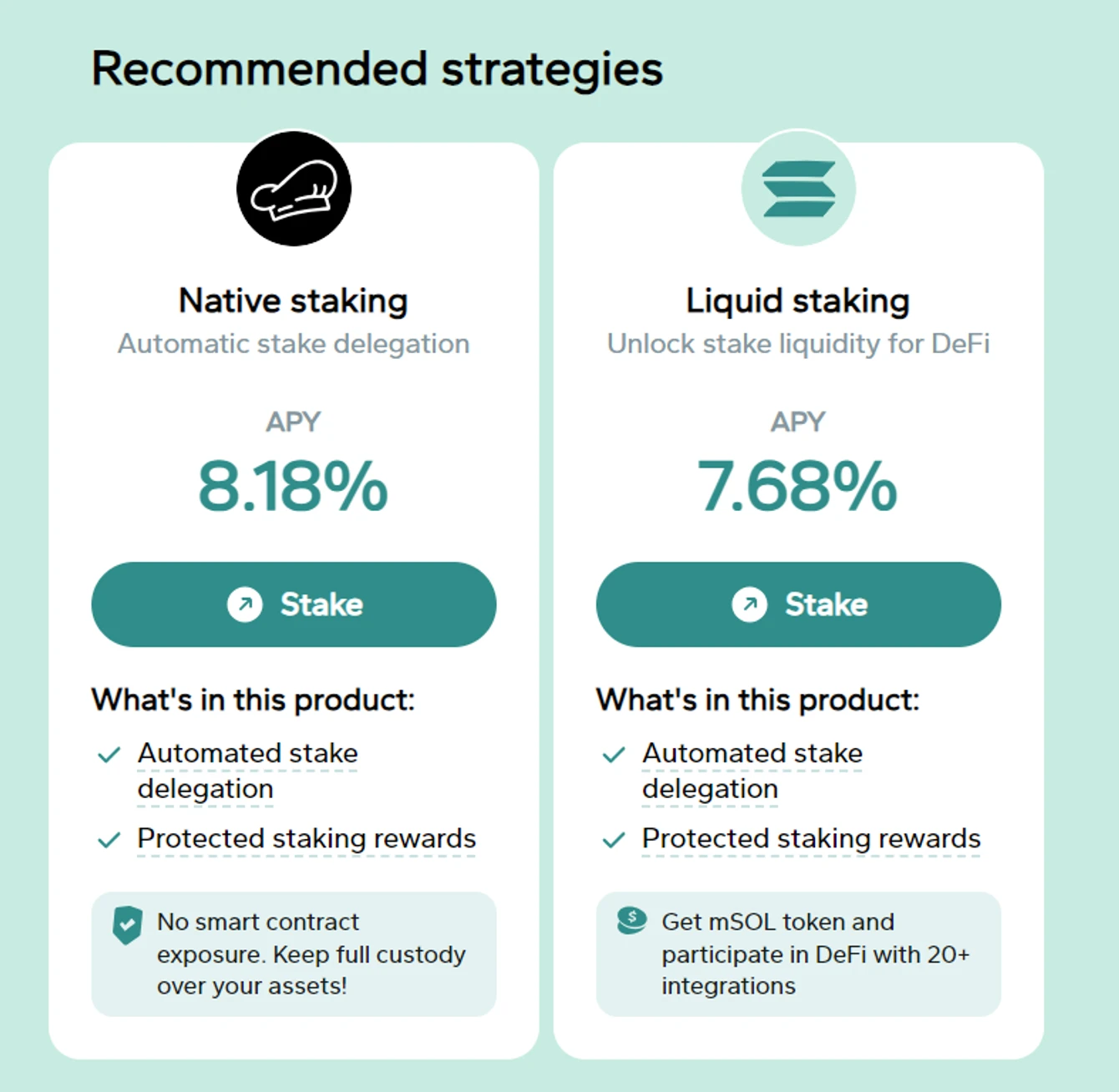

In terms of yield, Jito currently provides users with an APY of 8.26%, while Marinades native staking APY is 8.18%. Since the protocol charges a 6% management fee for mSOL, the APY of liquidity staking is slightly lower, at only 7.68%. Relatively speaking, the difference between the two is not large.

In terms of the integration of DeFi protocols, the total amount of mSOL is currently about 5.5 M, of which 3.4 M is distributed in wallets, accounting for about 61.8%, which is not much different from JitoSOL. Since Solana has fewer DeFi ecological protocols, the main farming strategies of the two are not much different. Both provide liquidity for various currency pairs in major DEXs, and use mSOL as collateral assets or lend mSOL in lending agreements. mSOLs strategy is relatively richer. For example, mSOL has integrated multiple CEXs, including Coinbase, Gate, etc., which is more convenient in exchange with SOL. In addition, it also integrates option trading, NFT purchases, etc.

From the perspective of token economics, the uses of the two tokens are similar, both of which are protocol-related governance functions and liquidity mining emissions for DeFi Farming. Currently, the third season of Marinade Earn is about to start, and 25M MNDE tokens will be provided to incentivize users to participate in specific Farming strategies.

Finally, from the comparison of valuation and TVL, Marinade and Jito have similar TVL, but the market value is less than one-tenth of Jito. From the business data, Marinade is relatively undervalued. However, from the perspective of currency price, MNDE has only doubled from the past year to now, and has not kept up with the rising trend of SOL. In the past 6 months, it has even fallen by 50%. The lack of maintenance of the currency price by the team and market makers has also caused it to gradually lose market attention (data time: June 22).

Based on the above analysis, Jito launched the airdrop points plan in September 2023, just when the Solana ecosystem was in a state of disrepair. At that time, its only competitors were Lido and Marinade. As Lido withdrew from Solana, Jito quickly seized this market share, and the airdrop points plan was in step with Solanas recovery, so it captured new funds in this recovery process and quickly surpassed Marinade. Marinade currently lacks the ability to compete with Jito in terms of business data and token prices, but it should be noted that the market is no longer a two-tiger fight between Jito and Marinade. Solanas recovery has attracted more liquidity staking protocols. The two new competitors, jupSOL and INF, have performed well, with current APYs exceeding 9%, leading similar protocols, and quickly grabbing nearly 20% of the market share. Among them, jupSOL is backed by the DeFi leader Jupiter, and the team provides 100k SOL staking, and distributes the staking income to jupSOL holders to increase returns; Sanctum, to which INF belongs, is an LST liquidity solution, and INF can share transaction fees on the Sanctum platform. This unique business makes INFs yield rate ahead of other solutions, and it is exclusive to INF holders. In comparison, although Jito has a leading MEV business, MEV rewards are not exclusive benefits for jitoSOL holders. After the airdrop, jitoSOLs TVL expansion is slightly weak, and we need to be wary of market competition from new competitors and quickly adopt new incentives to ensure continued business expansion.

3 Token Economics and Price Performance

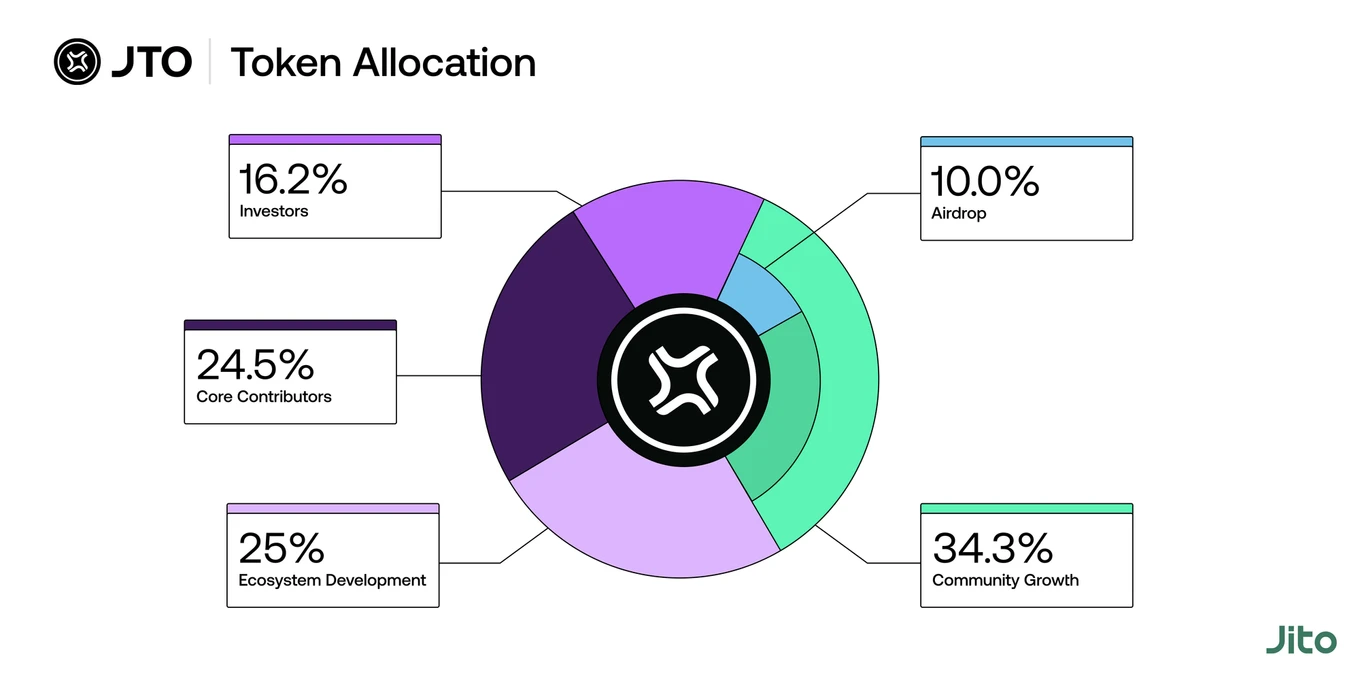

On November 25, 2023, the Jito Foundation announced the launch of the JTO governance token. The total supply of JTO is 1 B, and the distribution is shown in the following figure:

-

10% (100 million) for retroactive airdrops, of which 80% (80 million) are airdropped to JitoSOL point users, 15% (15 million) are airdropped to Jito-Solana validators, and 5% (5 million) are allocated to Jito MEV searchers. 90% of these airdrops are unlocked immediately, and the remaining 10% will be released linearly within one year;

-

24.3% is determined by DAO governance to determine the usage and distribution speed;

-

25% for ecosystem development, including funding the community and contributors to help drive the expansion of Solana鈥檚 premier liquidity staking protocol and related network advancements, controlled by the Jito Foundation;

-

The rest is allocated to the team and investors, both with a 1-year cliff and 3-year linear unlocking.

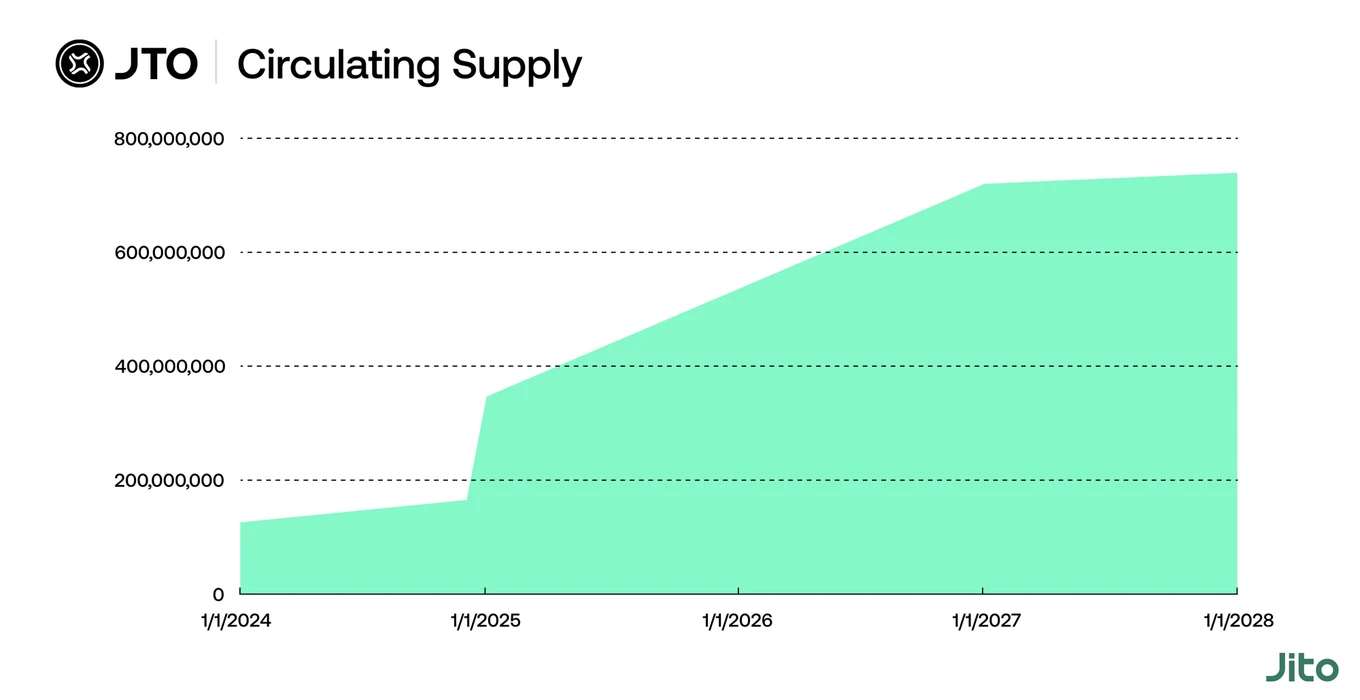

According to the distribution plan, the main inflation of JTO currently comes from the linear unlocking of 10% in the airdrop and the linear release of tokens for ecosystem development (25%). According to Token Unlock data, the daily token release is about 198.44k JTO. Due to the one-year cliff of investors and the team, JTO will not usher in a large amount of unlocking in the next six months, and the first unlocking will be in December 2024.

From the perspective of token usage, JTO currently does not have many practical functions and is mainly used for governance voting. In addition, JTO is used as an incentive for liquidity mining on Kamino and Meteora to increase JitoSOLs DeFi income.

From the perspective of coin price performance, JTO basically maintains the same trend as SOL. Here we compare SOL, JTO and JUP, which is also regarded as Solana Beta. It can be seen that in the past three months, the trends of the three are basically similar, but the fluctuation of JTOs coin price is significantly higher than the other two. Taking JTO as a Solana Beta investment target will be a higher risk and return choice. At present, the overall Solana ecosystem is weakening, partly due to the expected speculation of ETH ETF, which has caused the market focus to shift. From the trend of JTO, it has experienced a breakout growth after about two months of washing after its launch, and has fallen twice to around 2.3-2.7. At present, from the perspective of the chip range and K-line trend, this range is a strong support level for JTO, and it is currently at the low end of this range (data time: June 22).

4 Summary: Jito鈥檚 investment points

Based on the above analysis, the key points of Jitos investment are summarized as follows:

-

Business fundamentals: Jitos core business is liquidity staking and MEV. The core data include Solanas overall MEV growth, the usage ratio of Jito-Solana validators, and JitoSOLs TVL and market share. MEV income increases the yield of liquidity staking, but this is not Jitos monopoly advantage. Other LSD protocols staked in Jito-Solana validators can also obtain MEV income. JitoSOLs data growth is the most important for Jito. When LST APY is not much different, the primary competitiveness is reflected in DeFi protocol integration, strategy richness and security.

-

Competitive landscape analysis: JitoSOL has expanded rapidly in the market over the past year, thanks to (1) the points airdrop plan; (2) the rapid recovery of the Solana ecosystem; and (3) the lack of development of early liquidity staking protocols. These three factors combined in the same period contributed to JitoSOLs success. However, with the completion of the airdrop and the increase in competitors in the field, JitoSOLs market expansion is currently more difficult, and we need to continue to pay attention to the competition between Jito and emerging protocols.

-

Token economy and price analysis: As a governance token, JTO itself does not have much empowerment other than governance functions, and does not have any means of value capture. JTOs current main inflation comes from liquidity mining on the DeFi protocol. The higher the incentive, the greater the user demand for jitoSOL, thereby increasing TVL to attract users to invest in JTO, so the team has a certain need to pull the market. From the perspective of price analysis, JTO basically maintains the same token trend as SOL, but with higher volatility. Compared with JUP, which we have analyzed before, JTO has stronger business growth and higher price volatility. It is a target with higher risk and yield in the Solana ecosystem. At present, the overall trend of altcoins and Solana ecology is not strong, and JTO has fallen below the main support level. Waiting for signs of reversal may be a better trading opportunity.

关于我们

Metrics Ventures 是一家数据和研究驱动的加密资产二级市场流动性基金,由经验丰富的加密专业人士团队领导。团队擅长一级市场孵化和二级市场交易,并通过深入的链上/链下数据分析积极推动行业发展。MVC 与加密社区的资深影响者合作,为项目提供长期赋能支持,如媒体和 KOL 资源、生态合作资源、项目策略、经济模型咨询能力等。

欢迎大家来到DM分享和讨论有关加密资产市场和投资的见解和想法。

我们的研究内容将在Twitter和Notion上同步发布,欢迎关注:

推特: https://twitter.com/MetricsVentures

Hiring! We are looking for traders with good salary and flexible working location.

If you: have bought sol below 40/ ordi below 25/ inj below 14/ rndr below 3.2/ tia below 10 and meet any two of the above, please contact us at admin@metrics.ventures, ops@metrics.ventures

This article is sourced from the internet: Metrics Ventures Alpha: In the fiercely competitive Solana LSD track, can Jito stand out?

Related: BTC Ecosystem Tool Guide: Track Smart Money Movements and Grab the Next 100x Rune

In the Bitcoin ecosystem, rune market tools have gradually become the secret weapon for some investors to achieve high returns. For example, as of the time of writing, the BILLION鈥OLLAR鈥AT rune has achieved a hundredfold return from its initial price after it was minted to its highest point. As shown in the figure, the current price of this rune is 87.48 sats, while the market value is as high as $54.19 M, the 24-hour trading volume has reached $767.05 K, and the number of holders is 4,294. These data fully demonstrate the huge market potential and active trading of runes. However, such high-yield opportunities are still a secret in a small circle, and many community friends who have not deeply cultivated the Bitcoin ecosystem may not be aware of the…