原文作者:IOSG Ventures

背景

Currently, the Ethereum Rollup L2 ecosystem is taking shape, with an overall daily TVL of more than $37b, more than three times that of Solana and more than one-third of that of Ethereum. From the users perspective, the recent average daily number of users of mainstream L2 has reached 158k, exceeding Solanas data by about 100k.

However, the short-term performance of Rollups is not as expected. In terms of market value, among the mainstream Rollups, Arbitrum has a market value of $7.8b, Optimism has a market value of $7.3b, Starknet has a market value of $6.9b, and zkSync, which has just completed an airdrop, has a FDV of $3.5b, while Solanas FDV reached $74b during the same period. zkSync was recently launched, and its poor market performance did not meet the markets expectations for Rollups.

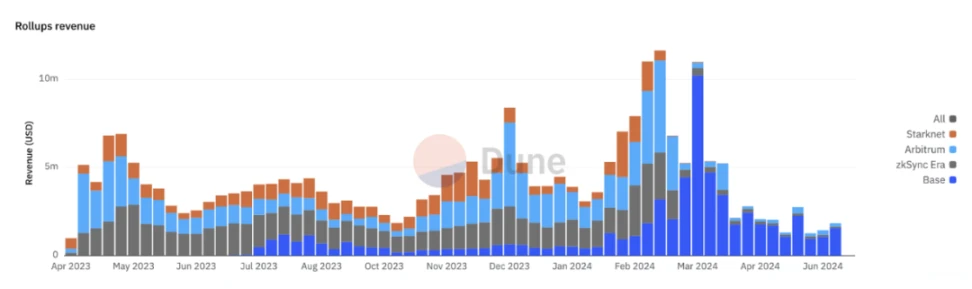

From the perspective of revenue, Ethereums revenue in 2023 reached $2b, while Arbitrum and Op Mainnet, which performed well in the same year, had annual revenues of $63m and $37m, respectively, which is a big gap with Ethereum. Base and zkSync, which entered the market this year and performed well, respectively earned $50m and $23m in revenue in the first half of 2024, while Ethereum generated $1.39b in revenue in the same period, and the gap has not narrowed. Rollups have not yet achieved a revenue scale comparable to Ethereum.

The low activity of some Rollups is certainly a reason, and this is a problem faced by most public chains. What we want to know more is how well Rollups have fulfilled their mission as mass adoption infrastructure, and whether their value is underestimated due to their current low activity?

Everything still has to go back to the earliest proposition. The birth of Rollups originated from the increasing congestion of Ethereum, and the fees reached a level that users could not accept. Therefore, Rollups came into being with the inherent purpose of reducing transaction costs. In addition to the well-known Ethereum L1-level security, the advantages of Rollups also include its disruptive cost structure, so-called the more users, the cheaper Rollups.

If this can be implemented well, we believe that Rollups will have irreplaceable value. A more reasonable cost structure can also improve the resilience of Rollups in the face of market changes. Continuous investment brought by healthy cash flow is the source of competitiveness, and protocols with advantages in profit margins will naturally have higher valuations and long-term competitiveness.

This article briefly analyzes the current economic structure of Rollups and looks forward to future possibilities.

1. The business model of Rollups

1.1 Overview

The Rollups protocol uses Sequencer as the income and expenditure point, charging users fees for transactions on Rollups to cover the costs incurred on L1 and L2, as well as to obtain additional profits.

On the revenue side, Rollups charges users the following fees:

-

Basic Fee (including congestion charge)

-

Priority Fees

-

L1 related costs

Potential fees that the protocol could capture by developing its own policies include:

-

MEV Fees

The cost side includes the L2 execution cost, which currently accounts for a small proportion, and the L1 cost, which accounts for the majority, including:

-

DA Cost

-

Verification costs

-

Communication costs

The difference between Rollups and other L2 business models lies in its cost structure. For example, the DA cost, which accounts for the largest proportion, is regarded as a variable cost that varies with the amount of data, while the verification cost and communication cost are more regarded as fixed costs to maintain the operation of Rollups.

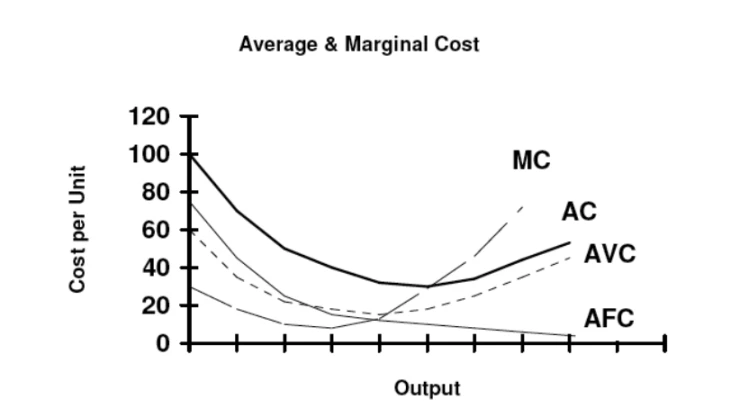

From a business model perspective, we hope to clarify the marginal cost of Rollups, that is, to what extent the additional cost of an additional transaction can be less than the average cost of each transaction, to verify the specific extent to which the more users, the cheaper the Rollup is true.

The reason behind this is that Rollups batches data, compresses data, and verifies aggregation, resulting in high efficiency and low marginal costs compared to other public chains. In theory, the fixed cost of Rollups can be well amortized to each transaction, so it can even be ignored if the transaction volume is large enough, but this also needs our verification.

1.2 Rollups Revenue

1.2.1 Transaction Fee Income

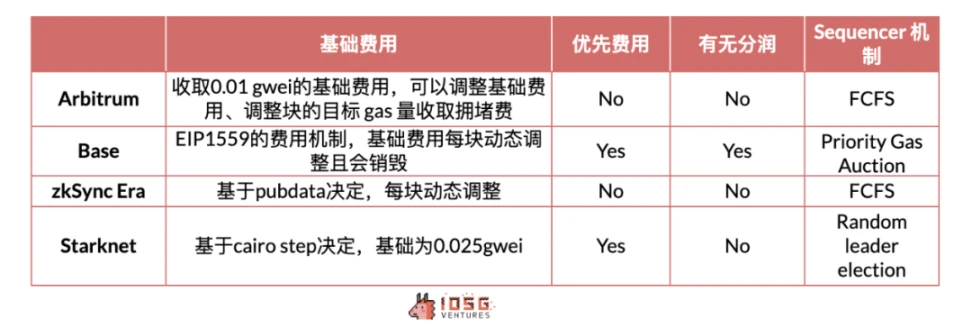

Rollups main revenue comes from transaction fees, i.e. gas. The purpose of the fees is to cover the cost of Rollups and obtain a portion of the profit to hedge the risk of long-term L1 gas changes and obtain a portion of the profit. Some L2s will charge transaction priority fees to allow users to execute urgent transactions first.

Aribtrum and zkSync adopt the FCFS mechanism, that is, the order of transaction processing is first come first served, and do not support queue jumping requests. OP stack has adopted a flexible approach to such issues, allowing queue jumping for transactions by paying priority fees.

Source: IOSG Ventures

For users, the cost of Rollups L2 is determined by the lower limit base fee when the chain is less active. When the chain is busier, each Rollups will charge a congestion fee based on the degree of congestion (often increasing exponentially).

Since Rollups have extremely low L2 overhead (only off-chain engineering and operation and maintenance costs), and the execution costs collected are highly autonomous, almost all users income from paying L2 fees will become the protocols profit. Due to the centralized operation of the Sequencer, Rollups have control over the basic fee floor, congestion fees, and priority fees. Therefore, the L2 execution fee will be a parameter game for the protocol. Under the premise that the ecosystem is relatively prosperous and the price does not arouse user disgust, the amount of execution fees can be designed at will.

Source: David_c @Dune Analytic

1.2.2 MEV Revenue

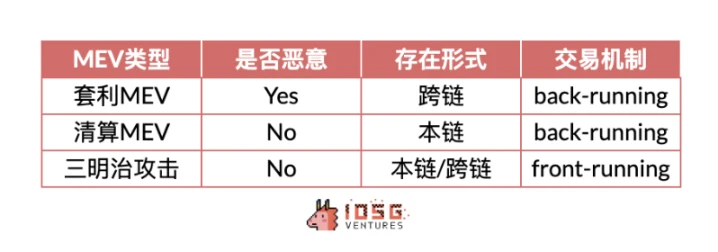

MEV transactions are divided into malicious MEV and non-malicious MEV. Malicious MEV is a front-running transaction similar to a sandwich attack, which is more about robbing the users transaction value. For example, in a sandwich attack, the attacker will insert his own transaction before the users transaction, causing the user to buy at a higher price or sell at a lower price, which is the so-called being sandwiched.

Non-malicious MEVs are back-running transactions such as arbitrage and liquidation. Arbitrage can balance prices between different exchanges and improve market efficiency; liquidation can remove bad leverage and reduce systemic risk, and is considered a beneficial MEV behavior.

Source: IOSG Ventures

Unlike Ethereum, Rollups does not provide a public mempool. Only the sorter can see transactions before they are finalized. Therefore, only the sorter has the ability to initiate MEV on the L2 chain. Since most L2s are centralized sorters, malicious MEVs are unlikely to exist for the time being. Therefore, the current MEV income will need to consider arbitrage and liquidation types.

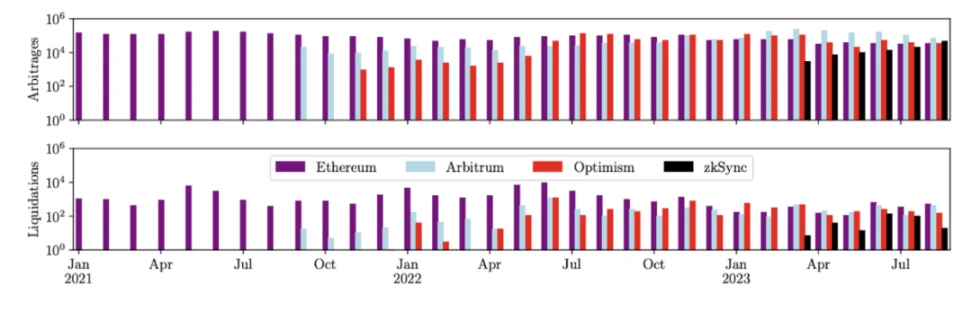

According to the research of Christof Ferreira Torres and others, they replayed the transactions on Rollups and concluded that Arbitrum, Optimism, and Zksync have non-malicious MEV behavior on the chain. The three chains currently generate a total of $580m in MEV value, which is enough to serve as a source of income worthy of attention.

Source: Rolling in the Shadows: Analyzing the Extraction of MEV Across Layer-2 Rollup

1.2.3 L1 related costs

This part is the fee that Rollups charges users to cover L1 related costs. The specific cost structure will be discussed later. Different Rollups charge differently. In addition to predicting L1 gas to cover the cost of L1 data, Rollups will also incur additional fees as a reserve fund to deal with future gas volatility risks, which is essentially an income for Rollups. For example, Arbitrum will add a Dynamic fee, and OP stack will multiply the fee by the Dynamic Overhead coefficient. Before the EIP 4844 upgrade, this part of the fee was estimated to be about 1/10 of the DA fee.

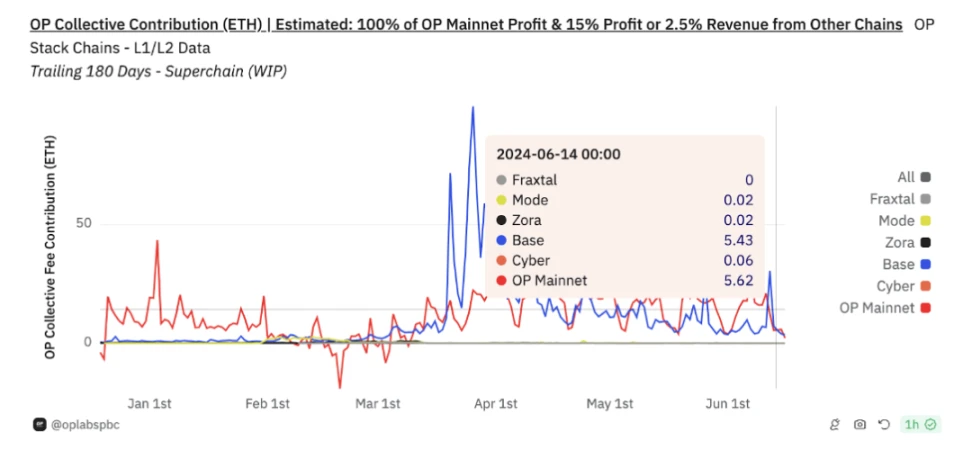

1.2.4 Profit Sharing

Base is relatively special because it uses OP stack. It promises to contribute 2.5% of total revenue/15% of the profit after deducting the cost of submitting data to L1 in L2 transactions, whichever is higher, to OP stack. In return, Base will participate in the on-chain governance of OP Stack and Superchain, and receive up to 2.75% of the OP token supply. According to recent data, Bases revenue contribution to Superchain is 5 ETH/day.

We can see that Base provides a considerable proportion of Optimisms revenue. In addition to cash flow, the healthy network effect also makes the OP Stack ecosystem more attractive to users and the market. Although some performances of Arbitrum, such as TVL or stablecoin market value, are higher than Base + Optimism, it is currently unable to exceed the latters trading volume and revenue. This can also be seen from the P/S ratio of the two – after considering Bases revenue, $OPs PS ratios are 16% higher than $ARB, reflecting the additional value that the ecosystem brings to $OP.

Source: OP Lab

1.3 Rollups Cost

1.3.1 Ethereum L1 Data Cost

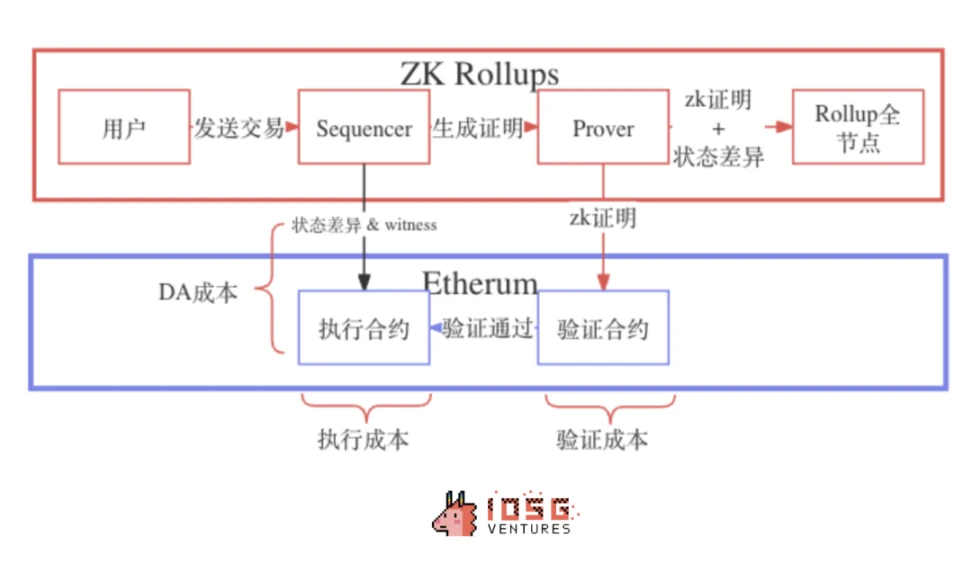

The specific cost structure of each chain is different, but the major categories can be divided into communication costs, DA costs, and verification costs unique to ZK Rollups.

-

Communication costs: mainly include status updates between L1 and L2, cross-chain interactions, etc.

-

DA cost: includes publishing compressed transaction data, state root, ZK proof, etc. to the DA layer.

Before EIP 4844, L1 costs mainly came from DA costs (over 95% for Arbitrum and Base, over 75% for zkSync, and over 80% for Starknet)

After EIP 4844, the DA cost dropped significantly. Due to different L2 mechanisms, the degree of DA cost reduction is also different, with a cost reduction of approximately 50%-99%.

1.3.2 Verification Cost

It is mainly used by ZK Rollup to verify the reliability of Rollups transactions through ZK means.

1.3.3 Other costs

Mainly includes off-chain engineering and operation and maintenance costs. Due to the current operation mode of Rollups, the operation cost of the node is close to the cost of the cloud server, which is relatively small (close to the cost of the enterprise AWS server)

1.4 Comparison of L2 profit and other L1 data

At this point, we have a general understanding of the overall income-expenditure structure of Rollup L2, and we can compare it with Alt L1. Here, Rollups chooses the weekly average data of Arbitrum, Base, zkSync, and Stakrnet as the data source.

Source: Dune Analytic, Growthepie

It can be seen that the overall profit margin of Rollups is close to Solana and has obvious advantages over BSC, reflecting the excellent performance of Rollups business model in profitability and cost management.

2. Rollup Horizontal Comparison

2.1 Overview

The fundamentals of Rollups vary significantly at different stages of development. For example, when there is an expectation of issuing coins in a transaction, Rollups will see a significant increase in transaction volume, and the resulting fee income and expense will also increase significantly.

Source: IOSG Ventures

Most Rollups are still in their early stages, and absolute profitability is not that important to them. What matters more is to ensure a balance between income and expenditure and long-term development. This is also the concept that Starknet has always declared, which is to not charge users extra fees and to make profits from this.

However, Starknet has been operating with negative returns since mid-March. Its on-chain activity performance is indeed poor, but what is the root cause of the negative returns, and will it continue for a long time?

Let鈥檚 continue to delve deeper into this question. In fact, the revenue structure of Rollups is relatively similar, but the marginal cost structure brought about by the Rollup mechanism of each chain is different, and the different calculation mechanisms such as data compression methods also bring about differences in costs.

Source: IOSG Ventures

We hope to compare costs among Rollups to help us compare the characteristics of different Rollups.

2.2 Cost structure of different types of L2

ZK Rollup

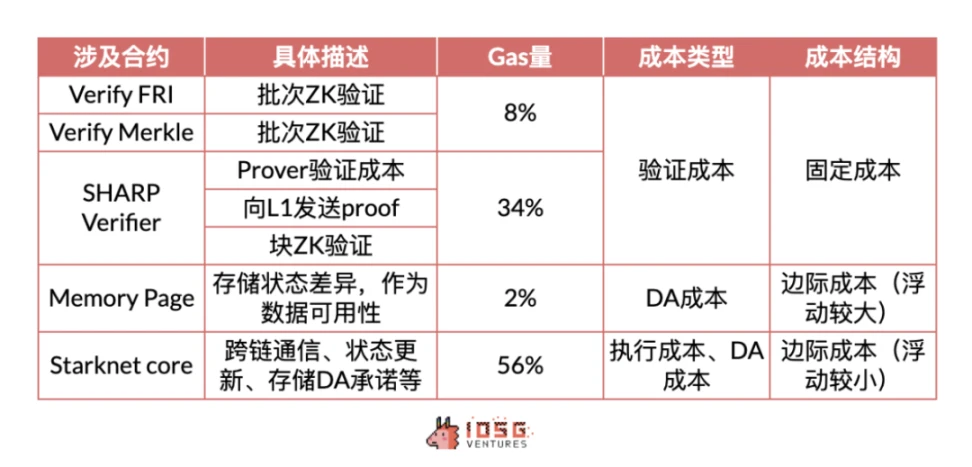

ZK Rollups differ mainly in verification costs, which can often be regarded as fixed costs and are difficult to collect through shared fees. This is also the root cause of Rollups deficit.

Source: David Barreto @Starknet, Quarkslab, Eli Barabieri, IOSG Ventures

This article mainly discusses two relatively mature ZK Rollups with high transaction volume.

星网

Starknet uses SHARP, a shared verification service of its own. After transactions are sorted, confirmed, and blocked, they are grouped into batches and transaction proofs are constructed through SHARP and sent to the L1 contract for verification. After passing, the proof is sent to the Core contract.

The fixed costs of verification and DA in Starknet come from blocks and batches, respectively.

Source: Starknet community – Starknet Costs and Fees

The variable costs in Starknet increase with the number of transactions, mainly DA costs, which theoretically do not incur additional expenses. In fact, it is even the opposite – Starknets transaction fees are charged per write, but its DA costs depend only on the number of memory cells updated, not the number of updates per cell. Therefore, Starknet previously charged too high DA fees.

There is a time lag between the collection of transaction fees and the payment of operating costs, which may result in partial losses or profits.

Therefore, we can see that as long as there are transactions, Starknet needs to continue to produce blocks and pay the fixed costs of blocks and batches. At the same time, the more transactions there are, the more variable costs need to be paid. Fixed costs do not significantly increase marginal costs.

Source: Eli Barabieri – Starknet User Operation Compression

Since Starknet has a computing resource limit for each block (Cairo Steps), its gas fee calculation method is to cover fixed costs and variable costs based on computing resources and data size. Since the cost of block/batch production is difficult to allocate to each transaction, but each block is closed after reaching a certain computing resource (fixed cost is triggered), part of the fixed cost can be calculated and charged through the dimension of computing resources.

However, due to the limitation of block time, if the transaction volume is insufficient (the amount of computing in a single block is insufficient), the computing resources cannot measure the amortized price well, so the fixed cost still cannot be fully covered. At the same time, the limitation of computing resources will be affected by the upgrade of Starknet network parameters. The huge losses in short-term operations after EIP 4844 reflect this point. The losses were not alleviated until the computing resource parameters in the fees charged were adjusted.

Source: Growthepie

Starknets fee model does not effectively cover fixed costs in every transaction, so negative revenue will occur when the Starknet mainnet is updated and transaction volume is extremely low.

zkSync (zkSync Era)

After the Boojum upgrade, the zkSync era shifted from block verification to batch verification and storage state differences, effectively reducing verification and DA costs. The process is basically similar to Starknet, where the Sequencer submits the batch to the Executor contract (state difference and DA commitment), the proof node submits the verification (ZK proof and DA commitment), and the batch is executed after the verification is passed (once every 45 batches); the difference is that Starknet has verification costs for both blocks and batches, while zkSync only has batch verification costs.

Cost comparison between zkSync and Starknet

Starknet batch sizes are much larger than zkSync Era, where each batch is limited to 750 or 1,000 transactions, while Starknet has no transaction limit.

Source: IOSG Ventures

In this way, Starknet has stronger scale capabilities. Since each block has computing resource limitations, the ability to process more transactions and batches in a single block makes it perform better in high-frequency transactions and scenarios that require a large number of simple operations, but when the transaction volume is small, there will be a problem of excessive fixed costs. zkSyncs compression efficiency and flexible block resources make it more advantageous when it needs to flexibly respond to L1 gas price fluctuations and lack of activity on its own chain, but there will be limitations in terms of block speed.

For users, Starknets fee model will be more user-friendly, less correlated with L1, and have a stronger scale effect. zksyncs fees are more efficient but will fluctuate more with L1.

For the protocol, in the low-activity stage, Starknets high fixed costs will lead to more losses, and zkSync will be more suitable for this scenario. In the high-activity stage, Starknet is more suitable for a large number of high-frequency transactions and control costs, and zkSyncs current mechanism may perform slightly worse in high transaction volumes.

2.3 Optimistic rollup

The cost structure of Optimistic Rollup is relatively simple. In the absence of verification costs, users only need to pay the computing cost of L2 and the DA cost of publishing data to L1. Among them, the publication of the state root is more of a fixed cost because it is related to block production, while the upload of compressed transactions is a variable cost that is easy to estimate and easy to amortize.

Compared with Zk Rollup, it has lower fixed costs and is more suitable for scenarios with appropriate transaction volumes. However, since each transaction needs to include a signature, the DA variable cost will be higher, and the marginal cost advantage in the large-scale adoption stage will be relatively smaller.

Source: IOSG Ventures

Based on the current scale of adoption, the fixed cost of ZK Rollup may result in a higher fee floor for unsubsidized transactions, which will cost users more than OP Rollups, but ZK鈥檚 advantage is clearly in scale:

High transaction volume and proof aggregation will spread the verification costs, and ultimately the marginal cost savings of L1 will exceed Optimism Rollups; running Validiums/Volitions and DAs that only require state differences, faster withdrawal speeds, etc. will be more suitable for scale-based economic needs and the RaaS ecosystem.

2.3 Data comparison

收入

From the gas fee charged by Rollups to users, we can see that Base has higher income, Starknet has lower income, Arbitrum and zkSync are on par, and the difference in transaction volume leads to horizontal and vertical gaps, so we calculate the revenue per transaction. We can find that before the EIP 4844 upgrade, Arbitrum had higher revenue per transaction, and after the upgrade, Base had higher revenue per transaction.

Source: IOSG Ventures

cost

From the perspective of the cost of each transaction, before EIP 4844, Base鈥檚 transaction costs were too high due to the high DA costs, and it was actually in a situation of high marginal costs. The cost advantage due to the scale effect was not reflected. After EIP 4844, with the significant reduction in DA costs, Base鈥檚 transaction costs per transaction plummeted, and it is currently the lowest transaction cost among all Rollups. Compared with OP and ZK, it can be seen that OP Rollups is a greater beneficiary of the upgrade. The actual cost of StarkNet鈥檚 L1 DA can be reduced by about 4 to 10 times, which is slightly less than OP Rollups by an order of magnitude. This is also consistent with theoretical inferences: in the EIP-4844 upgrade, the benefits of ZK Rollups are not as great as those of OP Rollups. The fee performance of ZK Rollup after the upgrade also reflects the impact of fixed costs on it.

Source: IOSG Ventures

profit

According to the data, Base has the highest gross profit due to the scale effect, far exceeding Arbitrum, which is also an Optimistic one. Starknet, which is also a ZK Rollup, has a negative transaction gross profit due to low transaction volume and cannot cover fixed costs. zkSync is positive but is also limited by fixed costs and is lower than OP Rollup. The upgrade of EIP 4844 did not bring direct help to the profit margin – the main beneficiaries will be users, whose fee costs will be greatly reduced.

Source: IOSG Ventures

3. 结论

3.1 Cost side

At present, it seems that most Rollups are still in the first half of their margin curve. As the transaction volume increases, the marginal cost gradually decreases, and the average fixed cost will also decrease significantly. However, after the rise of Ethereum L1 or L2 ecological transaction volume in the future, the increase in average transaction costs due to the capacity of the network will cause the marginal cost to gradually increase (as can be seen from the performance of Base from March to May). This is an issue that cannot be ignored in the long-term development of Rollups. While paying attention to the cost changes caused by short-term adoption, we also need to pay attention to the efforts made by Rollups on the long-term cost curve.

Source: Wikipedia – Cost curve

In the short term, for Rollups, the best way to build barriers is to more effectively reduce marginal costs, among which adjusting revenue and cost models according to market conditions is a better solution.

3.2 Income side

In order to maintain long-term competitiveness, the protocol tries not to charge users extra fees, and even subsidizes fees to keep user spending as low and stable as possible, as we see in the current situation of Starknet. Priority fees will certainly bring more income, but the premise is that the chain must be sufficiently active.

After EIP 4844, the revenue of some Rollups has dropped significantly (such as Arbitrum), because the hidden income from DA data fees, which is a part of the profit margin, has been almost eliminated. The revenue model of Rollups will become relatively simple, mainly mining from L2 fees. As the transaction volume grows, the priority fees and congestion fees generated will be important components of revenue. At the same time, in terms of active income, extracting MEV through Sequencer will also be one of the important sources of income for Rollups in the future.

In general, the business model of Rollups does have the advantage of economies of scale, especially ZK Rollups. The current market conditions are not suitable for Rollups to play their advantages, and they need to wait until the Base moment similar to March-May this year. The diversity of business models and the adaptability of different Rollups in different market conditions also let us see the far-reaching considerations of the Ethereum L2 Rollups ecosystem.

参考

https://community.starknet.io/t/starknet-costs-and-fees/113853

https://medium.com/nethermind-eth/starknet-and-zksync-a-comparative-analysis-d4648786256b

https://blog.quarkslab.com/zksync-transaction-workflow.html

https://www.alexbeckett.xyz/the-economics-for-rollup-fees/

https://forum.arbitrum.foundation/t/rfc-arbitrum-gas-fees-sequencer-revenue/24730

https://mirror.xyz/filarm.eth/aZwXFN-tfuZKrMjzT9rXchlY15HGuYJGGj_5FPtPZ88

https://x.com/ryanberckmans/status/1768290443425366273

https://mirror.xyz/lxdao.eth/CnZFjWYHbR1Vu9Z4UPa7JKDceLtVtNf1EfsQ98Zq7JI

This article is sourced from the internet: IOSG Ventures: Interpreting the Rollup revenue and expenditure structure, is the Rollup coin price overvalued?

Original article from Animoca Brands , translated by Nan Zhi from Odaily Planet Daily Animoca Brands, Animoca Brands Japan, San FranTokyo and MyAnimeList announced today that they will become launch partners of Anime Foundation, a community-owned anime and manga culture protocol across Web2 and Web3. The collaboration will create new opportunities and experiences for global fans, creators, studios, IP holders, and projects and brands originating from anime. This strategic collaboration follows Animoca Brands Japan’s 300 million yen strategic investment in MyAnimeList, an anime and manga community website and database with 16 million registered members. At the same time, Anime Foundation will establish a strategic alliance with Mocaverse, a growth network with an interoperable infrastructure layer for accounts, identities, reputation, and PointFi systems built by Animoca Brands. The strategic alliance will…