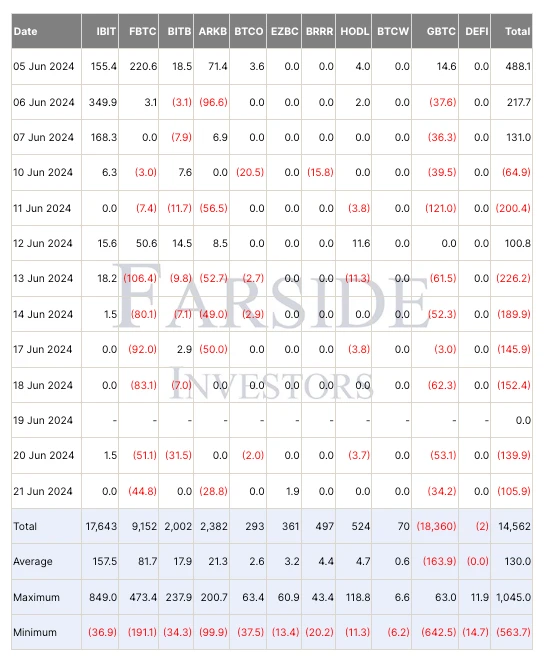

In the past two weeks, the dark cloud hanging over the BTC price is not only the continuous outflow of spot ETFs, but also the time bomb of Mt. Gox. Today, Mt. Gox trustees officially started to repay creditors. According to Nobuaki Kobayashi, the trustee of Mt. Gox, the compensation will be paid in BTC and will start in early July. Combined with the 14,000 BTC transferred from the Mt. Gox address a month ago, the market immediately reacted to the risk aversion after the news came out, causing BTC to plummet in the short term, once dropping below 61,000.

资料来源:Farside Investors;TradingView

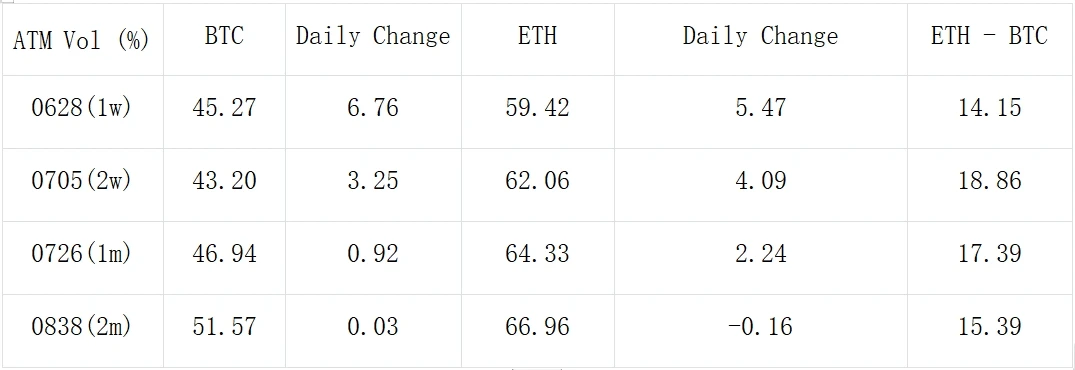

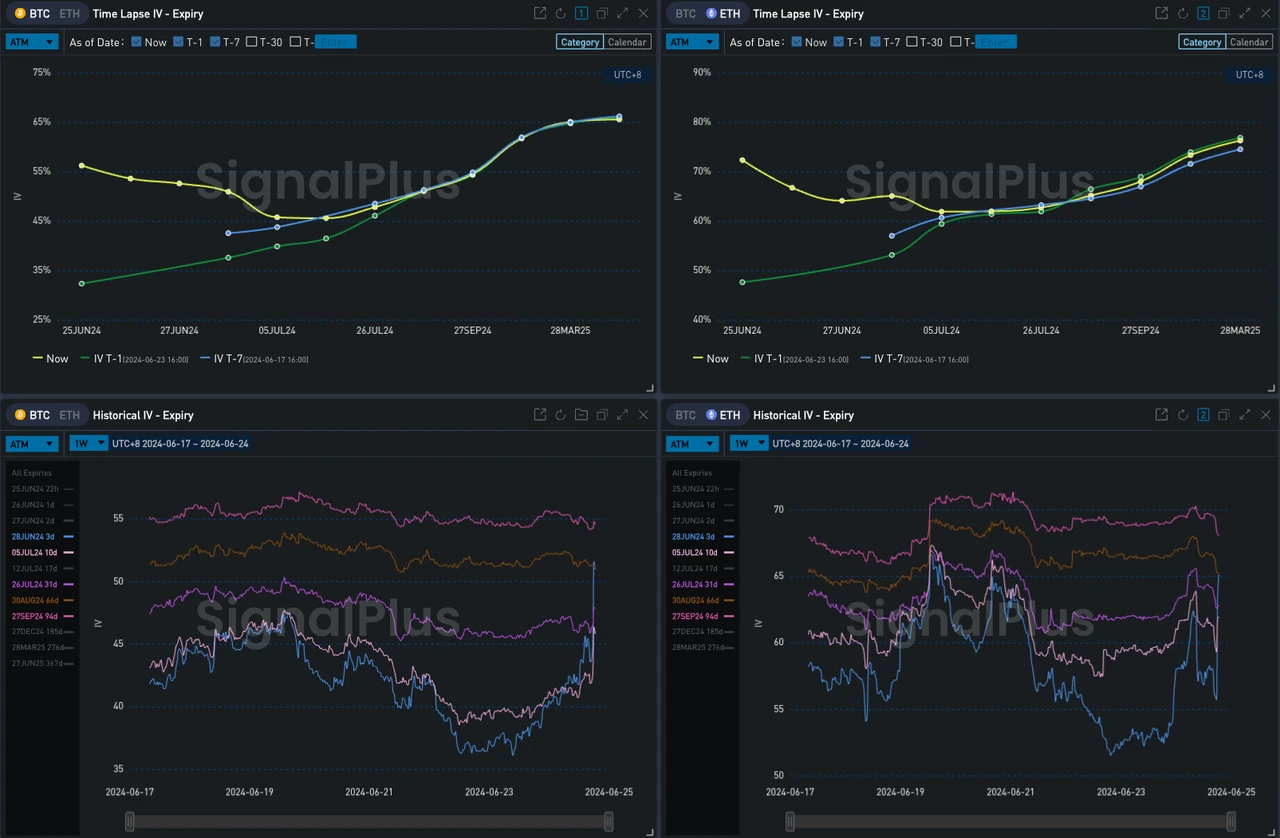

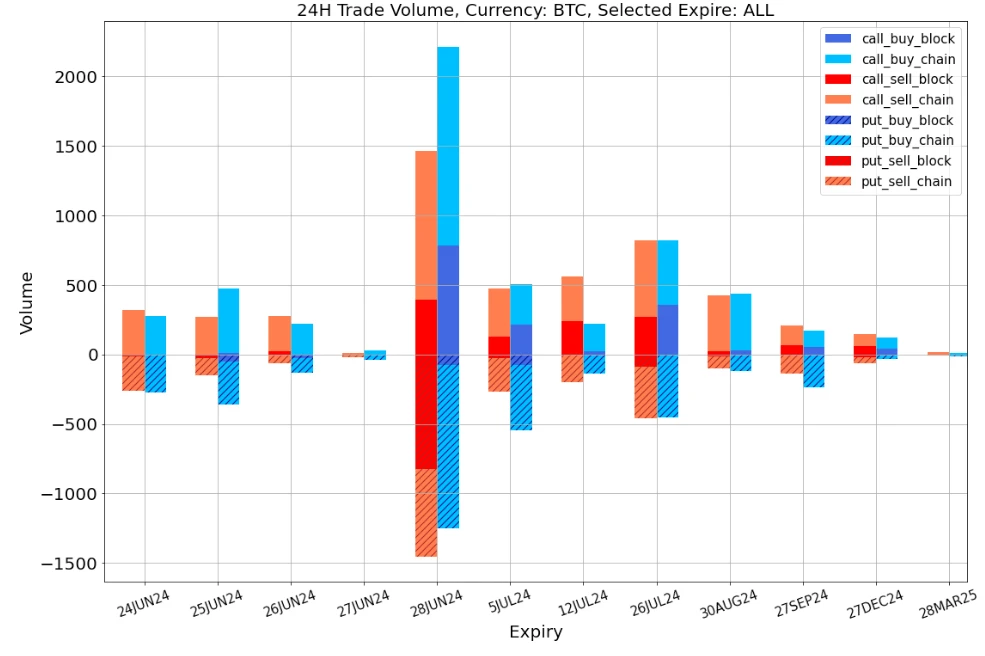

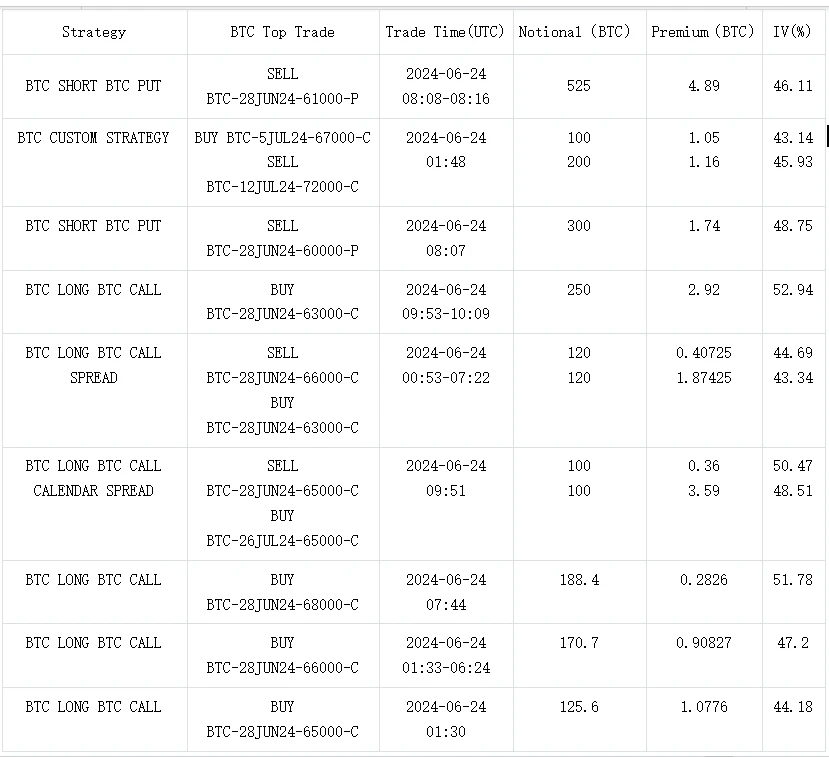

In terms of options, the increase in actual volatility and market concerns about the future market have significantly raised the level of implied volatility at the front end. At the same time, the Vol Skew at the front end also maintained a positive correlation with the price and fell to the negative range. From the perspective of BTC trading, before the news, although the price had been falling for several consecutive days, the Flow concentrated in the market at the end of June was still dominated by Long Risky. Perhaps the low price attracted the bottom-fishing of call options, or the trust in the two key support levels of 61000/60000.

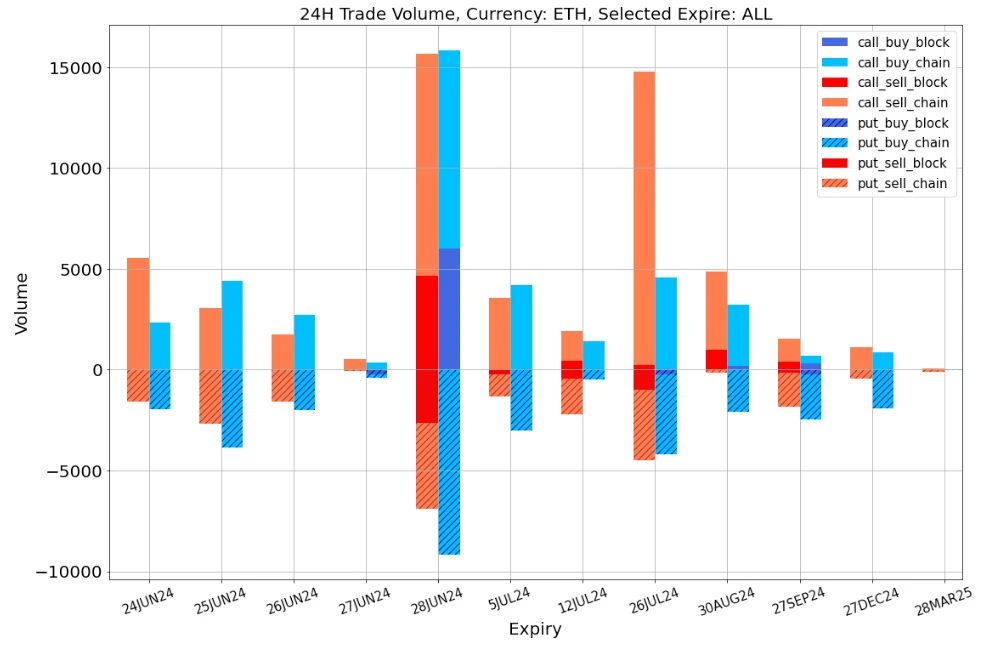

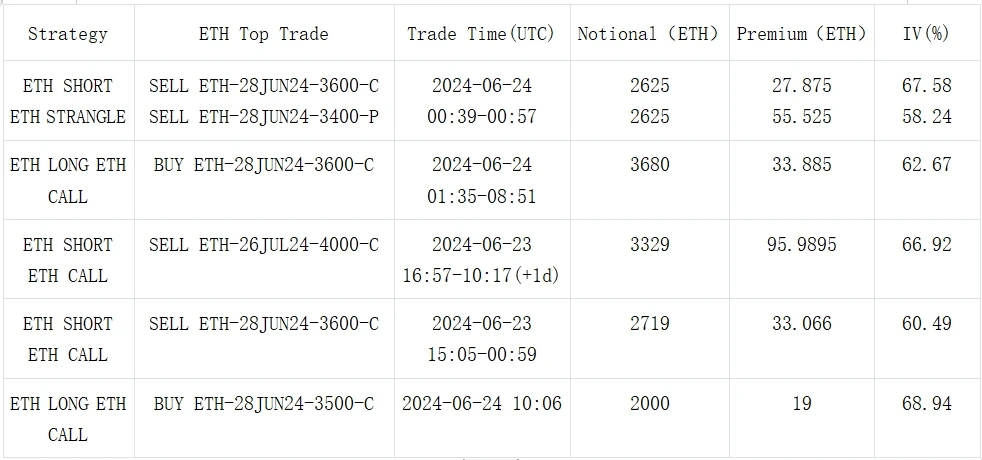

Regarding ETH, the president of The ETF Store once again stated that the Ethereum spot ETF may be launched next week, which gave the community some hope. Market expectations also pushed the smile curve to tilt towards call options in July, which was in sharp contrast to the front end. However, there seemed to be differences in the market. Under the conditions of high IV and high Vol Skew, more than 3,000 4000-C were sold at the end of July, becoming a hot spot for trading yesterday.

Source: Deribit (as of 24 JUN 16: 00 UTC+ 8)

Source: SignalPlus, Front-End IV rises after the plunge

Source: SignalPlus, Vol Skew

数据来源:Deribit,ETH 交易总体分布

数据来源:Deribit,BTC交易总体分布

来源:Deribit Block Trade

来源:Deribit Block Trade

您可以在ChatGPT 4.0的插件商店中搜索SignalPlus获取实时加密信息。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlus_Web3,或者加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram群和Discord社区,与更多朋友交流互动。SignalPlus官方网站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240624): Mentougou is here again

Related: Unveiling the Speed King of Blockchain – Solana

A performance report The Fastest Chains report released by CoinGecko on May 17 showed that Solana is the fastest among large blockchains , with the highest daily average real TPS reaching 1,054 (voting transactions have been removed). Sui is the second fastest blockchain, with the highest daily average real TPS reaching 854. BSC ranks third, but the real TPS achieved is less than half of Sui. From this report, it can be seen that Solana and Sui, which have the best performance, are both non-EVM-compatible blockchains. Furthermore, the average real TPS of 8 non-EVM-compatible blockchains is 284, while the average TPS of 17 EVM-compatible blockchains and Ethereum Layer 2 is only 74. The performance of non-EVM-compatible blockchains is about 4 times that of EVM-compatible blockchains. This article will explore the…