Original author: Miles Deutscher, Crypto Analyst

Original translation: Mia, ChainCatcher

In the cryptocurrency space, the over-fragmentation of altcoins has become a core factor in their weak performance in this cycle. After further research, I found that this fragmentation poses a serious threat to the overall health of the cryptocurrency market. Unfortunately, it seems that we have not yet found a clear solution to this challenge.

I wrote this post to hopefully provide more insight into this critical issue that will impact the future of cryptocurrency. It will explain how we got here, why prices behave the way they do, and the path forward.

Cryptocurrency market flooding: token inflation concerns behind the surge in new projects

In the cryptocurrency market in 2021, there is a frenzy of enthusiasm. New liquidity is pouring into the market like a tide, driven mainly by the enthusiastic participation of new retail investors. The bull market during this period seems unstoppable, and investors risk tolerance has reached an unprecedented peak.

During this period, venture capital firms began to pour unprecedented amounts of capital into the space. Founders and venture capitalists were opportunists, just like retail investors. The increase in investment was a natural, capitalistic response to market conditions.

For those who don’t know about private markets, in simple terms, venture capital (VC) invests money in the early stages of a project (usually 6 months to 2 years before product launch), when valuations are usually lower (and come with vesting clauses).

This investment helps to finance the project for development, while the venture capital firm often provides other services/connections to help get the project off the ground.

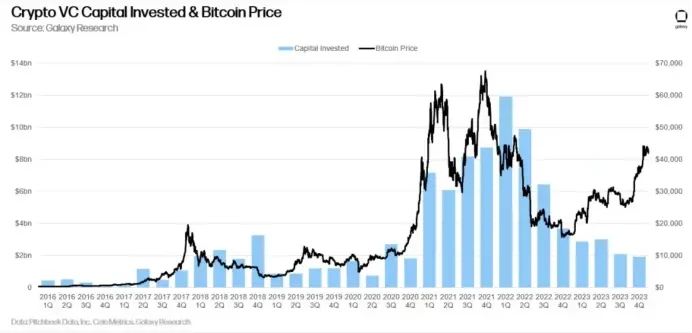

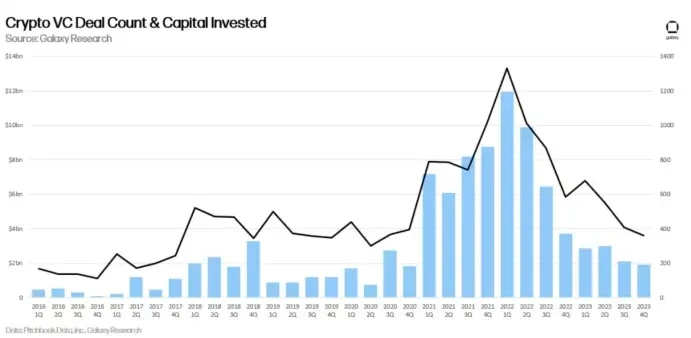

Interestingly, the largest quarter of venture capital funding ever ($12 billion) occurred in the first quarter of 2022.

This marked the beginning of the bear market (yes, VCs accurately timed the markets top).

But remember, VCs are just investors. The increase in the number of deals also comes from an increase in the number of projects created.

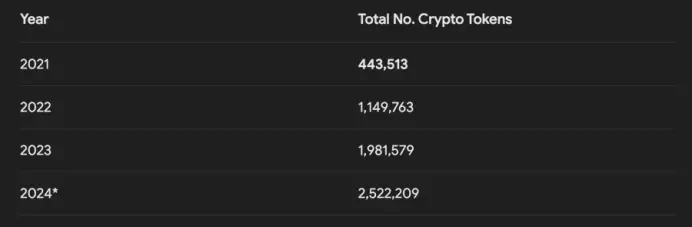

The low barrier to entry, coupled with the high returns from cryptocurrencies during the bull market, has made Web3 a hotbed for new startups. New tokens are emerging one after another, causing the total number of crypto tokens to quadruple between 2021 and 2022.

But soon after, the party was over. A chain reaction, starting with LUNA and ending with FTX, completely destroyed the market.

So what did the projects that raised so much money at the beginning of the year do?

They postponed.

Postponed again.

Postponed again.

Launching a project in a bear market is tantamount to a death sentence.

Low liquidity + poor sentiment + lack of interest means many new bear market projects die as soon as they come to market.

Therefore, the founders decided to wait for the market to reverse.

Finally, they waited for it in the fourth quarter of 2023.

(Remember, the biggest surge in VC funding was in the first quarter of 2022, 18 months ago).

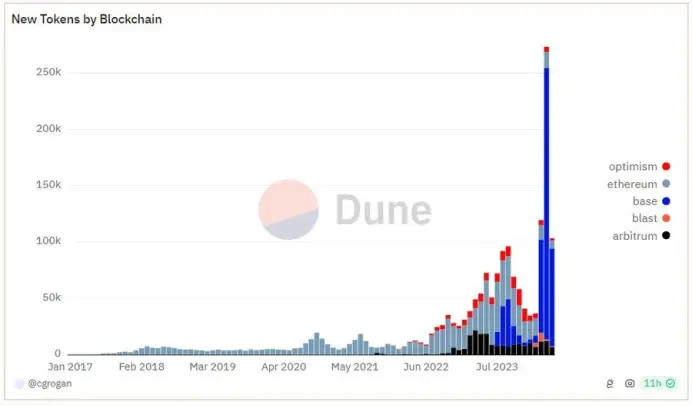

After months of delays, these projects finally waited for market conditions to improve and launched their tokens. As a result, they took action and launched new projects one after another, entering the market continuously. At the same time, many new players also saw these bullish market conditions as a good opportunity to launch new projects and make a quick profit.

As a result, 2024 saw a historic number of new project launches.

Here are some stats. They’re crazy. Over 1 million new crypto tokens have been launched since April alone. (Half of these are meme tokens created on the Solana network).

According to Coingecko data, the current number of crypto tokens in the market is 5.7 times that of the peak of the bull market in 2021.

Although Bitcoin (BTC) has reached an all-time high in this cycle, the over-fragmentation of the cryptocurrency market and the emergence of a large number of new projects have become the most serious problems at present and one of the main reasons for the markets continued struggle this year.

why?

The more tokens are issued, the greater the cumulative supply pressure on the market.

And this supply pressure is additive.

Many 2021 projects are still being unlocked, and each years supply is superimposed (2022, 2023, 2024).

Current estimates suggest that there is approximately $150 million to $200 million of new supply pressure per day.

This continued selling pressure has had a huge impact on the market.

Think of token dilution as inflation. Just as excessive money printing by governments causes the purchasing power of the dollar to decline relative to goods and services, an excessive supply of tokens in the cryptocurrency market reduces the purchasing power of those tokens relative to other currencies, such as the dollar. Excessive fragmentation of altcoins is effectively the cryptocurrency version of inflation, and it poses a serious threat to the overall health of the market.

And it’s not just the number of newly issued tokens that’s a problem, the low market cap/high circulation mechanism of many newly issued projects is also a big problem, which leads to a) high degree of fragmentation, and b) constant supply pressure.

All this new issuance and supply would be good if new liquidity entered the market. In 2021, hundreds of new projects are coming online every day — and everything is going up. However, that is not the case right now. So we find ourselves in the following situation:

A) insufficient new liquidity entering the market,

B) Huge dilution/selling pressure from unlocking

How can the situation be reversed?

First, I must emphasize that a key problem facing the cryptocurrency market is the lack of sufficient liquidity. Compared to traditional markets such as stocks and real estate, the over-involvement of venture capital firms (VCs) in the cryptocurrency field has become a significant and harmful problem. This over-skewed financing model has led to retail investors feeling frustrated that they cannot win from it, and if they feel that there is no chance of winning, then they will not actively participate in the market.

The meme tokens that have dominated the market this year are exactly where retail investors are looking for a way to win after feeling the lack of profit opportunities elsewhere. Because many high FDV (fully diluted valuation) tokens have done most of their price discovery in the private markets, retail investors often cannot get the 10x, 20x, or 50x returns that VCs can.

In 2021, retail investors will have the opportunity to snap up certain launch tokens and earn up to 100x returns. However, during this cycle, with many tokens being issued at extremely high valuations (e.g., $5 billion, $10 billion, or even $20 billion+), there is little room for price discovery in the public market. When the unlocked portion of these tokens begins to flow into the market, their prices tend to continue to fall due to the significant increase in supply, creating further challenges for retail investors.

This is a complex and multi-dimensional question that involves multiple aspects and participants in the cryptocurrency market. While I cannot give all the definitive answers, here are some thoughts and perspectives on the current dynamics of the cryptocurrency market.

-

Exchanges can strengthen the fairness of token distribution

-

Teams can prioritize community allocations and larger pools of funds from real users

-

A higher percentage could be unlocked at token issuance (perhaps implementing measures such as a tiered sales tax to discourage sell-offs).

Even if insiders don’t enforce these changes, the market will eventually do so. Markets always self-correct and adjust, and as the effectiveness of current models diminishes and the public reacts, things may change in the future.

At the end of the day, a more retail-oriented market is good for everyone. For projects, venture capital, and exchanges. More users is good for everyone. Most of the current problems are symptoms of short-sightedness (and the industry’s immaturity).

Also, on the exchange side, I’d also like to see exchanges be more pragmatic. One way to offset the crazy new listings/dilution is to be equally ruthless on delistings. Let’s clear out those 10,000 dead projects that are still sucking up precious liquidity.

The market needs to give retail investors a reason to come back. At least, this can solve half of the problem.

Whether it’s the rise of Bitcoin, an Ethereum ETF, a macro shift, or a killer app that people actually want to use.

There are many potential catalysts.

Hopefully I have been able to provide some understanding to those who may be confused as to the recent price action.

Fragmentation is not the only issue, but it is certainly a major one – and one that needs to be discussed.

This article is sourced from the internet: Why have altcoins performed poorly in this cycle?

Related: Bee Crypto Visa Upgrade, Make Your Black-Gold Cards More Luxurious

To esteemed Black Gold cardholders and all Beelievers, Two weeks have passed since the first batch of 1,000 Bee Network x Coin50 crypto Visa cards were issued. During this time, 1,000 Beelievers have seized the opportunity to experience this card. We are going to hand over the key to convenient crypto payments to more users, as we prepare to release the second batch of 5,000 Visa cards. At the same time, we will further enhance the payment experience for existing Black-Gold cardholders. *To enhance the payment experience for the first 1,000 Black-Gold cardholders, Coin50 and its 30 affiliated banking institutions and card issuers will upgrade the benefits of the first 1,000 Visa cards. This upgrade will expand the list of supported merchants, allowing you to truly enjoy using this card…