Task

Ranking

已登录

Bee登录

Twitter 授权

TG 授权

Discord 授权

去签到

下一页

关闭

获取登录状态

My XP

0

登录

Congratulations, you've earned 0 XP

+0XP

今晚的CPI数据、FOMC会议决议以及美联储对利率的展望无疑是市场关注的焦点,10年期美债收益率小幅回吐涨幅至4.40%附近,BTC价格与其依然保持较高的相关性,在$66000支撑位反弹,收复昨日一半跌幅,并升至$68000下方。

资料来源:投资

资料来源:TradingView

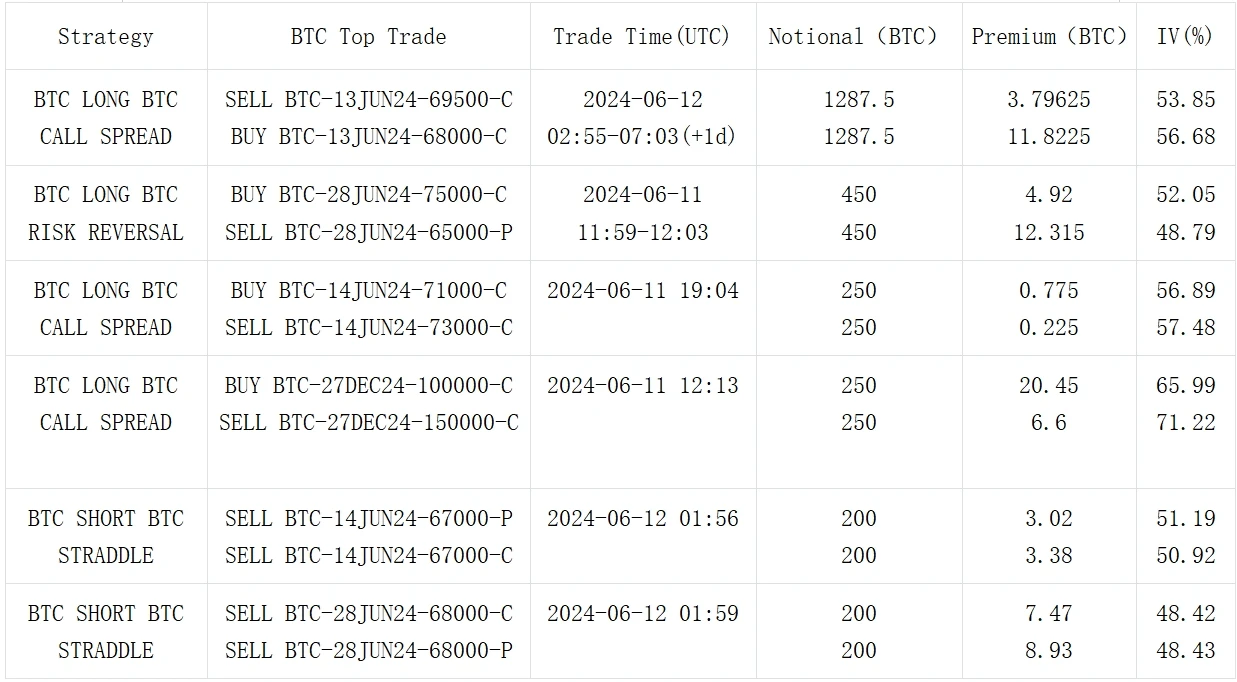

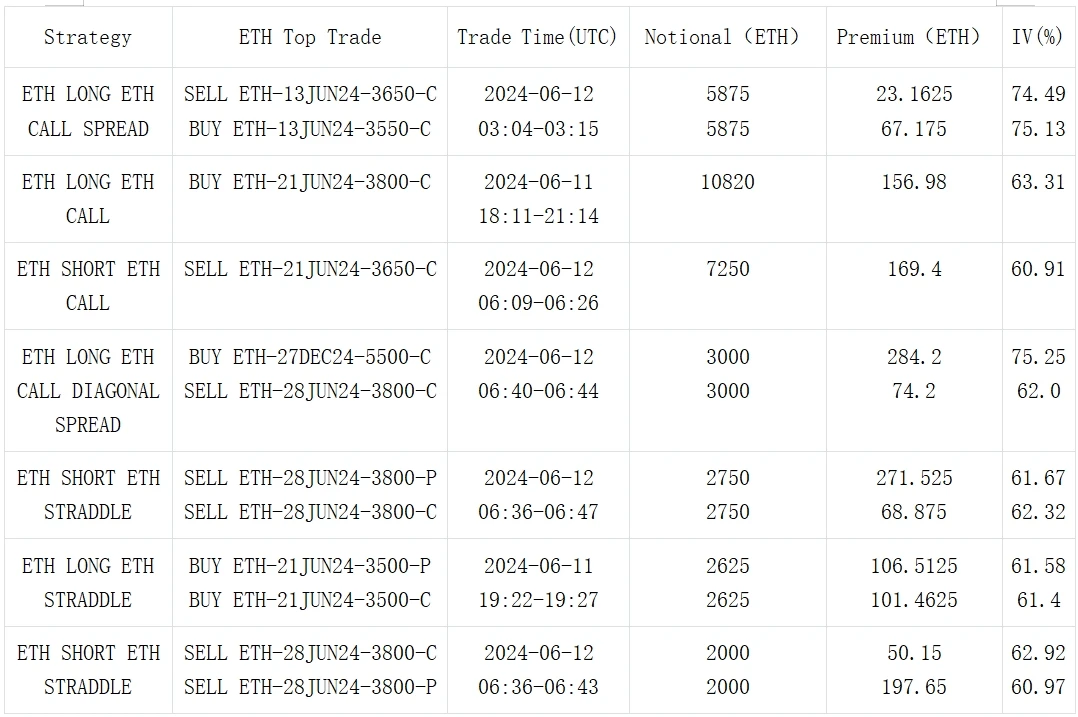

期权方面,随着美国经济事件的逐渐临近,前端IV大幅上涨,远端也小幅上调。交易方面,在价格反弹、Vol Skew较低、IV大幅上涨的情况下,前端昨日并未继续买入Put Flow,反而昨日大量看涨策略建立,BTC上比较有代表性的有13 JUN 68000 vs 69500 Call Spread (1287 BTC Per leg)和28 JUN 65000 vs 75000 Risky (450 BTC Per leg);另一方面,The ETF Store总裁预计ETH Spot ETF S-1文件将在6月底前获批,ETH整体看涨期权买入比例也大幅提升,25 dRR整体已升至零以上,接近近三个月以来数据最高值;此外,在IV整体上行趋势下,ETH 28 JUN 24 IV略有下跌,主要驱动因素或来自几笔较大的Short Straddle策略。

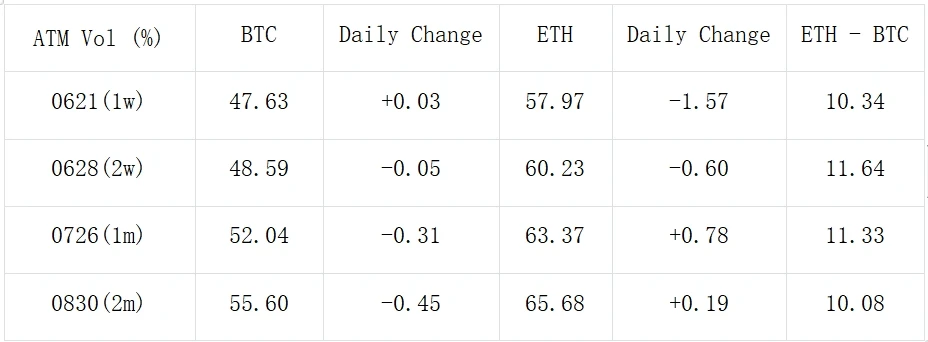

数据来源:Deribit(截至 6 月 12 日 16:00 UTC+8)

来源:SignalPlus,美国重要经济数据公布前,前端 IV 飙升

来源:SignalPlus,ETH 交易量倾斜度整体大幅上升

数据来源:Deribit,ETH 交易总体分布

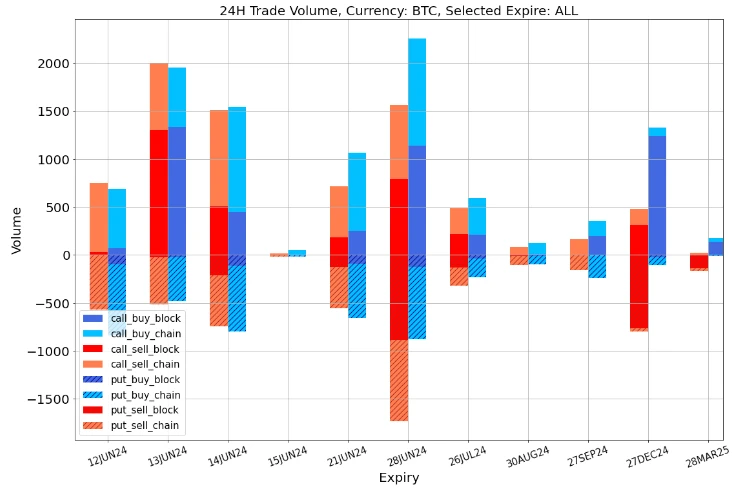

数据来源:Deribit,BTC交易总体分布

来源:Deribit Block Trade

来源:Deribit Block Trade

您可以在ChatGPT 4.0的插件商店中搜索SignalPlus获取实时加密信息。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlus_Web3,或者加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram群和Discord社区,与更多朋友交流互动。SignalPlus官方网站:https://www.signalplus.com

本文来源于网络:SignalPlus 波动率专栏(20240612):盘前反弹

相关:狗狗币、Solana 和 XRP 的未平仓合约下降:这是一个看跌信号吗?

简述 狗狗币的未平仓合约暴跌 64%,Solana 和 XRP 也出现大幅下跌。包括 DOGE、SOL 和 XRP 在内的主要加密货币的未平仓合约下跌了 51%。下跌暗示交易活动减少和潜在的市场情绪转变。最近的数据显示,狗狗币 (DOGE)、Solana (SOL) 和瑞波币 (XRP) 等主要加密货币的未平仓合约大幅下滑。这些山寨币合计下跌 51%,引发了对其未来市场地位影响的争论。 整个加密货币市场的未平仓合约下跌 未平仓合约是市场情绪和流动性的重要指标,反映了尚未结算的未平仓期货合约的总价值。对于加密货币,这些指标可以洞察投资者行为和市场动态。狗狗币领跌,其未平仓合约暴跌 64% 至……