Original title: Explanation and analysis of the Ethereum update Dencun 4 months after its implementation

Original author: Filippo Pozzi, DeFi researcher

原文翻译:白话区块链

Before the update called “Dencun”, Layer 2 already played an important role in the ecosystem. However, after the launch of this famous update, the explosion of Layer 2 has reached a level that was previously unimaginable, making it an indispensable element in the expansion and efficiency improvement of the entire ecosystem. Today we focus on analyzing the actual effect of this update, about four months after its official release. This period of time allows us to examine a large amount of data and evaluate the actual success or failure of the update.

1. What is Dencun

Dencun is an Ethereum update released on March 13, 2024, which combines the Cancun proposal for the Execution Layer and Deneb for the Consensus Layer. The update introduced a series of Ethereum Improvement Proposals (EIPs) aimed at improving different aspects of the Ethereum network. Among them, EIP-4844, also known as Proto-Danksharding, is of great significance in the scalability of Layer 2 by creating Blobs that increase the possibility of data management within the network. How to achieve it?

Without going into too many technical details, we can think of blobs as data packets (256 KB) that represent a series of transactions that occur on Layer 2. These packets are then packaged and subsequently sent to the Ethereum network for verification. Ill show you a graphical example via txcity.io.

What we see here is a representation of two blockchains: Ethereum on the left, and Abiteram (Dencun’s newer network) on the right, with each person moving representing a transaction.

Lets focus on the right side, which represents the Arbitrum blockchain, one of the main Layer 2 of Ethereum. As you can see, all those who use this blockchain leave a slip of paper on the counter before handing it over to the conveyor belt represented by the Arbitrum blockchain. This slip of paper represents the receipt of the transactions that took place within Arbitrum. Because Arbitrum uses a mechanism called optimistic rollup, it initially considers all transactions valid, based on the assumption that they are honest. Subsequently, the transactions are made public to everyone, with the opportunity to review and dispute them within a certain period of time.

Once a certain number of transactions is reached, as shown in the video, the postman collects all transactions by rotating and forming what we define as a blob. Later, if we look closely, as the postman starts pointing at the arrow indicating the direction of Ethereum, we will see that the image of the postman also appears on the left side of the screen, representing the Ethereum blockchain. Here, the postman holds his blob, a data packet of a series of transactions that occurred on Layer 2, and enters the Ethereum bus representing the main blockchain, that is, a block.

As the video shows, the process is as simple as a normal transaction. In fact, there is no difference between the postman and the many passengers represented by a boarding Ethereum block. The difference is that the postman brings a series of transactions, while the others represent a single transaction native to the Ethereum network.

Through this “simple” process of creating blobs, transaction fees on various Layer 2s have been reduced by more than 90%, making operations within these blockchains almost free, thus leading to a surge in transaction volume in all major Layer 2s.

We will now look at the improvements brought about by this update using on-chain data.

2. Average fees for major Layer 2 transactions

We can summarize todays discussion by looking at this graph, which shows the average transaction costs incurred before and after the implementation of Dencun.

It can be clearly seen from the figure that starting from March 13, the average transaction cost of Layer 2 such as Arbitrum, Optimism or ZkSync dropped instantly, from a value of about $0.50 to a value close to 0.

Amazingly, despite some temporary spikes in transaction costs on the base blockchains in the chart, all other major Layer 2s have been able to remain stable, with transaction costs close to 0 and not suffering from the block congestion issues that blockchains like Solana have experienced.

The reduction in transaction costs opened the door for a wide variety of people to enter the industry, even with a more limited investment. This triggered a wave of activity on all major Layer 2s, leading to a real boom in operations.

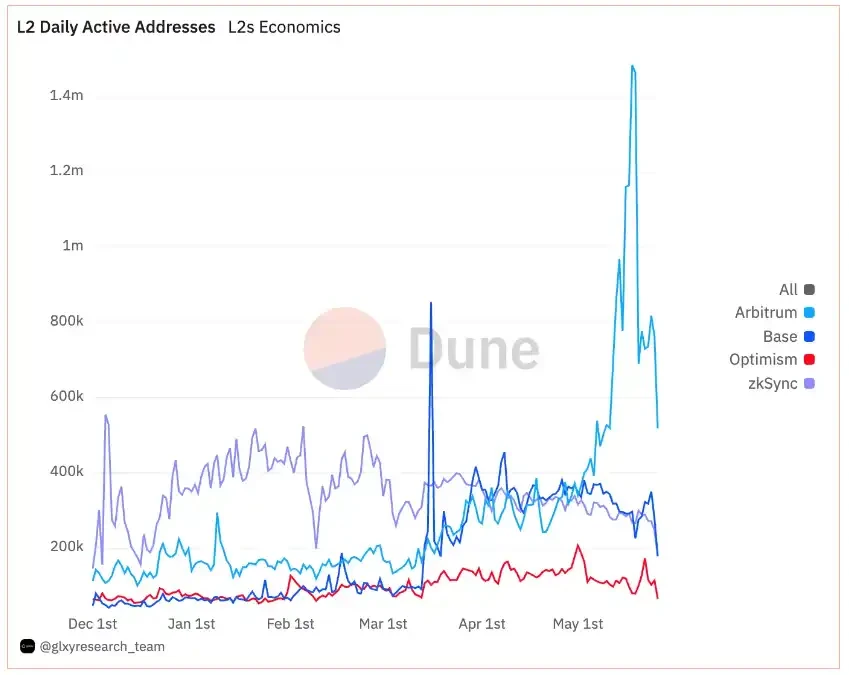

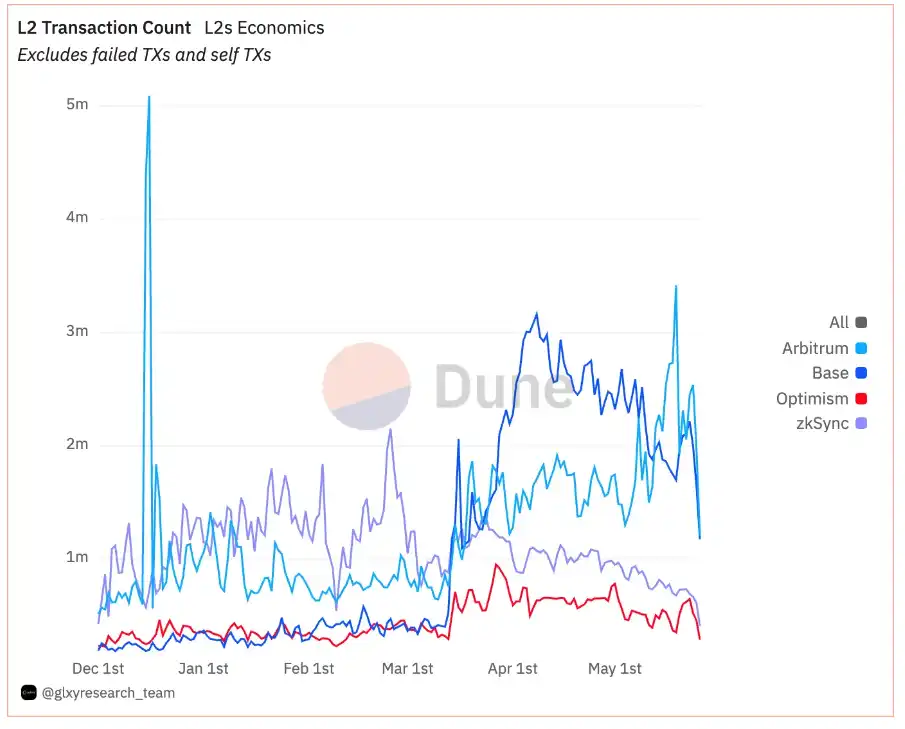

Another indicator that confirms the higher activity within the main Layer 2 is undoubtedly the number of transactions verified on the blockchain.

Source: Dune @glxyresearch_team / EIP-4844 Blobs

As the above chart clearly shows, with the exception of zkSync, all other Layer 2s recorded a significant increase in the number of transactions, resulting in a significant increase in transaction volume, with Base in early April and Arbitrum in late May being particularly significant.

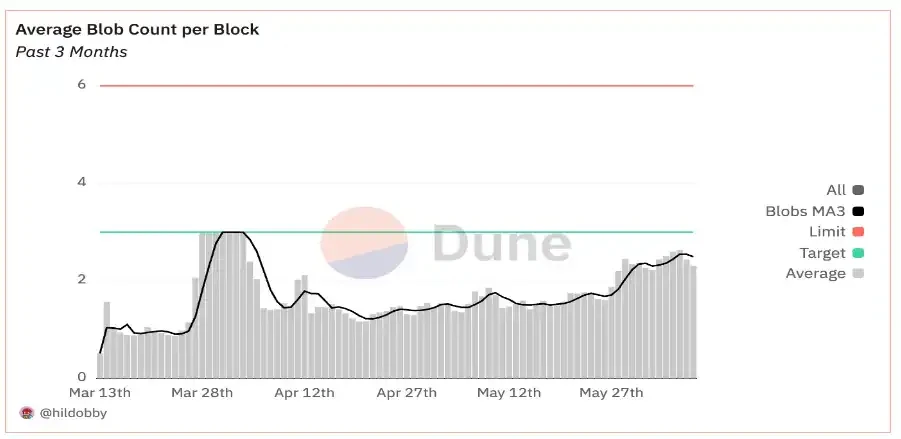

3. Average number of blobs per block

Source: Dune @hildobby/ Ethereum Blobs

The graph provides a detailed view of the operational status of the blockchain network, highlighting the number of blobs contained in each Ethereum block. The target and limit lines represent the ideal and maximum values supported by the network itself. These parameters are critical to optimizing the overall efficiency of the blockchain and avoiding excessive overhead. Actively monitoring the number of blobs in each block is essential to ensure that the network can effectively handle the transaction load while maintaining stability and performance. Therefore, this data remains critical to allowing operators to understand the health of the network.

4 Conclusion

There is no doubt that this update has significantly reduced transaction costs, and its effects are still being seen despite the increase in transaction volume on the main Layer 2.

As Vitalik Buterin highlighted in his article “Layer 2 as an extension of Ethereum culture”, Layer 2 has become an important part of the blockchain space and will continue to grow in importance. This is due to its increasingly widespread infrastructure integration, making its use increasingly important in the Ethereum ecosystem.

I want to end by quoting a portion of the aforementioned article, where Vitalik answers a question about how to successfully develop a culture for Layer 2. His answer, I think, is very fascinating and reflects the true, fundamental spirit of developers and DeFi enthusiasts, the real spirit.

This article is sourced from the internet: Four months after the Cancun upgrade, how are Layer2s doing?

Related: SignalPlus Volatility Column (20240528): Recalling Mentougou

U.S. stocks and bonds were closed yesterday due to the Memorial Day holiday, but there will be important data (GDP and the PCE inflation data favored by the Federal Reserve) released later this week, so it is considered a short but busy week. Source: SignalPlus, Economic Calendar In terms of digital currency, Bitcoin broke through the $70,000 mark again during yesterdays U.S. trading session after trading sideways for nearly a week. The markets bullish enthusiasm seems to have finally been impressed by the continued inflow of ETFs. Considering that the U.S. stock market is closed for holidays, the analysis platform Santiment characterized this wave of rise as an encouraging sign because it proves that BTC can perform well even when the correlation with TradFis rise and fall is not so…