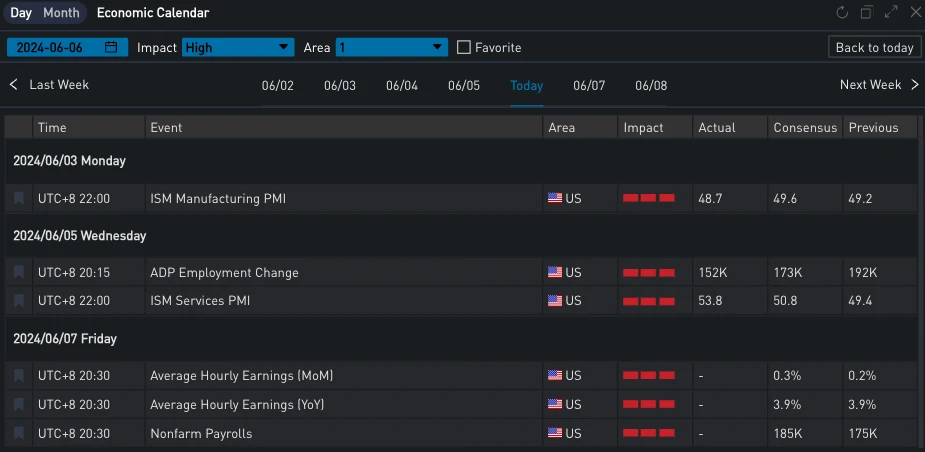

Before the release of non-farm data, yesterday (5 JUN), the US ADP index, known as the small non-farm, was lower than expected, recording 152,000 people, the smallest increase since January this year. U.S. Treasury yields continued to fall, with the 10-year yield falling below the 4.3% mark. The three major U.S. stock indices all closed higher, with the SP and Nasdaq up 1.18% and 1.96% respectively, and the Dow up 0.25%. Nvidia surged 5.16%, with its total market value exceeding Apple, ranking second in the world.

Source: SignalPlus, Economic Calendar; Investing

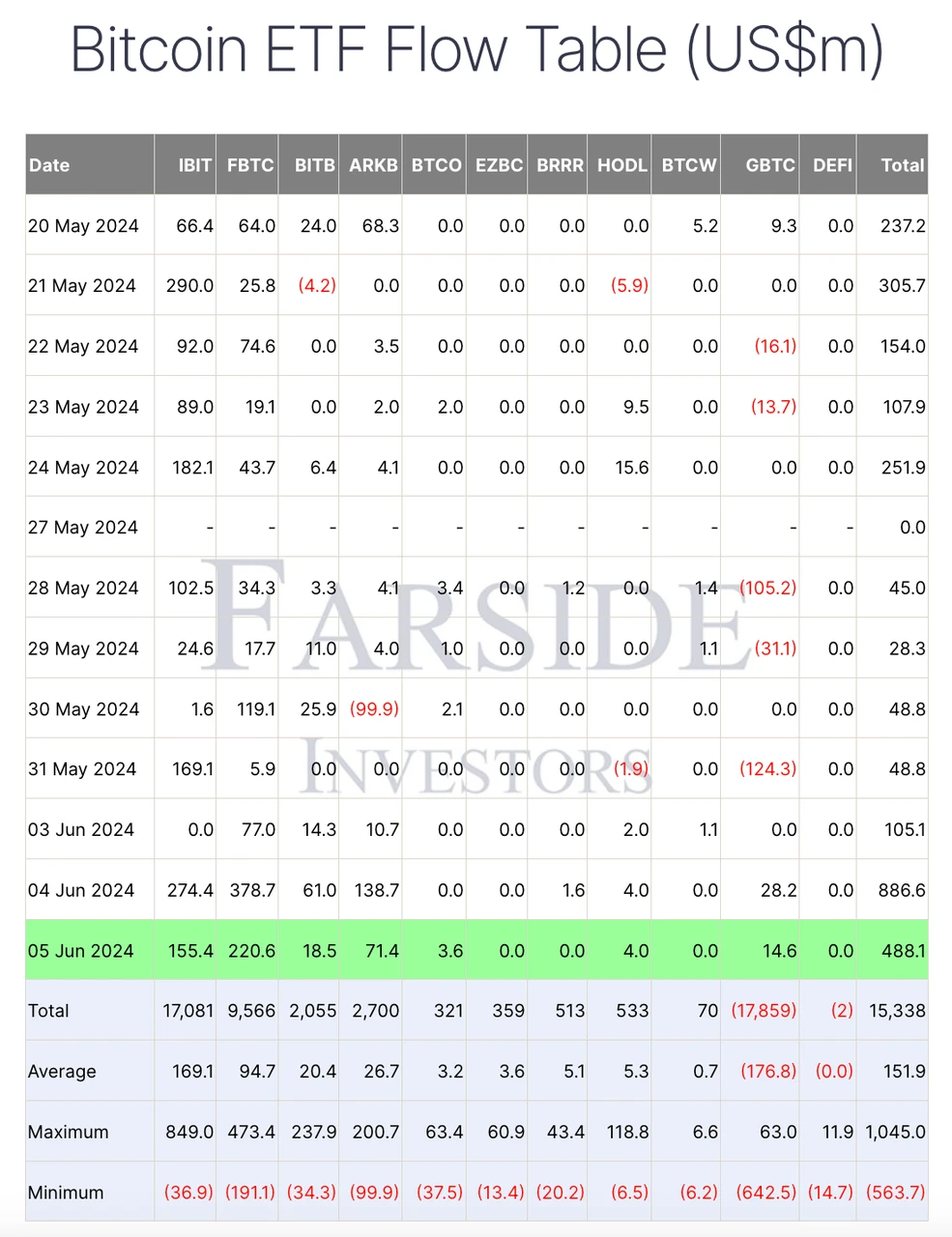

In terms of digital currency, under the favorable macro environment in recent days, the price of BTC continued to rise, challenging the resistance level of 71,600 again. The force that helped it rise must be inseparable from the accelerated inflow of ETFs in the past two days. The purchase volume on June 4 alone was as high as US$886 million, and it continued to increase by US$488 million yesterday.

资料来源:TradingView

来源:Farside Investors

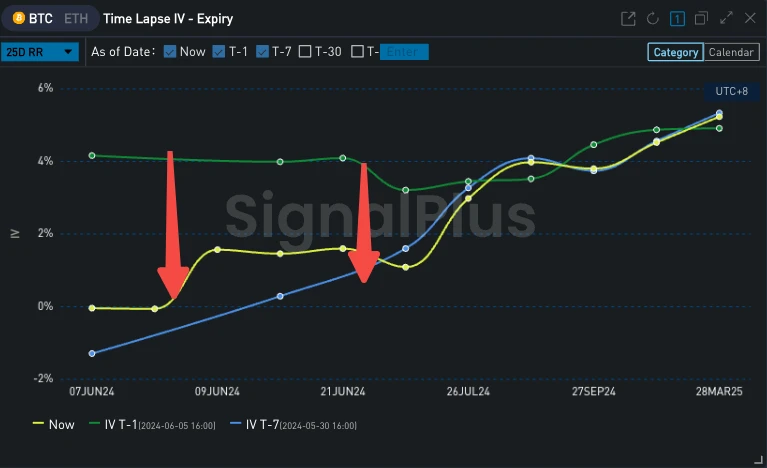

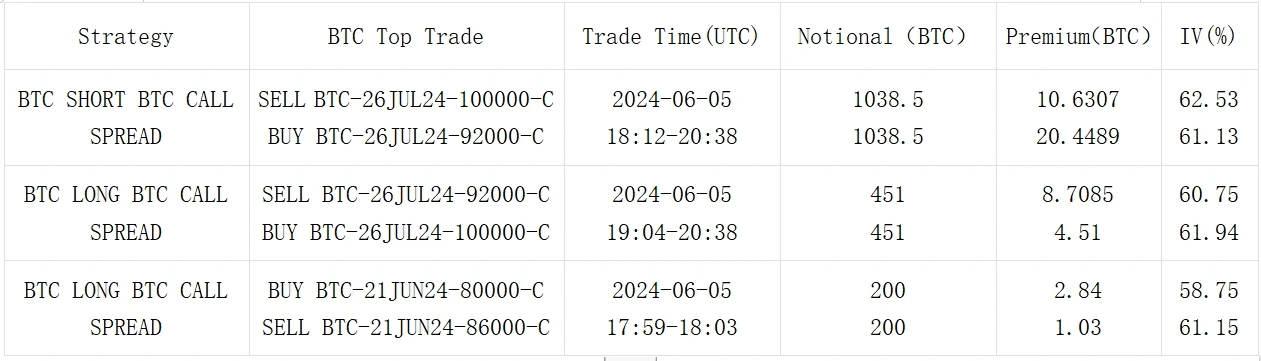

In terms of options, BTC front-end IV and Vol Skew fell at the same time. From the perspective of trading, the continuous rise in prices attracted traders to sell short-term call options, and there were also call spreads sold at the end of June. In addition, the last single-leg 92000 vs 100000 buy call strategy with more than 1000 BTC at the end of July became the focus of the market, but then almost half of the position was closed at the cost price within an hour.

Source: Deribit (as of 6 JUN 16: 00 UTC+ 8)

来源:SignalPlus

来源:SignalPlus

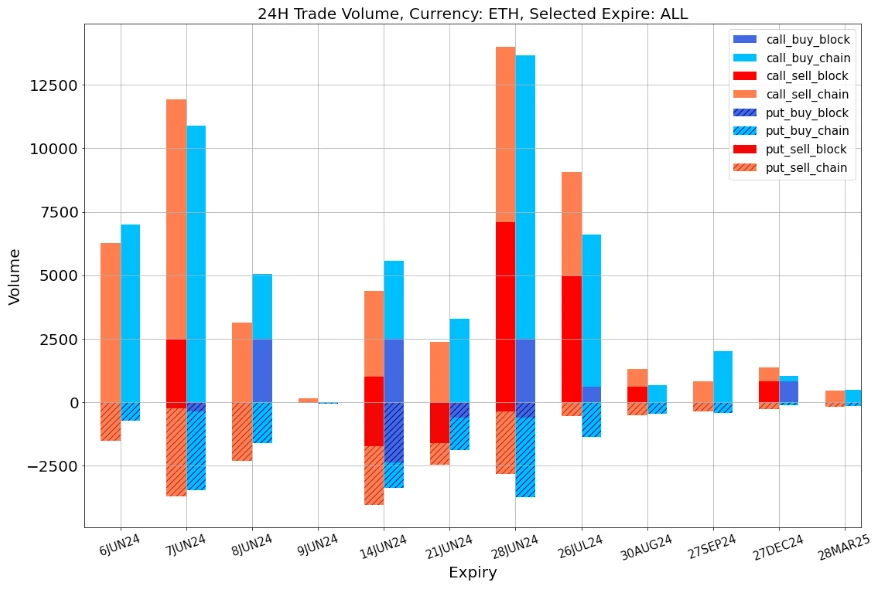

数据来源:Deribit,ETH 交易总体分布

数据来源:Deribit,BTC交易总体分布

来源:Deribit Block Trade

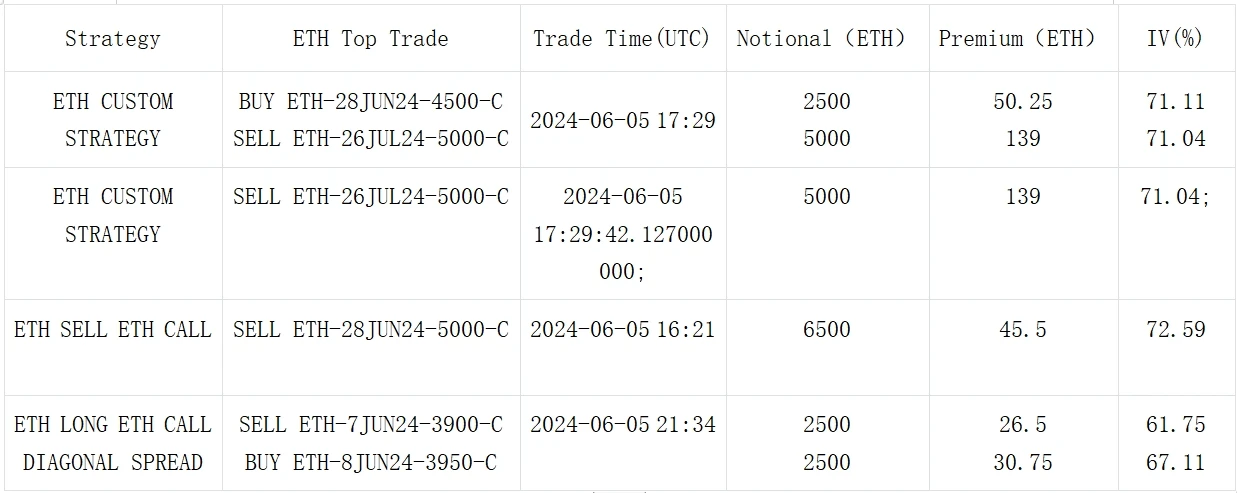

来源:Deribit Block Trade

您可以在ChatGPT 4.0的插件商店中搜索SignalPlus获取实时加密信息。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlus_Web3,或者加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram群和Discord社区,与更多朋友交流互动。SignalPlus官方网站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240606): ETF flows pour into the market

相关:3 种隐藏的宝石山寨币可能会在下个月上涨并给投资者带来惊喜

简述 最近的反弹和缺乏反弹使许多山寨币处于潜在反弹的边缘。 Ravencoin (RVN) 和 Akash Network (AKT) 等正在见证风向的转变,可能走向上涨。 Theta Fuel (THETA) 也将爆发,尽管在日线图上呈现看跌模式。 4 月份加密货币市场的波动导致比特币和许多山寨币经历了可观的增长。 然而,一些山寨币错过了这个机会,但正准备在 5 月份这样做。 BeInCrypto 准备了此分析,以聚焦于鲜为人知的代币,这些代币有望在未来一个月上涨。 关注 Theta Network (THETA) Theta Fuel (THETA) 的价格在整个 4 月和 3 月下半月只经历了下跌。 山寨币……