原作者: KNOWER

原文翻译:白话区块链

Today this article will introduce some major RaaS (Rollups-as-a-Service) providers and the author’s views on Restaking.

1. About Rollup

RaaS (Rollup-as-a-Service) is a controversial topic given the perspectives on Rollups (L2 and L3). On one hand, proponents argue that platforms like Caldera and Conduit make it very easy to build Rollups, which is positive for the development of the entire ecosystem. On the other hand, some people argue that we already have enough block space and these tools become irrelevant. My personal opinion is somewhere in between, and there are some strong arguments on both sides. I believe that Rollup infrastructure is positive for the space, both large and small, but I can also understand why people are skeptical about this technology driving cryptocurrency adoption.

L2 Beat lists about 55 active Rollups, and the top five (Arbitrum, Optimism, Base, Blast, and Mantle) account for 82.74% of the market as of this writing. I’m unsure whether this should be seen as a symptom of the early, undifferentiated Rollup design in the crypto space, or a general lack of interest in most Rollups — maybe it’s a combination of all three.

Arbitrum and Optimism are easily the most mature Rollups, and they are currently more like real chains (rather than Ethereum affiliate chains). Base has a very active community and is probably the best-positioned Rollup at the moment, despite having less locked value. A similar situation applies to Blast, although Im not sure if their higher locked value is more attractive than the community built by Base, which was built without a gamified points program. Base even explicitly stated that it would not issue tokens, but no one cared because it was the first Rollup to see spontaneous activity – Arbitrum and Optimism were mined heavily even before the airdrop announcement.

Mantle is a Rollup I am very unfamiliar with, but I briefly looked at the ecosystem and think they are better positioned than Mode, Manta, and even Scroll. Their future development depends entirely on the inflow of locked value and the deployment of new applications, both of which are to be determined before further development.

L2 Beat’s list of upcoming Rollups has 44 projects, which is more worrying than the 55 active Rollups currently in existence. These 44 Rollups use a variety of different designs, such as Optimiums and Validiums, but ultimately they are all competing for the same market. It is a worrying situation that so few active Rollups are able to “leap” from the “modular execution layer/Ethereum subsidiary chain to the dominant chain, which happens to be L2”.

L1s succeed when years of developer talent accumulate to a fundamentally stable base layer, providing an opportunity for community formation and ecosystem creation (think Solana’s Memecoin casino days, Ethereum’s DeFi summer rush, or even ordinals on Bitcoin). The utility of a Rollup comes from its shared security with the base layer, which 99% of the time is Ethereum, unless you’re talking about Solana’s L2 and its relatively low transaction costs.

I don’t think technology alone is enough to make a Rollup ideologically or market share important, as evidenced by the fact that some of the “most powerful” technologies (such as Scroll, Taiko, and Polygon zkEVM) haven’t even made breakthrough progress in the locked value game. Perhaps these teams do see an increase in locked value in the long term, but based on current sentiment and the lack of pursuit, I don’t see that happening. No, your eight users don’t want to attend another Galxe event, and they definitely don’t want points that can be exchanged for non-transferable tokens.

If you could put yourself in the shoes of a brand new, blissfully ignorant crypto investor, how would you feel about Rollups? Unless it has some memecoin you can make money with, I’m not sure you’d be ecstatic about seeing something like the 15th zero-knowledge Rollup and a zkEVM equivalent to the EVM.

This brief analysis (just a quick glance at L2 Beat) looks pretty bearish, but as long as I don’t have my money in L2 or L3, I’m fine with that. I don’t think more and more Rollups are necessarily a bad thing for the space, but we should be more candid about the utility it brings. Over the past few months, many applications have become application-specific chains (Lyra, Aevo, ApeX, Zora, Redstone), and I suspect this trend will continue until everyone from Uniswap to Eigenlayer is L2.

So while we can’t stop the number of new Rollups being deployed, at least we can try to be honest about the impact it has on crypto. We have so much block space that the Ethereum mainnet doesn’t even need any additional block space — it probably costs a maximum of $10 to complete a transaction right now, and it’s been like this for a few weeks.

RaaS providers like Conduit and Caldera are pretty hard to differentiate, and I say this with such confidence because hopefully someone will correct me where I’m wrong. Here’s a quick overview of their respective Rollup deployment processes:

-

Conduit offers OP Stack and Arbitrum Orbit; Caldera offers Arbitrum Nitro, ZK Stack, and OP Stack.

-

Conduit offers Ethereum, Arbitrum One, and Base as settlement layers; Caldera doesn’t list a settlement layer, but I imagine it’s probably very similar.

-

Conduit’s DA offerings include Ethereum, Celestia, EigenDA, and Arbitrum’s AnyTrust DA; Caldera offers Celestia and Ethereum, but plans to integrate Near and EigenDA soon.

-

Conduit allows you to use any ERC-20 as a native gas token; Caldera allows you to use DAI, USDC, ETH, WBTC, and SHIB.

Overall, the two platforms are very similar. I guess the only difference might come from actual consulting experience with the teams. I haven’t spoken to either team yet, so I apologize if any of this seems rushed or uninformed, but I think they’ll appreciate an honest look at RaaS and the current state of the industry.

I’ve thought about creating my own Rollup, just for fun, but I can’t reasonably spend $3,000 a month maintaining a virtual chain (unless a venture capitalist wants to PM me and we can talk).

Overall, I support Rollups as a Service (RaaS) and hope that everyone working on this space continues to work on it. I really don’t see a problem with it and think the argument about “there are too many Rollups” is meaningless given the current state of our industry.

2. About Restaking

While we’re on the topic of the state of our industry, now is a good time to briefly discuss some of my gripes with Restaking, LRT, AVS, and Eigenlayer.

As of today, the amount of Ethereum deposited in Eigenlayer is huge, at ~5.14M. At first, I thought most of the funds would be lost after the points program ended, but Im disappointed that the recent airdrop announcement did not result in funds flowing to more valuable places, but actually increased it. For those who expected Eigenlayers airdrop to easily increase capital by 20-25x, I think they may have been a bit self-deceiving, but I didnt expect them to geo-block almost all major countries afterwards. There have been many tweets expressing dissatisfaction with Eigenlayers double standards (including one tweet from myself), but I really dont think there is any point in discussing this issue anymore.

The team also released a massive whitepaper explaining how EIGEN works and introducing a new concept called intersubjective utility. In reality, no one really knows what it means and no one is discussing it because EIGEN will initially be non-transferable, which is a huge no-no for people who want to build a community around their protocol. If people can’t get rich through tokens or the ecosystem around tokens, people will turn to areas with money-making possibilities (such as memecoins).

I have no problem with Eigenlayer or the team itself, I want to make that clear up front. I do, however, have a problem with Restaking and the basket of AVSs currently whitelisted on Eigenlayer. Given the over 5 million ETH that has been deposited with Eigenlayer, you might think people would be able to earn a very high yield, right? I am here to tell you that this assumption is wrong.

When you think about the utility of resttaking, you are by default extracting economic security from the most economically stable set of blockchain validators in the world. You stake various types of stETH into a resttaking platform like Eigenlayer (or Karak, and eventually Symbiotic) in exchange for a higher yield on the already attractive stETH yield. My problem is that there is no inherent yield generation in resttaking itself, the yield must come from the AVSs provided within Eigenlayer. If you are a Restaker who deposits 10 stETH in Eigenlayer and delegates those rested ETH to an operator like ether.fi, then you need to trust them to choose the right basket of AVSs to generate yield for you.

But where do these benefits come from?

Indeed, Ethereum does not promise at the protocol level that ETH stakers will receive more rewards if they put their risk into the re-staking protocol. The income can only come from one place: the token issued by AVS itself.

I’m no expert, but I also struggle to understand why no one has asked this question on Twitter. Of course, more important issues like bad airdrops and risks to Ethereum security are getting more attention. But why is no one asking a simple question about what might happen after Eigenlayer launches and the penalty mechanism is finally enabled?

Where is the incentive to keep my assets deposited when the team neither discusses actual numbers on potential yield generation nor carries over $10M in assets, yet has over $500M or more in re-collateralized ETH?

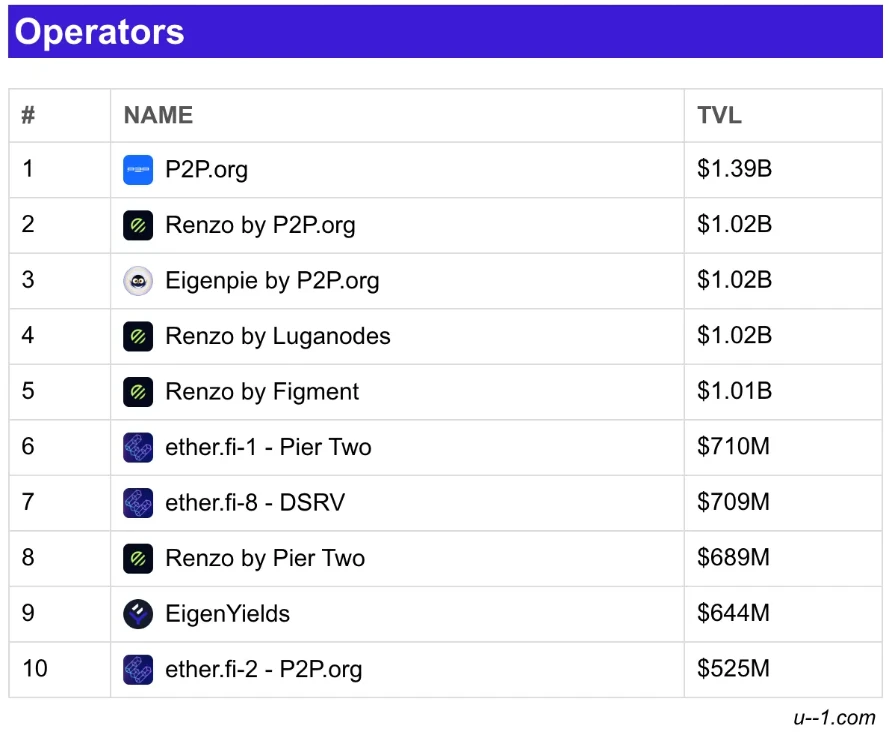

We are in an interesting situation where the top 10 operators on Eigenlayer have an average of 5 AVS registered each, and there is significant overlap between them. Eigenlayer wisely announced that the penalty mechanism will not be enabled for about a year to allow everyone to adjust to the new restaking reality. Considering that no one discusses the risks of restaking except Gauntlet and Mike Neuder, this is a wise decision. Although both articles are very good, they dont actually provide any specific examples because the current AVS has little effect.

As I said before, the advantages of Eigenlayer are clear. But is it necessary to provide each emerging protocol with close to a billion dollars of user Restaking ETH and expose it to future risk? Although the penalty mechanism is not yet enabled, it will be enabled in less than a year – are operators fully aware of their Restaking risks and the increasing risk with each subsequent AVS registration?

I’m not sure about this. Perhaps we’ll see some other restaking platforms gradually eat into Eigenlayer’s market share, ideally as they gain product-market fit and provide smaller amounts of Restaking ETH to AVS rather than the other way around.

This article is sourced from the internet: Crypto Talk: Some thoughts on RaaS and Eigenlayer

简言之,狗狗币的价格试图收于 $0.16 上方,这是启动反弹至 $0.20 的关键。未平仓合约在 48 小时内增长了近 $2 亿,交易员们渴望价格上涨。由于其流通供应中不到 84% 是盈利的,因此该 meme 币远未达到市场顶部。狗狗币的 DOGE 价格在 5 月初跌至 $0.12 的低点后已从该低点回升。尽管 meme 币的领导者被困在 $0.16 的障碍之下,但它可能会被清除。狗狗币价格上涨预期狗狗币的价格在投资者手中出现了看涨情绪的激增。可以看到交易员建立了多头合约,这导致未平仓合约上涨……