原作者: 后果阿

原文翻译:TechFlow

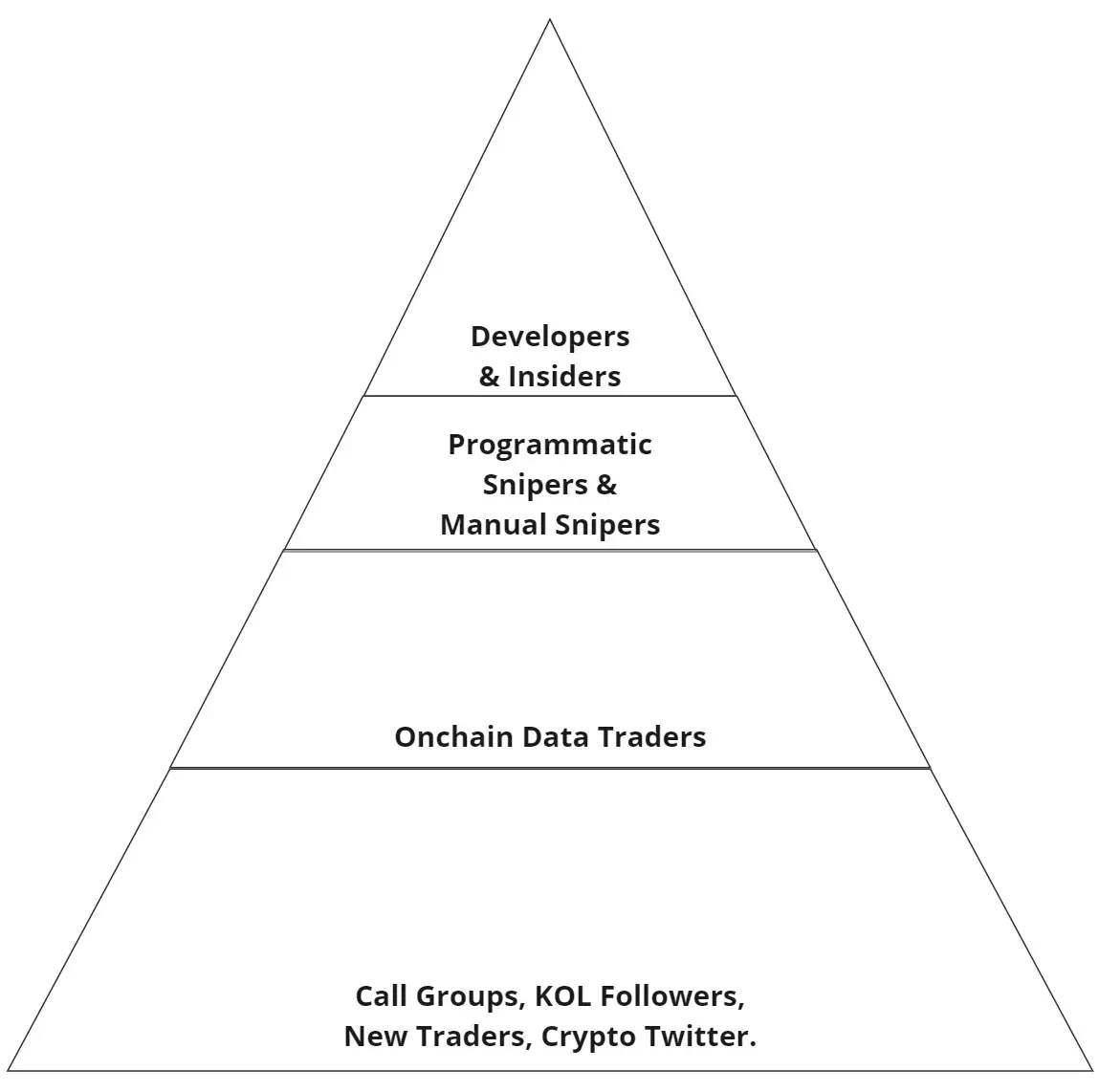

根据我的研究,这里对参与链上流动性游戏的角色进行简要总结。

开发人员和内部人员

虚假效用慢慢上升或被“利用”:

-

这些在早期的人工智能热潮中非常流行,因为当时没有人真正了解人工智能,但每个人都想尽早接触。

-

他们的路线图从未完成超过 1%,通常由意见领袖 (KOL) 炒作。

-

团队通常在合约启动时为自己分配大量供应,然后在其他人之前分发。然后这些代币被隐藏在多个钱包中,然后出售。

-

在最初的上涨之后慢慢拉起或者在几周的拉升之后遇到一个坑,在积累了大量的市值(2000-10000万)之后迅速跑路。

-

涉及反复发布符合当前流行观点的虚假项目的团体。这些项目通常是更成功的大型风险投资项目的衍生品。

程序化狙击手

定制机器人:

-

一个系统地针对多个 ETH 项目的自定义机器人。

-

该机器人根据智能合约和交易量遵循特定参数。

-

目标是从众多失败或流失的项目中获取 10 至 100 倍的回报,几乎像一种收入形式。

手动狙击枪 (ETH)

最赚钱的链上交易者之一:

-

搜索并发现新的合约地址,或者通过内部消息获取合约地址。

-

模拟合同以检查其安全性和其他潜在指标,或了解团队的背景。

-

在有希望的合同发布时,出价高于其他狙击手。

-

在没有反狙击防御措施或使用 Fjord 等预发布平台的情况下,承诺启动链上或隐形项目时,抓住大量供应。

-

使用多个钱包狙击以持有大量供应,超过1%。

-

在许多情况下,项目都会受到狙击手的攻击,他们可以在早期阶段将项目打得落花流水。

-

很多狙击手进入项目方,互相对峙,希望傻钱进来,在市值达到 50 万到 100 万的时候卖出,然后项目就死了。这种事情每天都在 ETH 主网上发生。

-

通过结合基本面分析和机器学习,能够确定哪些合约可能带来超过 $5 百万或更多市值利润的狙击手在过去一年中的表现明显优于其他人。

-

大多数狙击手持有硬币的时间都不超过几个小时。

链上数据交易者

追踪狙击手和内部人员的行动:

-

追踪盈利(最高 PNL)钱包的动向。

-

跟踪数量和持有者警报。

-

通常在狙击手抛售后买入强劲的项目;或者,即使他们知道狙击手持有大量供应,如果发射非常有希望,他们也会购买。

-

新启动的项目通常会进行一些基本或叙述性的分析。

-

长期持有人。

-

随着链上交易成为该领域不断增长的一部分,并且越来越多的链上服务可用于零售用途,它们的受欢迎程度也随之降低和增加。

-

它是上述参与者的退出流动性。

-

这些交易员经常对新启动的项目进行押注,而这些项目最终都会归零。这只是看谁先入场的问题。

-

依靠愚蠢的加密推特(CT)、意见领袖(KOL)或其他后期的链上交易者作为退出流动性。

其他交易员

还没有学会如何使用 Etherscan 或检查代币的基本指标:

-

从呼叫组、意见领袖(KOL)和加密推特(CT)获取信息。

-

较慢的交易者倾向于购买炒作的产品。

-

相信加密货币除了投机之外还具有其他实用性。

-

叙述上落后了一步。

-

可能只在这个领域工作了不到一年。

-

这些交易者很可能已经放弃购买新的实用项目或 meme 币。或者他们正在慢慢开始了解链上交易,并逐步升级到上述类别。

总结

链上交易是开发者、狙击手、链上数据交易员等的流动性游戏。随着进入链上空间的流动性减少,参与者之间的竞争变得更加激烈,结果是金字塔顶端的人收获了大部分回报。

本文来源网络:链上流动性博弈:开发者、狙击手与交易者的狩猎

原文作者:Distilled 原文翻译:TechFlow 简介 在过去的两年里,我全心全意地关注着山寨币市场。然而,市场上一直有一个疑问:期待已久的类似 2021 年的山寨币季节尚未出现。在这里,我将解释原因并提供优化山寨币策略的建议。 让我们首先定义“山寨币季节”。 定义:当山寨币跑赢比特币 ($BTC) 且价格全线飙升时。这是一个山寨币繁荣的时期,市场中弥漫着兴奋的情绪。 可以把它想象成水涨船高。这就是强劲的山寨币季节所能做的事情,它推动了几乎所有行业的发展。 驱动力是什么?大量涌入市场的流动性。 跟踪流动性流动 从历史上看,曾有过…