U.S. stocks and bonds were closed yesterday due to the Memorial Day holiday, but there will be important data (GDP and the PCE inflation data favored by the Federal Reserve) released later this week, so it is considered a short but busy week.

资料来源:SignalPlus,经济日历

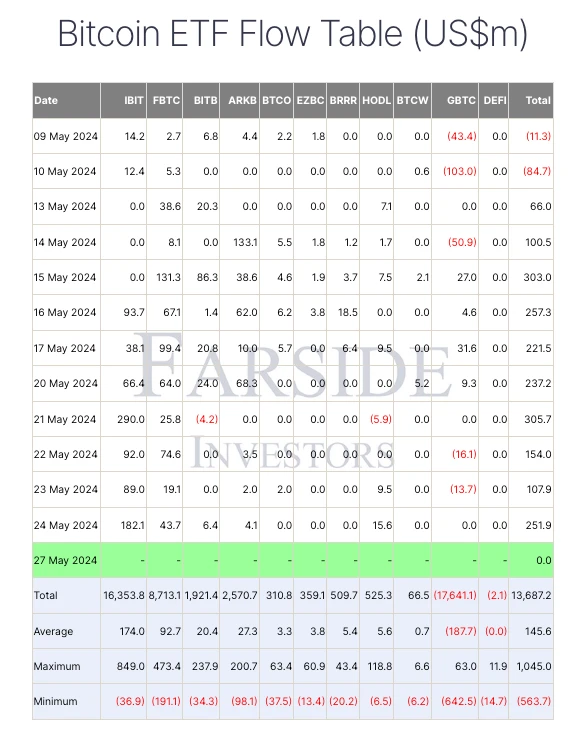

In terms of digital currency, Bitcoin broke through the $70,000 mark again during yesterdays U.S. trading session after trading sideways for nearly a week. The markets bullish enthusiasm seems to have finally been impressed by the continued inflow of ETFs. Considering that the U.S. stock market is closed for holidays, the analysis platform Santiment characterized this wave of rise as an encouraging sign because it proves that BTC can perform well even when the correlation with TradFis rise and fall is not so close.

Source: TradingView; Farside Investors

But things did not go smoothly. Just after BTC broke through 70,000, the market received news that Mt.Goxs cold wallet transferred 12.24 kBTC to an unmarked address, worth about $840 million. In 2014, Mt.Goxs creditors were hit hard when the exchange collapsed. The exchange has been trying to recover funds for repayment over the past decade. Todays transfer on the BTC chain was seen by some traders as a potential catalyst for selling pressure and bearishness. The BTC price then fell rapidly from the intraday peak to below 68,000.

Source: Twitter

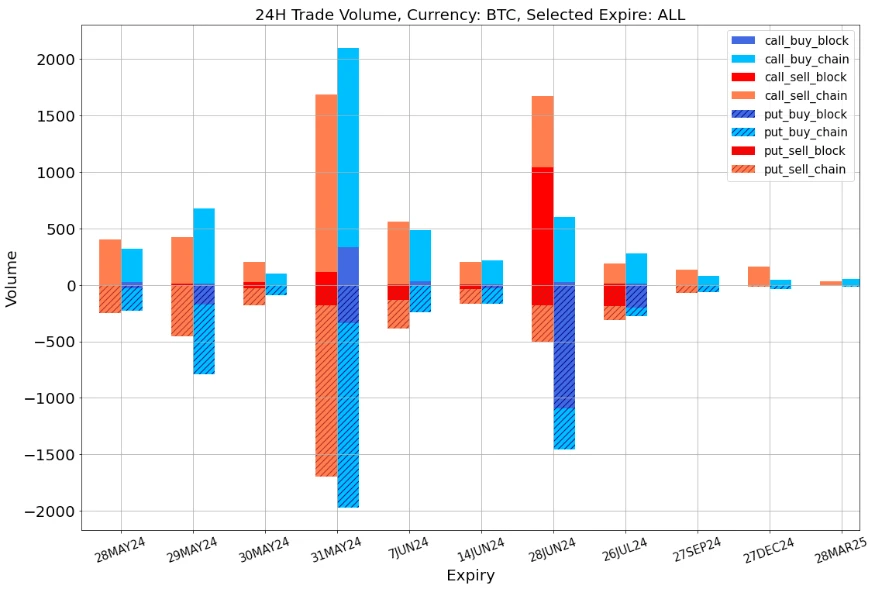

In terms of options, the markets attention has returned to BTC. The roller coaster market in the past 24 hours and the markets concerns about potential selling pressure have raised the implied volatility. The IV curve has flattened and risen overall, and the volatility smile has quickly tilted towards put options after the price fell. From the perspective of transactions, the largest BTC transaction was also a group of Short Risky (450 BTC per leg) in June, selling 75,000-Call and buying 65,000-Put as protection, with a net premium of about 2B TC.

Source: Deribit (as of 28 MAY 16: 00 UTC+ 8)

来源:SignalPlus

来源:SignalPlus

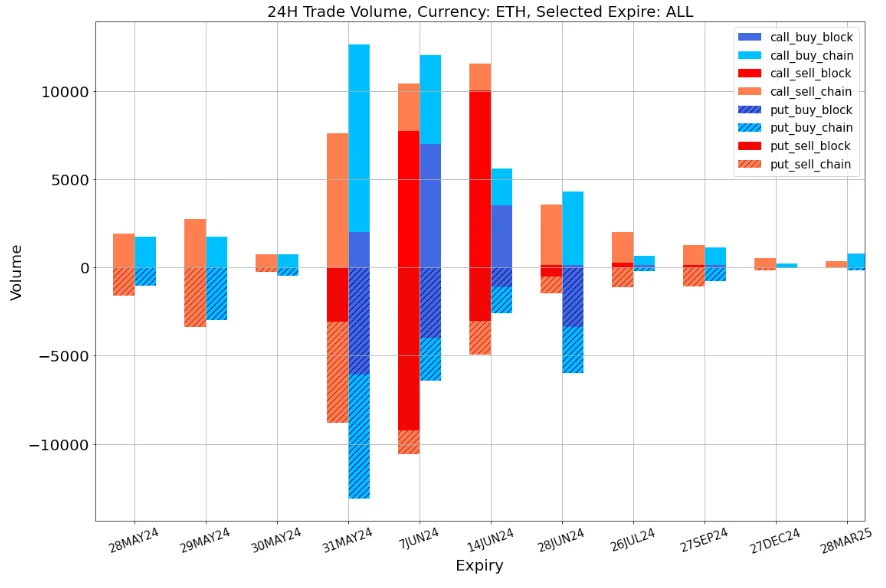

数据来源:Deribit,ETH 交易总体分布

数据来源:Deribit,BTC交易总体分布

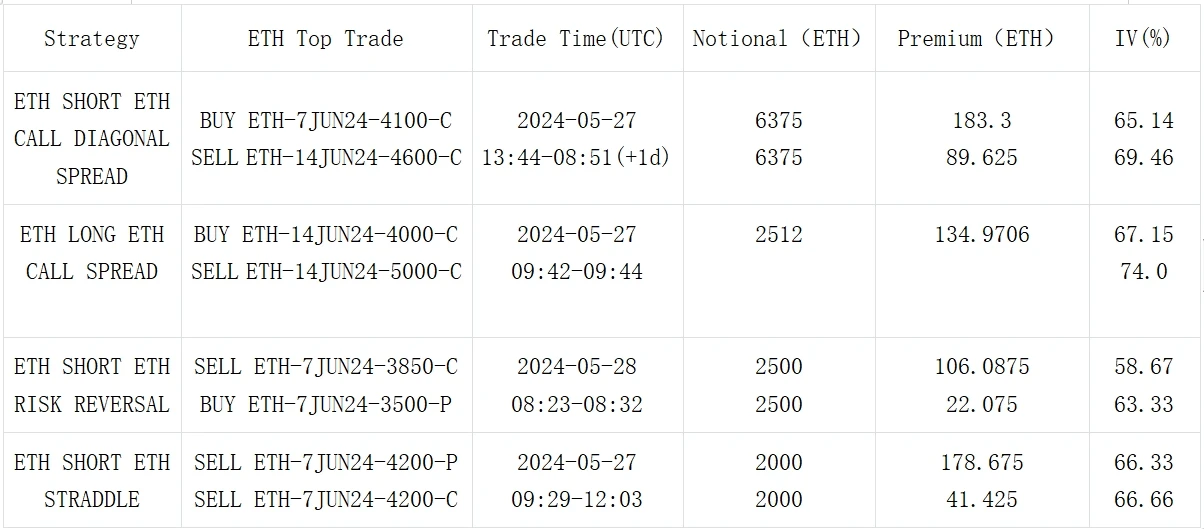

来源:Deribit Block Trade

来源:Deribit Block Trade

您可以在ChatGPT 4.0的插件商店中搜索SignalPlus获取实时加密信息。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlus_Web3,或者加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram群和Discord社区,与更多朋友交流互动。SignalPlus官方网站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240528): Recalling Mentougou

Related: a16z: Five principles for avoiding token issuance traps

Original author: Miles Jennings, General Counsel and Head of Decentralization at a16z Crypto Original translation: Karen, Foresight News “How do I launch a token?” is one of the most common questions we receive from founders. Given the rapid evolution of the cryptocurrency industry, FOMO is spreading as prices rise. Everyone else is launching tokens, should I do it too? But for builders, it is even more important to be cautious about token launches. In this post we will explore the preparations before token launches, risk management strategies, and an operational readiness assessment framework. To an outside observer, the tension between Blockchain Builders and the U.S. Securities and Exchange Commission (SEC) may seem exaggerated. The SEC believes that almost every token should be registered under U.S. securities laws, while Builders believes…