Cryptocurrency prices saw significant volatility on Thursday, with liquidations of all leveraged crypto derivatives positions surging to over $360 million that day, the highest level since May 1:

-

The sectors with strong wealth-creating effects are: RWA sector and Ethereum staking sector;

-

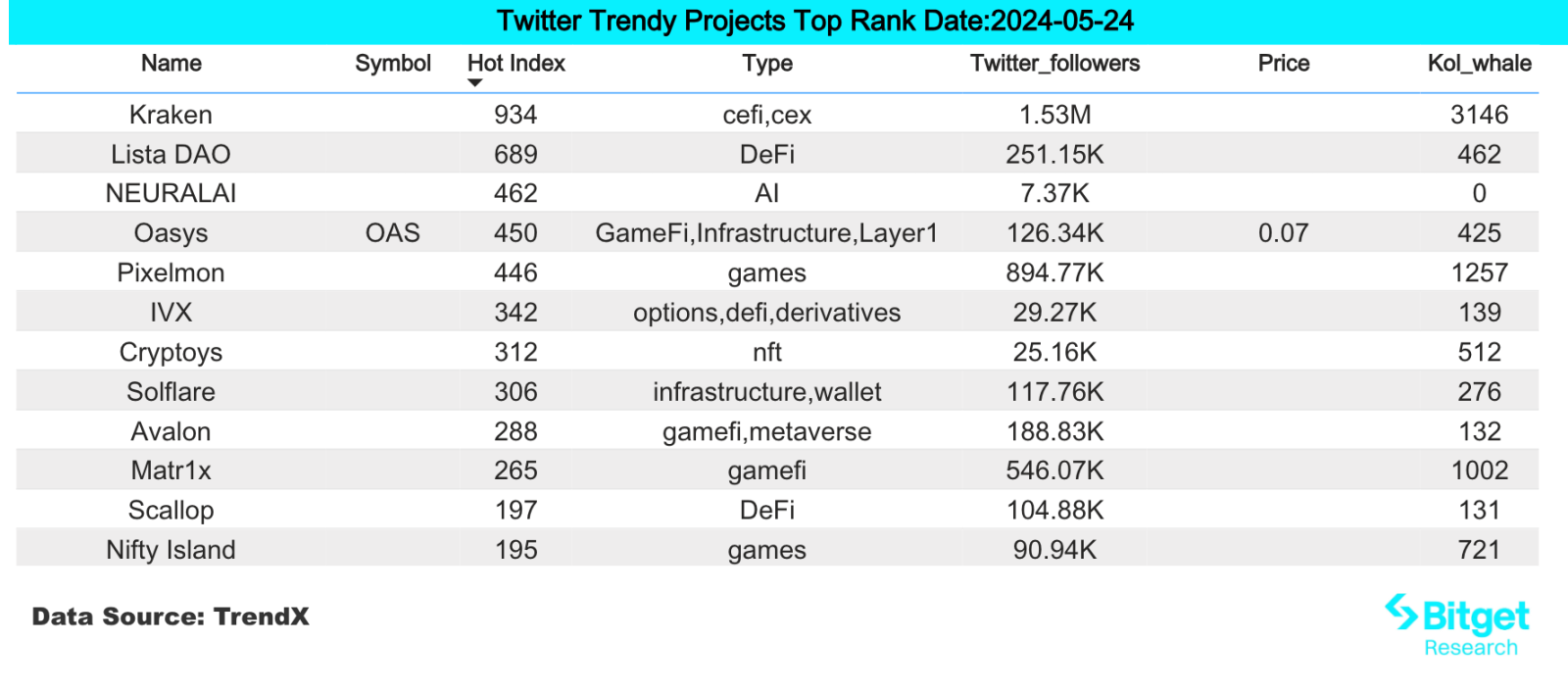

Hot search tokens and topics by users are: Plume Network, Lista (LISTA);

-

Potential airdrop opportunities include: Sanctum, Synthr;

Data statistics time: May 24, 2024 4: 00 (UTC + 0)

1. 市场环境

Cryptocurrency prices saw significant volatility on Thursday. Before the approval, ETH first fell to $3,500 around the closing time of the traditional U.S. market, then soared to around $3,900, and finally stabilized above $3,800 after confirmation. Bitcoin also fell to a low of $66,000, then soared to $68,300 before falling back below $68,000.

According to data from CoinGlass, during this turbulent period, liquidations of all leveraged crypto derivatives positions soared to more than $360 million that day, the highest level since May 1. Most of the liquidated positions were long positions, worth about $250 million, indicating that highly leveraged traders were concentrated on betting on an immediate surge after the ETF was approved. ETH traders were hit the hardest, with liquidations reaching $132 million.

2. 财富创造领域

1) Sector changes: RWA sector (ONDO)

Main reason: This bull market mainly originated from the traditional market buying brought by ETFs. As a way to introduce traditional financial markets, RWA has been constantly updating its products and raising funds. Recently, RWA layer 2 network Plume Network completed a $10 million seed round of financing.

Rising situation: ONDOs daily increase today is 13.46%;

影响后市的因素:

-

宏观货币政策变化:宏观环境方面,10年期美债收益率上升支撑RWA轨道基本面;需关注后续美元指数、美债收益率及加密市场变化,动态调整交易策略;

-

项目TVL变化:RWA轨道项目基本都是靠TVL支撑的,可以关注RWA轨道的TVL变化,如果某个项目的TVL持续上涨/突然上涨,一般是买入信号;

2) Sector changes: Ethereum staking sector (LDO, SSV, ETHFI)

Main reason: The U.S. Securities and Exchange Commission today approved the 19 b-4 forms of multiple Ethereum spot ETFs, including those from BlackRock, Fidelity and Grayscale. Since ETFs only allow Ethereum tokens and do not allow staking, this regulation greatly reduces the attractiveness to ETF investors, so the Ethereum re-staking sector will usher in substantial benefits.

Rising situation: LDO rose 10.8% in the past 4 days, SSV rose 7.97% in the past 7 days, and ETHFI rose 22.85% in the past 4 days;

影响后市的因素:

-

Fund inflow after ETH ETF is approved: At present, the ETF is in the countdown for listing after approval. If a large amount of funds flow in after approval, it will further push up the ETH price.

-

Protocol trends: The cash flow of staking sector projects is relatively stable and easy to predict. They are a type of project whose token prices can be estimated more accurately. The main influencing factors are the protocol TVL, income distribution method, token destruction, etc.

3) The sector that needs to be focused on in the future: TON ecosystem

主要原因:

-

Pantera 对 TON 的投资可能至少超过 1000 万美元,这是 Pantera 历史上对加密货币的最大笔投资。

-

TON 生态中的高流量项目 Notcoin 已上线币安,但 TON 代币本身尚未上线币安,市场预计 TON 上线币安只是时间问题。

-

TON 生态的基础设施建设尚处于起步阶段,目前已涌现出 Notcoin、Catizen 等高流量项目,依托 Telegram 形成了庞大的用户基础。

-

生态中稳定币发行量的增加带来了金融活力,TON链上USDT供应量在两周内就达到了1.3亿,成为USDT发行量排名第八的区块链。

具体项目清单:

-

TON: The native token of the Ton chain, currently listed on exchanges such as OKX and Bitget.

-

FISH: Ton ecosystem head meme token.

-

REDO: A dog-themed meme coin on the Ton chain.

3. 用户热搜

1)热门 Dapp

Plume Network:

Modular RWA L2 network Plume Network announced its launch on Arbitrum Orbit. Plume is a modular L2 blockchain dedicated to real-world assets (RWA), integrating asset tokenization and compliance providers directly into the chain. Plume Network team members come from companies and projects such as Coinbase, Robinhood, LayerZero, Binance, Galaxy Digital, JP Morgan, dYdX, etc. Yesterday, it completed a $10 million seed round of financing, led by Haun Ventures, and participated by Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures and Reciprocal Ventures. The funds raised will be used to recruit more employees in engineering design, marketing and community functions. The Plume Network open incentive testnet will be launched in the next few weeks, followed by the mainnet later this year.

2)Twitter

Lista (LISTA):

Binance Megadrop will launch Lista (LISTA), a liquidity staking and decentralized stablecoin protocol. The maximum supply of the token is 1 billion, the initial circulation is 230 million (23% of the supply), and the total Megadrop is 100 million (10% of the supply). Binance will list LISTA after the Megadrop is completed, and the specific listing plan will be announced separately. Lista DAO is a liquidity staking and decentralized stablecoin lending protocol. Users can stake and liquidity stake on Lista, as well as borrow lisUSD using a range of decentralized collateral. The report also introduces the LISTA token: LISTA is the governance token of Lista DAO, which is used for the following functions: governance, protocol incentives, voting, and fee sharing. The protocol consists of the following main parts that work together: decentralized stablecoin lisUSD and BNB liquid staking token slisBNB.

3)Google 搜索区域

从全球角度来看:

ETH ETF: A new compliance milestone in the crypto world: Ethereum spot ETF finally approved. On May 23rd, local time in the United States, the U.S. Securities and Exchange Commission (SEC) officially approved all Ethereum ETFs, providing investors with a new opportunity to invest in Ethereum through traditional financial channels. This decision is seen as a major endorsement of the cryptocurrency industry, becoming the second cryptocurrency ETF approved by the SEC after the spot Bitcoin ETF. After approval, the price of Ethereum rose slightly and fluctuated around $3,800, reaching a high of $3,856. It is currently reported at $3,807, a 24-hour increase of 1.3%. After the news landed, the fluctuation was not as large as in the previous few days, but it caused a lot of attention on the entire Twitter social media.

从各地区热搜来看:

(1) Europe and CIS regions show a certain degree of interest in MEME:

As the crypto market rebounded significantly, PEPE tokens continued to hit new highs, and users began to buy back their chips into MEME coins to gain higher returns. From the searches of European users, it can be seen that European users generally search for MEME coins more frequently, which also means that users in the European market are more involved in the MEME coin market.

(2) The Asian region has shown a clear increase in attention to BTC, ETH ETFs, etc.:

Influenced by Bloombergs report that Hong Kong may pass BTC and ETH ETFs this week, searches in the Asian region have clearly increased their attention to the event. As the core region of Asian finance, Hong Kong has always been at the forefront of financial innovation. With the passage of ETFs, it has once again become the focus of Asia. Traditional finance and large funds can enter the encryption field through this channel, which has a positive impact on both industry development and retail investment.

潜在的 空投 机会

圣殿

Solana 生态系统 LST 协议 Sanctum 正式宣布推出忠诚度计划 Sanctum Wonderland。据介绍,Sanctum Wonderland 旨在充分利用 SOL 通过游戏化的体验获得收益。用户可以通过质押 SOL 来收集宠物并获得经验值进行升级,并通过宠物获得 EXP。

此前,Solana 生态流动性质押服务协议 Sanctum 完成种子轮扩容轮融资,由 Dragonfly 领投,Solana Ventures、CMS Holdings、DeFiance Capital、Genblock Capital、Jump Capital、Marin Digital Ventures 等跟投,目前融资总额已达 1061 万美元。

具体参与方式:打开链接,连接钱包,填写邀请码,②兑换Sol为Infinity,充值至少0.122 SOL+0.05。充值钱包需准备至少0.172 SOL,充值至少0.11 SOL。宠物会自动成长并获得EXP,一旦LST余额低于0.1 SOL,宠物将进入休眠状态,停止获得EXP。有能力的玩家建议充值1 SOL以上,1 SOL每分钟可获得10 EXP,可随时提现,GAS费用极低。

Synthr

Synthr is a full-chain synthetic protocol that allows cross-chain minting and transfer of synthetic assets without the need for cross-chain bridges. The project mints assets on-chain through synthetic assets (Synthetix), which means that its technology can easily bring RWA to the chain, such as real estate, bonds or stocks, for cross-chain transactions and transfers.

The project raised $4.25 million from top funds including MorningStar Ventures, Kronos Research, and Axelar Fdn.

Specific participation method: The project has just been opened for testing. Users can participate in early interactions by entering the test network, registering a wallet, and receiving test coins through the faucet. Continue to pay attention to the subsequent progress of the project and actively participate in various on-chain interactions.

更多Bitget研究院信息:https://www.bitget.fit/zh-CN/research

Bitget研究院专注于聚焦链上数据,挖掘价值资产,通过实时监测链上数据和区域热搜挖掘前沿价值投资,为加密爱好者提供机构级洞察。截至目前已为Bitgets全球用户提供【Arbitrum生态】、【AI生态】、【SHIB生态】等多个热门板块的早期价值资产,通过深度数据驱动研究,为Bitgets全球用户创造更好的财富效应。

【免责声明】市场存在风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何观点、看法或结论是否适合自己的具体情况。根据此信息进行投资需自行承担风险。

This article is sourced from the internet: Bitget Research Institute: US SEC approves Ethereum spot ETF 19b-4, ETHFi and other ecological assets are expected to continue to rise

Original | Odaily Planet Daily Author | Asher In the past week, with the strong rebound of Bitcoin prices, the GameFi sector has also seen a good increase. Perhaps now is a good time to invest in the GameFi sector. Therefore, Odaily Planet Daily has summarized and sorted out the blockchain game projects that have been popular recently or have popular activities. Secondary market performance of blockchain gaming sector According to Coingecko data, the Gaming (GameFi) sector rose 6.9% in the past week; the current total market value is $20,475,708,280, ranking 28th in the sector ranking, down three places from the total market value sector ranking last week. In the past week, the number of tokens in the GameFi sector increased from 360 to 365, with 5 projects added, ranking…