In the past 48 hours, both the cryptocurrency market and the TradFi lobbying group were caught off guard by the sudden change. The U.S. SEC suddenly changed its position on the approval of the ETH ETF, suddenly requiring various ETF issuers to update their latest 19 b-4 filings and notify the NYSE and CBOE that these funds will be listed on the exchange, indicating that the possibility of the ETH ETF being approved is quite high.

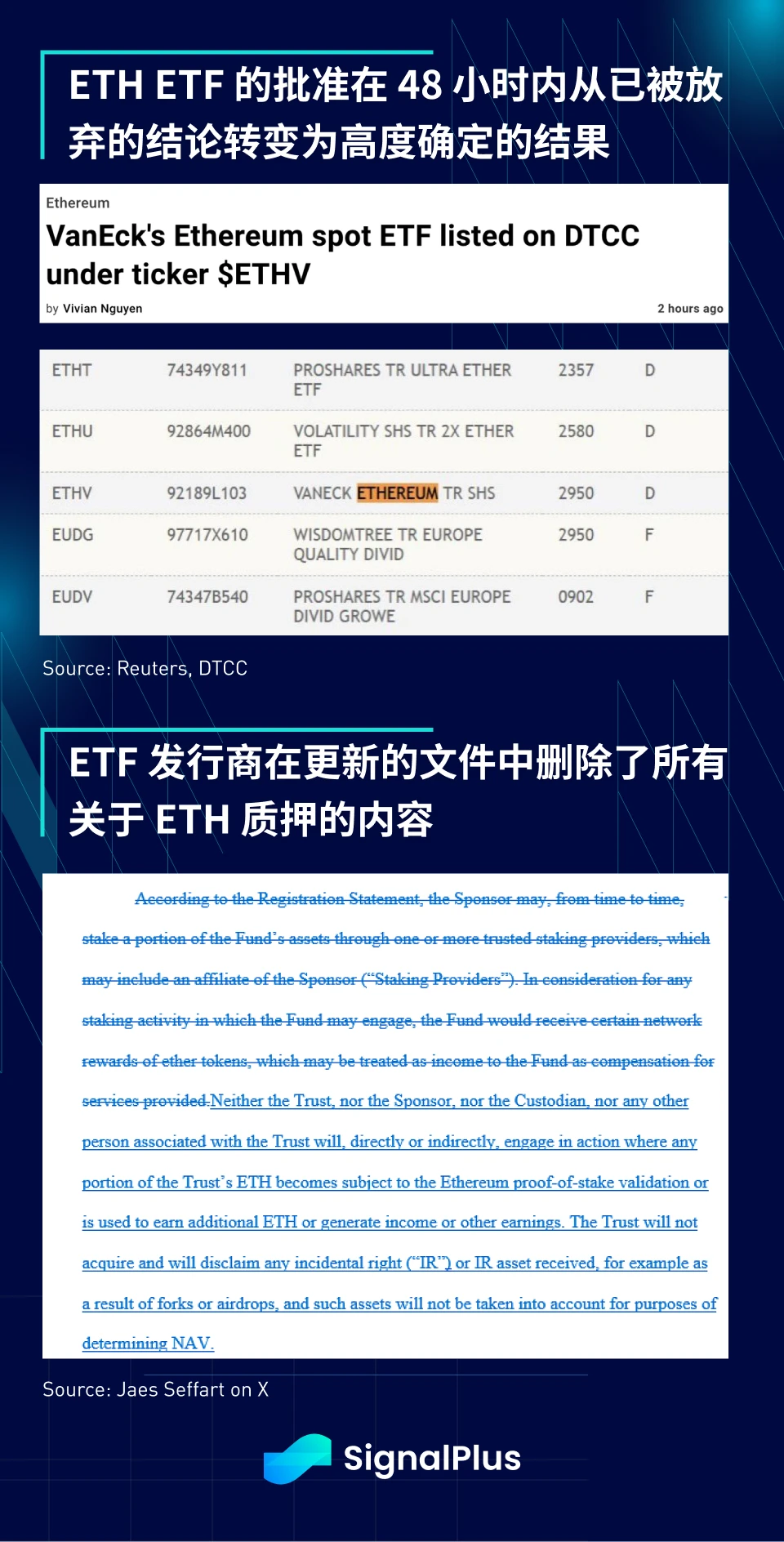

In response, five institutions that applied to issue ETFs (Ark 21, Fidelity, Franklin Templeton, Invesco/Galaxy, and VanEck) updated their 19 b-4 filings in the past 24 hours. VanEck’s product has even been listed on DTCC under the name $ETHV. This progress is really too fast!

So what’s changed in the updated document? ETF Analyst reports that, unsurprisingly, the SEC asked all issuers to remove all references to ETH staking, as this is the agency’s main argument for ETH being a security, so the underlying assets of the final ETH ETF may not be “staking for profit”, but what if it is packaged through a centralized exchange, or done through a third-party platform willing to pay deposit interest? How will the final S-1 document describe it? This industry is indeed still the most advantageous for lawyers!

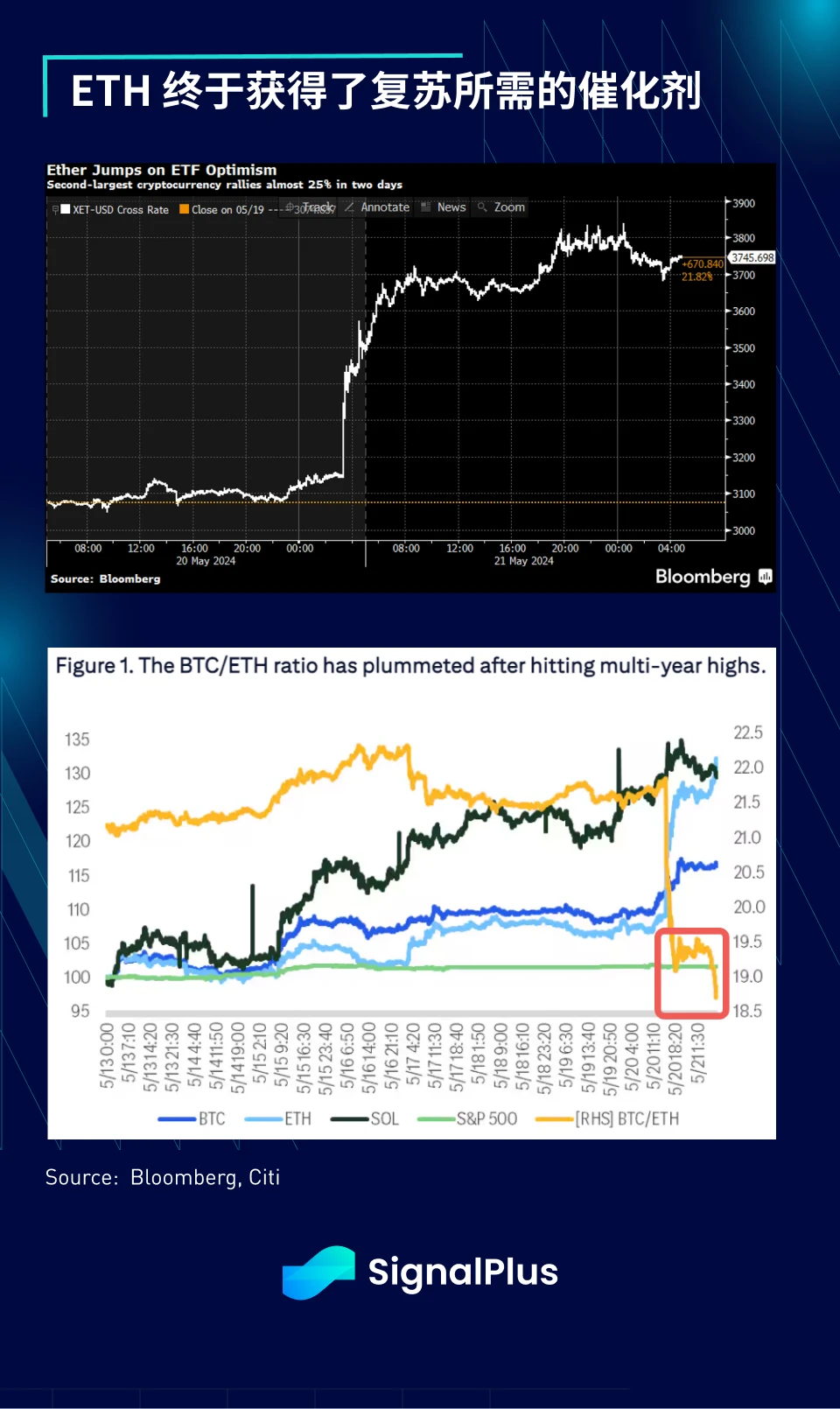

ETH of course surged on the news, surging 25% from $3,100 to $3,750 in less than 2 days. ETH has performed relatively poorly over the past 2 years, and has significantly lagged behind BTC over the past year, facing falling fees, competition from L1-EVM, and an over-focus on complex liquidity staking and re-staking, taking away the original sound money narrative of Ethereum before POS. Today, similar to the approval of the BTC ETF, the entry of TradFi bigwigs is once again expected to be the catalyst Ethereum needs to get out of its trough.

Unlike in January, the market now has a playbook for how these ETF launches will work, or at least a precedent to look to:

-

Since the approval of the BTC ETF in January, the Bitcoin price has been increasingly driven by the speed of inflows into the TradFi ETF.

-

BTCs correlation with macro factors and even Nasdaq is much higher than in previous cycles

-

BTC experienced a rapid bullish cashing out in January, falling from around $57,000 to around $50,000, and then the accumulated capital inflows quickly pushed the price to a new high of over $72,000. Will market participants behave in the same way this time?

-

Given that ETH is so unpopular, have native users accumulated enough ETH? Unlike the case of the BTC ETF, the possibility of the original ETH ETF being approved has long been in a very small state.

-

What impact will the combination of Grayscales selling backlog and ETF inflows ultimately have on prices?

-

The circulation of ETH is much smaller than that of BTC. Should we expect future net inflows/outflows of ETH to cause larger price fluctuations?

-

How aggressively will Larry Fink and Wall Street promote ETH this time?

-

As trading volumes continue to shift towards the US time zone, will the influence of the US market (which is at an all-time high year-to-date) continue to grow?

-

From a timeline perspective, there is still a long way to go before the final S-1 approval date. By the time the ETF is launched, will the macro environment (economy and interest rates) have changed significantly?

Speaking of changing macro factors, while the market awaits Nvidia’s earnings report today, a host of Fed speakers have quietly but firmly changed their rate narrative once again, this time back to a hawkish stance. This week and the past week alone:

-

Fed Governor Waller: In the absence of significant weakness in the job market, I need to see a few more months of good inflation data before I can feel comfortable supporting an easing of the monetary policy stance.

-

Vice President Jefferson: It is too early to tell whether the recent deceleration in inflation will continue

-

Vice Chairman Michael Barr: Inflation data for the first quarter of this year were disappointing. These results do not give me the confidence to support loosening monetary policy

-

Atlanta Feds Bostic: Im in no rush to cut rates… My forecast is that inflation will continue to decline this year until 2025, he said, adding, however, that prices will fall more slowly than many expect.

-

Cleveland Feds Mester: My previous forecast was three (rate cuts), but based on what Im seeing in the economy right now, I dont think thats still appropriate… I need to see a few more months of inflation data showing that inflation is falling

-

San Francisco Feds Daly: Its not clear whether inflation is actually receding, and theres no urgency to cut rates

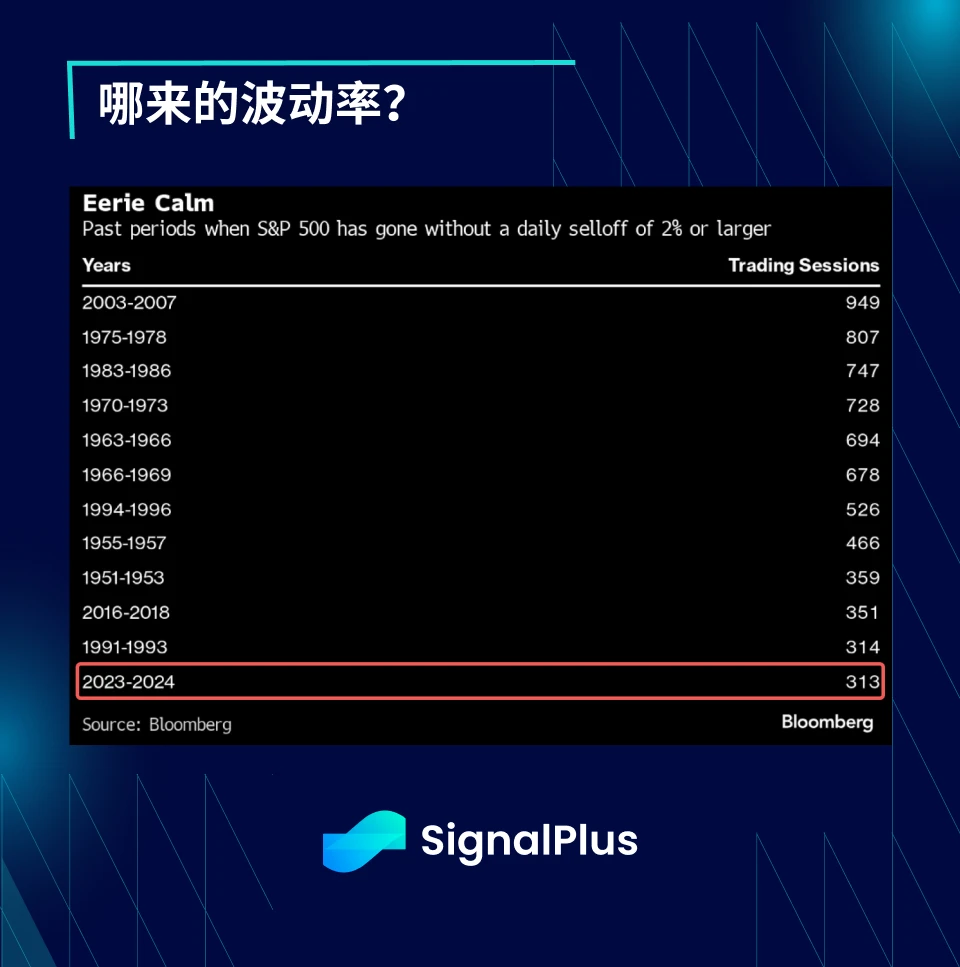

The SPX has not fallen by more than 2% in a single day for 313 days. The last time this happened was from 2016 to 2018, when the record was 351 consecutive days. The longest record was from 2003 to 2007, when there was no decline of more than 2% for about 3 years. No wonder everyone is selling volatility.

您可以在ChatGPT 4.0的插件商店中搜索SignalPlus获取实时加密信息。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlus_Web3,或者加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram群和Discord社区,与更多朋友交流互动。SignalPlus官方网站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Et tu, ETH?

相关:链游周报 | Immutable 推出$5000万游戏悬赏计划;超90%游戏代币下跌(4.22-4.28)

原创 | Odaily星球日报 作者 | Asher 编辑 | 秦晓峰 过去一周,加密市场整体较为低迷,但 GameFi 板块仍有不少热门项目发布大动作。或许随着市场的回暖,山寨币的轮动也会来到 GameFi 板块。因此,Odaily星球日报对近期热度较高或者活动火爆的区块链游戏项目进行了总结和梳理。 区块链游戏板块二级市场表现 据 Coingecko 数据显示,Gaming(GameFi)板块过去一周下跌 9.8%;目前总市值为 $ 19,853,737,045 ,位列板块排名第 22 位,较上周总市值板块排名下降一位。过去一周,代币数量…