Yesterday (21 May), according to Jinshi, Fed Governor Waller said that weak inflation data in the next three to five months will allow the Fed to consider cutting interest rates at the end of the year, and there is no need to raise interest rates at the moment. Fed Vice Chairman Barr also reiterated that high interest rates need to be maintained for a longer period of time. The 10-year US Treasury yield fell for the first time in five days, once dropping to 4.40%, but has recovered most of its losses today, now reporting 4.437%. The three major US stock indexes closed higher, with the SP and Nasdaq rising 0.26%/0.2% respectively, reaching new historical highs again.

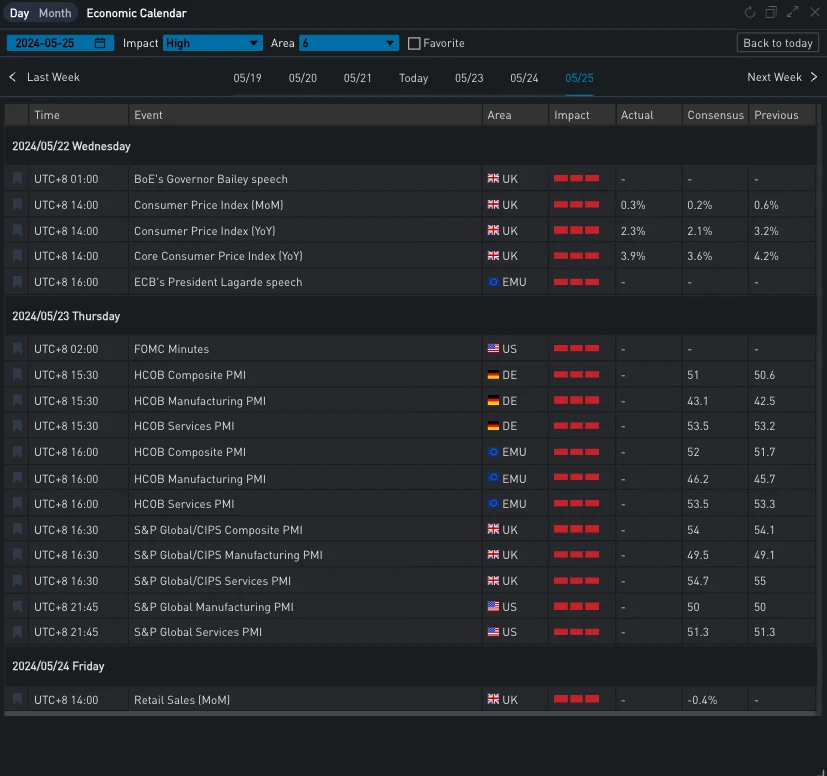

资料来源:SignalPlus,经济日历

资料来源:投资

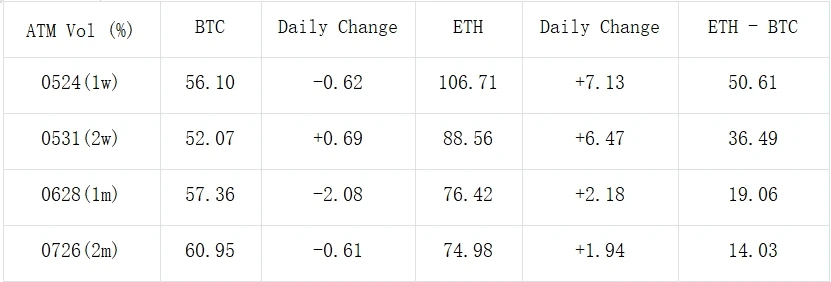

In terms of digital currencies, as the Ethereum spot ETF decision date approaches, ETHs overall IV level has risen again, and the price has successfully broken through the 3,700 mark. Bitcoin prices are slightly weak, and the currency price has adjusted back to around US$70,000.

Source: Deribit (as of 22 MAY 16: 00 UTC+ 8)

来源:SignalPlus

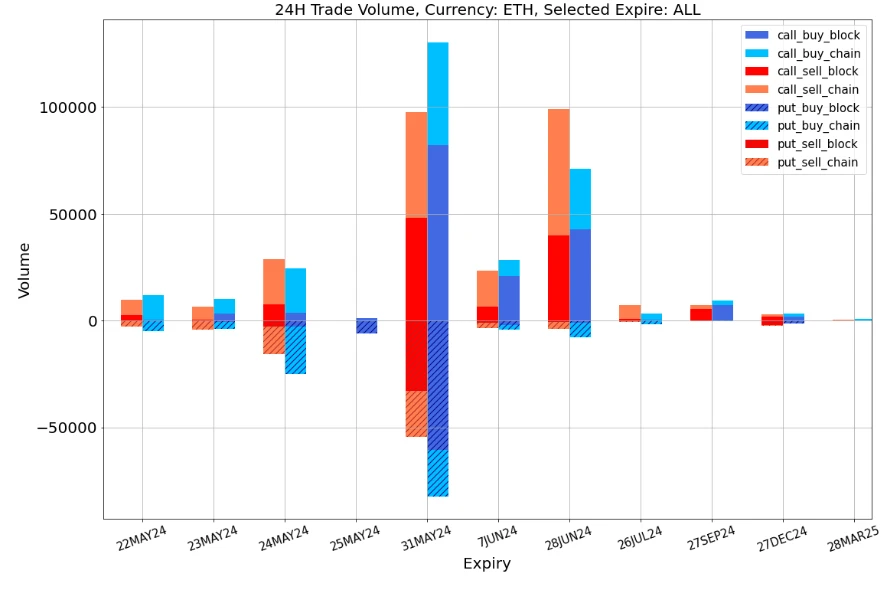

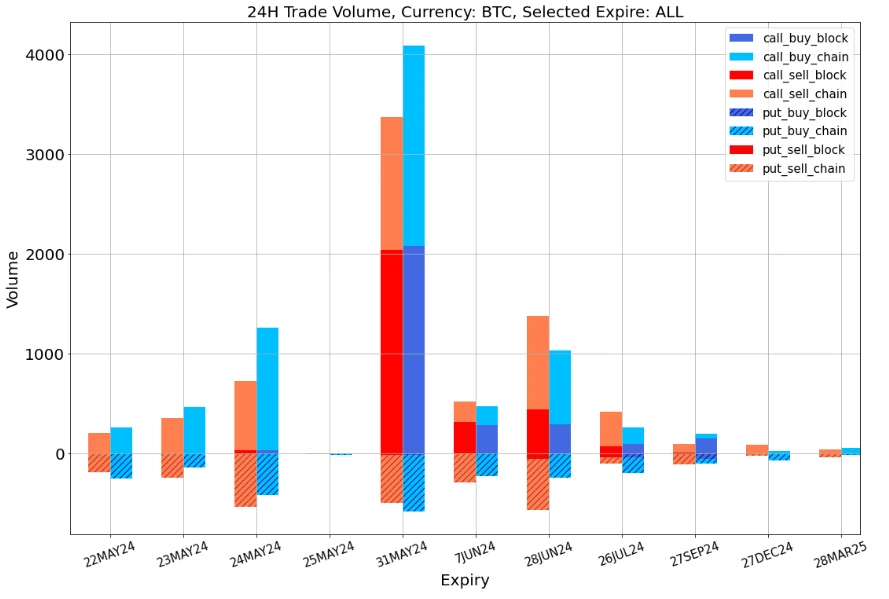

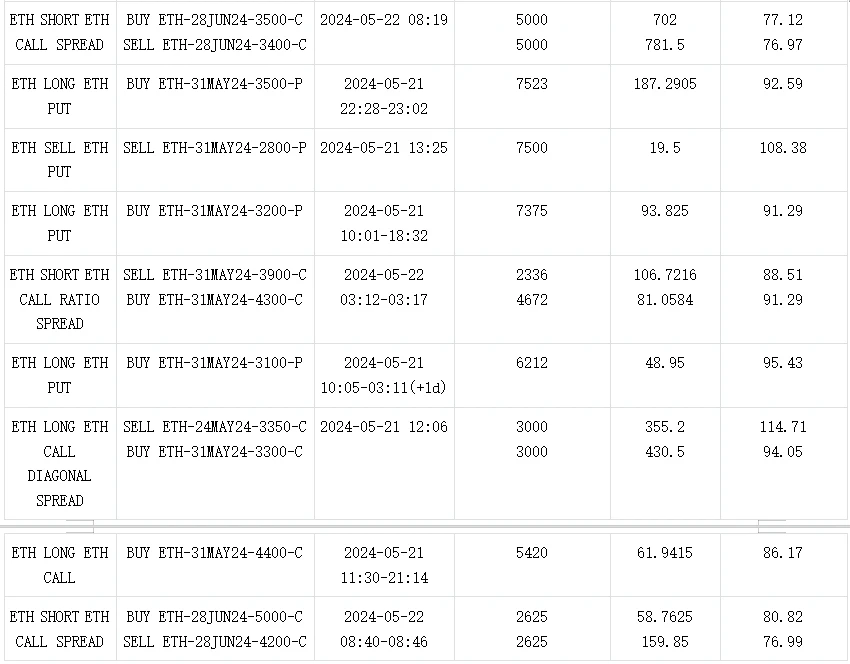

In terms of trading, BTC mainly adopts bullish strategies, among which the single-leg transaction volume of 31 MAY 77000 vs 81000 Call Spread is close to 1400 BTC, becoming the focus yesterday. In terms of ETH, the sharp rise in the price of the currency has caused a large number of stop-loss and take-profit orders, among which the 31 MAY 3000-C buy-back stop-loss is about 19500 ETH, and the 28 JUN 24 3600-C sell-profit is about 18000 ETH, which is the most significant position reduction point yesterday; the bulk platform has hot transactions, mainly including the June bullish Call Spread, the end of May Long 3400 Put, the selling of call options and the buying of put options on Wing explain the overall significant decline of ETHs Vol Skew in the upward market yesterday.

来源:SignalPlus

数据来源:Deribit,ETH 交易总体分布

数据来源:Deribit,BTC交易总体分布

来源:Deribit Block Trade

来源:Deribit Block Trade

您可以在ChatGPT 4.0的插件商店中搜索SignalPlus获取实时加密信息。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlus_Web3,或者加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram群和Discord社区,与更多朋友交流互动。SignalPlus官方网站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240522): Tomorrows Resolution ETF

相关:Polygon(MATIC)价格陷入盘整,但牛市反弹可能即将到来

简言之,Polygon 价格目前处于盘整状态,正朝着阻力位 $0.746 前进。MATIC 持有者表现出潜在积累的迹象,这在历史上曾导致反弹。Polygon 原生代币的供应中只有 33% 处于盈利状态,因此有资格获得可观的收益。Polygon (MATIC) 价格等待强劲的看涨信号,这些信号可能会推动山寨币摆脱目前陷入的盘整状态。鉴于山寨币是盈利能力最低的资产之一,投资者很可能会推动价格上涨以实现利润。Polygon 投资者暗示积累 MATIC 价格可能会突破 $0.74 关口,只要投资者采取相应行动。只要这些 MATIC 持有者不抛售,盘整可能会继续,积累可能会带来上涨。这是 MATIC 的可能结果……