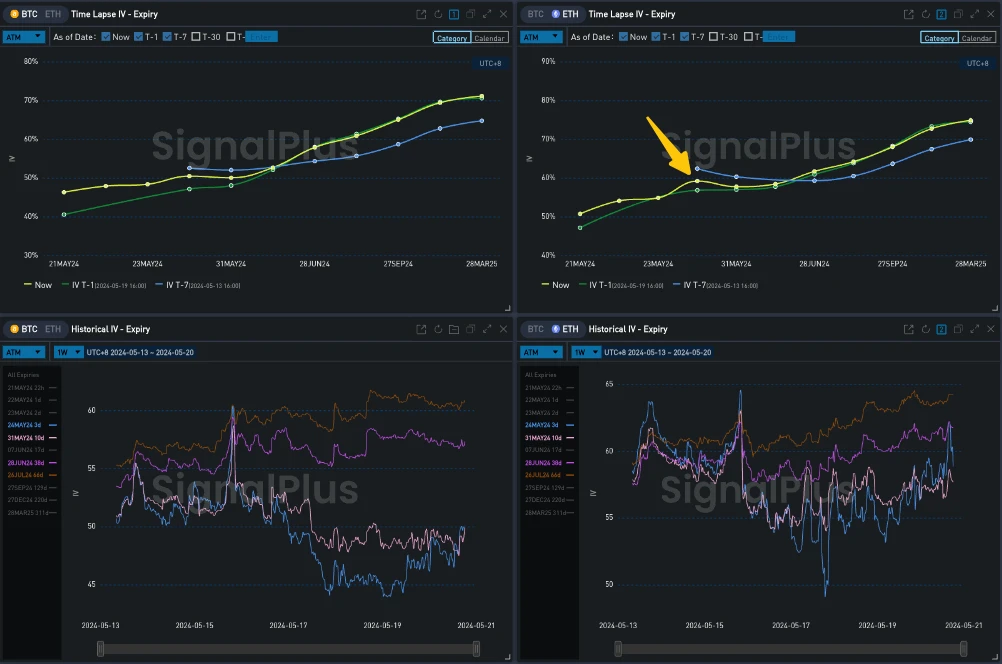

In terms of digital currency, this week the U.S. SEC is expected to announce the final decision on VanEcks ETH Spot ETF on May 23rd local time, which has attracted great attention from the market. From the volatility pricing of the options market, it can be seen that the ATM Vol of ETH 24 MAY has continued to rise in the past few days and formed a local high point. The overall level is also 5-10% higher than BTC Vol. The slope of the term is also flatter due to the higher Vol Premium at the front end. This will undoubtedly be an important moment for the cryptocurrency community. Although the market is relatively optimistic about the approval of the ETH ETF, the recent weak trend of ETH seems to suggest that the market has digested the rejection of Ethereum this time. Analysts believe that the approval of the ETH ETF is expected to be achieved next year, which will provide investors with more investment opportunities and promote the development of the entire crypto industry.

Source: SignalPlus, BTC ETH ATM Vol

Source: Deribit (as of 20 MAY 16: 00 UTC+ 8)

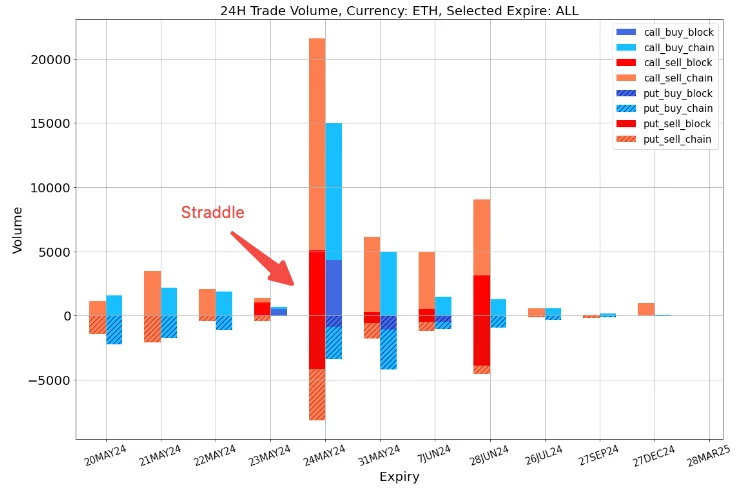

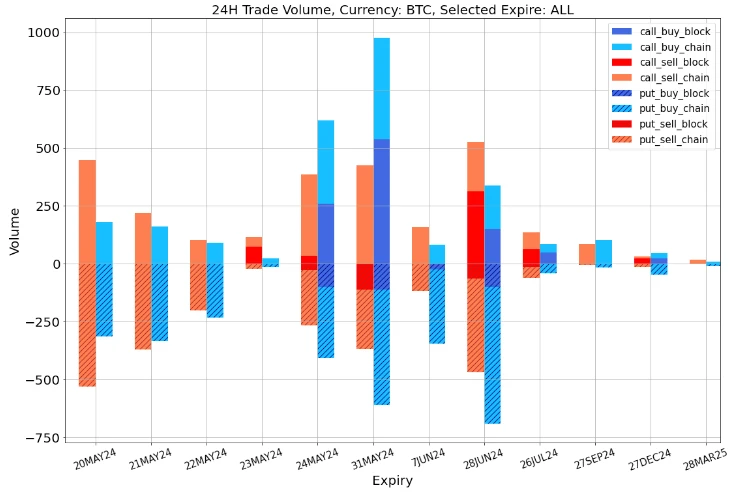

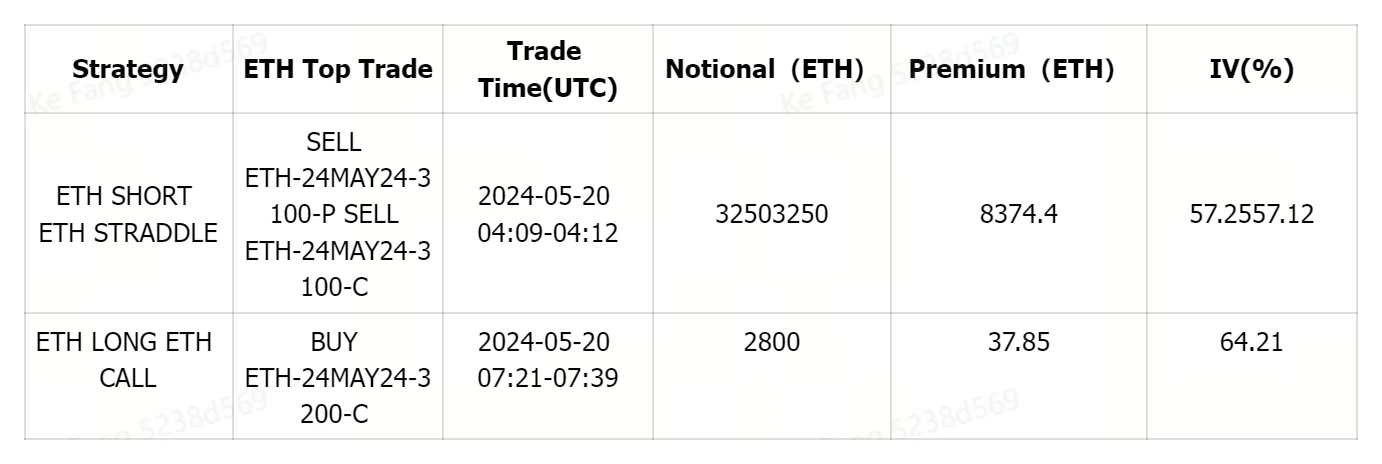

In terms of trading, ETH 24 MAY attracted a group of Sell Straddle transactions of 3250 ETH per leg in bulk due to the formation of a local IV high, betting on the Premium of IV-RV. In terms of BTC, a large number of long put option transactions emerged in May and June in the past day, driving the decline of Vol Skew in this range.

数据来源:Deribit,ETH 交易总体分布

数据来源:Deribit,BTC交易总体分布

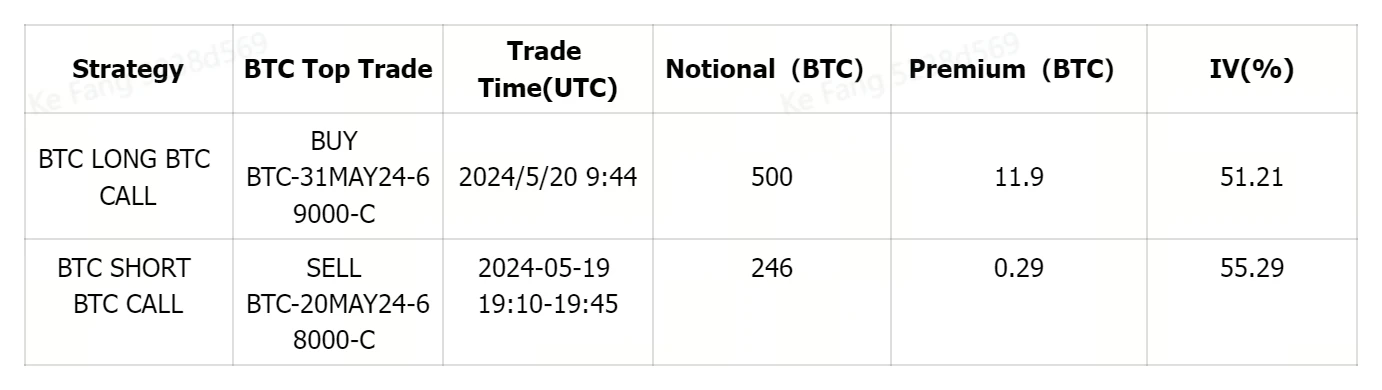

来源:Deribit Block Trade

来源:Deribit Block Trade

您可以在ChatGPT 4.0的插件商店中搜索SignalPlus获取实时加密信息。如果您想第一时间收到我们的更新,请关注我们的推特账号@SignalPlus_Web3,或者加入我们的微信群(添加助手微信号:SignalPlus 123)、Telegram群和Discord社区,与更多朋友交流互动。SignalPlus官方网站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240520): ETF Resolutions This Week

简而言之,Tron 价格一直试图收于 $0.121 上方,更广泛的市场线索可能引发反弹。MACD 和 ADX 目前都表现出潜在的看涨势头。融资利率在过去 24 小时内出现上升,表明乐观情绪激增。由于更广泛的市场线索和投资者的看涨情绪,Tron(TRX)的价格可能会在未来几天得到提振。问题是 TRX 能否成功完成反弹还是会中途停止。Tron 投资者看到潜在的 Tron 价格交易在 $0.118 观察到几个看涨线索,主要来自投资者。这在资产的融资率中很明显。加密货币中的融资率是指交易者之间为平衡市场而支付的费用。积极……