原作者: MIDAS CAPITAL

原文翻译:TechFlow

介绍

The concept of the meta-game is one of the more esoteric concepts in crypto, and it has neither a concrete definition nor a fixed structure. It is one of those things where “those who know it know it.” However, once you see it, it is hard to unsee it. In today’s post, I will try to unpack my thoughts on it, and hopefully readers will have a clearer understanding of the meta-game and how to think about it.

Before we get started, it’s important to point out that the concept of the metagame was popularized by Cobie in his article Trading the Metagame . Well-known traders like Dan from Light Crypto and CMS Holdings have also mentioned the concept in various podcasts. The idea is nothing new, but I hope to provide some new insights and build a structure around it.

The best way to understand metagames is through game theory, a branch of behavioral economics . It involves understanding the rules of the game, your opponents best response function, and your best response function given all the other information. We will use our intuition and look at the data to analyze these games and understand how to play each game with the optimal strategy.

It’s important to understand that every metagame is different. There are similarities between them, but none are exactly the same. Therefore, it’s important to have an overall framework and build your strategy based on that. This is what we’re going to explore today.

What is the metagame?

I will not define the metagame. It is more useful to explain how its mechanics work and the framework we use to understand it. The metagame has several components, which can be summarized as follows:

-

Basic Mechanics

-

Behavioral changes

-

Best Response Function

-

Reflection loop

The base mechanic can be thought of as the foundation of the metagame, and it can be broken down as follows:

-

Catalysts, usually (but not limited to) price movement – this sparks a narrative, and price moves with the narrative. The reason for the price movement can often be traced back to a protocol upgrade, KPI, or other event/metric.

-

The essence of a catalyst is the underlying mechanism that supports a reflexive loop.

Behavioral changes are how market participants express their views on catalysts

The best response function is how you as a trader should respond to the catalyst, how other market participants view the catalyst, and how they will respond to it. The best response function involves thinking about position sizing, entries, and exits.

Reflection loops can be categorized as follows:

-

Market participants identify the underlying mechanics → play the game → prices behave in a way that fits the rules of the game → the rules become more and more obvious → more participants identify the underlying mechanics → more players enter the game → the cycle continues.

The above four components provide a high-level overview of how metagames develop, evolve, and dissipate.

Theoretical Framework

Below is a flowchart detailing how to start from identifying the metagame, to understanding it, and then hopefully extracting value from it. Let’s work through this in a little more detail. First some theory, then we’ll look at some examples and data.

Step 1: Identify potential metagames, observing/looking for the following:

-

Developing narratives, sentiment analysis, unusual price action.

-

Position yourself as the protocol or department that solves a known problem.

-

A binary event that is widely known and understood.

Step 2: Identify the underlying mechanisms

-

Given the catalyst and how it is perceived, how does it drive changes in market participant behavior?

-

There are two types of underlying mechanisms, self-enhancing and self-defeating

-

Self-reinforcing: An ongoing foundational mechanism, the catalyst is ongoing so the meta-game will exist for a while. For example, BTC ETF inflows/outflows – given that data is published daily, this can be viewed as a repetitive game.

-

Self-defeating: A base mechanic that drives a behavior, causing the meta-game to dissipate quickly. For example, Facebook changed its name to META – this was a one-time event and can be considered a single-interaction game.

Step 3: Assumptions about Metagame Duration

-

The nuances of the underlying mechanics determine how long the game lasts, as well as entry and exit strategies.

-

Generally speaking, self-reinforcing metagames lead to the creation of sub-metagames, while self-defeating metagames disappear as quickly as they appeared.

Step 4: Quantify the persistence of the underlying mechanism

-

You need to make assumptions about whether games are self-enhancing or self-defeating, and then find data that either confirms or invalidates those assumptions.

-

For example, if we are playing a meme metagame, it would be nice to look at relative volume (as a proxy for attention)

-

For example, if we were playing the BTC ETF metagame, it would be helpful to see data points on what funds are flowing in/out of the ETF, where they are coming from, and how the price is responding to them.

-

This is largely a gut feeling driven by data issues.

Step 5: Use quantifiable metrics and general market strength to guide exits.

-

There is no specific or repeatable exit strategy.

-

The time to quit is different for every metagame, and generally speaking, intuition is key.

-

Looking at data, market cap, relative volume, etc. is helpful — but ultimately, it’s a discretionary choice.

Meta-game example

Let’s look at some current and past examples of metagames, along with the associated logic and data. In this section, we’ll look at a self-reinforcing metagame (ETH killer deal), a self-defeating metagame (Facebook rebranded as META), and a currently ongoing metagame (BTC ETF flows).

Example 1: ETH Killer Metagame

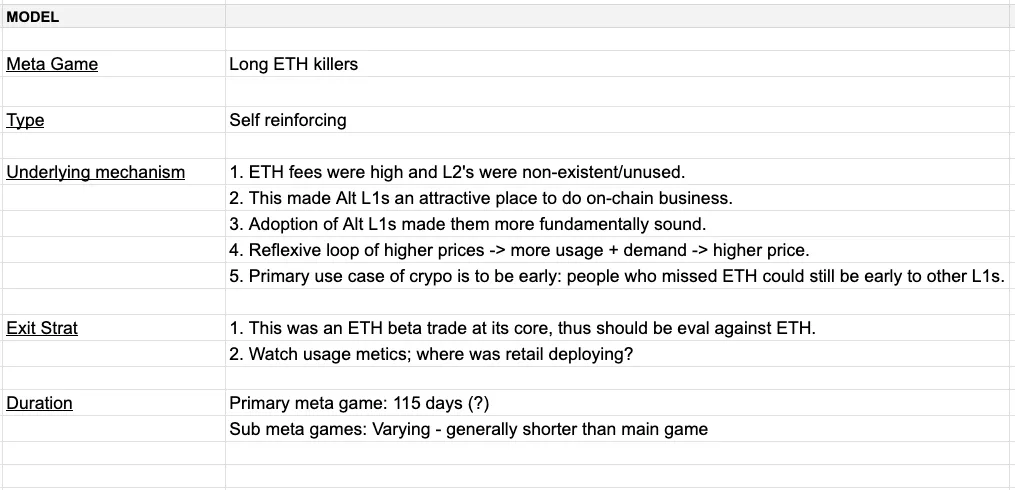

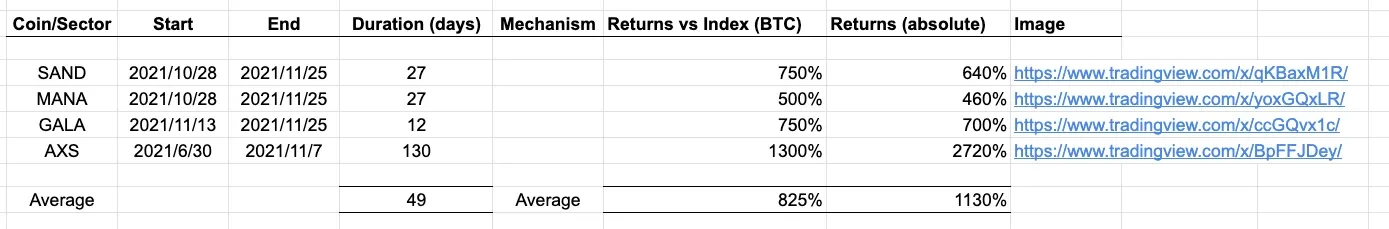

I am assuming this is a metagame that most readers are very familiar with, and it is one of the trades for the bull run of 2021. Below is a table outlining the basic parameters of the metagame.

If the table isn’t clear, I’ll take a moment to explain this metagame in detail. Let’s think back to the bull run of 2021. Retail investors came here to gamble, ETH fees were expensive, scaling solutions were insufficient, and Solana and Avalanche positioned themselves as solutions to the problem (i.e., transactions were faster and cheaper), and that was the underlying mechanism.

The underlying mechanism is self-reinforcing (reflexive) , as long as we are in a bull market, ETH fees will remain high, so the reason to be long ETH will last throughout the bull market. As SOL and AVAX outperform ETH, the trade becomes clearer and more participants trade it. The nature of the underlying mechanism supports an upward reflexive loop.

Given the persistence of the metagame, it has spawned sub-metagames, which are spin-offs of the main game. Specifically, the boom in SOL and AVAX DeFi and the emergence of FOAN trading. Market participants are positioning Phantom, Harmony, Cosmos, and Near as new Alt L1 trading. Mechanically, those who feel they missed the main game have found sub-games that are tangential to the main game to participate in.

Generally speaking, sub-meta-games have smaller rewards and do not last as long as the main game.

-

Primary → main metagame; Secondary → sub-metagame

-

start, end, duration → time parameters

-

Mechanics → Description of the underlying mechanism

-

Returns vs. Index → A measure of performance relative to a primary or underlying mechanism theme

-

Absolute Return → Performance measure in absolute terms

The parameters of the game are largely subjective. It is objectively clear that X outperforms Y, but when performance begins and ends is subjective. The same subjective logic can be applied to the selection of indices. How do we define excess performance? The function of the table is simply to approximate some objective truth.

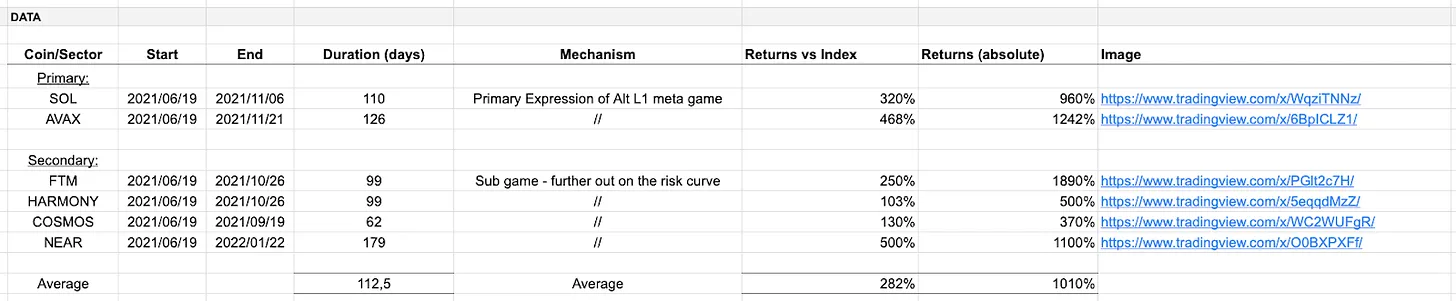

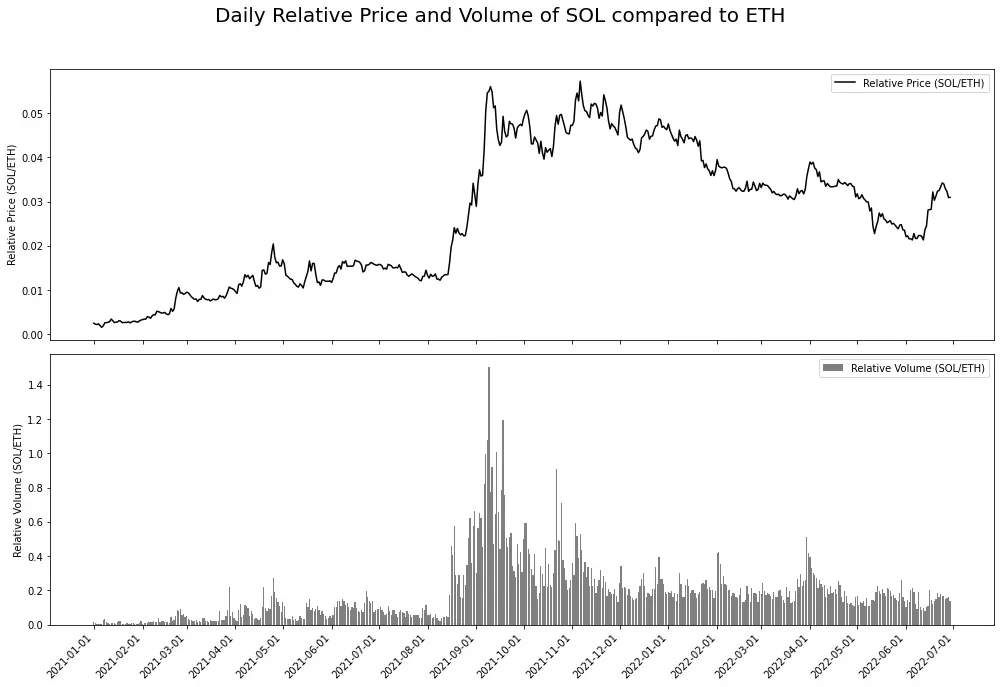

There are two graphs below – SOL vs ETH and AVAX vs ETH. They show the relative volume and relative price performance of SOL and AVAX to ETH, with data sourced from the Binance Futures API. The idea is simple, use relative volume as a proxy for relative interest and see how this matches up with relative price performance.

It is noteworthy to find excess returns in the long term for this metagame in the second half of 2021. I assume this is because of the price drop in the summer of 2021, which put all games on hold while the narrative attracted more players. When the market rebounded, the direction of capital allocation became clear. This may be motivated reasoning, but I think it is accurate to some extent.

In order to think about an exit strategy, we need to revisit the assumptions of the underlying mechanics. This metagame is a solution to an ongoing problem (high ETH fees), a problem based on a bull market. Therefore, the most basic exit strategy is to sell when you think we are near the end of the bull market.

Example 2: Facebook changes its name to Meta

On October 28, 2021, Facebook changed its name to META, which triggered a speculative frenzy for crypto projects related to the metaverse, which is a fairly obvious foundational mechanism. The difference between this foundational mechanism and the previous one is the duration. Example 1 is self-reinforcing, while example 2 is self-defeating, what I mean by this is that the catalyst in example 2 is a one-time event. This changes the rules of the game slightly, let me explain.

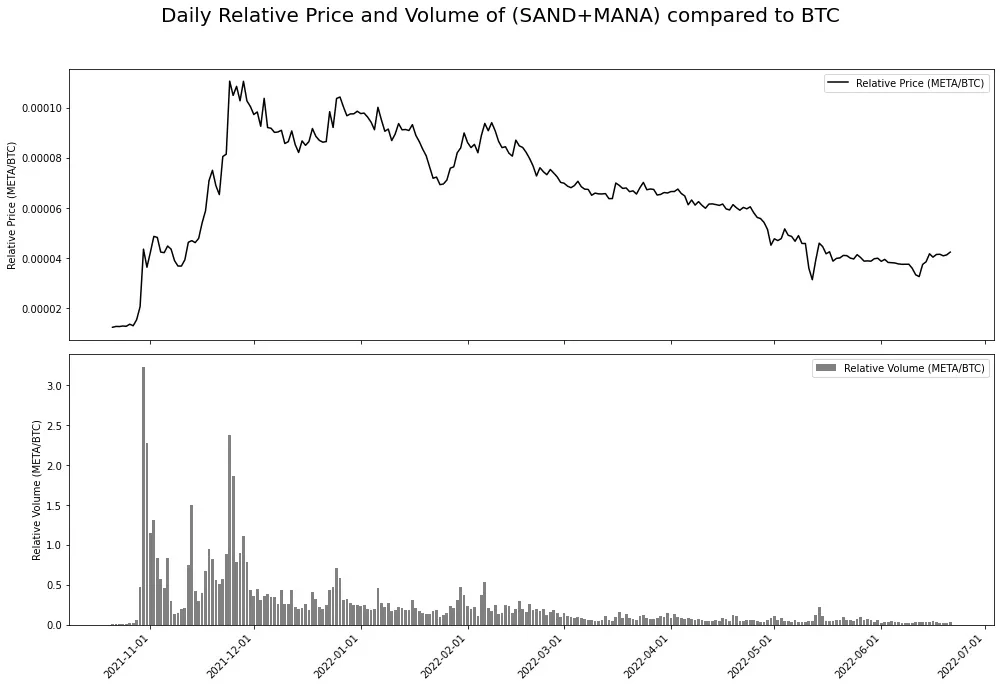

Take a look at the chart below – it shows how attention has changed over time. If we assume that every project has some equilibrium share of the attention economy, we have our baseline. After the one-time catalyst, we have a huge re-rating in the attention economy share of the Metaverse tokens. This drives exceptional price volatility, which in turn attracts more attention. However, as the catalyst fades away, the metagame begins to unravel rapidly. This can also be understood in terms of fragility; over time, coordination points become more vulnerable to external forces (i.e. price action in major currencies) – in large part, Bitcoins -9% drop on November 26th put an end to this frenzy. Over time, the ability of the one-time catalyst to act as a coordination point is diminishing – which is reflected in the diminishing attention below.

Prior to the rebrand, Axie Infinity had already had a semi-closed development, and the concept of the Metaverse was gaining traction in Silicon Valley. All the ingredients were in place, and the META rebrand was just the spark that lit the fire. The main beneficiaries of the Metagame were Decentraland ($MANA) and The Sandbox ($SAND) – they were immediately repriced.

Again, in order to think about an exit strategy, we need to revisit the assumptions of the underlying mechanism. Namely, the underlying mechanism of a one-time catalyst is self-defeating. Therefore, one should actively look for ways to exit a trade. If we look at the chart below, we can see that it reflects the stylized example above, and relative volume can be used as a proxy for share of the attention economy. Additionally, it is important to understand market structure, and it is impossible for $SAND and $MANA to consistently trade three times as much as $BTC, which defies logic.

Example 3: BTC ETF Metagame

Note that this section was originally written in late March, and updated thoughts on this metagame can be found later in this section.

This is an example of the metagame going on right now; most crypto market participants are playing this trade. The underlying mechanism is bullish ETF inflows for several reasons:

-

We are approaching the halving and the amount of coins flowing into ETF products is multiple times the new supply. This makes the narrative of limited supply + tokens even more attractive.

-

The approval of ETF products lends legitimacy to crypto as an asset class and provides a whole new investor base with access to BTC.

Similar to the ETH Killer metagame (Example 1), this metagame is self-reinforcing. ETF products trade seven days a week, so the price of BTC trades (loosely) as the beta of these ETF flows. Given the underlying mechanics, we can make some assumptions about ETF flows and prices:

-

ETF inflows are positive for BTC prices

-

ETF outflows are bad for BTC prices

As a basic model, this is a fairly straightforward play. However, as with all things in life, the devil is in the details. Given that GBTC was originally a closed-end fund, the vast majority of outflows have come from GBTC – and it is expected that these flows will slow down as we enter the second half of the year. = All else being equal, GBTC outflows will decrease, so net inflows should be boosted – bullish.

Current thoughts on this metagame:

I guess this will serve as a reflex to my original BTC ETF metagame thesis. A lot has happened since I originally wrote this section, in particular the halving has occurred and ETF flows have declined and occasionally been negative. I think the metagame is still going on, but the reflexivity is operating in the opposite direction, i.e., ETF inflows have turned into outflows and the price has responded. The relationship between ETF flows and BTC price performance seems fairly clear in both directions.

It is important to note that ETF flows and prices are not mechanically correlated, and like all metagames, this is somewhat of a shared illusion. As ETF flows find equilibrium, most likely with 0 daily flows, I expect this metagame to dissipate. It is also important to note that the level of attention paid to ETF flows is relative to their size, with both large and small days making headlines, while average days receive little attention. As this metagame recedes further and further into the rearview mirror, I expect only outlier days to attract attention.

In the near future, we may get an ETH ETF metagame similar to the BTC ETF metagame. All else being equal, I expect:

-

As the likelihood of ETF approval becomes more apparent, ETH will trade higher, and we can use the approval odds and rhetoric from the Bloomberg ETF brethren as a proxy for this.

-

The risk after the ETF approval is reduced as the market analyzes the ETF inflows and ETHE (Grayscale product) outflows.

-

If inflows are comparable to BTC (which I doubt), this is bullish. Lack of inflows is bearish and potentially bullish for Solana.

Assuming the fees for the ETH ETF product will be similar to the fees for the BTC ETF, I am not entirely sure what the outcome of higher fees would be, Occams Razor suggests it would be bearish. BTC price action and BTC ETF inflows set the stage for the ETH ETF to perform well, which is somewhat a given, and as we start trading the ETF ETF metagame, I think the market will price the BTC ETF in based on its performance. If there are large outflows from BTC ETFs between and after the ETH ETF approval, I think the ETH ETF will die. Other interesting things to watch include whether the ETH in the ETF will be collateralized, and whether ETF holders will get that benefit, which seems unlikely because of well, securities laws, Howie test, etc, but it would be a surprise if it were.

Some general thoughts

There are certain laws or logics to market behavior, and asset behavior that violates these laws will quickly revert to the mean. The logic/laws are largely dynamic, but the Overton window (i.e., policy window) changes more slowly than most people think. In addition, there are some laws that cannot be violated, like gravity.

The metagame is more of a mental model than an investment framework, and it is difficult to build a solid structure around how these games develop, evolve, and behave because they are all different. Identifying these games and theorizing how they will develop requires a degree of intuition honed through market time and first principles thinking.

I have already described in detail one self-defeating, self-reinforcing, and currently ongoing metagame, other examples include:

-

Meme, 2021 (self-defeating)

-

ETH Merger, 2022 (Self-Defeating)

-

Crypto x AI, 2024 (Self-Enhancement)

-

SOL killers, 2024 (unclear)

-

Meme, 2024 (self-defeating)

-

RWA, 2024 (Self-Enhancement)

-

New Currency, 2024 (Very Changing)

-

BTC ETF beta, 2024 (self-reinforcing)

There are many different metagames, and each one is different. However, the basic protocol is the same: identify the metagame, understand its underlying mechanics, deduce how long the metagame will last, and then plan how to best capture value from it.

This article is sourced from the internet: Understanding the Crypto Metagame: The Core Drivers of Market Narrative and Behavior Change

Related: Optimism (OP) Price Recovery Triggered After This Major Development

In Brief Optimism price saved skin by recovering before falling below $3.00. On Tuesday, the development team began testing fault proofs on the Ethereum Sepolia testnet. About $364 million worth of OP is on the verge of becoming profitable, which will drive investors to act bullish. The Optimism (OP) price is on the verge of making a potential comeback after noting a 30% correction over the last few days. This recovery will be triggered by development on Tuesday, but OP will still need to cross some barriers before this recovery can be solidified. Optimism Fault Proofs Test Begins Optimism development firm OP Labs announced on Tuesday that it would be beginning fault-proof testing on Ethereum’s Sepolia testnet. This is the second iteration of fault-proof testing after already being deployed on…