The TRUMP meme coin has been in a continuous downtrend for the past month, failing to break above the $21.45 barrier. The token fell below $12 earlier in the week but recovered after the political clash between US President Donald Trump and Ukrainian President Zelensky.

Despite being up by 8% today, technical indicators show persistent bearish pressure as the meme coin struggles to find a support level.

TRUMP Is Facing Bearish Pressure

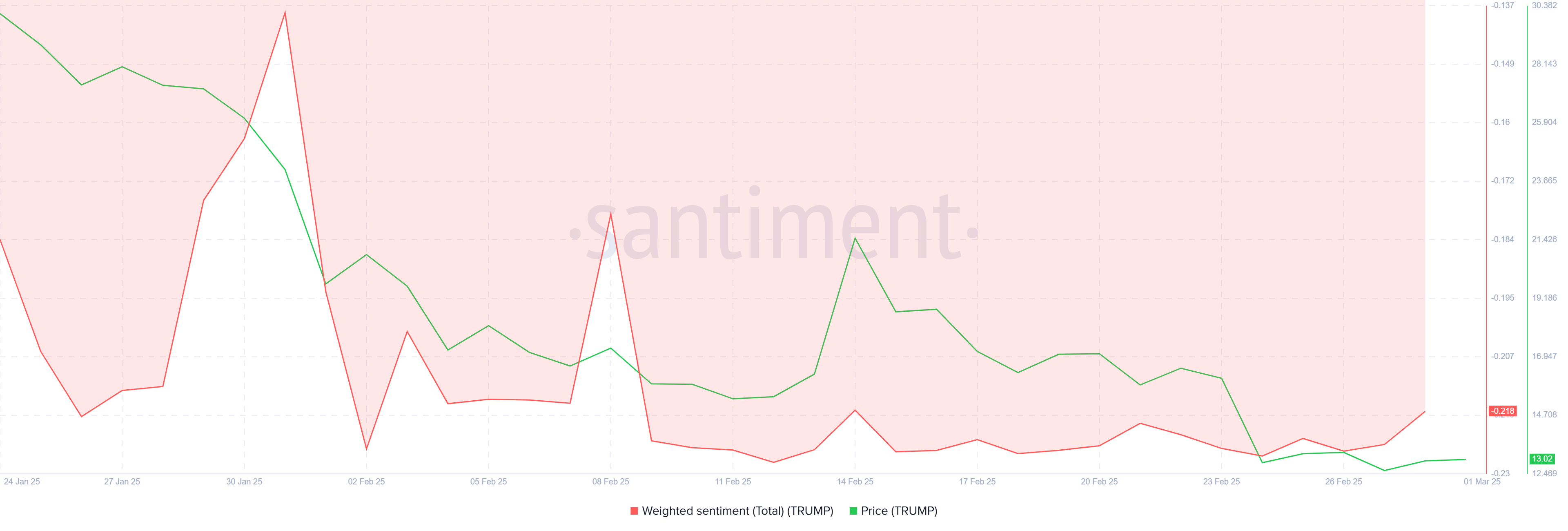

The investor sentiment surrounding TRUMP has been largely negative in recent days. As the political showdown between Trump and Zelensky created significant buzz on social media, the meme coin saw some buying actions today, but the overall momentum remains notably low.

This reflects a lack of confidence in any immediate price recovery.

Negative sentiment surrounding political conditions is likely to discourage new investments, which will only deepen TRUMP’s ongoing price drawdown. This overall atmosphere suggests that further declines are possible unless significant changes occur.

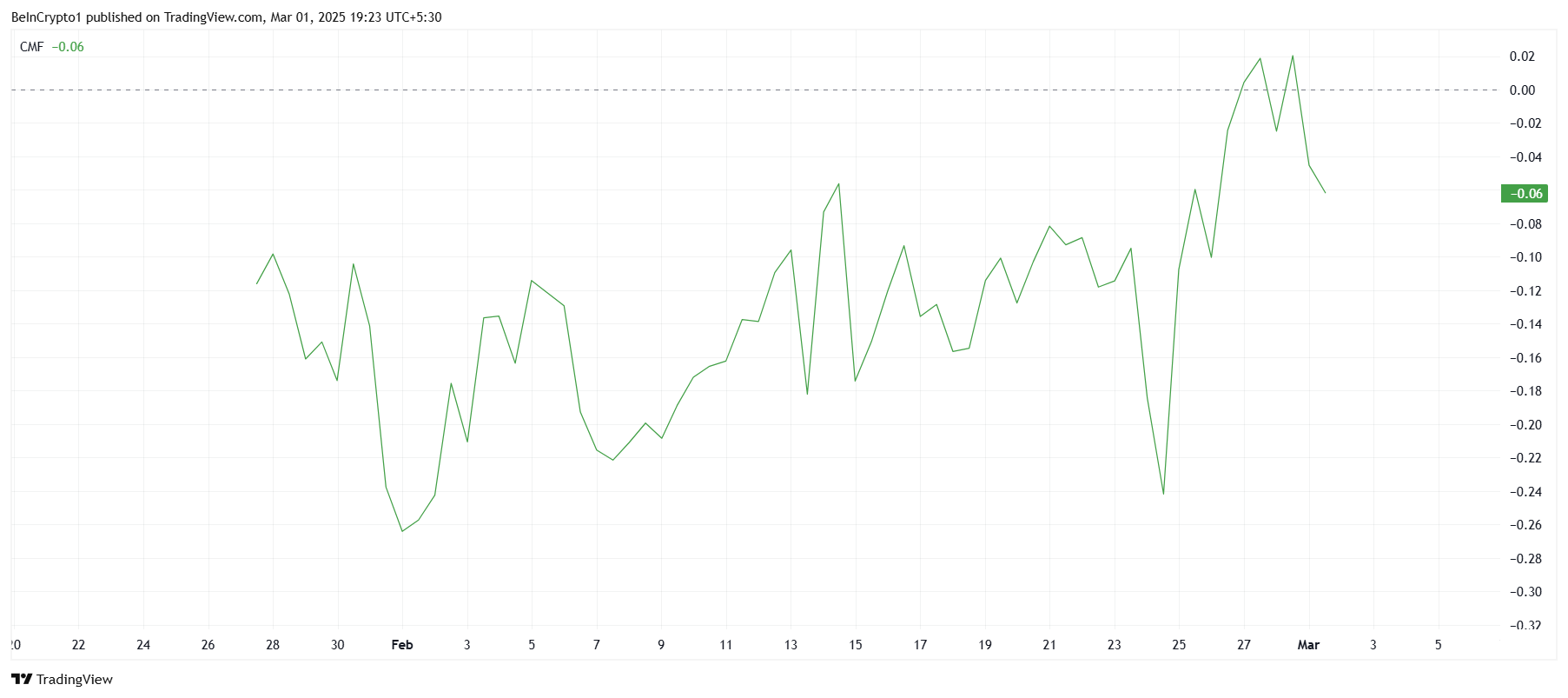

The technical indicators for TRUMP reflect the overall negative market sentiment. The Chaikin Money Flow (CMF) indicator, which tracks the accumulation and distribution of an asset, shows a clear downward trend.

The CMF has failed to secure the zero line as support, indicating that the inflows that once kept the altcoin afloat have turned into outflows.

This reflects weakening investor confidence, exacerbated by the ongoing political tension and the lack of bullish triggers for the asset. Without a shift in the broader market or sentiment, the downward pressure on TRUMP’s price is expected to continue.

TRUMP Price May Fall Further

TRUMP’s price has recently hit a new low of $11.07, marking a significant drop from its previous levels. At the time of writing, the altcoin has managed to recover slightly to $13.12, but it remains stuck below the critical resistance of $14.48.

This barrier has proven difficult to overcome, indicating that the altcoin could continue its struggle in the short term.

If the bearish momentum persists due to political factors like Trump’s tariff policies, TRUMP could slide even further. The next potential support level lies at $11.07, and if this fails, the altcoin could fall below $10.00, deepening losses for investors.

Given the current conditions, the price may continue its downtrend unless broader market cues shift.

Although the likelihood of breaking through the $14.48 resistance seems low, positive developments in the broader market could bring some relief. If this happens, TRUMP could attempt to flip the $16.00 level into support, but it would likely face consolidation below the key $21.45 barrier.

本文源自網路: TRUMP Price Hits All-Time Low; US-Ukraine Rift Fuels Fear

Related: Crypto market sentiment is low: Stablecoin growth shows capital inflows | Frontier Lab Crypto 市場 Weekly Report

Market Overview Overall market overview This week, the 加密貨幣currency market is in a volatile downward trend, and the market sentiment index has fallen from 11% to 8%. The market value of stablecoins has basically begun to grow rapidly (USDT reached 142.7 billion, USDC reached 57.2 billion, with an increase of 0.49% and 2.32% respectively), indicating that institutional funds have begun to enter the market again, with the growth rate of US funds being the main one. It can be seen that after the decline in the past two weeks, US investors have begun to enter the market again; although the release of data and the release of the Feds revelation paper have gradually eliminated the markets concerns about the US economic recession, and the market has gradually begun to price…