For most of February, the 加密貨幣 market trended sideways, but this week, activity has plunged due to the impact of Donald Trump’s war trades. The downturn triggered over $800 million in liquidations in the past 24 hours as traders struggled with the volatility.

Despite the pullback, crypto whales have continued to accumulate some coins, positioning themselves for potential gains in March. This analysis examines some of these assets.

Bitcoin (BTC)

BTC broke below a key support line this week, which had kept its price within a range since the beginning of February, and fell to multi-month lows. The market’s leading coin now trades at $79,610, a price low last recorded in November.

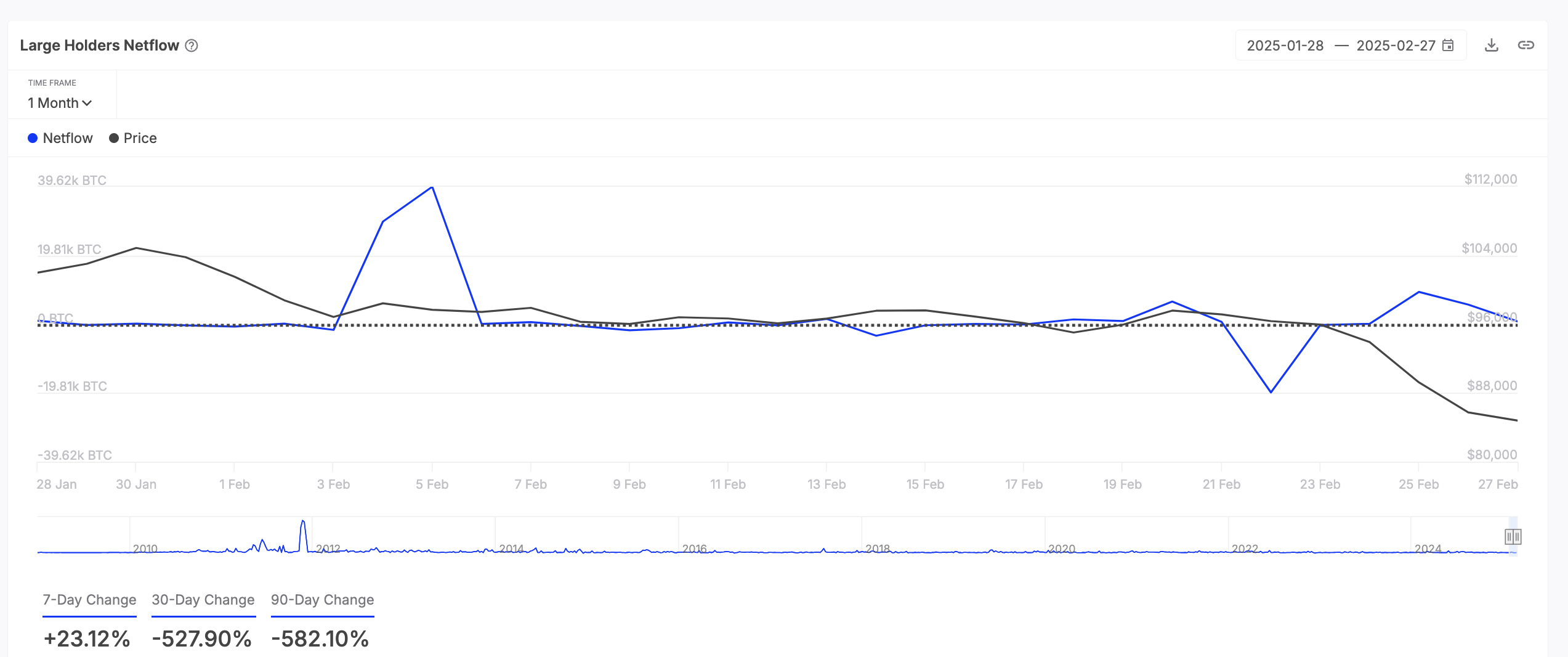

BTC whales have taken advantage of its discounted prices to strengthen their holdings, as reflected by the surge in the coin’s large holders’ netflow. According to IntoTheBlock, the metric has rocketed by 23% in the past seven days.

Large holders are whale addresses that hold more than 0.1% of an asset’s circulating supply. Their netflow tracks the difference between the inflows and outflows of an asset held by these major investors.

When it rises like this, it indicates that large holders are accumulating more of the asset, suggesting increased confidence and potential upward price pressure. This trend may also prompt BTC retail traders to increase their buying pressure.

If this continues, it will reduce the coin’s supply in circulation and drive up its value in March, possibly back above $95,000.

The Sandbox (SAND)

Metaverse-based token SAND has also seen renewed interest from whales this week as the market anticipates a broader recovery in March. The token trades at $0.29 at press time, noting a 43% decline over the past month.

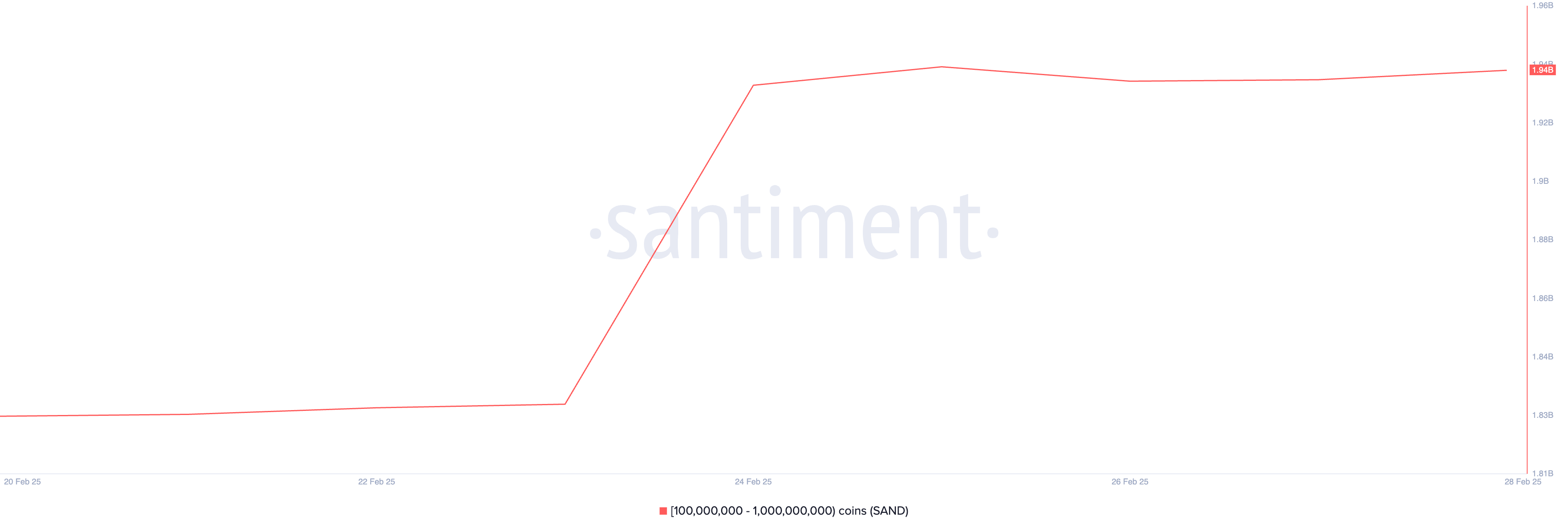

According to Santiment’s data, over the past week, whales holding between 100 million and 1 billion tokens have accumulated 180 million SAND valued above $52 million at current market prices. At press time, this cohort of investors holds 1.93 billion SAND tokens, its highest count since June 2024.

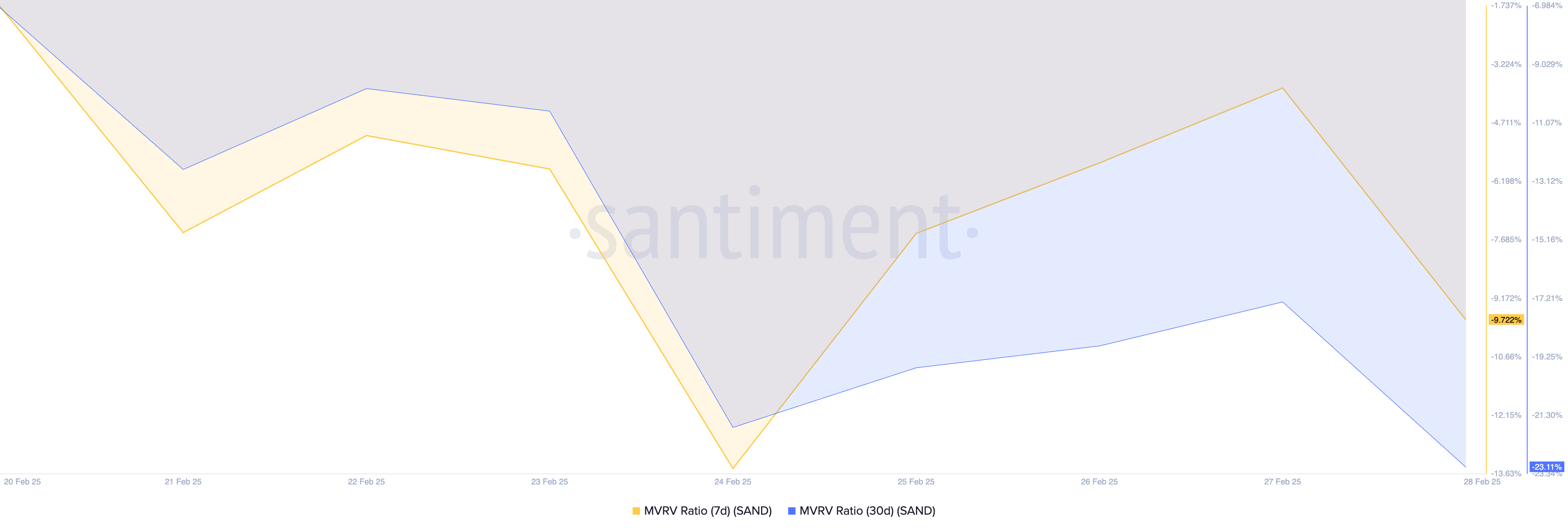

The surge in SAND whale holdings is due to its current undervalued status, as reflected by readings from its market value to realized value (MVRV) ratio. As of this writing, the altcoin’s 7-day and 30-day MVRV ratios are -9.72 and -23.11, respectively.

Historically, negative MVRV ratios are a buy signal. They indicate that the asset trades below its historical acquisition cost, presenting a buying opportunity for traders looking to buy the dip.

Hence, if this whale accumulation continues, it could push SAND’s price past the $0.35 mark in March.

Optimism (OP)

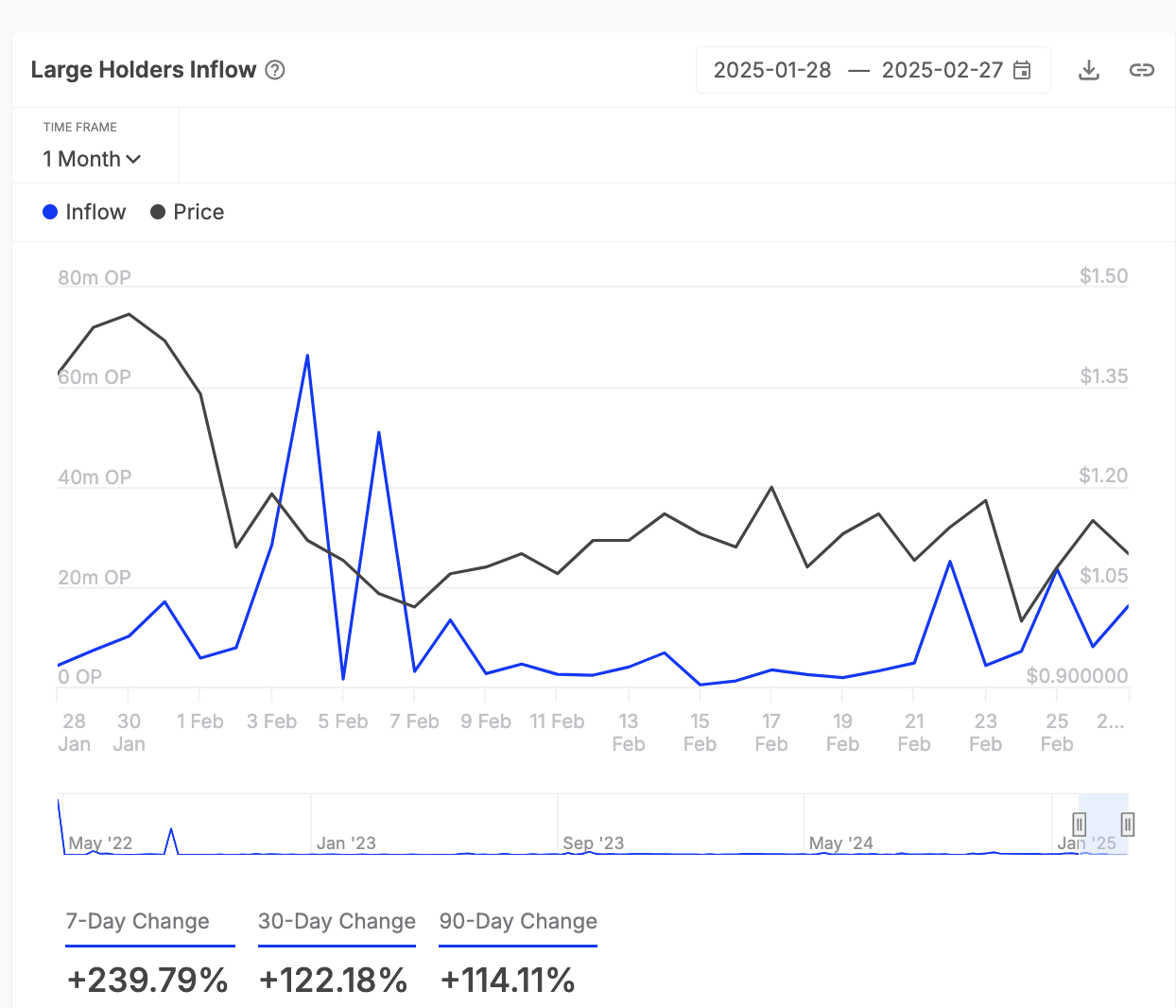

Layer-2 (L2) token OP is another asset that the whales are strategically acquiring for gains in March. IntoTheBlock’s data has revealed a 240% surge in its large holders’ inflow in the past seven days.

OP’s value has dipped 8% during that period, indicating that its whales have increased their inflows despite the price drop.

When large holders increase their inflows, they are transferring significant amounts of an asset into their wallets. This is generally seen as a bullish signal, as it suggests confidence in the asset’s future price movement and potential for upward momentum.

If this continues into March, it could drive OP’s price to $1.52.

本文源自網路: What Crypto Whales Are Buying For Potential Gains in March 2025

Related: Crypto market after the AI bubble burst: Where are the future investment opportunities?

Original author: 0xTodd , Partner at Nothing Research In the past week, many friends have called me to ask about the market. I feel it is necessary to make my thoughts public and disclose my views on the current market situation – what has changed and the future course of events. My family members who have been following me for a long time know that I am a long-term investor. Therefore, starting from 2019, I have an annual strategy that is updated every year. This is probably the one for 2024-2025, for discussion with my family members. 1. DeepSeek bursts the bubble When DeepSeek came out, no matter whether it really took 5 million US dollars to train such an AI, the narrative is this: algorithm improvement has defeated computing…