Ethereum Investors Capitalize During Dip, Accumulating Amidst Price Decline

Ethereum has recently struggled to maintain upward momentum after failing to break above the $2,800 resistance. The altcoin king’s price experienced a steep decline due to broader market bearish conditions, causing it to fall below $2,500.

Despite the downturn, Ethereum investors have remained confident, seizing the opportunity to accumulate at lower price levels.

Ethereum Investors See An Opportunity

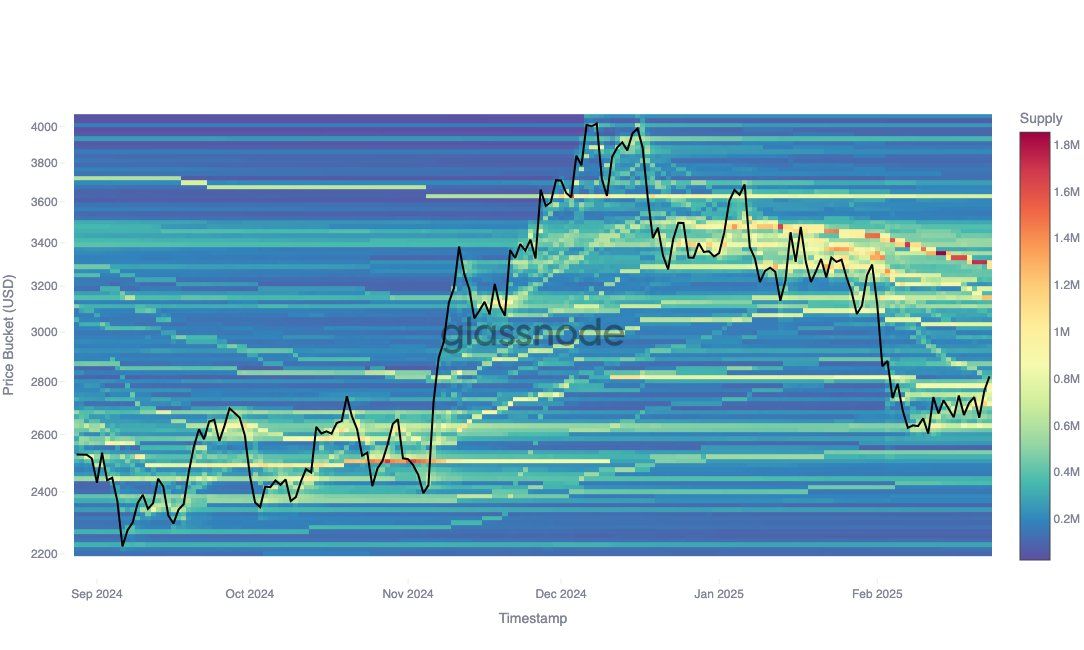

Ethereum’s market sentiment reveals investor conviction through the Cost Basis Distribution (CBD) data. According to Glassnode, the CBD shows that investors have consistently accumulated Ethereum even as the price dropped. Multiple cost bases are moving lower, indicating that market participants are taking advantage of the price dip.

The data reveals significant support at $2,632, with 786,660 ETH being acquired at this level, and resistance at $3,149, where 1.22 million ETH has been accumulated. This support and resistance range is crucial for Ethereum’s price stability, as it reflects where large groups of investors are buying or selling. As Ethereum’s price continues to trade within these zones, the market remains cautiously optimistic.

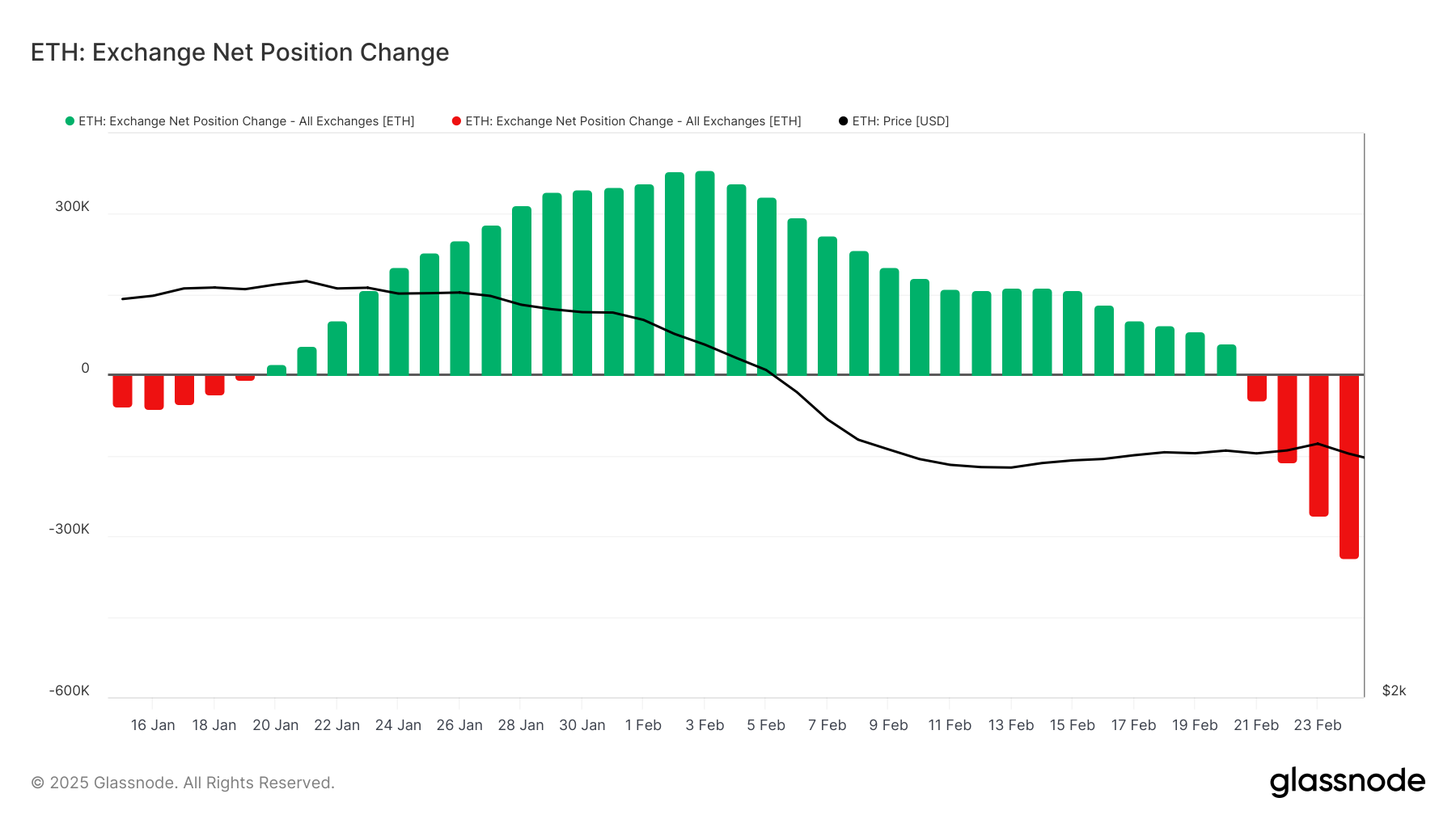

Ethereum’s macro momentum remains solid despite recent price declines. Ethereum’s exchange net position change shows a notable shift, with 178,500 ETH flowing out of exchanges over the last 48 hours.

This indicates that investors are moving their holdings off exchanges, possibly to hold long-term in anticipation of future gains. The outflows amount to roughly $444 million, signaling strong investor confidence in Ethereum’s recovery once the bearish trend subsides.

ETH Price Needs To Break This Pattern

Ethereum’s price currently sits at $2,486, marking an 11% drop over the past 48 hours. This decline follows a failed attempt to break above the $2,793 resistance, keeping Ethereum in a near 3-month-long downtrend. However, despite being below $2,500, Ethereum’s future price action shows potential for recovery.

The altcoin could see a rebound if it successfully flips the $2,654 level into support. If Ethereum manages to reclaim this level, it could potentially break above $2,793 again, aiming for the psychological $3,000 mark.

However, if Ethereum fails to reclaim $2,654 and struggles under the weight of continued market bearishness, the price could dip further to $2,344. Such a scenario would extend losses and possibly invalidate the current bullish outlook, leaving investors awaiting clearer signs of a price reversal.

本文源自網路: Ethereum Investors Capitalize During Dip, Accumulating Amidst Price Decline

Related: Story (IP) Targets Major Breakout After 24% Surge, Eyes $9 All-Time High

Story (IP) has surged by nearly 25% in the past 24 hours, making it the market’s top-performing asset. This double-digit rally has propelled IP to the upper trendline of the descending parallel channel. The trendline has kept the altcoin’s price in a downtrend since it reached an all-time high of $9 on February 21. A successful breach of this level could mean further gains. IP Eyes Bullish Breakout IP’s value has declined since climbing to an all-time high of $9 four days ago. Currently exchanging hands at $5.01, the altcoin’s price has since dipped by 45%, trading within a descending parallel channel. IP Descending Parallel Channel. Source: TradingViewThis pattern is formed when an asset’s price moves between two downward-sloping parallel trendlines. It indicates a sustained bearish trend with lower highs and…