Non-agricultural data hit hard, interest rate cut expectations turned, BTC medium-term trend faces a big test (01.06~01.

本報告中提及的有關市場、項目、貨幣等的資訊、意見和判斷僅供參考,不構成任何投資建議。

On January 10, the non-farm data released by the U.S. Department of Labor exceeded expectations by a wide margin, hitting the market hard. Although U.S. stocks and BTC had adjusted before, the heavy blow of the non-farm data made the expectation of a mid-term interest rate cut clear, and the pricing and trading logic of U.S. stocks and BTC needed to be re去中心化金融內德。

Although the market has experienced some adjustments since the Fed’s “hawkish” stance on the 18th, the lack of trading points in the next stage may lead to a loss of upward momentum. It will take time for all parties to find a trading direction.

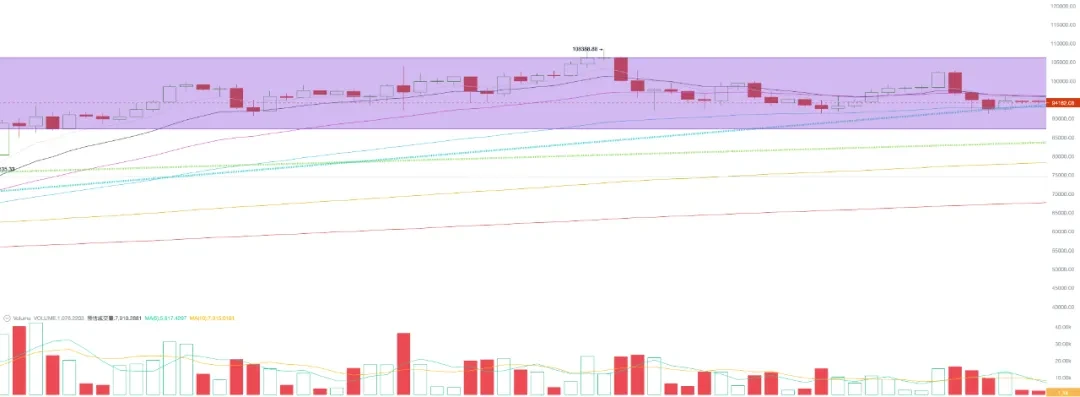

This week, BTC opened at $98,347.65 and closed at $94,509.62, down 3.9% for the week, with an amplitude of 11.74%. The trading volume was larger than last week. The current price is still within the box consolidation area, and it has temporarily received support after stepping back on the second stage of the upward trend line during the upward period. If the funds are insufficient, the BTC price will fall below the upward trend line and may step back on the lower edge of the box at $87,000.

The expected reduction in US interest rate cuts is a foregone conclusion. Currently, US stocks are still in the stage of digesting and absorbing this repricing. If the market can stabilize and gradually start the economic growth trading point, BTC will return to the upward trend. Otherwise, it may bear huge retracement pressure. After all, BTC has recorded a large increase since the Trump deal, while the Dow Jones has almost given up all the gains.

In the medium term, if the market stabilizes, BTC may have a chance to develop an independent trend, but the probability is not high.

Macro-financial and economic data

The seasonally adjusted non-farm payrolls released by the U.S. Department of Labor on Friday were 256,000, exceeding the previous value of 212,000 and far exceeding the expected 160,000. The unemployment rate was 4.1%, lower than the previous value of 4.2% and lower than the expected value of 4.2%.

Data shows that the US job market is strong, and the current high interest rate environment has not had a significant inhibitory effect on the current US economy. Therefore, the market believes that the Feds focus will shift completely to curbing inflation. Combined with the Feds hawkish speech on December 18, the market believes that the interest rate cut cycle since September 2024 will enter a pause. According to CME FedWatch, the probability of a rate cut in January has fallen to 6.4%.

Major U.S. investment banks have all lowered their expectations for interest rate cuts in 2025, with most saying that the previous two rate cuts will be reduced to one, with the timing adjusted from June to the second half of the year. Bank of America even believes that there is no hope for a full-year rate hike, and that rate hikes may resume in the first half of the year, because employment data is expected to be better after Trumps economic policies are gradually implemented, and inflation will continue to rebound.

In this context, the US dollar index rose sharply to 109.65, approaching the high of 110. The yield of one-year US Treasury bonds fell to 4.223%, and the yield of ten-year Treasury bonds fell to 4.762%. London gold continued to rise to US$2,689.88 per ounce. The Nasdaq, Dow Jones and SP 500 continued the adjustment trend since December 18, falling 2.34%, 1.86% and 1.94% respectively for the whole week.

For US stocks, the overall outlook is positive according to the major investment banks, but there may be many twists and turns in the first half of the year. The response to Trumps policies after he took office on January 20 and when economic growth will become the focus of trading have become key concerns in the short and medium term.

Stablecoins and BTC Spot ETF

Due to the relatively sufficient adjustments since December 18, there was no large-scale capital outflow from BTC and the 加密貨幣 market this week. Instead, it received an inflow of approximately US$708 million.

This week, BTC Spot ETF received inflows on 3 of the 4 trading days, with a total inflow of $313 million for the week. In terms of stablecoins, there were positive inflows on 4 days of the week, with a supply of $296 million.

As of the weekend of January 12, the crypto market remained relatively stable in terms of funding over the previous week, and the attitude of funding in the future market is very important.

Selling pressure and selling

As the market continued to decline, short-sellers intensified the selling, reaching the largest selling day in half a month on January 10. This week, short-sellers sold 164,517 coins, an increase from last week.

The selling of long-term investors has been shrinking for three consecutive weeks. From a cyclical perspective, the second round of selling has been suspended this week. If they sell again, they should wait until the price breaks through $100,000 again.

The exchange inventory is still in a continuous downward trend, reaching 29,770 this week, the largest outflow in six weeks, indicating that BTC priced at $90,000 to $100,000 is still very attractive to many funds.

週期指標

According to the eMerge engine, the EMC BTC Cycle Metrics indicator is 0.625, and the market is in an upward phase.

結尾

EMC Labs由加密資產投資者和資料科學家於2023年4月創立,專注於區塊鏈產業研究和加密二級市場投資,以產業前瞻、洞察和資料探勘為核心競爭力,致力於參與蓬勃發展的區塊鏈產業透過研究和投資,推動區塊鏈和加密資產造福人類。

欲了解更多信息,請訪問:https://www.emc.fund

This article is sourced from the internet: Non-agricultural data hit hard, interest rate cut expectations turned, BTC medium-term trend faces a big test (01.06~01.12)

Related: Behind the surge in RIF and URO, are Molecules three engines rising?

Original author: KarenZ, Foresight News In mid-November, after RIF and URO experienced an astonishing thousand-fold growth in just a few days, the DeSci market immediately entered a correction phase. It is worth noting that URO rebounded strongly last weekend, with an increase of nearly 200%. We cant help but start to explore who the platform behind it, pump.science, is? At the same time, what role does Molecule, which is from the same team as pump.science and Bio Protocol, play? What is Molecule? Molecule aims to advance scientific research through democratized funding and IP tokenization, transforming IP into liquid on-chain assets, and aligning incentives between researchers and funders to foster a more collaborative and efficient scientific research ecosystem. Molecule is working on three modules: Catalyst, a fair distribution platform for scientific…