文章原文來自 Presto Research

Odaily星球日報Golem編譯( @web3_golem )

關鍵點:

-

Whale alerts are popular because large on-chain transactions are often seen as a precursor to an impending token sell-off and a sell signal. To evaluate these claims, Presto Research analyzed the price changes of BTC, ETH, and SOL after large deposits to Binance.

-

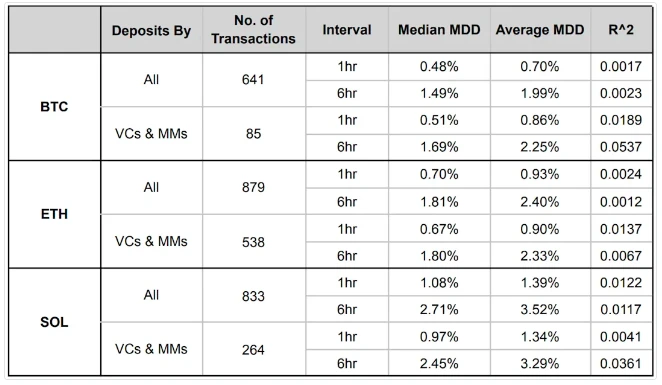

According to the regression analysis, the R-squared values between large exchange deposits and subsequent price changes are low (ranging from 0.0017 to 0.0537). Narrowing the data to deposits from VCs and MMs (market makers) slightly improves the R-squared values, but their practical utility as trading signals is still limited. The results strongly suggest that whale deposits to exchanges lack predictive power as reliable trading signals.

-

On-chain metrics are effective in other ways, such as analyzing blockchain fundamentals, tracking illicit financial flows, or explaining price volatility. They will serve the industry better only if investors have more realistic expectations about their capabilities and limitations.

One of the main differences between 加密貨幣 assets and other assets is the public availability of their transaction records, which are stored on a distributed ledger. This transparency of the blockchain has led to the emergence of various tools that take advantage of this unique feature, which are all classified as on-chain data. One of these tools is Whale Alerts, a service that automatically notifies you of large on-chain crypto transactions. They are popular because large transactions are often seen as a precursor to an impending sell-off and are therefore considered sell signals by traders.

This report evaluates the validity of this widely held hypothesis. After briefly outlining popular whale alert services on the market, we will analyze the relationship between large transaction deposits and the prices of BTC, ETH, and SOL. We will then present the results of our analysis and provide the main conclusions and recommendations.

Whale Alerts Overview

Whale Alerts refers to services that track and report large crypto transactions. These services have emerged as the crypto ecosystem has grown, reflecting the high recognition of the transparency features of blockchain by market participants.

history

The term whale became popular as early Bitcoin adopters, miners, and investors (e.g. Satoshi Nakamoto, Winklevoss Twins, F2 Pool, Mt. Gox) accumulated large amounts of Bitcoin. Initially, blockchain enthusiasts monitored large transactions through blockchain explorers (e.g. Blockchain.info) and shared this information on forums such as Bitcointalk or Reddit. This data was often used to explain major fluctuations in the price of Bitcoin.

During the 2017 bull run, as the number of whale transactions and large transactions increased, the market urgently needed automated monitoring solutions. In 2018, a European development team launched a tool called Whale Alert, which can track large crypto transactions on multiple blockchains in real time and send alerts through X, Telegram and the web. The tool quickly gained favor among market participants and became the preferred service for seeking actionable trading signals.

Source: Whale Alert (@whale_alert)

Basic Assumptions

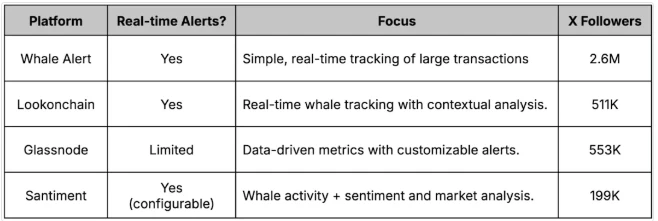

Following the success of Whale Alert, a number of platforms offering similar services have emerged over the years, as shown in the image below. While many of the new platforms have added more features to provide context to alerts, the original Whale Alert has remained focused on simple, real-time notifications and remains the most popular service, as evidenced by its large number of followers on X. A common feature of all of these services is that they rely on the assumption that large on-chain transactions (especially exchange deposits) are indicative of an impending sell-off.

Mainstream whale alert services, source : Whale Alert, Lookonchain, Glassnode, Santiment, X, Presto Research

Signal validity assessment

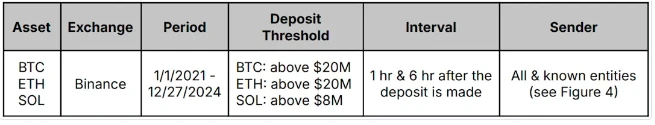

Supporters of the Whale Alert service believe that on-chain asset transfers to exchanges often precede liquidation and are therefore effective sell signals. To verify this hypothesis, we analyzed the changes in digital asset prices after large deposits entered the exchange. The following figure shows the key parameters of the analysis. The assumption is that if large transaction deposits can be used as reliable trading signals, a clear relationship between deposits and corresponding asset prices should be observed.

Key parameters analyzed, source: Presto Research

Assets, exchanges, analysis periods, and deposit thresholds

Our analysis focuses on three major crypto assets — BTC, ETH, and SOL — and their USDT prices on Binance between January 1, 2021 and December 27, 2024. This timeframe was chosen to align with the duration of operations of the wallet address currently used by Binance to aggregate deposits.

The deposit threshold is set based on an analysis of exchange data. Specifically, based on the limits of $50 million, $50 million, and $20 million set by Whale Alert for BTC, ETH, and SOL whales, we lowered the deposit thresholds to $20 million, $20 million, and $8 million, respectively, which matches Binances 40% share of global spot trading volume.

Entity Type

We also specifically analyzed deposits to known entities and performed the same analysis on a narrower data sample to examine whether deposits to specific types of entities show a stronger relationship with price movements. These entities were identified through Arkham Intelligence and supplemented by our own investigations, as shown in the figure below.

Entities with known addresses. Source: Arkham Intelligence, Presto Research

Measuring market impact

To assess the potential selling pressure of whale deposits, we made the following assumptions:

-

After a deposit greater than a threshold is confirmed on-chain, selling pressure manifests itself in a specific timeframe. We analyzed two timeframes: one hour and six hours.

-

The maximum drawdown (MDD) over a specified interval is used as a measure of the deposit price impact, if any, effectively filtering out the noise during that period.

result

The analysis results are shown in the following figures

-

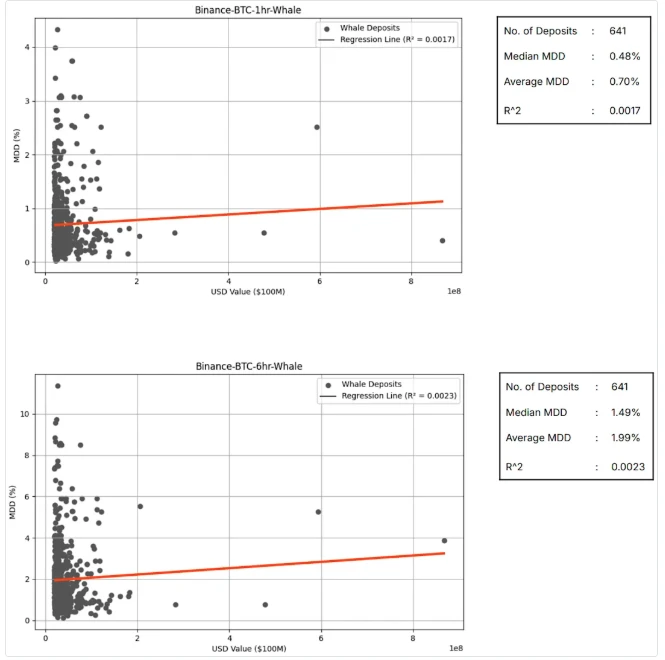

BTC whale deposit impact (all):

Source: Binance, Dune Analytics, Presto Research

-

Impact of BTC whale deposits (VC and MM only):

Source: Binance, Dune Analytics, Presto Research

-

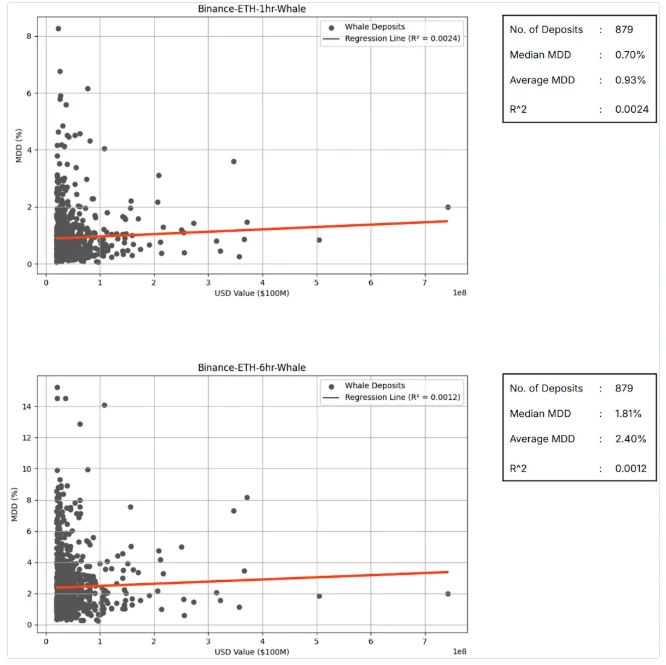

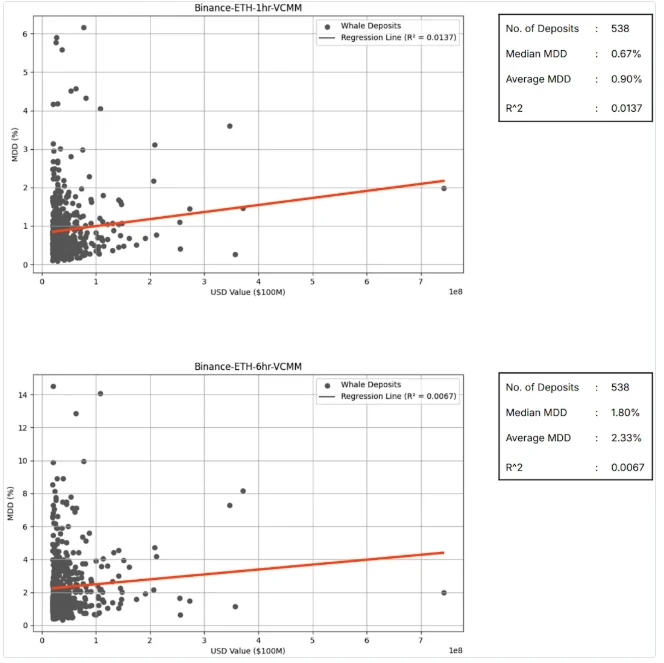

ETH whale deposit impact (all):

Source: Binance, Dune Analytics, Presto Research

-

Impact of ETH whale deposits (VC and MM only):

Source: Binance, Dune Analytics, Presto Research

-

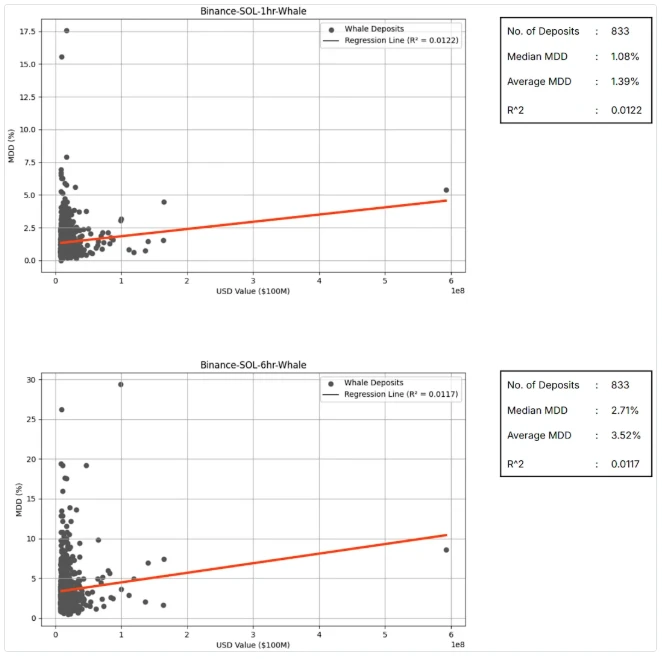

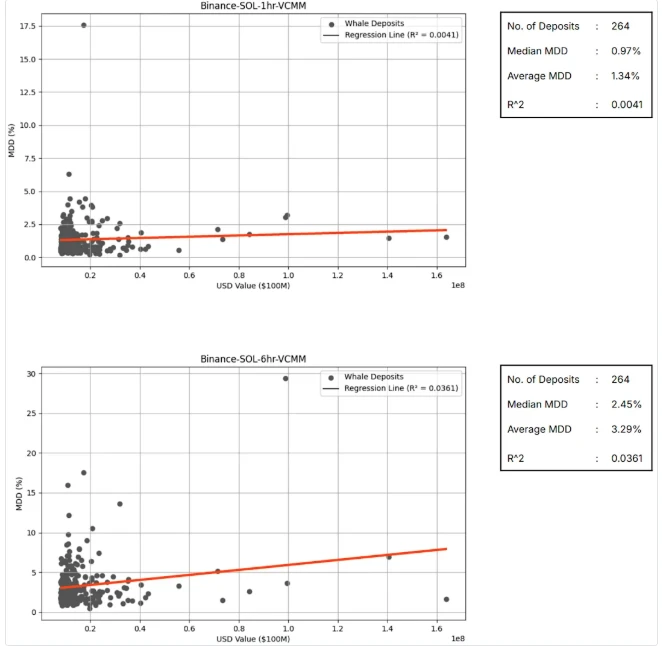

SOL whale deposit impact (all):

Source: Binance, Dune Analytics, Presto Research

-

Impact of SOL whale deposits (VC and MM only):

Source: Binance, Dune Analytics, Presto Research

重點

Source: Binance, Dune Analytics, Presto Research

The above figure summarizes the results of the above statistics and draws the following three conclusions:

-

Large exchange deposits have weak predictive power with price declines : the R-squared values for all 12 scenarios show very weak predictive power and range from 0.0017 to 0.0537.

-

VC and MM deposits may be slightly better predictive signals : in this part of the data, the R-squared value has improved, but this improvement may simply be a result of reduced sample noise and not a true stronger correlation. Moreover, the absolute value is still low, indicating that its actual effectiveness as a trading signal is limited.

-

ETHs whale deposits mainly come from VC and MM : they account for 61% of ETH whale deposits (i.e. 879 out of 538), while BTC accounts for only 13% and SOL accounts for 32%. This reflects the characteristics of different assets: ETH has a high turnover rate due to its diverse Web3 uses (e.g., Gas fees, staking, DeFi collateral, and Swap medium), while BTC is more stable as a value storage asset.

綜上所述

Admittedly, our analytical approach has certain limitations, and regression analysis has its inherent limitations, and relying solely on R-squared values to draw conclusions can sometimes be misleading.

But having said that, this analysis, combined with context and individual observations, strongly suggests that whale deposits to exchanges lack sufficient predictive power to be a reliable trading signal . This also provides us with insights into the broader use of on-chain indicators.

On-chain metrics are undoubtedly valuable tools, especially for analyzing blockchain fundamentals or tracking illicit financial flows, and they may also be useful in explaining price movements after the fact. However, using them to predict short-term price changes is another matter entirely. Price is a function of both supply and demand, and exchange deposits are only one of many factors that influence the supply side, even if it is useful at all. Price discovery is a complex process that is also influenced by fundamentals, market structure, behavioral factors (e.g., sentiment, expectations), and random noise.

In the highly volatile cryptocurrency market, where participants are constantly seeking “foolproof” trading strategies, there will always be an audience that is attracted by the “magic” of on-chain indicators. While some “overzealous” data vendors are eager to exaggerate the promises of their platforms, on-chain indicators can only better serve the industry when investors have realistic expectations of the capabilities and limitations of these tools.

This article is sourced from the internet: Is it reliable to use the movements of whales as trading signals?

Related: Movement Announces TGE and Movement Mainnet Beta

Movement Network Foundation , an organization dedicated to driving innovation and promoting MoveVM technology, today announced the successful launch of Movement Labs ’ Movement Mainnet Beta and $MOVE ’s 代幣 Generation Event (TGE), marking an important milestone in the successful integration of the first Move-based blockchain into Ethereum. The launch of Mainnet Beta represents the first phase of Movement’s production infrastructure. During this phase, infrastructure providers can deploy basic network components including follower nodes, RPC nodes, and indexers. Network operators will focus on two key tasks: ensuring the correct synchronization of the network and verifying safety measures. This managed launch environment lays the foundation for Movement’s innovative “ postconfirmations ”, a mechanism that can achieve transaction finality in as little as one second – much faster than existing Ethereum scaling…