Exploring new opportunities in the crypto space in the new bull market | NX.one

Original author: siixx

Since Trumps victory, the 加密貨幣 market has been injected with powerful momentum, ushering in a remarkable bull market. Bitcoin prices have soared, breaking through the $108,000 mark, up 126% from the peak of the previous bull market. Mainstream cryptocurrencies such as Ethereum have also risen, and the total market value has reached an unprecedented $7.5 trillion. This strong bull market has not only attracted the attention of many traditional investors, but also brought new vitality to various tracks in the crypto market. In this bull market full of opportunities, the following tracks and potential projects deserve close attention from investors and industry practitioners.

DeFi track: Fluid, a new lending protocol

In the field of DeFi, the momentum of this round of bull market is particularly rapid, and the total locked-in volume has shown explosive growth. As of December 18, it has reached 137 billion US dollars, compared with 83 billion US dollars on November 1, an increase of 65% in just 60 days. Among them, lending protocols, as one of the core applications of DeFi, are also expanding rapidly. For example, the total locked-in volume of the leading lending protocol AAVE has reached 22 billion US dollars, an increase of 73.36% in this round of bull market, and the emerging lending protocol Fluid has exceeded 1 billion US dollars in just 3 months.

Fluid is a lending protocol deployed on Ethereum that combines automated market making (AMM) and is directly competing with Aave to share the pie. Its features lie in its dynamic interest rate mechanism and innovative risk control model. It has been warmly welcomed by users since its launch, and the community response has been very positive. It has huge growth potential. Its innovations and advantages are as follows:

1. Innovative liquidation mechanism

Fluid uses a mechanism similar to Uniswap to divide users assets that may be liquidated. When liquidation occurs, large-scale liquidation is carried out in groups of targets rather than in individual targets. This innovation makes the users liquidation line about 5% higher than the leading AAVE, while reducing liquidation fees. For example, when the market fluctuates greatly, traditional lending protocols may trigger multiple liquidations due to fluctuations in the price of a single asset, while Fluid can manage risks more effectively, reduce unnecessary liquidation events, and provide users with a more stable lending environment.

2. High capital efficiency

Users can earn not only loan interest (similar to AAVE) but also transaction fee income (similar to Uniswap) on their assets (collateral) and debts (loans) on the Fluid platform. This dual-income model improves the efficiency of fund use, making deposit interest higher and loan interest lower. Assuming that a user deposits a certain amount of crypto assets on the platform as collateral and borrows money, through Fluids mechanism, their assets can earn loan interest while also participating in the platforms transaction fee distribution, thereby realizing asset appreciation.

3. Project cooperation and development potential

-

AAVE has passed a community vote to buy Fluid project tokens at a low price, which shows the industrys recognition of Fluid.

-

The old project instadapp team is experienced and has not issued tokens indiscriminately. In the future, Fluid will launch a new token economy. The instadapp project token INST may be converted with the Fluid project token at a 1:1 ratio, providing users with more value expectations.

-

Binance 网页3 wallet recently cooperated with Fluid, increasing the possibility of its tokens being listed on Binance in the future, further enhancing the projects visibility and market potential.

-

Fluid is expected to fully benefit from the bull market dividend of the DeFi track. As more users and funds pour into the DeFi field, Fluids innovative model will attract more lending demand and drive its business growth.

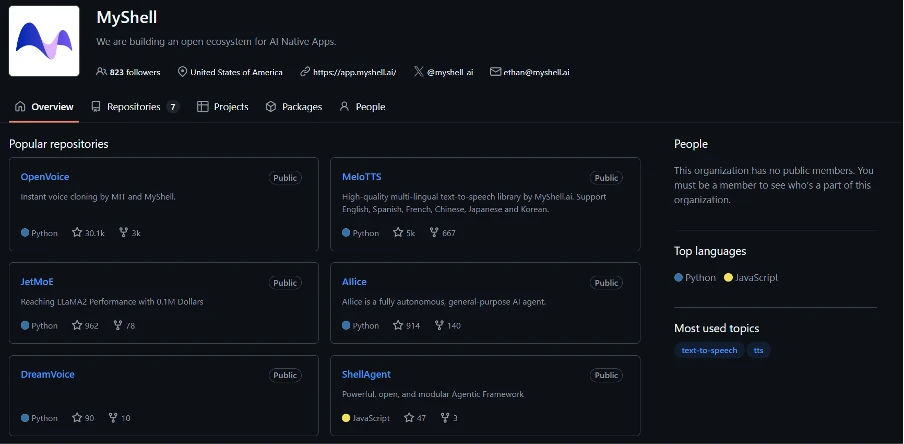

AI track: Binance promotes AI application store myshell

The AI track has also performed well in this bull market. The integration of AI concepts and encryption technology has spawned a series of innovative projects and attracted a lot of investment. In the past year, the total financing of AI-related encryption projects has reached 278.1 billion yuan, a year-on-year increase of 113%. AI application mall projects such as myshell have obtained investments from well-known institutions such as Binance with their unique positioning and strong technical support, and are expected to occupy an important position in the wave of combining AI and blockchain.

Myshell is an AI application mall project. The platform brings together various AI applications. Users can purchase, use and trade AI solutions, and developers can publish their own AI applications. The potential and highlights of the Myshell project are as follows:

1. Helping developers and the AI industry develop

As an AI application store, myshell aims to break the monopoly of large AI companies in the future, provide income opportunities for small and medium-sized developers, and promote the diversified development of the AI industry. Its platform brings together a variety of useful AI products covering different application fields, providing developers with a platform for display and profit, and also providing users with a rich selection of AI applications.

2. Obtaining Binance support and coin issuance expectations

The project has received investment support from Binance, which provides strong financial and resource guarantees for its future development. Given Binances influence in the crypto industry, myshell is likely to issue coins and be listed on Binance in the future. Once it is online, it will attract more users and funds to enter the platform, further promoting the development of the project. In addition, there are relatively few high-quality AI agent projects on the BNB chain. Myshell is likely to become a key support target of Binance and enjoy more ecological resources and development opportunities.

3. Advantages of interaction between Web2 and Web3

The myshell project has performed well in the interaction between Web2 and Web3, lowering the threshold for users to enter the Web3 world. Users can use AI applications more conveniently, and the projects tokens will empower its ecosystem. Future airdrop plans also provide potential profit opportunities for early participants, attracting more users to pay attention to and participate in the project.

Game + AI Track: L2 Soon Chain

The gaming track has been accumulating strength in the first half of 2024. According to a report from a market research agency, the size of the crypto game market has increased significantly by 38.9% in Q2 this year, reaching US$2.75 billion. Thanks to the application of blockchain technology, the ownership and tradability of in-game assets are better protected, attracting many players to participate. At the same time, the SoonChain project seized this trend and combined AI with Layer 2 technology to create a better AI-powered gaming experience.

SoonChain is a Layer 2 public chain deployed on the Ethereum network. Its feature is that it combines smart contracts and AI technology to optimize the performance of decentralized applications (DApps), increase transaction throughput and reduce transaction fees, and enhance user experience and functional innovation. The community has a positive attitude towards it, especially looking forward to its breakthroughs in the fields of games and AI. Specifically, there are three points:

1. L2 public chain optimizes transaction experience

As an L2 public chain, SoonChain solves the scalability problem of traditional blockchains and optimizes transaction costs and efficiency. In AI-powered gaming scenarios, this means that real-time transactions, asset transfers, and NFT transactions for complex games can be carried out quickly and cheaply. When players trade items and transfer assets in the game, they no longer need to endure high fees and long confirmation times, which improves the smoothness of the game and user experience.

2. AI-driven game development and upgrades

SoonChain uses AI technology to drive game development, greatly simplifying the game development process and reducing development costs. At the same time, in the later upgrades and adjustments of the game, AI can quickly optimize and improve based on the players behavior data and feedback to provide better game content. For example, AI can automatically generate game scenes, character images or mission plots, saving time and energy for game developers while keeping the game fresh and attractive.

3. Decentralized governance combined with NFT

The public chain token AIGG enables holders to participate in the decision-making process of AI game development, motivating players and creators to actively participate in the platform ecosystem construction. In addition, SoonChain combines the NFT elements common to AI and games. AI can quickly generate game-related props or peripheral NFTs, and quickly trade them on the public chain through AIGG. This not only enriches the economic ecology of the game, but also provides players with more collection and investment opportunities.

Meme launch track: multi-chain launch platform Chain.fun

The meme launch track is also highly competitive in this round of bull market. From pump.fun to Clanker, Meme coins have attracted the attention of a large number of investors and crypto enthusiasts with their unique cultural attributes and spreadability, and they hope to find the next coin to get rich. Since the start of the bull market, with the influx of capital and Musks media hype, many new meme coin projects have continued to emerge, and trading activity has continued to rise. The daily trading volume of some popular meme coins has even reached hundreds of millions of dollars. This hot market performance not only reflects investors pursuit of emerging and interesting crypto assets, but also reflects the strong influence of meme culture in the crypto field. In this context, the Chain.fun project, as an innovative force in the meme track, is worth our understanding.

Chain.fun aims to help users easily initiate, create and launch Meme coins on multiple blockchain networks such as Solana, Ethereum, BSC, Base and Ton. The platform aims to provide a simple tool for the crypto community to help users leverage different blockchain technologies, launch their own Meme coins at a lower price and trade, invest or have fun. Its features include:

1. Multi-chain and cross-chain support

Chain.fun is known for its multi-chain cross-chain support, allowing users to choose the most suitable platform to launch memecoin projects based on blockchain characteristics. Users can take advantage of Solanas fast transactions, Ethereums smart contract capabilities, and BSCs low costs to optimize transaction costs and speed, thereby enhancing project competitiveness. Cross-chain technology further breaks the limitations of a single chain, providing creators with more freedom and choices, allowing them to flexibly allocate resources and enhance the overall strength of the project.

2. Social and community driven

Given the social-driven nature of 模因幣, Chain.fun attaches great importance to promoting its popularity through social platforms and community power. The platform encourages community members to actively participate in interactions, and creators can promote their own currencies through voting, publicity, and cooperation. This community-driven model not only strengthens the connection between users, but also injects a strong impetus into the spread and development of Meme Coin.

3. Decentralization and transparency

Adhering to the decentralized concept of blockchain, Chain.fun allows anyone to participate in platform activities without intermediaries. At the same time, based on the transparent nature of blockchain, every Meme coin transaction and its related data are publicly traceable. This ensures the fairness and credibility of the transaction and creates a safe and reliable environment for users.

4. NFT and collection value

In addition to Meme coins themselves, the Chain.fun platform also has the potential to transform memes into NFTs, giving them unique collectible value. With the help of NFT technology, Meme coins are no longer just an interesting digital currency, but are more likely to become digital assets with artistic value, further enriching users investment and collection options.

結論

In summary, in the current bull market environment of the crypto market, the four projects Fluid, myshell, chain.fun and SoonChain have shown unique advantages and huge development potential in DeFi, AI, Meme launch, AI and games. Investors and industry practitioners can pay close attention to the development of these projects and seize new opportunities in the crypto field. However, the crypto market is highly uncertain and risky. When participating in project investment or cooperation, you should fully understand the projects technology, team, market and other aspects, and make decisions carefully.

This article is sourced from the internet: Exploring new opportunities in the crypto space in the new bull market | NX.one

Original article by Chris Burniske, Partner at Placeholder Compiled by Odaily Planet Daily ( @OdailyChina ) Translated by Azuma ( @azuma_eth ) Editor’s Note: On December 30, 2022, Solana fell into its darkest hour, when SOL once fell to $8, the lowest price since the collapse of FTX. On the same day, Chris Burniske, former head of Ark Invest crypto and current partner of Placeholder VC, published a milky article on X, publicly calling for more SOL and saying that he would continue to increase his position. Everyone knows the story after that. SOL has been soaring all the way, and has recently broken through $240, with a trend of continuing to set new highs. By November 2024, Ethereum had gradually fallen into a low ebb due to narrative bottlenecks…

你好